Introducing the VTS Total Portfolio Solution

Aug 13, 2025

VTS Community,

Welcome to Volatility Trading Strategies. My name's Brent Osachoff and I founded VTS back in January 2012 with the goal of helping each and every one of you reach your retirement goals. The best way I know how to achieve that is through what I call:

Tactical rotation through Volatility targeting

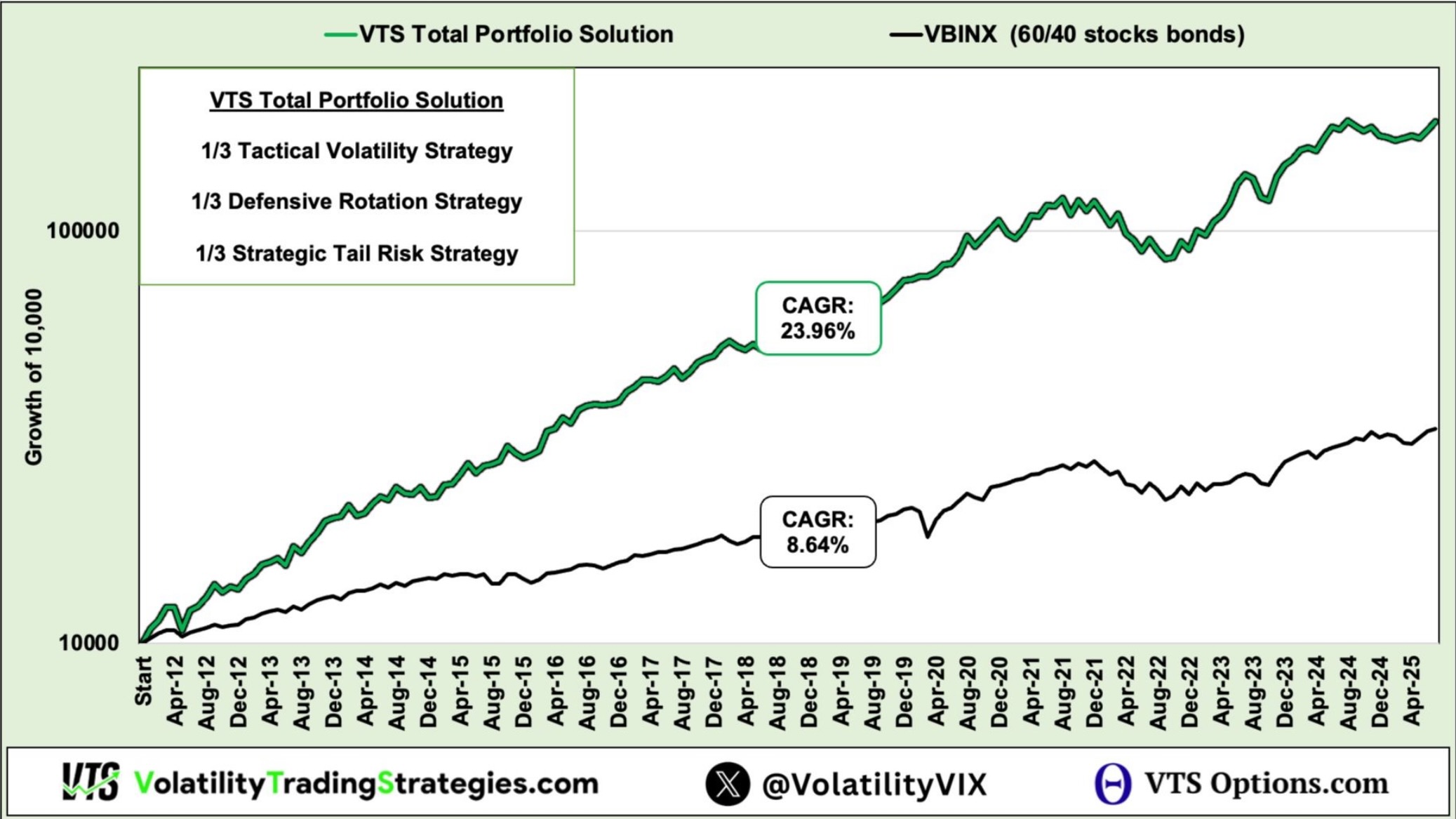

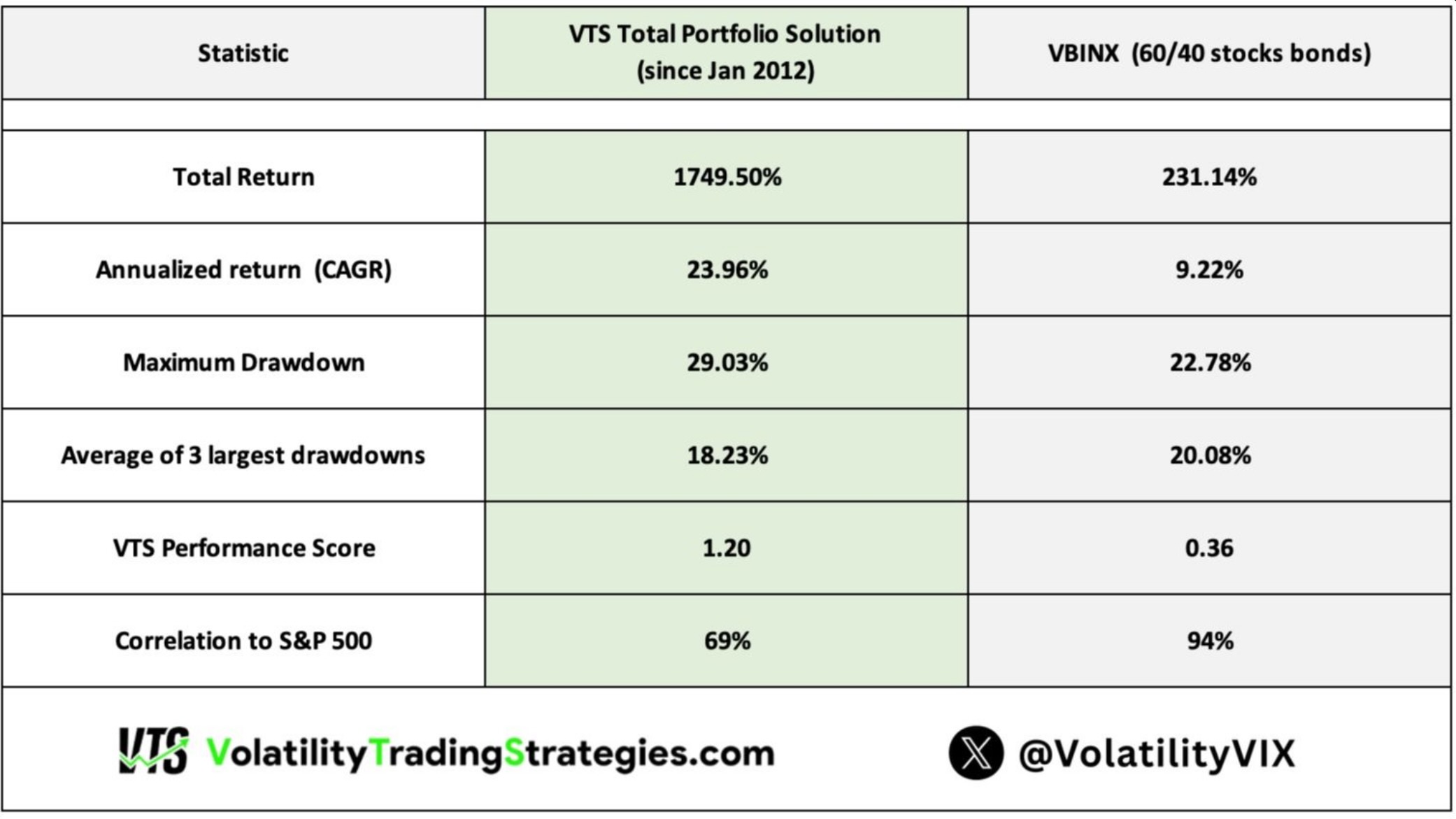

It is the ONLY way to participate in most of the good periods in the market while also being protected against the occasional market crash. The diversified VTS Total Portfolio Solution is comprised of our three main strategies, and this extensive course is going to break down every aspect of it from the strategies, performance, trade execution, correlations, trade frequency, ETF replacements, risk tolerance, management fees, rebalancing, and many more lessons.

Feel free to ask any questions you have in any of the lessons, I'm always here to help.

If you prefer video, click here for lesson 1 on YouTube

Current allocations

The Total Portfolio Solution is currently made up of three strategies with an equal weight to each.

