Part 5 - VB Threshold strategy through the 2020 pandemic

Jan 05, 2022VTS Community,

Continuing on with the discussion on VTS strategies during the pandemic, we'll talk about what could be considered the main "tail risk" strategy we have, the VB Threshold strategy. If you want to review the previous articles they are here:

Part 1: How did VTS strategies really do during the pandemic

Part 2: Defensive Rotation strategy through the pandemic

Part 3: Tactical Balanced strategy through the pandemic

Part 4: Tactical Volatility strategy through the pandemic

Part 5: VB Threshold strategy through the pandemic - today

Part 6: Total Portfolio Solution through the pandemic

Tail risk is generally defined as the probability of portfolio losses due to a rare event beyond a few standard deviations from the mean of a normal distribution.

The pandemic in 2020 certainly qualifies, as the 34% peak to trough drawdown was the 3rd largest S&P 500 drawdown of the last 50 years. Only the financial crisis in 2008 and the dot com bust in 2000 saw a larger decline in equity prices. With respect to volatility markets, one could argue it was the largest volatility event since October 1987 due to the speed and severity in the rate of change in volatility.

The VIX index itself closed at 82.69 on March 16th, 2020 which is the highest reading since VIX data began in 1990, even higher than the peak of the financial crisis. More than that, it reached that level in just three weeks as opposed to the 2 months it took the VIX to reach a similar level in 2008. Needless to say, the pandemic was a tail risk event.

The "tail risk" ready VB Threshold strategy

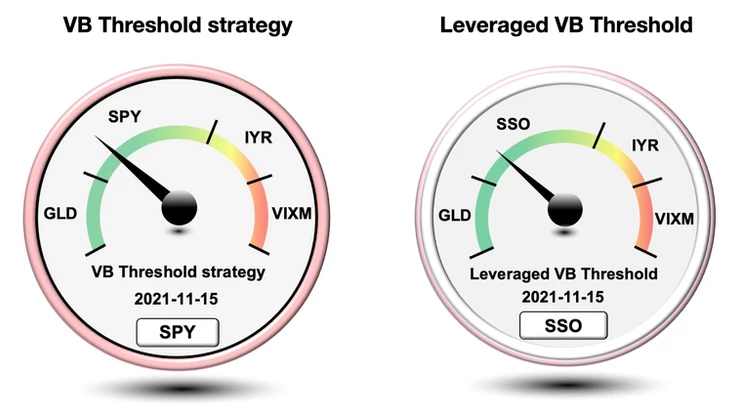

The VB Threshold strategy is designed to tactically rotate through different asset positions depending on the level of our proprietary VTS Volatility Barometer.

In both the standard and leveraged versions, the Volatility Barometer reading on that day determines the position we hold:

From 0-20% - Gold

From 20-60% - Equities

From 60-80% - Real estate

From 80-100% - Long Volatility VIXM

*VIXM is the ProShares VIX MidTerm Futures ETF that track the underlying SPVXMPIT index you can check out here.

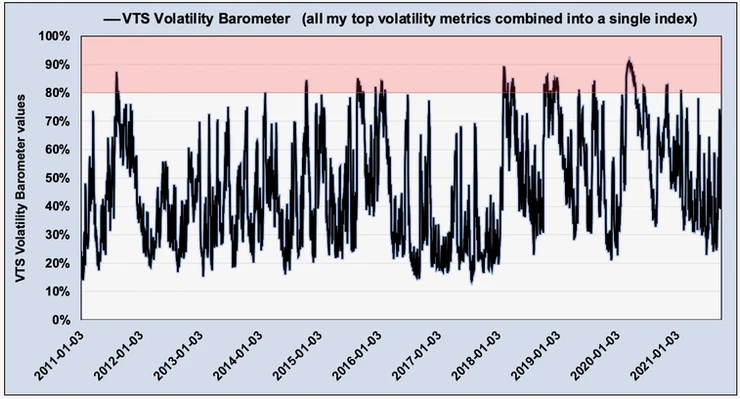

The VTS Volatility Barometer doesn't get over 80 very often so the long volatility positions within the portfolio are only reserved for the most extreme periods of elevated market volatility. Since inception in 2011 the Volatility Barometer has been above 80 on less than 5% of trading days.

VB Threshold during the pandemic in 2020

The VB Threshold strategy had a very solid year in 2020 on both an absolute and risk adjusted basis. The point of today's article is to show how it "would have" done had we remained active in our trading through the pandemic and kept trading the signals as the strategies are designed, which in this case would have meant Long Volatility with the VIXM.

* If you missed part 1 of this article series, I talked about all the reasons why in February 2020 I decided to move the entire VTS portfolio to cash and wait out the pandemic on the sidelines. I don't want to relitigate that decision, but I will remain systematic and we won't do that again in the future. At the time I thought it was the right thing to do, and in the end it did mean that our portfolio lost 0% during that crisis. While we would have done substantially better, in the end there's nothing wrong with going flat during such an extreme event.

