Is Trading on Margin Smart, or Investing Suicide?

Aug 21, 2025

VTS Community,

Don't trade on margin / Don't trade on margin / Don't trade on margin. Write that 100 times on the chalkboard like Bart Simpson...

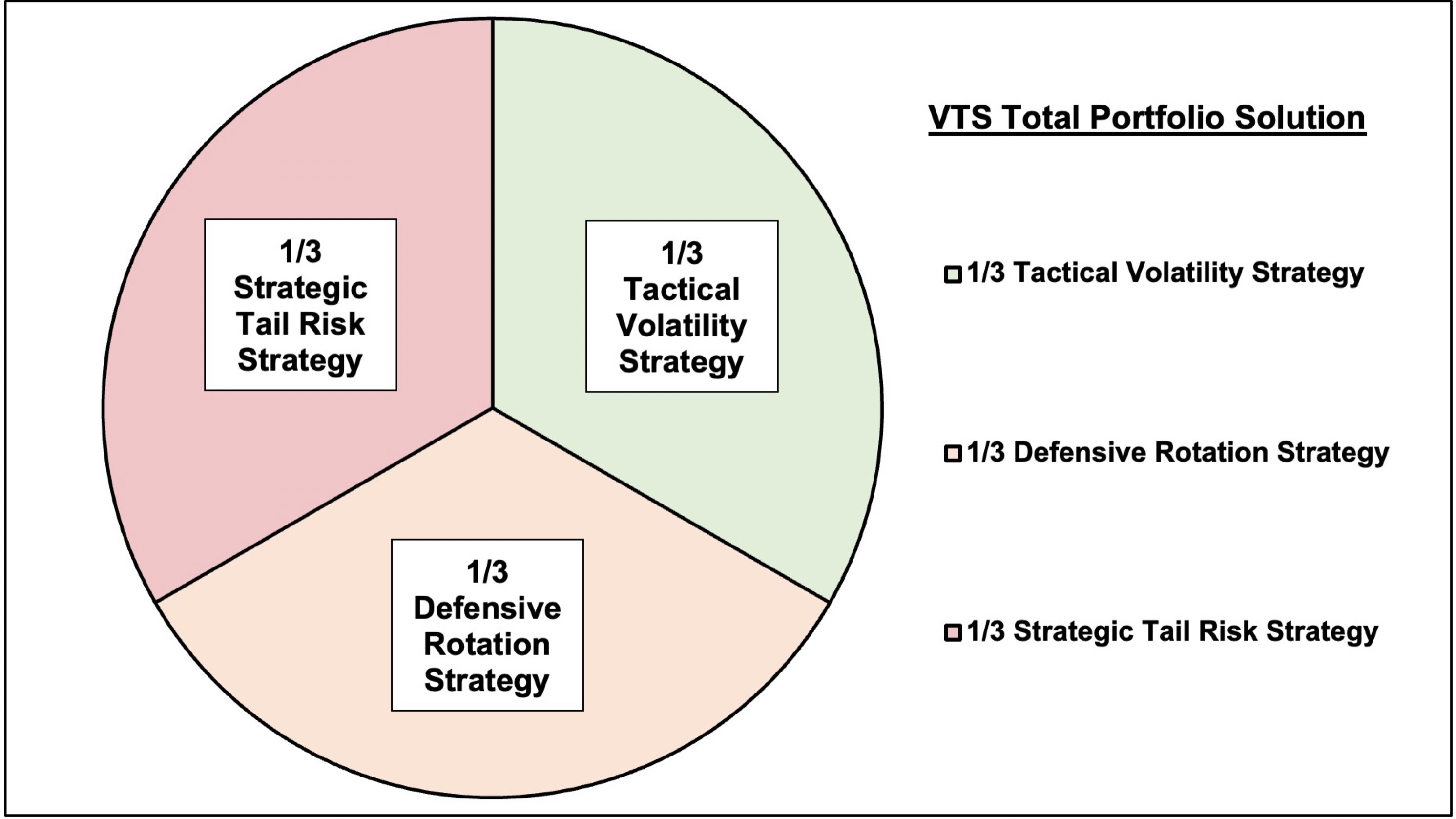

One of the more common questions I get emailed has to do with trading on margin, and whether it's a good idea to just ramp up the allocations to our VTS Total Portfolio Solution. Performance has been great for 14 years, why not just go for it?

