Part 2 - Defensive Rotation strategy through the pandemic

Oct 12, 2021VTS Community,

How did VTS Strategies really do during the pandemic?

Part 2: Defensive Rotation

Part 3: Tactical Balanced

Part 4: Tactical Volatility & Aggressive Vol

Part 5: VB Threshold

Part 6: Total Portfolio Solution & Leveraged Total Portfolio

As I discussed in part 1 of this article series where I went over my rationale at the time for moving to cash during the pandemic, the purpose of this series is to shed light on the tail risk portion of each of our VTS strategies and explain how they are all designed to function in a crisis.

Now of course no market crisis is ever truly the same as any previous one, they all have their own unique characteristics so I don't imagine it will ever play out exactly this way again. However, it's definitely important for people to have a good understanding of what their money is invested in, and the high volatility positions are a key part of how I plan to navigate difficult markets long into the future.

Defensive Rotation & Leveraged Defensive Rotation

Let's start with the only VTS strategy that would actually have done worse had we maintained our positions through the pandemic, and this will also shed some light on why we made our recent change to add a high volatility cash threshold to the strategy.

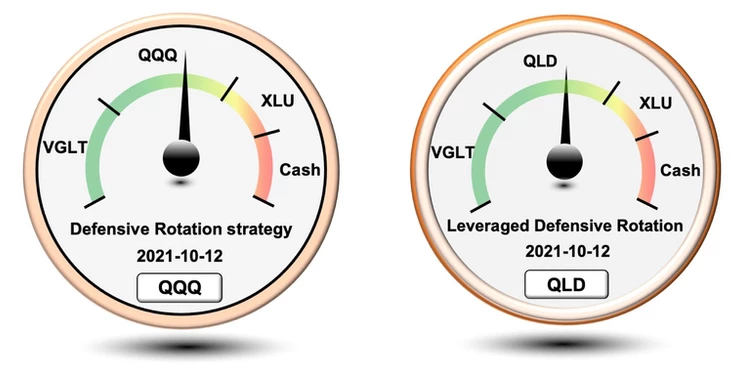

Potential positions depending on volatility conditions:

QQQ - Stable markets

VGLT - Very low volatility environments

XLU - Elevated volatility environments

Cash - This is new, for extremely high volatility conditions

QLD - Replaces QQQ in Leveraged Defensive Rotation strategy

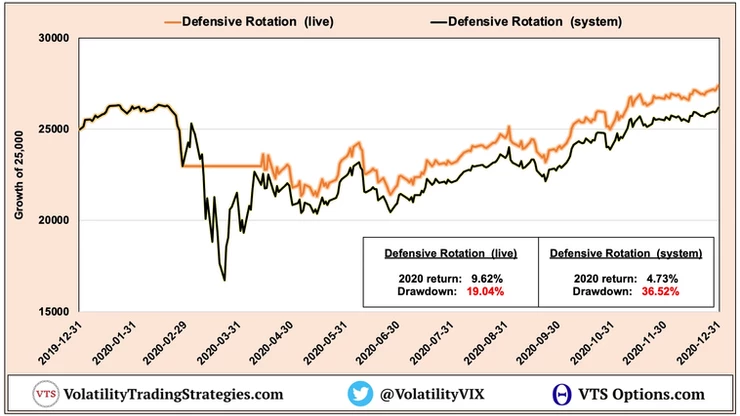

2020 Defensive Rotation strategy without the cash threshold:

Live is what the strategy actually did in 2020

System is what the pure spreadsheet signals were meant to be

As we can see in the chart, the live trading results for the strategy in 2020 was a return of 9.62% and a maximum daily drawdown of 19.04%. Comparing that to the systematic trades through the pandemic we can see that moving to cash actually improved performance by avoiding that month of extreme volatility.

* Now it's very important to mention that the pandemic in 2020 was actually the worst performing period for XLU (utilities) compared to the QQQ (equities) through any market crash of the last 20+ years. Typically utilities perform substantially better than equities, but that was one period where there wasn't much discrepancy between them and therefore not much protection offered by moving to XLU vs just staying in QQQ.

