Introducing the VTS Total Portfolio Solution

Why do investors hold their stocks when the market is crashing? Why hold bonds or gold when the market is stable? Not all assets are suitable to hold at all times, and buy and hold investing doesn't work. We need to be smarter if we want to succeed long-term. We need to be Tactical!

At VTS, through data mining dozens of key Volatility metrics, we rotate into the positions and asset classes with the highest probability of success given the current market environment.

Meet the VTS Strategies ➡️

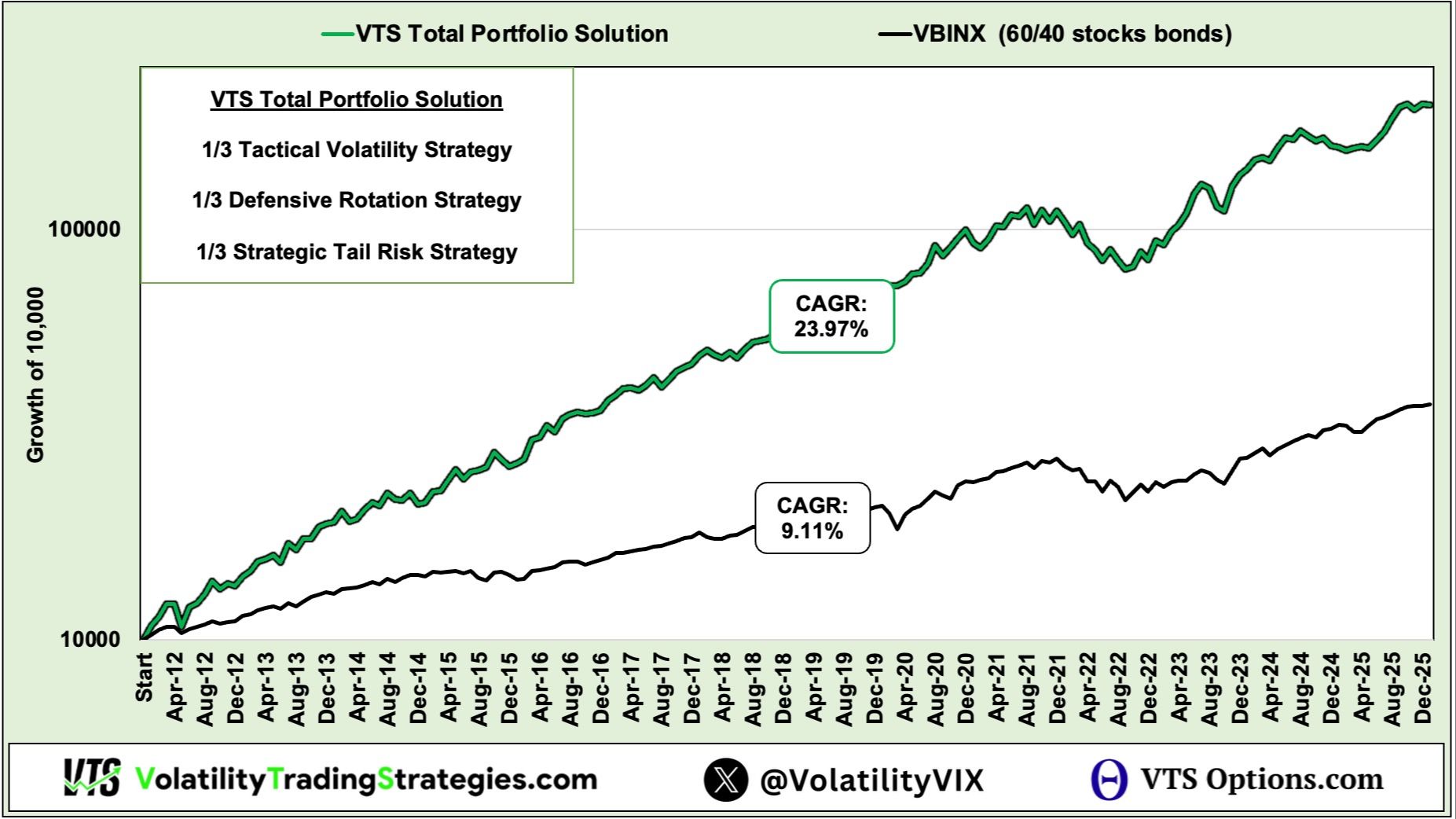

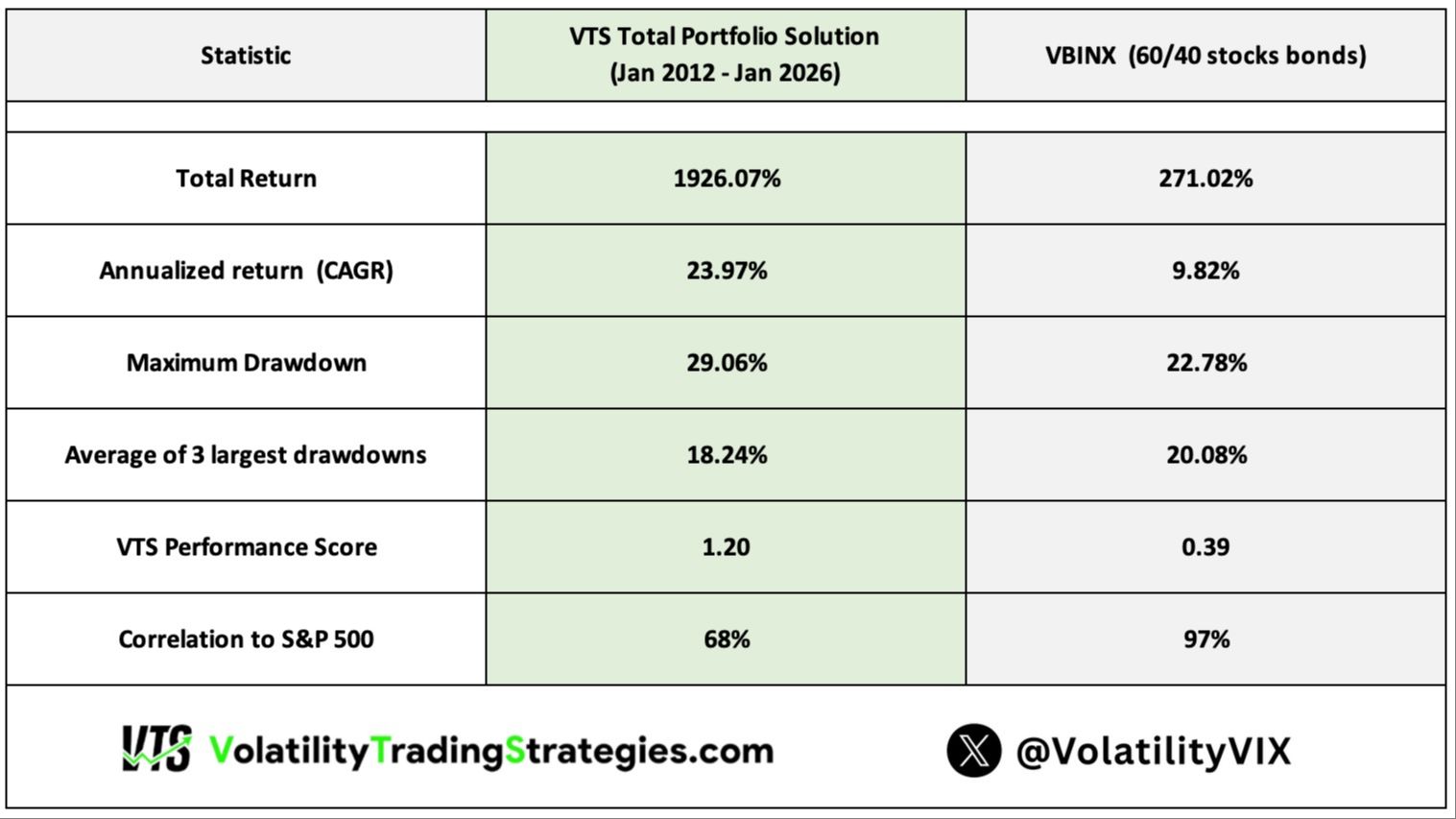

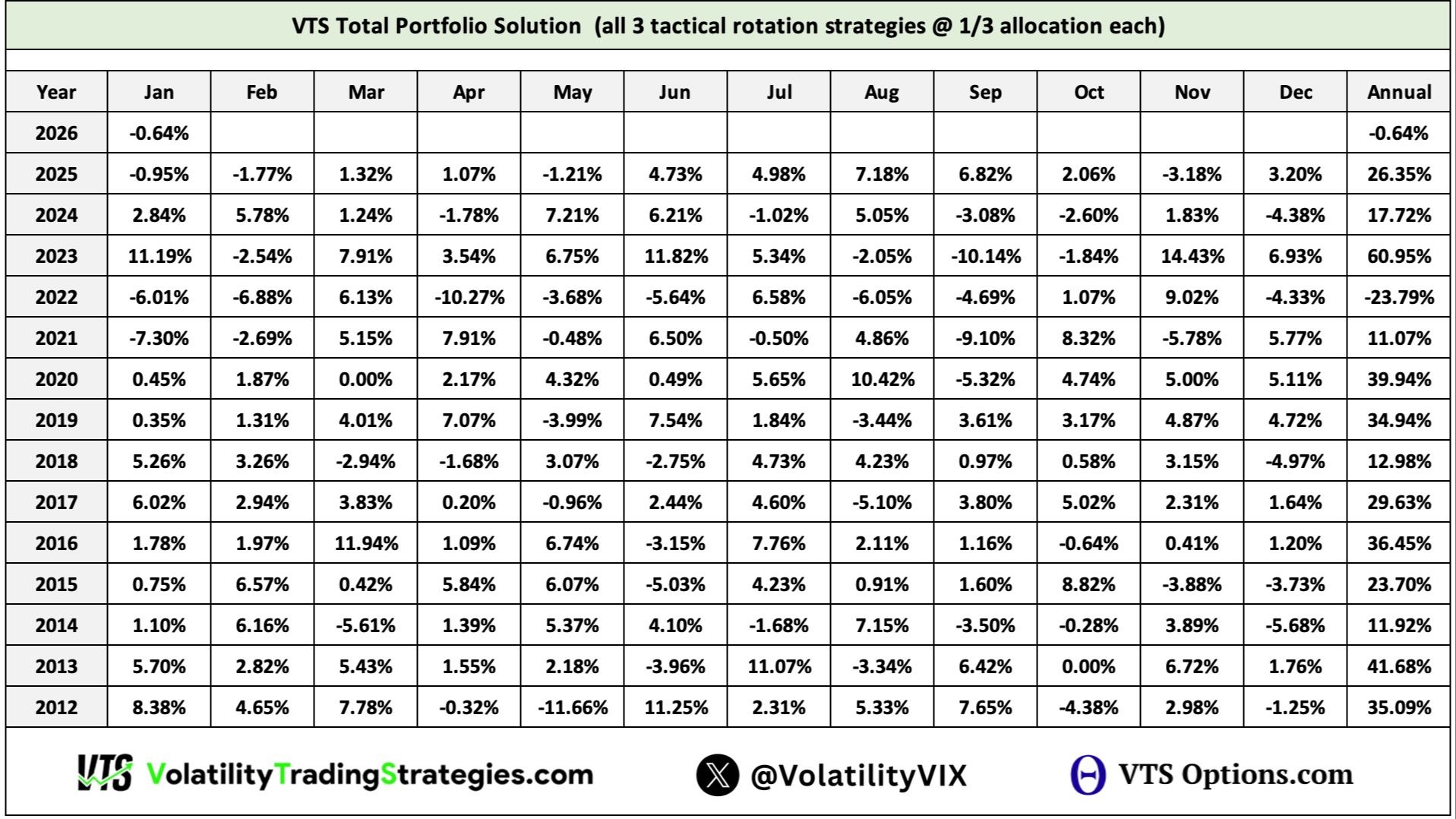

The VTS Total Portfolio Solution utilizes all 3 of our strategies to give investors the perfect balance between great long-term performance and exceptional risk management.

1/3 VTS Tactical Volatility Strategy

Volatility ETPs like VXX & UVXY decay long term. The problem though for "Short Volatility" traders is that they are also risky and have huge price spikes during market crashes. The VTS Tactical Volatility Strategy uses Volatility Targeting to maximize the best time to be Short Volatility and profiting from stable markets, Long Volatility and profiting from market crashes, or to be safely in Gold.