They each use their own Volatility metrics to determine the trade signals, they use different underlying assets, and they have their own threshold levels to cycle through those ETFs. These three points of diversification means that trading all three strategies in the same portfolio improves the risk adjusted performance compared to any one of them on their own.

Maximizing risk adjusted performance

The whole purpose of tactical rotation through Volatility targeting is to only allocate to the asset classes that historically have the best performance in that given market environment. We remain consistent and disciplined with our systematic approach and let time and the law of large numbers work its magic. This style of investing isn't always obvious to see it working in the short run, there will be missed opportunities and underperformance here and there, but over multiple bull and bear market phases the performance really starts to add up.

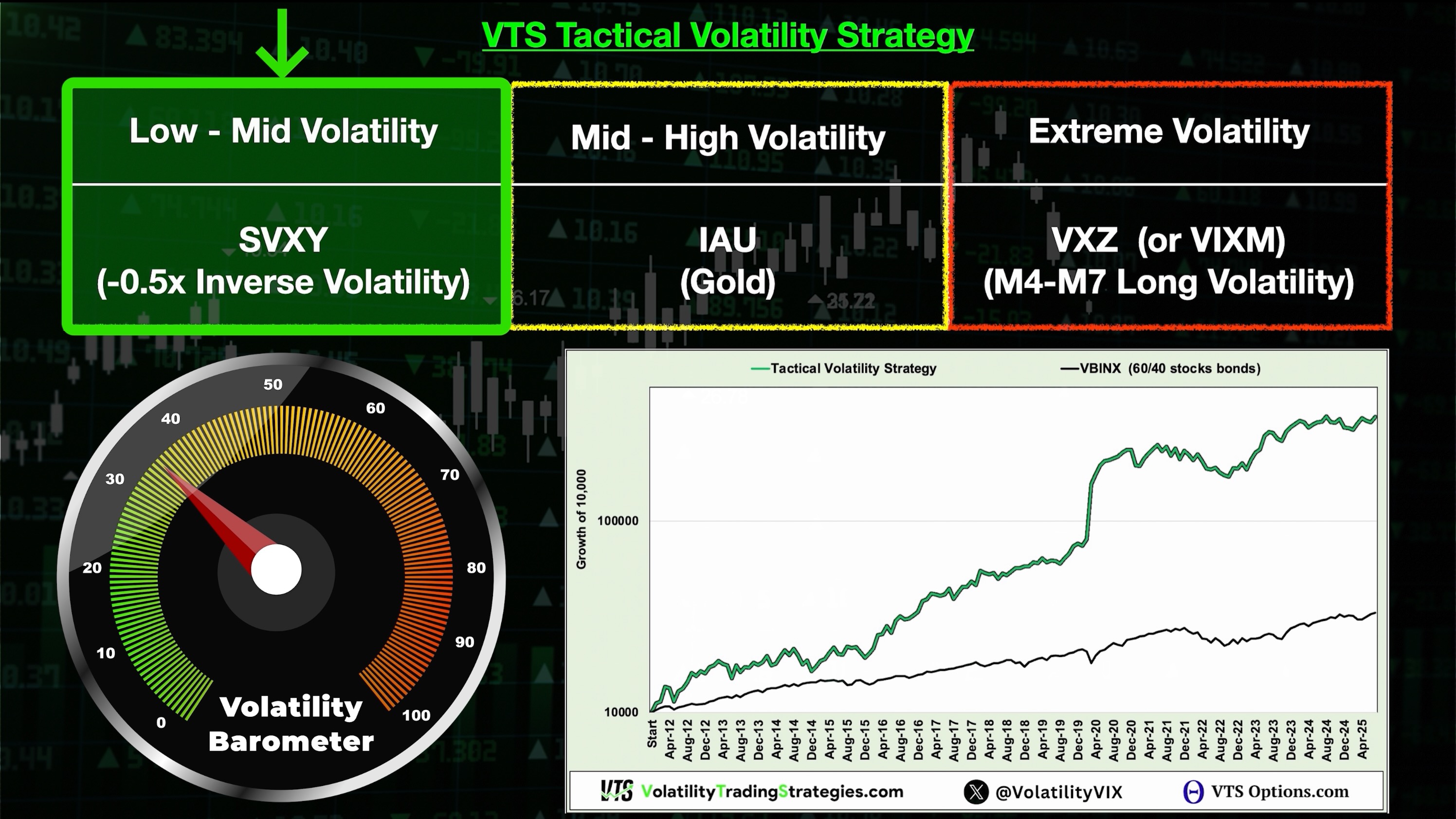

1/3 Tactical Volatility Strategy

Given that I was one of the early pioneers of the Short Volatility trade when the Vol ETP market launched 15 years ago, we could consider this our flagship strategy. There will be more detailed stand alone lesson on each strategy coming in this course diving into more detail so stay tuned for those.