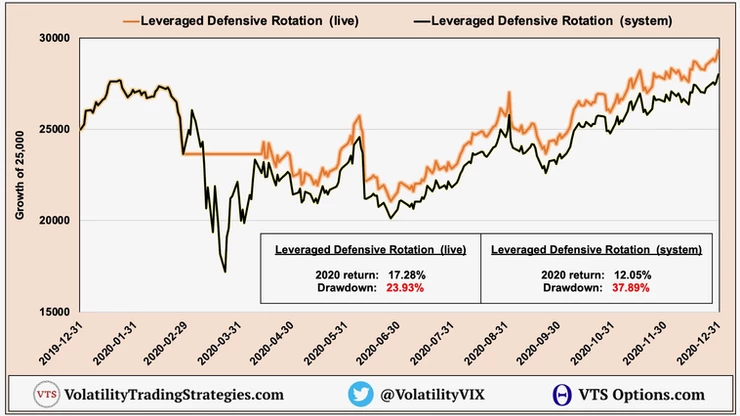

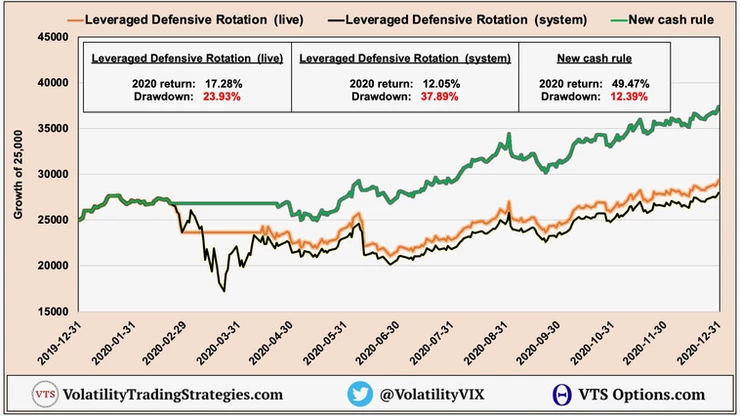

2020 Leveraged Defensive Rotation without the cash threshold:

The performance is a little different for the Leveraged version of the strategy but it's a similar story. In live trading the Leveraged strategy returned 17.28% with a maximum daily drawdown of 23.93%. Allowing the trades through the pandemic actually reduced the return to 12.05% and increased the maximum daily drawdown to 37.89%. So still an up year, but that would have been difficult to trade through and maintain confidence. As we'll go over in future articles though, this is where the long volatility positions in a few of our other strategies are meant to do the heavy lifting.

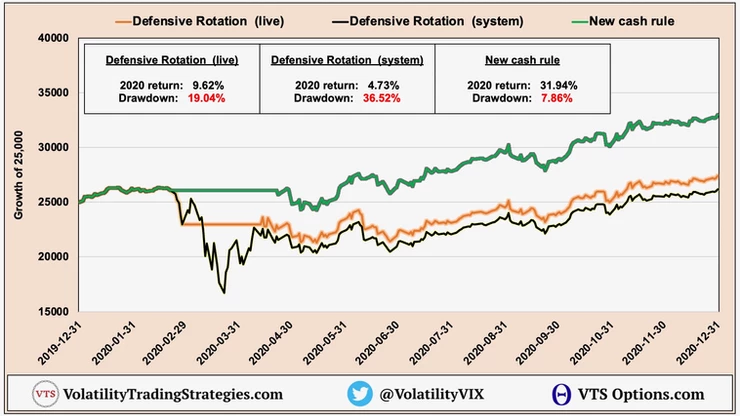

This is why we added the high Volatility Cash threshold

In a previous article you can view here titled Defensive Rotation as a stand alone strategy, I went over the reason for adding a cash threshold at the very high end of volatility metrics. It's because we want to try to avoid some of that extreme volatility when it's unclear how our XLU utilities position will perform. Utilities have had periods where it did very well in a crisis, and then other times where it's no better than equities. Having a small sliver of cash positions available eliminates that inconsistency.

If you're getting value so far:

Subscribe to my YouTube channel

2020 Defensive Rotation strategy with the Cash threshold:

We can see above, the cash threshold improves results significantly and also would have negated the need to move to cash during the pandemic because the signal would have done that for me anyway. This Cash threshold isn't likely to trigger very often as historically my volatility metrics have only crossed that level on 4.62% of trading days in the last 10 years. However, we can see in the chart that a small change can potentially make a very big difference.

2020 Leveraged Defensive Rotation with the Cash threshold:

Same story with the Leveraged Defensive Rotation, where adding that cash threshold could potentially improve results significantly and remove all that uncertainty around which asset class will actually perform best during an extreme crisis. The easiest way to solve the problem is to just not play the game, and move to cash for a few weeks during the worst of it.

We will exit to cash again, but this time for the right reasons

This article series isn't about excuses, it's just explanations and preparation for the next market crash because there will be many more in our investing horizon. It turns out moving to cash was the best choice for the Defensive Rotation strategy during the pandemic.

The next time around though our move to cash will be entirely systematic, and quantifiably the best position to be in during an extreme market crisis.

Part 3, Tactical Balanced strategy coming soon...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.