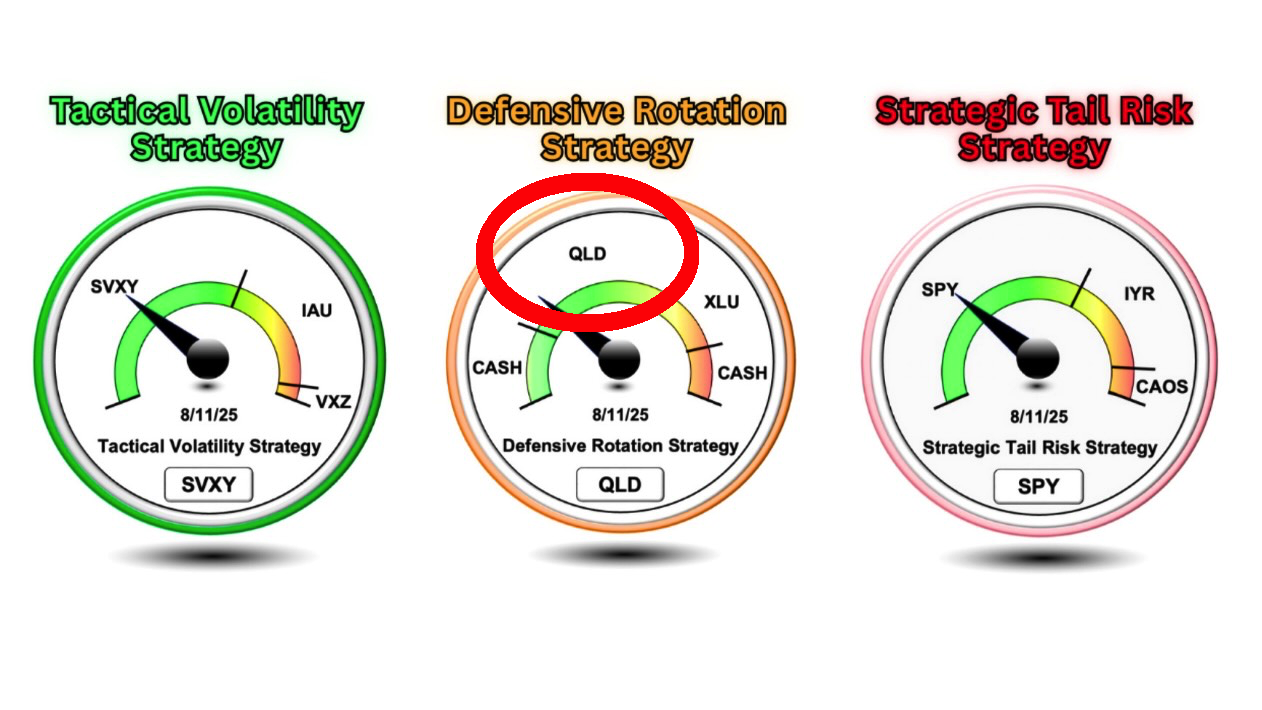

Now some of you might be thinking, what is he talking about, we already use the 2x Nasdaq QLD in the Defensive Rotation Strategy instead of the 1x QQQ, so we are already using leverage. Yes, true, but let's define some terms.

Leverage vs Margin

- Leverage just involves using a leveraged ETF, which amplifies gains or losses of an underlying index and trades like a regular stock without requiring any margin or incurring any interest. They can be 2x leverage like the QLD that we use, or even 3x leverage like the TQQQ. There's a very long list of leveraged ETFs.

- Margin, however, is when you borrow funds from your broker to buy more stocks or ETFs than your available cash value, increasing your buying power but incurring margin interest on any borrowed amount over your cash value. Just to be clear, you pay your broker to trade on margin, and it's not cheap.