Generally speaking the Tactical Volatility Strategy mines Volatility data to partition the market into different actionable ranges. During stable markets the strategy capitalizes on the fact that inverse Volatility ETF's can significantly outperform equities. It is in our best interest to participate in this explosive growth when we can catch a longer term stable trend. However, when market volatility rises the risk of holding Volatility products is too great we then need to cycle into a safety position to protect capital. Lastly, during rare times of extreme market Volatility we can flip the switch and go Long Volatility to potentially profit from a major market crash.

Low - Mid Volatility ---> SVXY (Short Volatility)

Mid - High Volatility ---> IAU (Gold)

Extreme Volatility ---> VXZ (Long Volatility)

Hopefully now you can see why I call this investing style "tactical rotation through Volatility targeting"

Each asset class has its own historically best performing market environment and it makes sense to only allocate to it during those ranges. When we're no longer in that advantageous market environment we move into an asset class that performs better in the new range, and rinse repeat. Over time, this is how we've been able to crush buy & hold investing.

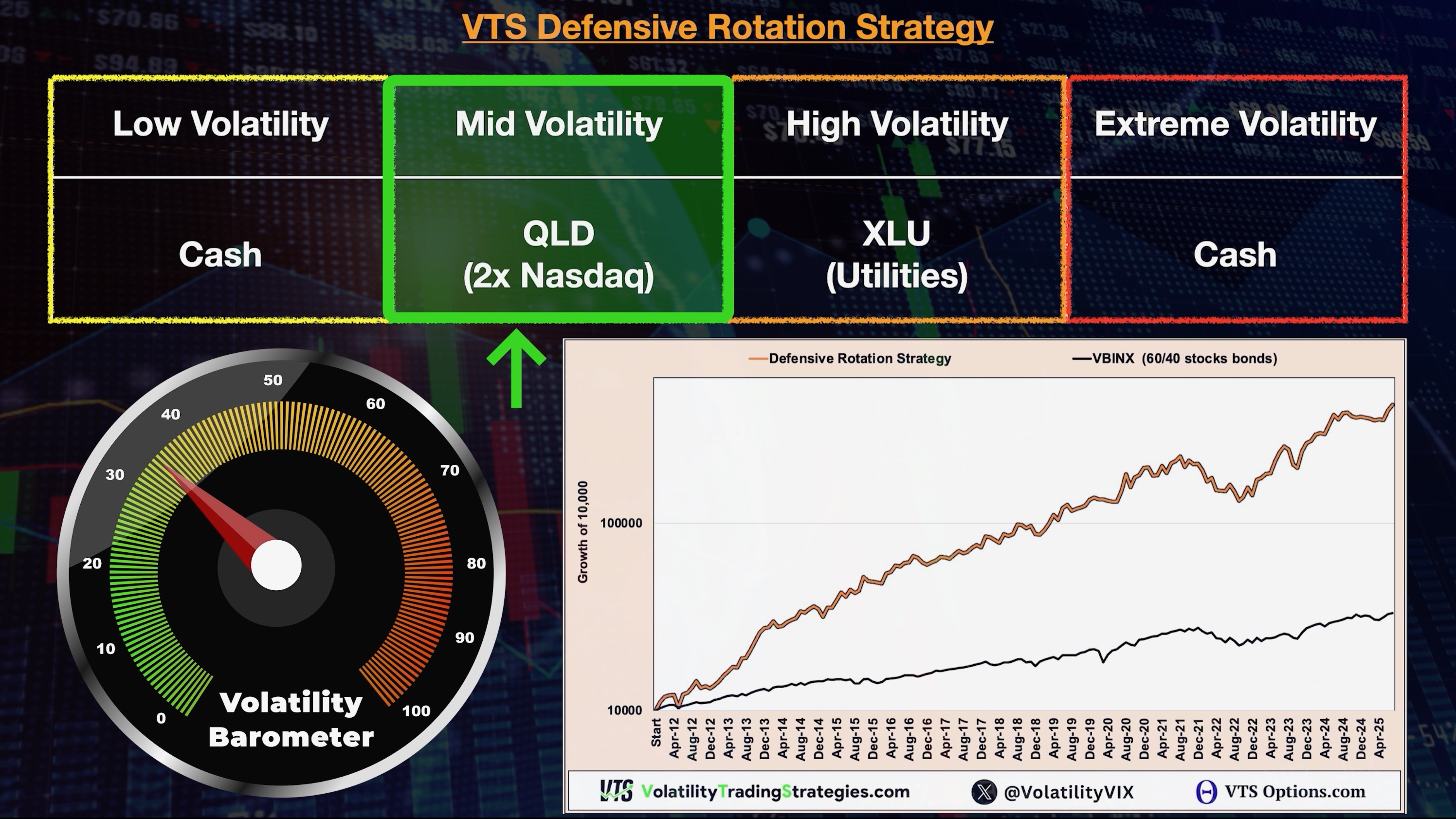

1/3 Defensive Rotation Strategy

This strategy capitalizes on the fact that many of the world's best performing stocks are technology related. In fact in recent years, a significant portion of market gains are coming from just a handful of high flying tech stocks. Nvidia, Tesla, Apple, Amazon, Microsoft, Google, these are largely responsible for market gains which is why we want a dedicated allocation to the Nasdaq index.

Given our success with Volatility targeting and reducing drawdowns by cycling into safety when necessary, during stable markets we can take on a leveraged Nasdaq position. When Volatility elevates though we cycle into Utilities which perform much better than equities in that uncertain environment. In extreme Volatility over the 90th percentile we move fully to Cash and watch the market crash safely from the sidelines. Lastly, we also have a Cash position during extreme low Volatility and the reason for that is that by the time the market reaches those levels of complacency, it's fairly common for that to mark a short term bottom.

Extreme Low Volatility ---> Cash

Low - Mid Volatility ---> QLD (2x Nasdaq index)

High Volatility ---> XLU (utilities)

