Hysteresis and the Defensive Rotation Strategy part 2 - Live trading example

Aug 14, 2025

VTS Community,

Hysteresis and the Defensive Rotation Strategy

If you missed the original article a couple weeks ago it's worth reading if you're interested in the "why" regarding our lower threshold Cash positions. You can click here to check it out the article

Hysteresis just refers to a system that uses a delay between an input and output signal.

The Defensive Rotation Strategy moves to Cash when the Volatility Barometer goes below 20%, and won't get back into the market until the Volatility Barometer crosses back over 30%. This delayed 10% band of Cash is just used to add a little diversification between the strategies to have one of them doing something a little different during lower Volatility environments.

Recent trade action

Yesterday was our second exit to Cash when the Volatility Barometer dipped below 20%. Here's the trade sequence in the last few months:

May 27th: Enter QLD (original entry after XLU)

- We remained in QLD for 46 trading days making almost 20% return

July 31st: Exit QLD and move to Cash (Barometer < 20%)

- We remained in Cash for 2 days and avoided an ugly day in the market that sent the Volatility Barometer up to 71%. Lucky?

August 4th: Re-enter QLD (Barometer reset higher)

- We remained in QLD for 6 trading days as the market has rocketed higher and Volatility crashed again, making about 7%

August 13th: Exited QLD yesterday (Barometer below 20%)

It's been pretty decent timing so far, so we will now remain in Cash until the Volatility Barometer goes back up over 30%. That 10% hysteresis range will trigger the strategy back to baseline where the lower threshold will again be 20%.

Very subtle trade dial change

So you'll notice that both Tactical Volatility and Strategic Tail Risk will both remain in aggressive positions during low Volatility, but Defensive Rotation has that lower Cash threshold

So anytime the Defensive Rotation Strategy moves to Cash in that lower Volatility range, I will move the threshold line from the 20% on the original signal up to the 30% level, just temporarily until it resets.

If you're not looking closely you probably won't even notice the change, but I'll show you the dial from 2 days ago, and then the dial today to illustrate:

Dial from 2 days ago showing 20% Cash range:

Trade dial after yesterday showing a larger 30% Cash range:

