VTS Options - New Trade example

Oct 18, 2019This is a sneak peak into what VTS Options delivers. Here's what subscribers see for all new trades. Plus of course, all the regular VTS content every day that you can also see here

* If you are interested in learning options trading, claim your free trial to VTS down below

Until the end of the month, I'm offering VTS + VTS Options (160$) for just 80$ a month!

New Trade - Oct 18, 2019

VTS Options community,

It doesn't take long following VTS to have heard me say we're looking for "high probability trades." I say that a lot and my actual portfolio is usually full of them. I like trades that have a higher chance of success, and then I typically use stop-losses to protect against times when markets do unexpected things.

But that does beg the question, do I ever take low probability trades?

The answer is yes. Now typically with most traders when they take these types of high reward trades they do it through long puts and calls, but I don't like the risk reward profile of those much at all. Far too much daily decay for my liking. You have to nail it perfectly and quickly to have those pay off. I mostly steer clear of long puts and calls.

Today I'll show an example in line with the VTS style of low probability high reward trades

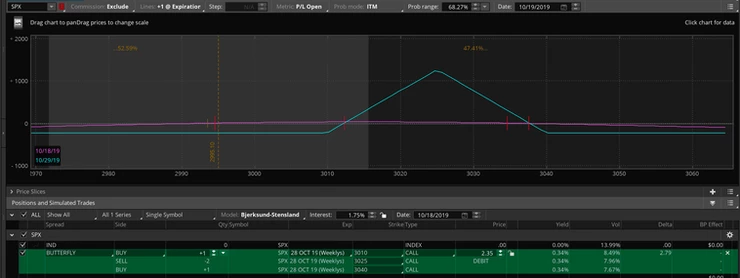

The premise is that we have a Fed meeting coming up at the end of October. That is marked by the white line in the above chart. Most investors are expecting yet another rate cut. So I think there's a reasonably good chance the S&P 500 drifts higher into the meeting and finds itself knocking on that all time high area just before the Fed meeting, which is in the green circle in the above chart.

Yes, this is a directional guess, but there are times when a good ol' educated guess is called for. This is a good thesis for a trade. If I'm right, what trade type will best capture this?

A butterfly spread. It's opened in a single transaction and is made up of 2 short strikes in the middle at the price you expect the market to be at, and then 1 each long strike on the sides to cap the losses.

It's a great trade for exercising some "guesswork" with respect to where markets may be in the future. The payoff is far higher than the risk, so even if a few of them fail along the way (to be expected) every now and then one of those big winners more than covers any small losers.

This trade is part of my "Directional Flies" strategy and I use it often.

Trade Details:

Long Butterfly (SPX)

BUY to OPEN 28 Oct 19 SPX 3010 Call SELL to OPEN 2x 28 Oct 19 SPX 3025 Call BUY to OPEN 28 Oct 19 SPX 3040 Call

October 28 contract has 10 days to expiry

Current approximate debit: 2.35$

* prices move around intraday, so the lower the better

Margin Requirement:

Easy margin calculation, it's just the cost of the spread times 100

2.35 * 100 = 235

The margin requirement per contract is 235$

Risk Management:

These trades do decay over time, so I like to keep the allocation very small and just let them expire. I can do that because SPX is a cash settled index and we don't worry about assignment.

No stops, set and forget

Allocation Size:

This will depend on your own level of risk tolerance.

My personal allocation for this trade will be 3%

* Extra note today: Remember 1 contract is roughly 235$, so a 3% allocation to this trade would require about 8,000$ in available capital for your options portfolio. If you have less than that, you can either skip this trade, or allocate as much as 5%. I wouldn't go more than that, so if you don't have 5,000$ in options capital, perhaps it's best to skip this trade.

The Greeks: (article)

Delta positive - Bullish trade, we want the S&P to climb about 1%

Theta negative - On a 10 day long position, expect some decay

Vega negative - Trading out of the money on a trade we are letting expire, vega isn't really an issue here.

Volatility Metrics:

(Click the links for educational content)

VTS Volatility Barometer: 40.01%

VIX Index: 14.09

M1 VIX future: 16.59

SPX HV(20): 14.25

Current Open Positions

Highlighted red means closing today

Highlighted green means opening today

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.