All Investors should be Short Volatility Traders

Jul 07, 2025

VTS Community,

Fortune favors the bold

I truly believe that if a person does not have a portion of their investment portfolio dedicated to a Volatility ETP strategy, they are leaving a lot of future profit potential on the table. I know for me personally, my investment portfolio and my net worth are very thankful that I began this Volatility trading journey 15+ years ago when the first product VXX hit the market.

To date I've traded VXX, XIV, UVXY, SVXY, VXZ, and many of the Volatility ETPs with probably 10,000 transactions or more. I'd like to think in the 15 years since then, I've done my part through countless articles and videos to shine some light and understanding on the Volatility ETP complex.

Check out my YouTube channel for hundreds of Volatility Trading videos

Why should people care about Volatility ETPs?

I could write for hours on all the reasons why products like VXX, UVXY, SVXY, VXZ, and others can be such valuable securities to trade. Today, let me give you three visualizations on why that's the case.

1) The long-term buy & hold rate of return is decent...

I'm definitely going to spend a nauseating amount of time in this course talking about risk management and drawdown reduction, so please just give me some leeway to make this initial point, before I immediately debunk it afterwards.

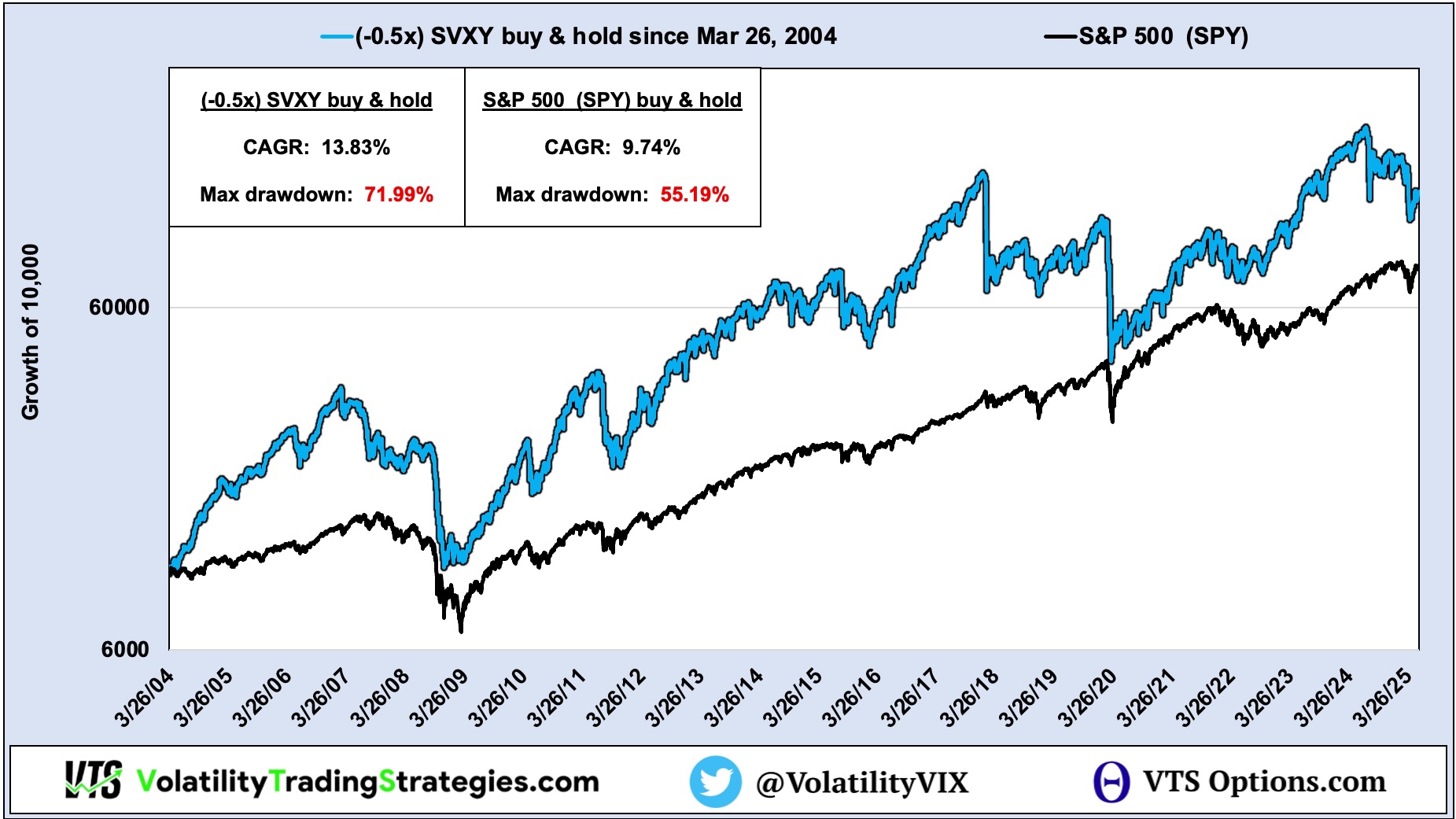

If you look at the performance of the -0.5x SVXY straight up buy & hold, simulated back to the launch of VIX futures on March 26, 2004, at least from a rate of return perspective, it's actually decent.

It's one of very few Volatility related securities that IF a person was able to buy it and just never look at it, the terminal results were acceptable. 13.83% a year is nothing to scoff at. Now like I said, I will immediately debunk that.

Please don't just buy & hold Volatility ETPs

That would be an excruciatingly wild ride and a totally unnecessary roller coaster to be on. However, if we compare it to the S&P 500 (SPY) over the same time period it's actually substantially better than the stock market

-0.5x SVXY since 2004: 13.83% CAGR

SPY since 2004: 9.74% CAGR

Now the vast majority of investors wildly overestimate their own risk tolerance and I would never give anyone the impression that buy & hold is anything to consider. With a maximum drawdown of 72% it's a complete non-starter for ALL investors.

The point is though, the rate of return by itself is high enough that investors need to put SVXY on their radar and learn how to trade it. We can do dramatically better than buy & hold, but it's a start right?