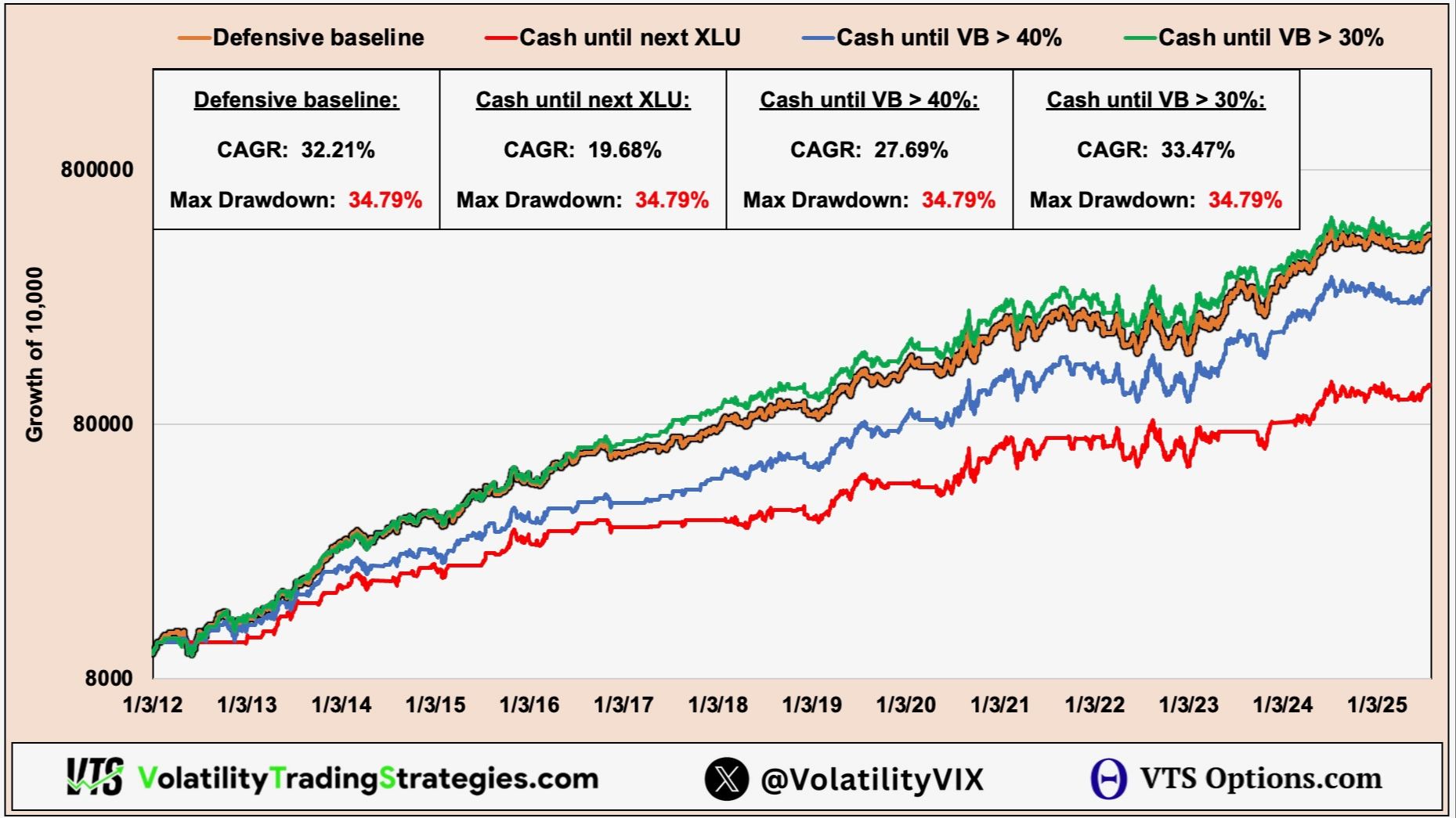

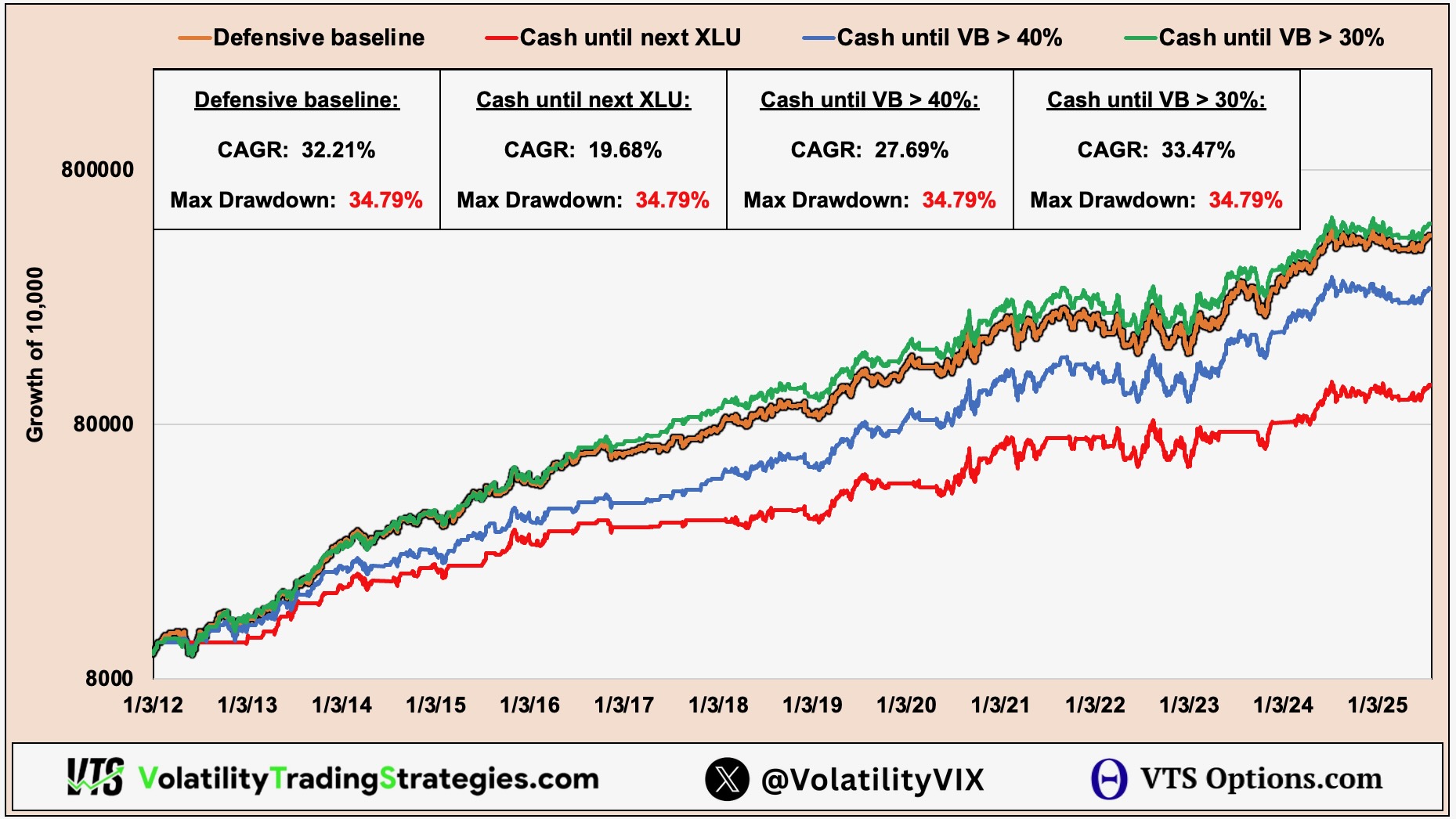

Using a hysteresis style system and moving that Cash threshold up to 30% after an exit from QLD not only adds diversification by decoupling from the underlying stock market, but it also adds a slight performance boost. Nothing to write home about, I would say it's statistically insignificant, but at the very least it's not losing anything.