Extreme Volatility ---> Cash

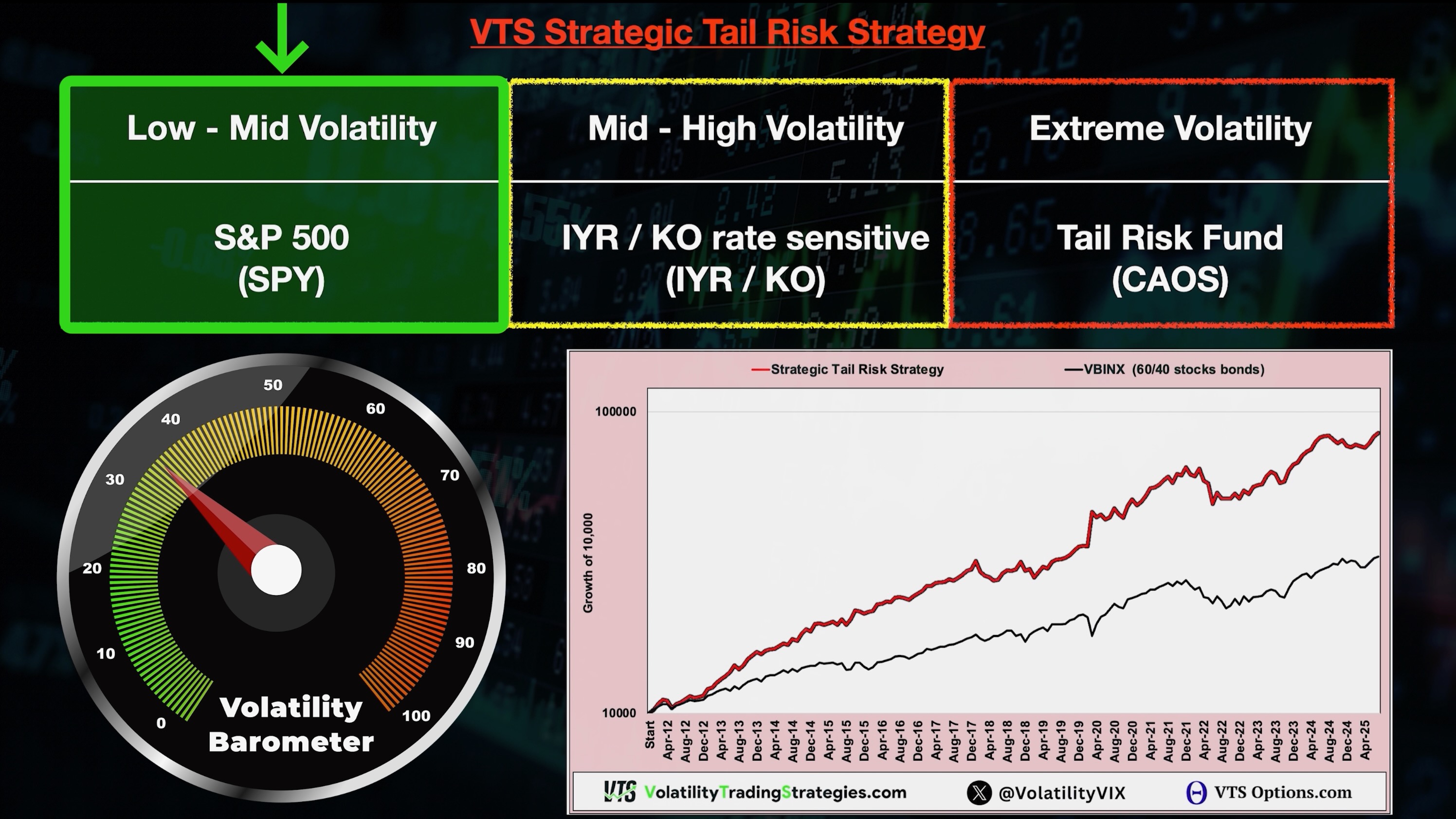

1/3 Strategic Tail Risk Strategy

Our third strategy uses a different combination of Volatility metrics and offers us yet another set of different asset classes to diversify the Total Portfolio Solution even further.

During stable markets the stock market performs very well so there's no reason not to be allocated to the S&P 500. Again though, as Volatility rises things get more ambiguous and we need to cycle into our safety positions. If we're in a potentially rising interest rate environment we'll use Coca-Cola as our safety position, and in a stable or decreasing interest rate environment then Real Estate is our asset of choice. During extreme Volatility the market is likely crashing and we'll hold a dynamic "Tail Risk" fund to side step the risk.

Low - Mid Volatility ---> SPY (S&P 500 index)

Mid - High Volatility ---> IYR / KO rate sensitive (Coke or Real Estate)

Extreme Volatility ---> CAOS (Tail Risk dynamic fund)