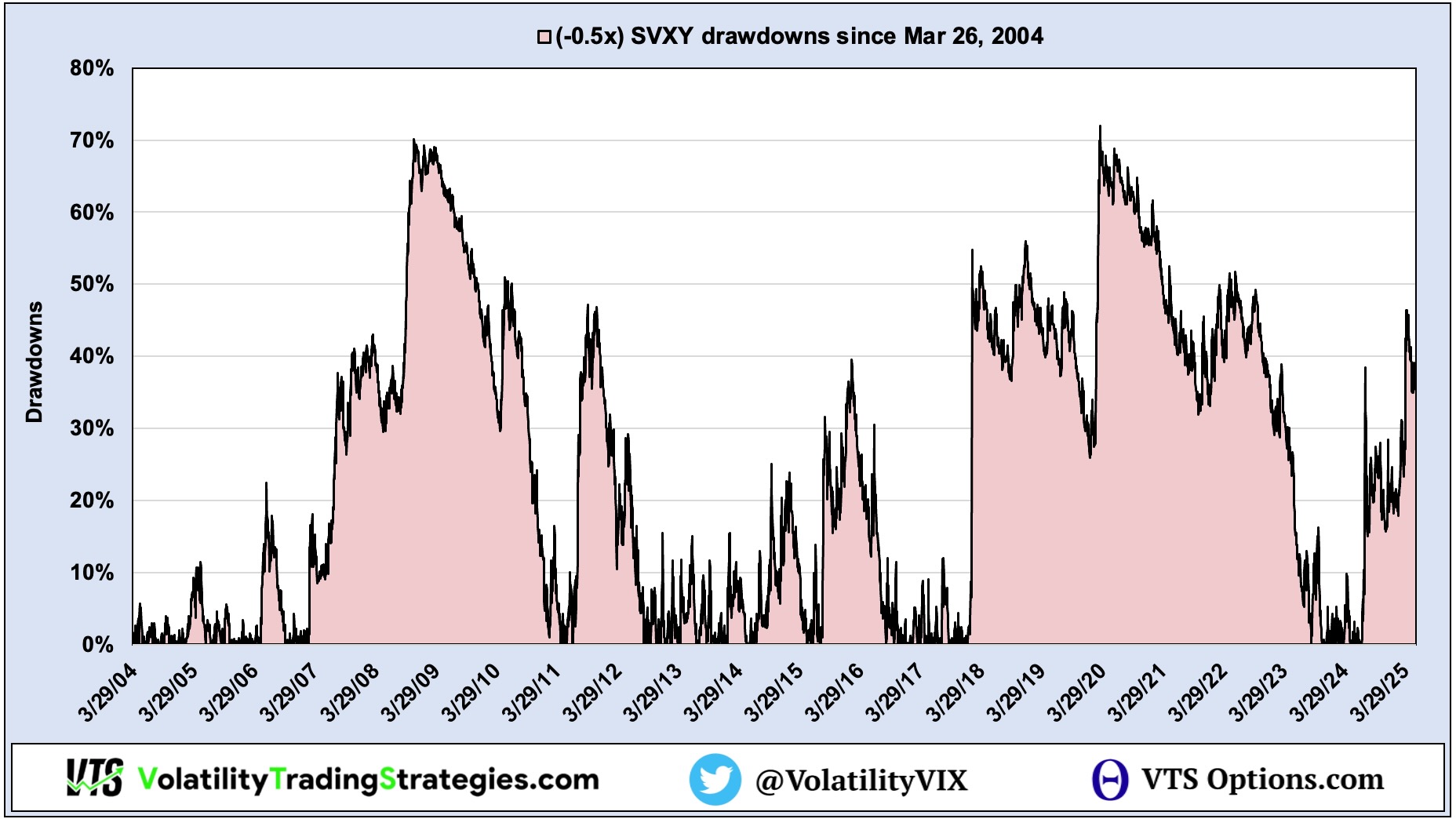

2) SVXY has been a wild and crazy ride

For most investors, when they see something with an incredibly volatile history like SVXY, they immediately dismiss it as too risky. That does make some logical sense by the way. If our end goal is consistency, surely Volatility ETPs breach everyone's risk tolerance and should be ignored right? In my opinion, no. Those investors are missing the forest for the trees.

The opportunity is huge exactly BECAUSE it's so wild and crazy

Think about it this way. If there was an asset class that was stable and consistent long-term with very low drawdowns, such as low coupon rate government bonds or something, do you think you could design a strategy that tactically rotates in and out of positions that actually improves the buy & hold results?

Probably not right?

If it's stable and consistent to begin with, buy & hold would almost certainly outperform active trading long-term. This is one of the reasons why study's show roughly 90% of active fund managers underperform their benchmark. That's because it's actually not that easy to mess around with active trading strategies and outperform just boring old buy & hold.

However, SVXY and the other Volatility ETPs are so wild and crazy, it is actually possible to trim down some of those insane drawdowns and improve long-term performance.

-0.5x SVXY drawdowns since March 26, 2004:

If we can apply our knowledge of the Volatility complex and work to reduce some of those staggeringly large drawdowns, we can significantly improve the long-term results. That's not possible with securities that don't suffer those massive drawdowns in the first place.

Investors get this part backwards. They think they should avoid underlying securities that are volatile, when in actual fact those are the ones that have the most potential for the savvy tactical investor.

You will learn this throughout the course. When I see something like -0.5x SVXY that has a 14.5% annual return but suffers 70%+ drawdowns I get excited.

3) Volatility ETPs have A LOT of low hanging fruit

So we've already established that the terminal buy & hold rate of return is decent at around 14.5%. However, we've also determined that a 72% maximum drawdown is a complete non starter for any investor with even a shred of self preservation.

So we're done here right? SVXY should be ignored? It's too risky, it's too volatile, just forget about it. WRONG!

Let me show you what I mean by low hanging fruit by adding an incredibly basic Volatility metric trade filter to the mix. If you've followed my work and the daily emails then no doubt you've heard me speak a lot about the VX30:VIX Roll Yield.

If you haven't, check out this video explaining the VX30:VIX roll yield

To get to the point, the VX30:VIX Roll Yield essentially measures how much potential decay the Volatility products have built in.

Think about it as the "kinetic energy" of the Volatility space. VX30:VIX roll yield is no guarantee, but it's an excellent way to gain an advantage when trying to develop a timing system for actively trading Volatility ETPs.