Example:

Let's take an investor with $100,000 in their broker account who wants to fully invest it in the VTS Total Portfolio Solution as an example. The current allocations are as follows:

Each individual strategy has its own set of Volatility metrics to determine the signals, they use different thresholds to move between assets, and they use their own asset classes to provide diversification for the entire portfolio. I call this our 3 point diversification:

Only one of our three strategies (Defensive Rotation) uses leverage. You can see for lower Volatility stable markets we will be using the 2x leveraged Nasdaq ETF called QLD.

* That does not require any additional margin to buy, it trades exactly like any other stock or ETF, and you don't pay any additional broker fees

If an investor wanted to allocate their $100,000 based on the trade signals from this latest calm market period it's easy:

- $33,333 into SVXY

- $33,333 into QLD

- $33,333 into SPY

That would allocate the entire $100,000 the investor has, but would not require any margin interest to do it. Technically speaking they would be trading on leverage due to the QLD position, but this is not margin.

Margin is a different animal

Now let's take an investor who wants to trade our VTS Total Portfolio Solution on margin. They believe in it so much that they actually want to double all the allocations. The performance has been great and I'm very proud of my work over the years so I would thank that person for the vote of confidence.

I would tell you directly not to do it, but I would at least be flattered :)

If a person wanted to double the allocations this would mean allocating to the ETFs using $200,000, even though the investor only has $100,000 in their account.

Trading on 2x Margin would look like this:

- $66,666 in SVXY

- $66,666 in QLD

- $66,666 in SPY

If you have a margin account at your broker, they will let you do this.

You can buy stocks or ETFs worth double the cash value in your account and in fact, many brokers will allow you around 3x margin if you like. You could technically stretch your $100,000 cash value in your account to somewhere around $300,000 of value in stocks or ETFs depending on which ones you buy.

Banks will help you be as reckless as you want

Want me to really blow your mind? You could do it using leveraged ETFs meaning you would be way over the 3x leverage, maybe pushing 5x, 7x, depending on which ones you buy and how the margin is treated.

Wild! No wonder rookie traders get themselves into trouble!

The internet is full of horror stories of new traders who made a great profit right out of the gates and thought trading on margin was a gift. Like somehow the banks are doing you a favour by loaning you so much money so easily.

You think the banks are helping you? Wake up my young Padawan, EVERYTHING they do is for themselves

New traders crush it their first few months and think it's a great idea to leverage and margin to the gills to supercharge their progress, only to realize very quickly their success was simply the lucky result of an advantageous market. When you're trading on leverage and margin, losses multiply exponentially.

Margin interest is not cheap

Even if your account never gets into trouble trading on margin, you still have to pay fees to do it and they may be higher than you think. I've spent some time researching all the major brokers to try to get an estimation for the current margin loan interest rates for 2025.

These are all annualized values showing how much interest you are charged on every dollar above the cash value of your account. Some are lower than others but you can see they are not insignificant:

Trading on margin is "usually" a bad idea

You'd have to be very confident in 2 things in order to consider trading on margin:

- Your overall portfolio drawdowns are contained to a reasonable level. When you're using leverage and margin, everything gets amplified so even smaller drawdowns will get compounded to uncomfortable levels. Even a moderate 20-30% drawdown could get juiced to a portfolio melting disaster if you're not careful

- The expected rate of return of whatever stocks, ETFs, or strategies you are using leverage and margin on, it better be significantly higher than the interest rates being charged. If your broker charges 10% and the stock or ETF you're on margin with has a long-term return of 10% or less, well, you're just a math dummy aren't you? Also, there should be a VERY healthy margin of outperformance to even consider it.

I personally DO trade on margin

Well, what a hypocrite I am right? I went through that whole damn spiel illustrating why it's not a good idea to trade on margin, but I personally do and have been for over 15 years now.

There is one underlying condition that if you understand and follow it, you can significantly boost investing performance without getting into any trouble.

So when can we trade on margin?

I hate to do this but this blog is getting a little long... I feel like a part 2 is warranted :)

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.