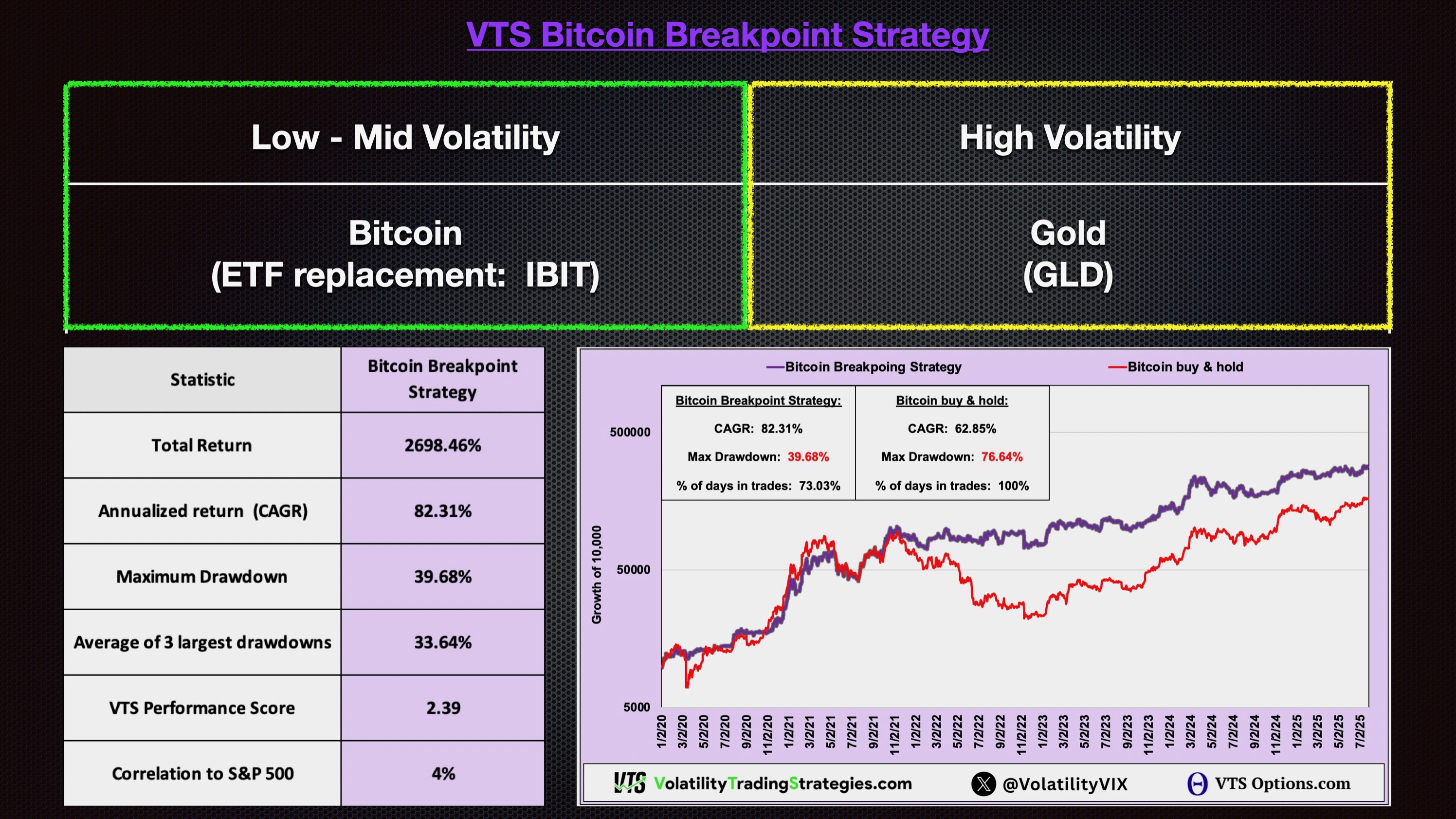

* Optional Bitcoin Breakpoint Strategy

Not for the faint of heart, but if you're a believer in the long-term viability of Bitcoin and its staying power as a strong asset class into the future, then we have a tactical rotation strategy that will capitalize on the explosive growth while also be ready to shift to safety when needed. Just looking at historical prices there's obviously nothing wrong with Bitcoin performance during good times. The only real issue is when it crashes, it REALLY crashes! There have been numerous 70%+ drawdowns along the way.

Our optional Bitcoin Breakpoint Strategy maintains an aggressive Bitcoin position roughly 75% of the time, but also shifts into safety Gold when necessary. The "diamond hands" mindset is only for those that don't understand Volatility targeting. The truth is you can still benefit from the crypto story without suffering gut wrenching drawdowns.

Low - Mid Volatility ---> IBIT (Bitcoin ETF, or use Bitcoin directly)

High Volatility ---> GLD (Gold)

* Optional: The Bitcoin Breakpoint Strategy is not an official allocation in the Total Portfolio Solution and no performance is officially recorded from it. The trade signals are in every daily email to VTS subscribers and is only for those investors who want to divert a little of their capital to participate in the Bitcoin story.

Full disclosure, for the last 2 years I've allocated roughly 5% of my total capital to this strategy. I feel like that's enough to benefit from any potential growth, but not enough to derail the rest of my portfolio if Bitcoin fizzles out and dies.

Are you ready for the crash?

Everybody and their dog already knows the stock market will eventually fall off a cliff and suffer an extended recession. It's happened before and it will definitely happen again. The problem is, nobody knows WHEN it's going to crash.

- Maintaining a long-term bearish position leads to disastrous results because the market does trend up most of the time, even when we feel there are many reasons why it shouldn't be.

- Hedging a portfolio doesn't work because it's a constant bleed of capital during good times that even when the market crashes, won't recover as much capital as was lost over time.

- Buy & hold clearly doesn't work because the long-term performance of those pie chart style portfolios is 7-8% at best. When you back out inflation investors are hardly making anything.

Keep the good, ditch the bad

What investors need are strategies that can remain bullish and capitalize on good market environments, but also move to safety during higher risk periods and protect capital.

That's where the VTS Total Portfolio Solution comes in:

I strive to provide investors the best of both worlds and help you achieve your long-term investing goals. Welcome to VTS! This course will break down every aspect of our portfolio and my investing philosophy. Thank you very much for the support, and feel free to ask any questions you have.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.