Are "Trend Following" Trading Strategies TOO Boring?

Aug 15, 2025

VTS Community,

VTS is too boring!

It doesn't happen often, but every time the market is in one of these slow grind up periods where every day seems to just be a repeat of the last, I get a few emails asking when we're going to start taking new trades. I do think it's worth reminding people:

The point of trend following is to remain allocated to the trend :)

It's not always a direct correlation but I would say there's definitely a relationship between performance and trade frequency. During times when there are no trades being taken that likely means one of two things:

a) We're riding a strong market uptrend and making a nice profit. Currently this is the case with all 4 of our strategies crushing it the last 2 months.

b) We're parked in safety while the market is crashing. Equally important to not be taking trades, just hanging out in safety is preserving capital.

I actually quite enjoy both of those periods when they happen. Now I will say my Options trading is quite a bit more active with numerous trades per week, and given that there's a decent amount of discretion involved with Options trading it means new trades can be found every day no matter what the market is doing.

But for our trend following strategies at VTS, the whole point is to ride periods exactly like the one we're currently in. Low trade frequency is a good thing!

M1:M2 VIX futures Contango streak

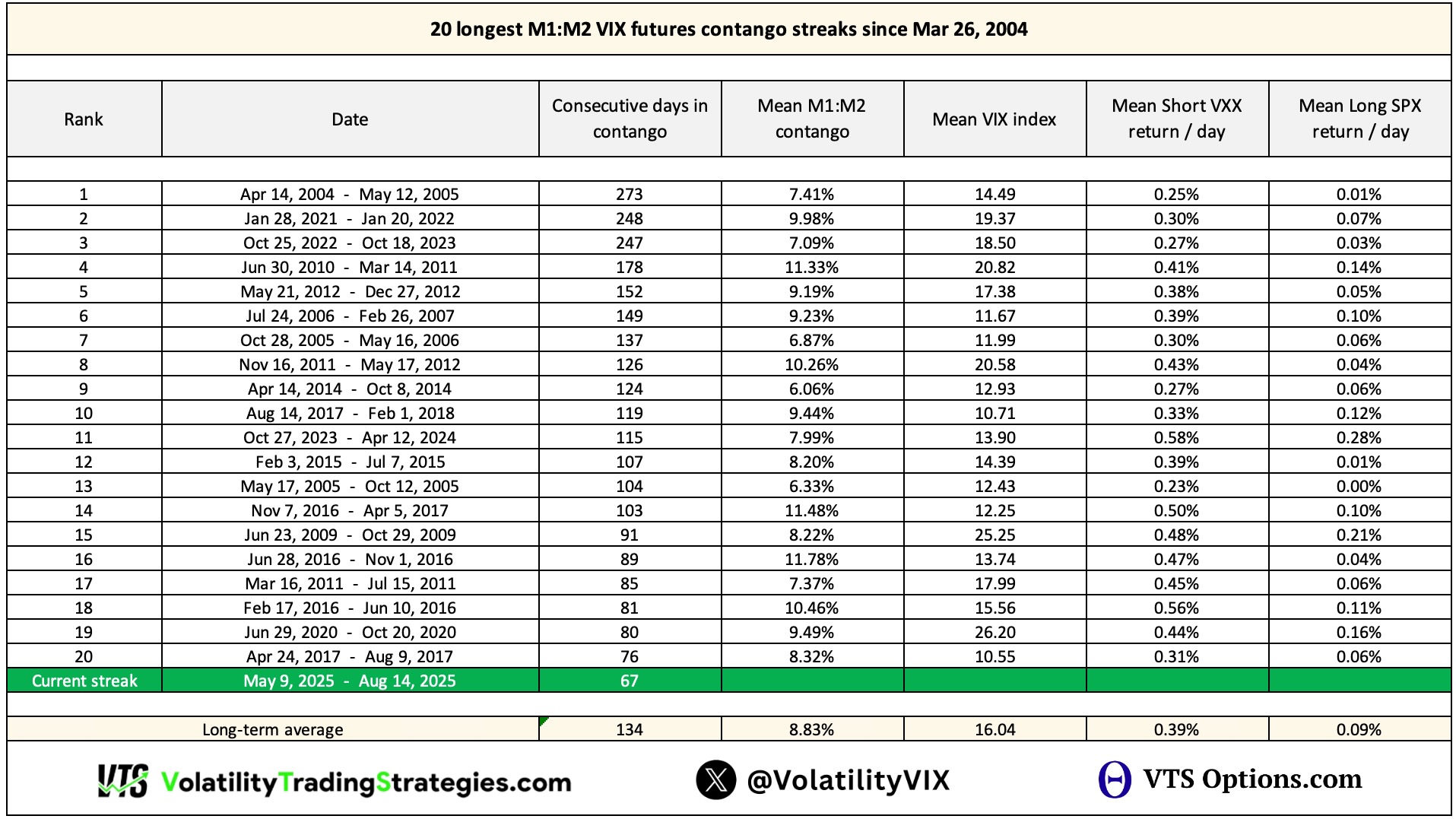

It's pretty easy to visually illustrate why our trade frequency the last 2 months has been so low. Remember, when the 2nd month VIX future (M2) is trading above the front month VIX future (M1) we call that Contango. VIX futures Contango is present during stable lower Volatility periods and usually mark reasonable S&P 500 performance.

This current 67 day Contango streak is building (highlighted green)

The above chart shows the top 20 longest M1:M2 Contango streaks since VIX futures launched in March 2004. The current streak of 67 days and counting isn't quite on the list yet, but it's getting close. This is why things feel so boring the last couple months. There's absolutely no reason to be taking new trades when all we are doing is riding the market up and making a nice profit.

