Tactical Long Volatility Allocations are Difficult, but Important

Oct 01, 2021VTS Community,

Appreciate all the engaging emails about yesterday's blog, and there was a lot of good feedback on what asset class would be best suited for the VB strategy going forward. We will revisit it for a final decision soon, but if you missed the article it's here.

Volatility Barometer in the 80% - 100% range

Today we'll talk about the 80-100% range and the analysis here doesn't require more than one asset class because in my opinion there is only two viable choices that make any sense. Remember, Tactical Balanced will be in Gold and Defensive Rotation will either be in Utilities or Cash, so adding either of those which do actually perform reasonably well here isn't an option. We don't want to double up and over-allocate to any asset class, especially in this 80%+ range which can be more unpredictable. So the choices are simple:

Cash or Long Volatility?

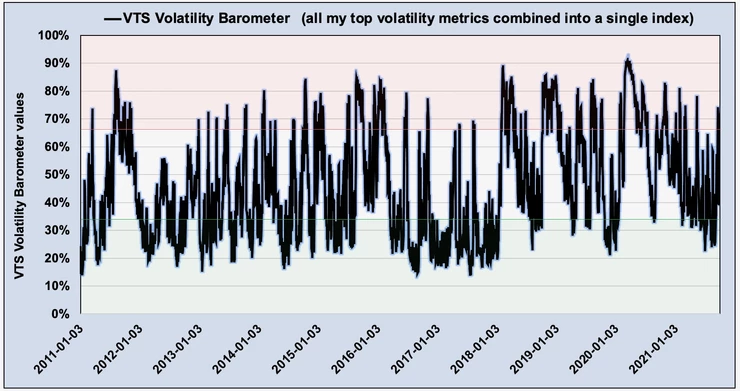

The Volatility Barometer only goes over 80% in the most volatile markets when there really is a fear of significant weakness going forward. Since inception of the Barometer on January 1st, 2011 it has only been above 80% on about 5% of trading days.

Option #1) Cash

Since it's only 5% of trading days there would be nothing wrong with just holding cash and waiting for whatever scared the market to calm down. As you all know, I view cash as an active portfolio position and there are times when cash is the best asset class to hold. Given how the math works out and how punishing drawdowns are to a portfolio, not losing money is sometimes the best goal to have, and nothing makes that easier than cash.

Option #2) Long Volatility

Statistically, the average recession cycle in the United States is 6-7 years, so investors have to have a plan of action when extended market downturns happen. Now granted in the last couple decades the Fed and government have taken extreme measures to try to slow that cycle down, but I personally don't think that's a game they can win indefinitely.

Protecting capital is always the top priority during a crisis, but since the Volatility Barometer only goes over 80% on about 5% of trading days, why not try to find ways to actually make a profit in those rare events as well? If the risk reward profile is balanced, why not try to turn calamity into opportunity?

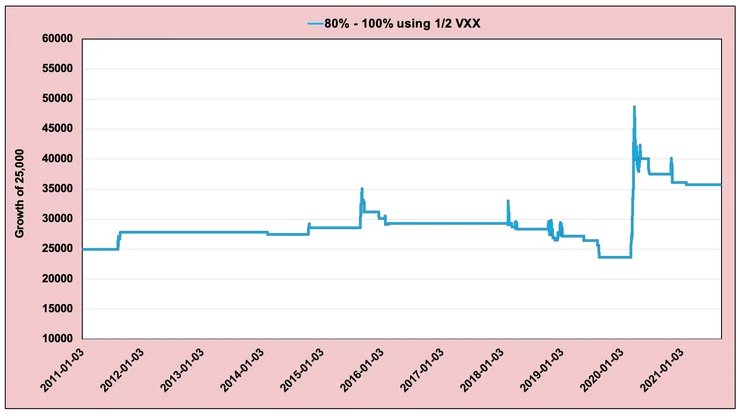

Performance of 1/2 VXX when the VTS Volatility Barometer > 80% (~5% of days)

Disclaimer: I will do a full blog explanation on why we moved to Cash during the Covid crisis and the effect of that discretionary decision soon. I wanted to wait a long time because my explanation may end up sounding like an excuse, and I only want it to be an explanation. The truth is, the VB Threshold strategy (and our Total Portfolios) would have had a monster year in 2020 if I stuck to the systematic signals. Again, full blog coming soon but let's just say instead of the 18.86% the VB Threshold strategy did make in 2020, it would have been up nearly 70% with the help of long volatility. The strategy was great, it was my discretionary move to cash that was the issue. More to come soon I promise....

With that out of the way, let's just say that in a market crash of extreme proportions there are ways to significantly profit from the madness, and the key is strategic long volatility. It's one of the most difficult trades to time correctly and trying to do so will lead to larger drawdowns, that's a given.

However, when there is an extended recession I would like to be there to capitalize on it. I've said many times, VTS is a tail risk portfolio that can also crush it in bull markets.