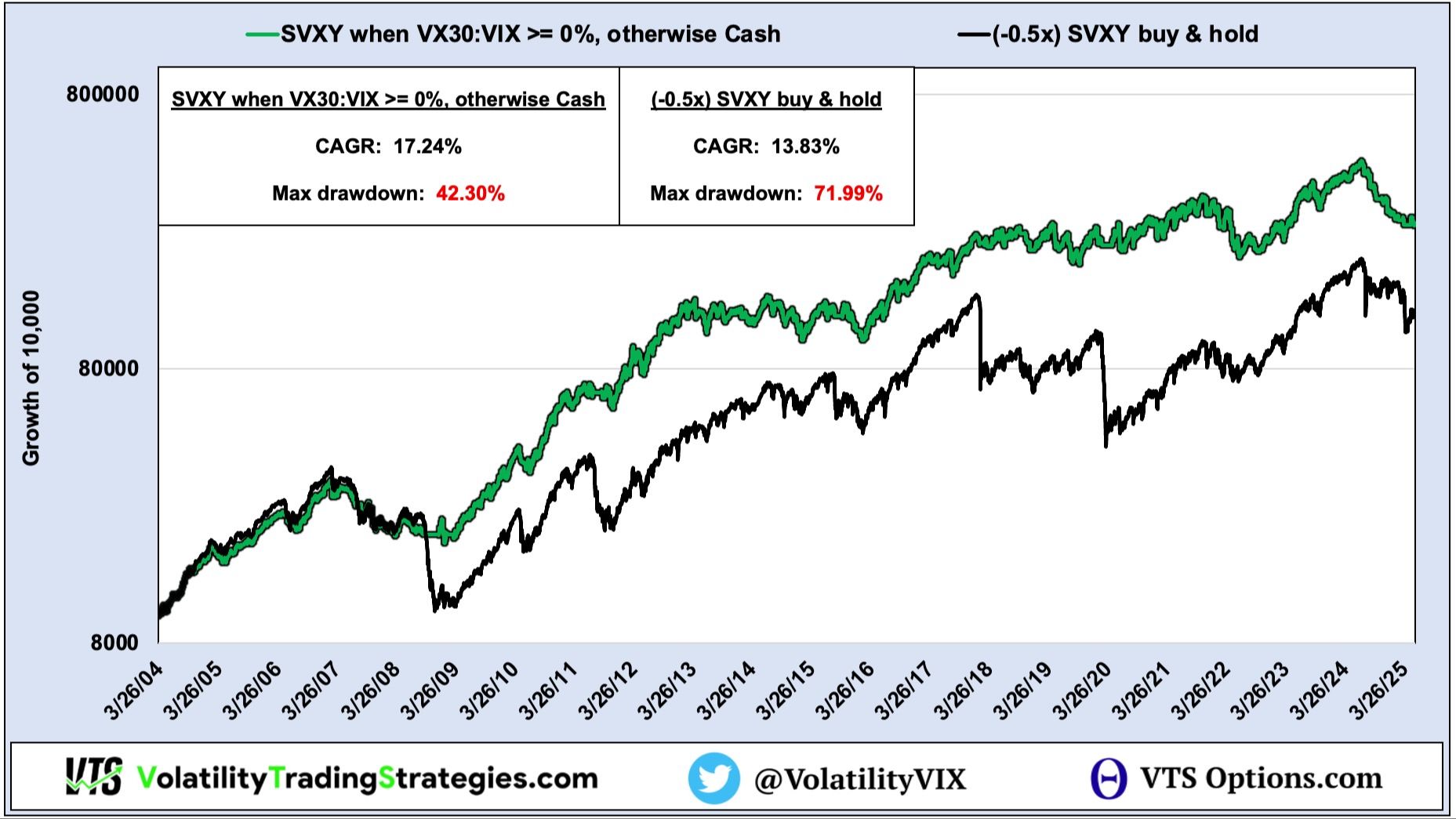

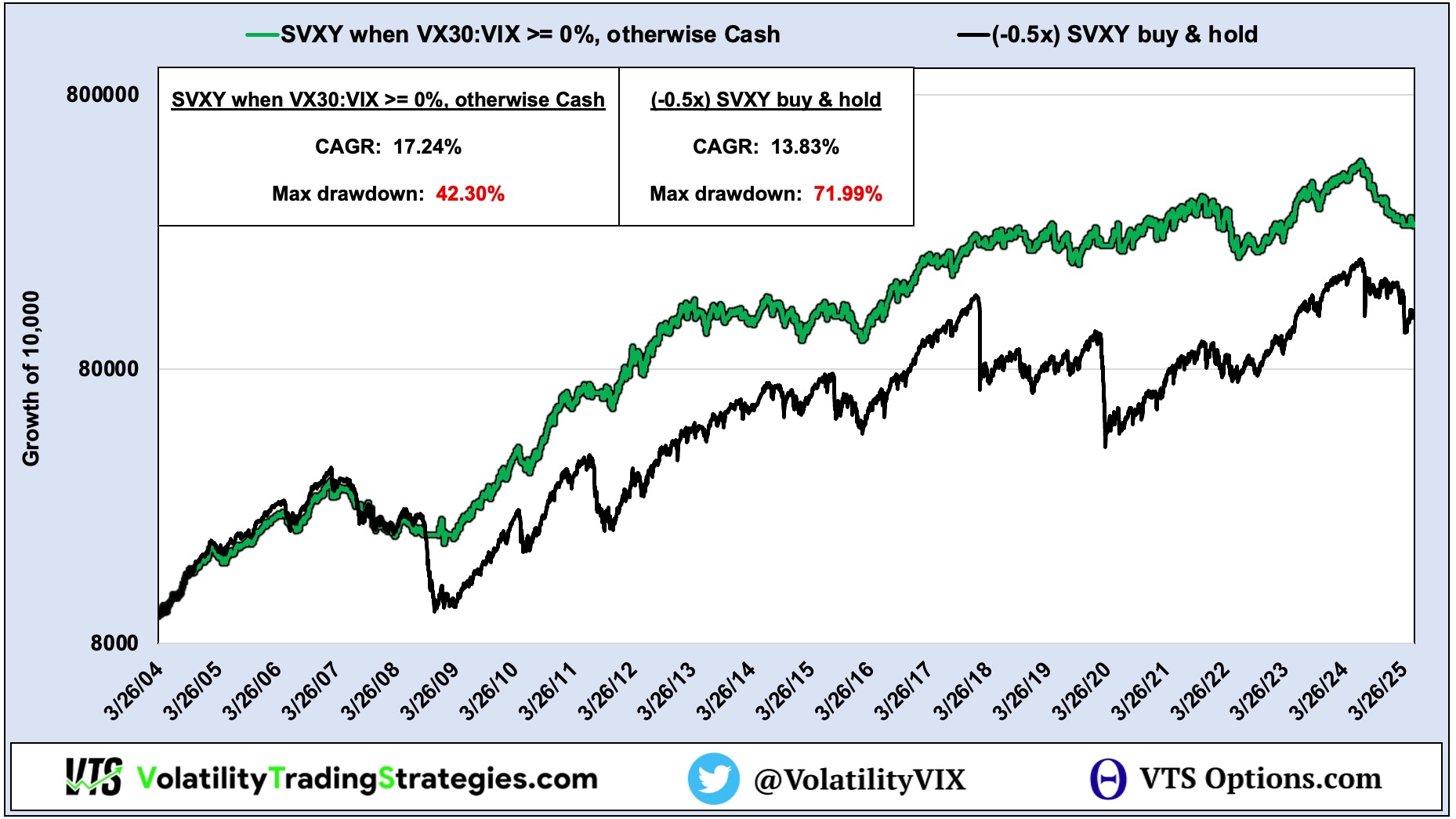

If we apply that simple Volatility metric and ONLY hold long SVXY when the VX30:VIX roll yield is greater than 0%, some impressive early results follow. By the way, the VX30:VIX roll yield is positive on 82.38% of trading days, so we're actually only eliminating about 17% of the highest Volatility days in the market.

Long SVXY when VX30:VIX roll yield > 0% vs SVXY buy & hold

We've barely scratched the surface but we seem to already be on the right track right? Those results with the VX30:VIX filter are substantially better than SVXY buy & hold, which remember was already better than holding the S&P 500.

The devils advocate in you might be saying to yourself right now, well sure, but isn't that true of everything? Couldn't we do the same thing with the S&P 500? Well, let's try!