Enjoy trends while they last

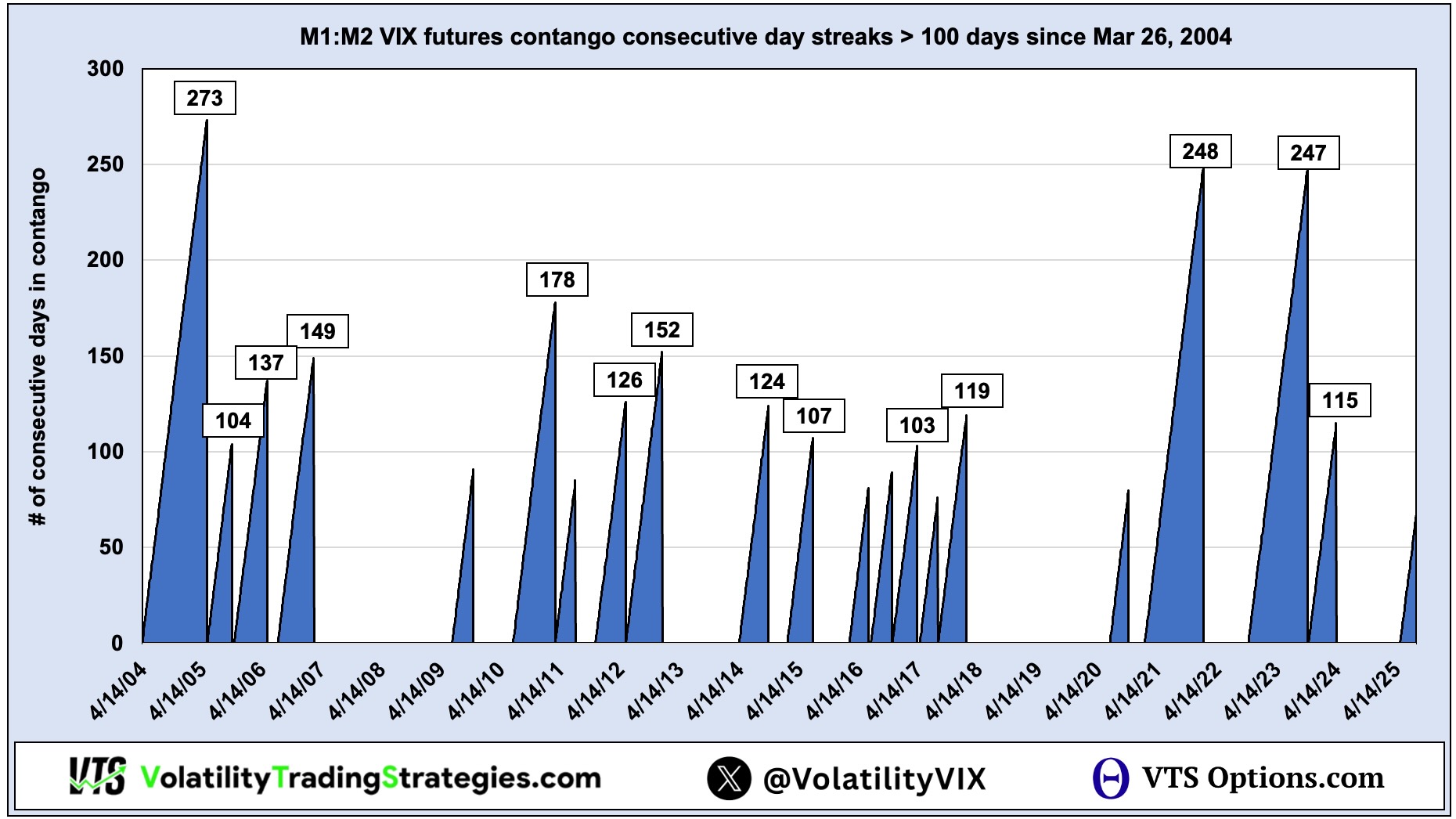

Stable uptrends in the market don't actually happen that often so I do think it's important to just enjoy the lack of trades when we're in one of them. To illustrate, again we can use the M1:M2 VIX futures but this time highlighting the Contango streaks that broke 100 days or longer going back to 2004:

Each one of those blue periods was likely a time when our strategies took no new trades. Those are the boring stretches of low Volatility where easy profit is made so enjoy them while they last.

We always remain nimble

- Of course it's always possible that the current 67 day streak turns into 100 days, 200 days, perhaps approaching 300 and we're about to set a new record this year. That would be fantastic because if we were to approach those record levels, I'm quite sure our performance would be stellar. After all, during stable market periods we are trading with some leverage, so bring on the boring!

- It's also possible that Monday is an ugly day that ruins the party and pushes our strategies into safety positions again.

The overall point is, the trend is our friend and since we can never know how long it will last, we don't mess with it by trying to guess and front run when it will end. If you exit trades every time a streak lasts a month or two, it means you'll NEVER participate in the best ones.

The market will tell us when to exit to safety, it's not my call...

Trade frequency snapshot

There will of course be a full lesson discussing trade frequency, trends, and performance comparisons in the Total Portfolio Solution course, but if you want to see at a glance the annual trade frequency for each of our strategies is here:

I've marked the lowest trade frequency years in green because that is ideally what we want. Like I said, it doesn't always guarantee good results but there's definitely a correlation there.

It may be boring from a day traders perspective, but for me, there's nothing boring about making money and extended streaks of calm markets are most welcome.

The trend is our friend, have a great weekend!

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.