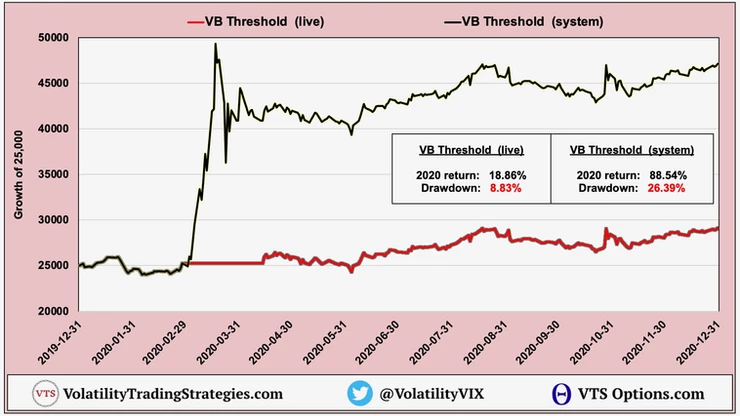

VB Threshold strategy live vs the system in 2020:

Our live results were very solid, returning 18.86% with a maximum drawdown of only 8.83%. In any year regardless of market conditions I consider that a success and I'd take that every year going forward if it was offered to me. As we can see though, had we remained trading the signals as the system is designed, it would have been a monster year with a return of 88.54%.

The Volatility Barometer went over 80% on February 24th, 2020 and remained over 80% right through April 23rd, 2020. Under those conditions the VB Threshold strategy should be in the tail risk position of VIXM and capitalizing on the crisis. Again I don't want this to sound like an excuse, I made the decision I did in the moment and I just have to learn from it and move on, but we're just trying to show what the strategies are designed to do. It would have been a monster year for VB, live and learn...

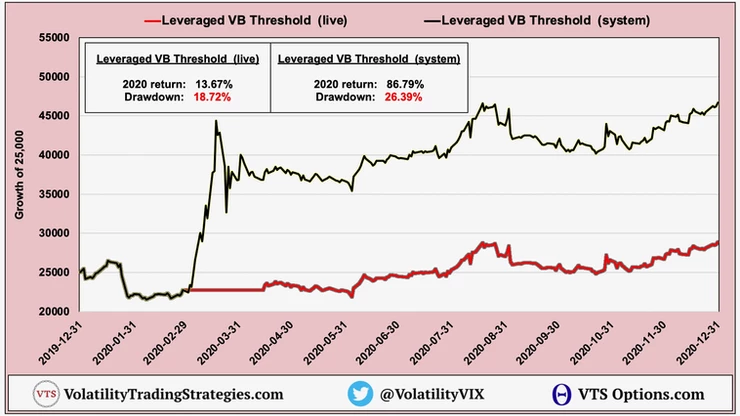

Leveraged VB Threshold live vs the system in 2020:

As I've discussed in this YouTube video, adding leverage doesn't always lead to a higher return and that was true for the Leveraged VB Threshold in 2020. The live results of 13.67% weren't as high as its un-leveraged version, but using the Long Volatility VIXM would have been a similar story and seen an 86.79% return that year.

* It's beyond the scope of this article but if you're curious about that drawdown after the profitable run up, I call that "the dreaded giveback" part of the long volatility trade which you can read more about here and here

If you're getting value so far:

Subscribe to the YouTube channel here

Follow me on Twitter here

VTS is a tail risk portfolio

As the old saying goes, everyone is a genius in a bull market and that applies on both sides of the equation.

- Bullish investors do fine during solid uptrends

- Bearish investors make plenty of profit during market crashes

The key, and what could be considered the Holy Grail of investing is to be able to do both of those within the same portfolio. That's what my work at VTS is all about. We're coming up on our 10th anniversary since I launched and I think my track record speaks for itself. We've crushed our benchmark and returned far more during this 11+ year bull market run than the broad market. However, I've also dramatically reduced the drawdowns and even profited from market crashes along the way.

The reason for that is, while I'm very conscious of the fact that markets do trend upwards over time and it would be a fools errand to try to go against that, there are times when the market does crash violently and it's very beneficial long term to have a method to profit from those crashes. Granted they are few and far between, but given the extraordinary financial engineering we have seen in the last few years I am expecting an extended downturn to become a reality at some point. Maybe not this or even next year, but at some point these bubbles will have to pop and we will want to be there to capitalize.

All of our tactical rotation strategies move to safety positions when volatility metrics become elevated, and three of the five have overt tail risk characteristics. Our Tactical Volatility and Aggressive Vol strategies both also use long volatility positions (1/2 VXX and 1/2 VIXY) as tail risk hedges during the most elevated volatility periods. However, both of those volatility strategies are designed to use them more sparingly at around 2% of trading days long-term.

VB Threshold will be closer to 4-5% of trading days allocated to long volatility which is why if we had to rank them, it's the VB Threshold that is the main tail risk strategy.

I don't want a recession, but I'm ready for it

I always say, I really don't want to see an extended recession so I don't mind seeing the markets trending upwards with a few medium sized pullbacks along the way.

- On the one hand, I don't ever want to see a recession because the burden falls heavy on the lower incomes and I don't ever want to see people get hurt due to the mistakes and recklessness of the financial and regulatory elites.

- On the other hand, due to the tail risk aspect of my portfolio I will likely make a nice profit if we saw a repeat (or something worse) of the financial crisis.

I'm torn between the two. Favour one outcome, ready for either if necessary, and we just keep pushing forward with risk management at the forefront.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.