Green: Using our 30% threshold

Blue: Using a larger 40% threshold

Red: Waiting until a fresh new XLU position

Why move to cash in the first place?

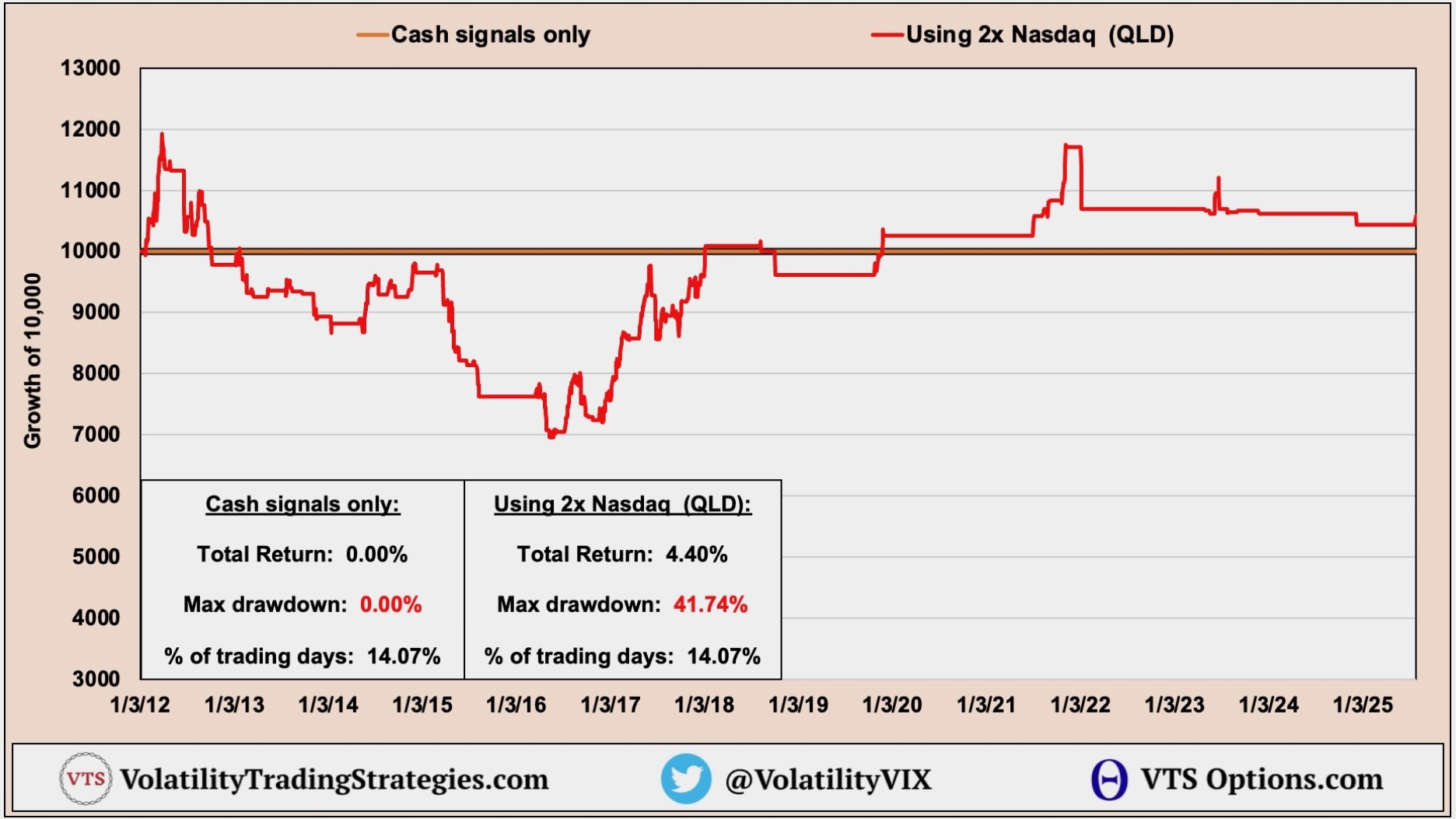

That lower threshold below 20% can introduce some noise to the system without really adding any benefit. It doesn't happen every time but quite often when the market is in those very low ranges of Volatility, that can mark a short-term bottom where it's running on fumes and likely to just chop around not making any real progress. We can see it in the numbers by comparing the two choices.

Moving to Cash below 20% vs remaining in QLD:

So performance wise, basically a wash, but it definitely reduces some of that whipsaw action that can occur when the market gets complacent.

You will very likely not even notice this is happening. Like I said I'll be moving the threshold line a little bit and you'd have to squint to see the trade dial changing but at least now you understand why we do this.

- We exit to Cash below 20% on the Volatility Barometer

- We re-enter positions when the system resets over 30%

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.