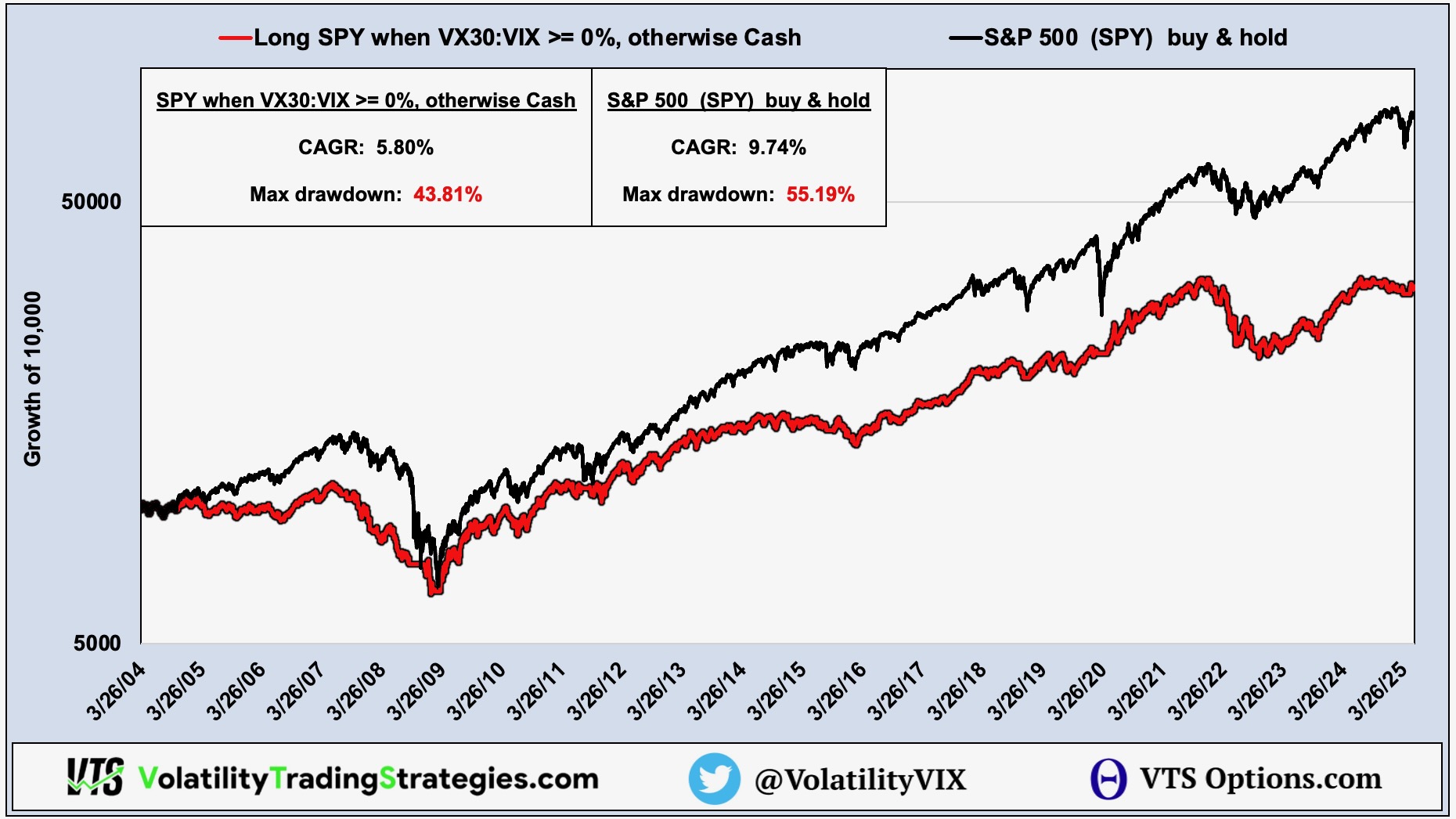

Long SPY when VX30:VIX roll yield > 0% vs SPY buy & hold

Nope! Adding a VX30:VIX filter to the S&P 500 made the results worse. Now, it was more consistent and it did reduce the drawdown, but the rate of return dropped.

It's like I said above with reason #2. If something is largely consistent it actually takes some pretty high level trading skills to tactically invest and improve on buy & hold. Now the S&P 500 has had some pretty epic crashes so you can't call it consistent with a straight face.

However, in comparison to Volatility ETPs the point still stands. The more consistent something is, the harder it is for most investors to outperform it.

Luckily for us we're not "most" investors are we?

With higher risk comes HUGE reward opportunities...

Hopefully I've opened your eyes a little bit to the huge potential offered by these wild and crazy Volatility products. Most people won't touch them. Too complex, too risky. Not me though.

I've always been the type of person that when things get hard, I just roll up my sleeves and get to work

Throughout the rest of this course I'm going to prove to you that not only is the SVXY safe enough to trade, but you might actually start kicking yourself that you didn't find out about Volatility Trading Strategies 15 years ago...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.