1/3 VTS Defensive Rotation Strategy

The VTS Defensive Rotation strategy tactically allocates only to the most advantageous asset class given current market conditions. The Nasdaq index when markets are stable, Utilities during elevated risk, and full Cash for safety when markets are melting down.

1/3 VTS Strategic Tail Risk Strategy

With the risk of recession higher than it's been in many years, it's now more important than ever to have tail risk protection within a portfolio. Our Strategic Tail Risk strategy utilizes Long Volatility positions to not only survive market crashes, but to thrive and profit from them.

VTS Bitcoin Breakpoint Strategy

This "Optional" Strategy for Crypto Traders fixes the fundamental reason why Bitcoin Traders ultimately fail: DRAWDOWNS!

Through mining Volatility metrics we can exit to our safety position of Gold BEFORE the market crash happens, reducing risk, and dramatically increasing long-term profit

Claim Your FREE Trial to VTS!

Every day you'll see our live trades for all 5 tactical strategies, the proprietary VTS Volatility Barometer, the extended Volatility Dashboard metrics, and my daily blog. Plus you'll gain access to the 30-part Iron Condor course exclusive to VTS subscribers.

Claim Your FREE Trial NowPerformance is tracked from all live trades for the strategies sent out to paying VTS members in every daily email, and includes all trade fees and dividends

* All information, analysis, and articles on this site are provided for informational purposes only. Nothing herein should be interpreted as personalized investment advice as I make no recommendations to buy, sell, or hold any securities or positions. I’m making this website available “as is” with no warranty or guarantees of its accuracy, completeness or currentness. If you rely on this website or any of the information contained, you do so entirely at your own risk. I do not hold myself out as a financial advisor and nothing herein is a solicitation for any fund or securities mentioned. Although I may answer general questions about the information herein, I’m not licensed and registered under security laws to address your personal investment situation. Past performance is not indicative of future results. Any and all financial decisions are the sole responsibility of you the individual.