Part 1: How did VTS Strategies really do during the pandemic?

Oct 11, 2021VTS Community,

Part 1: How did VTS strategies really do during the pandemic?

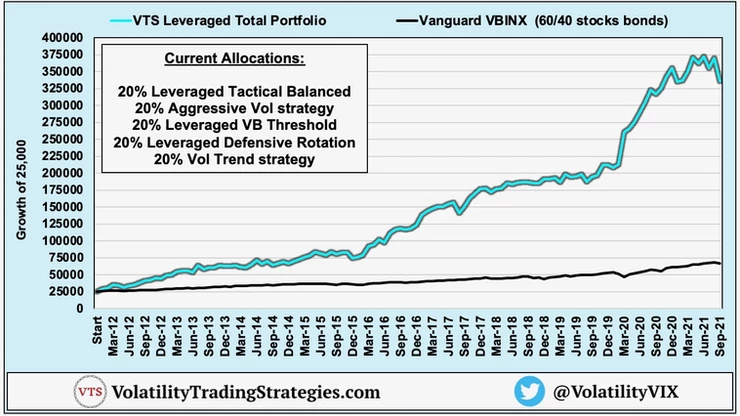

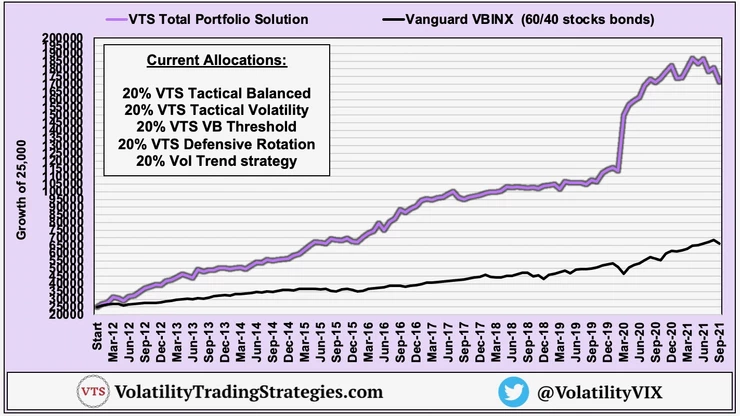

In a planned 6 part series of articles over the next several days I'm going to be circling back to the early days of the pandemic in March 2020 and break down how the VTS strategies "would have" performed had we remained in all our positions. Not to give too big a spoiler here because we will go into each strategy on it's own in detail, but essentially I'm going to be explaining why our portfolios should have looked like this in March 2020:

It's something that I've never gone into detail with because I'm a HUGE believer that only live trading results matter. I rarely show backtests unless it's necessary and I don't talk about woulda coulda shoulda. I'm a former professional golfer who made a living competing every day for my purse. In golf there's no long term contracts, there's no teammates to rely on, you're all alone out there and every day is a new day. You must post your real scores for the world to see, and you only get paid based on performance, period. I've carried the same mindset into my investing career. I have good periods and I have bad periods, but I show everything without making excuses.

No excuses, just explanations

I want to make very clear, this isn't to re-write history. I'm already proud of the fact that we didn't suffer any drawdown in that period because that certainly wasn't the case for most investors. And of course if the government and the Fed didn't go to the extreme financial measures that they did, things could have been worse for most people. Being flat over that difficult time period was a win and overall our 2020 results were great, especially when factoring in the very low drawdowns. I consider 2020 an A- overall. As you'll see though, not quite as big of a win as it should have been.

The decision to move to cash

On February 28th 2020 I did something that I've never done before in the near decade since I launched VTS. I made a discretionary decision to override the systematic signals and instead, move the entire portfolio to cash and wait out the storm of the pandemic. We were in cash all the way to April 13th, 2020 when we resumed regular trading. Those 6 weeks we just took care of our lives and weren't too focused on investing. I still did a blog everyday with articles and videos, but there were no official trades taken.

I've mentioned this many times before but I already spend 4-5 hours every day just answering emails from VTS Community members, it's just part of my day. During the early stages of the pandemic though it was completely overwhelming. I had hundreds of emails a day, people were scared. They have families, jobs, their health to take care of and in many cases those were being threatened. Given the market was already behaving strangely as far as asset class correlations go, the sheer panic of the situation was enough at the time to lead me to that decision to move to cash and just let everybody take care of the most important things in their lives. I don't want to relitigate it because it's just what I did in the moment. With investing, decisions have to be made and that's the one I came to so it is what it is.

What I can say though is, I won't do that again!

VTS has tail risk protection, we'll do fine in market crashes

The VTS strategies are all designed to have a good answer to a market crash, and a few of our strategies are considered tail risk strategies with strategic long volatility positions available. They are designed to be able to profit from extreme market crashes like what happened in 2008, or the pandemic in 2020, or the next one on the horizon because it will eventually happen again. And not for nothing, but the next time could be a real disaster.

* Side note, did you know that roughly 40% of all the money the US has ever printed was post pandemic just in the last 18 months? That's a staggering fact that in my opinion will have grave repercussions for the future. Obviously saving as many lives as possible was the stated goal but still, everything has consequences and I suspect the global economy will pay for this one down the road. We'll definitely want to be ready.

If you're getting value from my work:

Subscribe to the YouTube channel here

Follow me on Twitter here

Trend following works great, most of the time...

I've designed the VTS Portfolio's to be able to perform well during bull markets, but also during bear markets. Now of course there's no free lunch with investing and trade offs have to be made. In order to perform well during trends both up and down, it does mean sometimes the in-between choppy periods like now do cause our systematic strategies some problems. Options trading is better suited for whipsaw environments which is what VTS Options is for, but we'll circle back to that point at a later date. As far as systematic rules based strategies though we simply can't have it all, so I deal with the occasional frustrating whipsaw period in order to take advantage of the bulk of market trends in both directions.

You need to understand the strategies your money is in

For all of you who follow my work and trust my experience will navigate us through good times and bad over the coming years and decades, these next few articles are for you.

Again it's not excuses, just explanations, because I do think it's important for all of you to fully understand the strategies you're investing in. I don't want my decision 18 months ago to mean that you don't feel secure in what you're doing. If you just looked at the performance in March 2020 you'd probably be pleased to see no drawdown occurred, but you wouldn't actually know that we have those market crash signals in place.

Hindsight is always 20/20 and of course none of us could have known what was going to happen. As it turns out with perfect hindsight, I did myself and my work a little bit of a disservice by missing out on that opportunity to display the other side of the VTS Portfolio. The risk management side I talk about so much. The reason we move to safety quickly. The reason we have long volatility in the portfolio. The reason I speak on tail risk. Unfortunately, I did not get to demonstrate that because I made an emotional decision in a crisis.

Learning from mistakes

Not making money isn't the same thing as losing money so it's not something I dwell on too much, but the unfortunate reality is that successful investing is often built on learning from mistakes. I've made my fair share in the last 17 years since I retired from golf and shifted my focus to investing. This one from March 2020 wasn't a regret as much as just a positive reinforcement that the strategies I've built are good, and they will do their job.

I wish it wasn't the case because a lot of people get hurt during recessions, but sadly we will have plenty of opportunities in the future to display our tail risk positions. If people think March 2020 is as bad as things can get in the market, I've got bad news for you because at some point it's going to get much worse. The market will be down 20-30% again, and just when everyone thinks the dip will be bought, the bottom will truly fall out.

The next time around I will just get out of my own way and let the strategies do what they are designed to do!

Part 2-6 for individual strategy breakdowns coming soon...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.