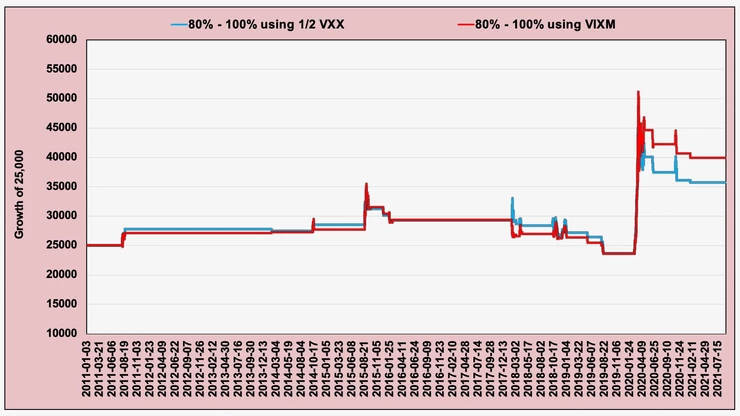

1/2 VXX vs VIXM?

There's nothing wrong with using the VXX for long volatility, it's the original volatility ETP that launched January 29th, 2009 and it changed the game forever so using the original is definitely an option. However, slightly better results may be achieved by using the VIXM.

- VXX tracks the 1st and 2nd month short-term VIX futures

- VIXM tracks the 4th to 7th month mid-term VIX futures

Since VIXM targets the middle range of the VIX Futures Term Structure, it does tend to move a little slower and can be a little less punishing on whipsaw days. Not a lot, they are both long volatility and there is always a price to pay for getting the market direction wrong, but it may provide a little better cushion against the worst whipsaw days.

1/2 VXX vs VIXM when VTS Volatility Barometer > 80%

* Just a side note, we used to use the VXZ which is virtually identical to VIXM in the VB Threshold strategy for most of it's history, but when the inverse volatility ETP ZIV was terminated we switched to 1/2 VXX because VXZ liquidity is a little too low these days. VIXM is better than VXZ now, especially during market crashes where the volume ramps up a lot and it may be viable to use. We'll talk about this point a lot more the next time we get a long volatility signal.

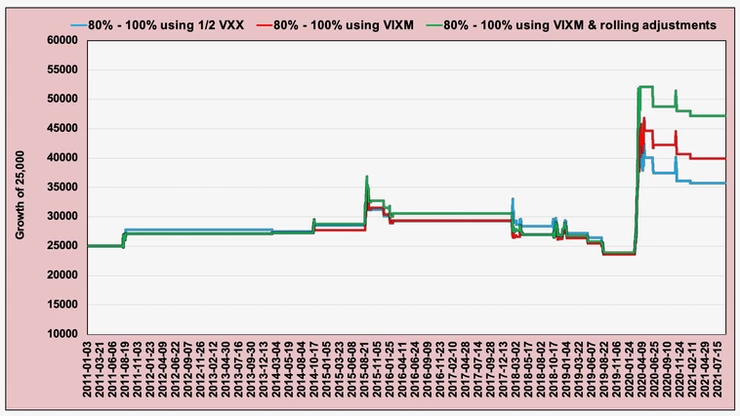

Getting out before the dreaded "give back"

The problem with long volatility is that at some point the market is going to bounce and recover. When that happens, the volatility metrics that got us into the trade in the first place don't go away in one day. They can linger a few days and some of the profit that was made is given back on the other side. For a detailed explanation of why this is, check out this article:

Long Volatility is a frustrating trade

Fortunately I've put a lot of work into solving this problem and I do use a scaling method of rolling off the volatility metrics in the high end based on momentum of the signal, and may be able to hang on to more of those gains when the market recovers on the other side.

Using VIXM and my rolling adjustments when Volatility Barometer > 80%

Outperforming the market long-term means having an answer for good periods, and bad

We've crushed our benchmark in the last 10 years, but it's just as important to have an eye to protecting those gains and potentially profiting when the inevitable decline happens, because it will happen. Not fear mongering here but I suspect it will be quite a spectacular decline when the powers that be are truly out of bullets.

The financial industry is mostly made up of bull market portfolios. Strategies or holdings that do well as long as the stock market cooperates, and then some tail risk funds which are combined in some buy and hold style portfolio. One does well and the other bleeds capital, and vice versa. We know why it's done that way of course. It's easy for advisors to set up and market to clients. They make exorbitant fees for themselves in the process but it doesn't do any favours for investors as the results are quite disappointing long term. As we know about 85% of advisors and asset managers underperform their benchmarks which leaves most investors struggling to even outperform inflation.

Investors have to get off that hamster wheel

My work is focused on creating a true "Total Portfolio Solution" that will do its job whether the market is going up or down. In order to do this it does require us to decouple from the broad market and dramatically reduce our correlation to the S&P 500 (article).

Of all the performance statistics I track, my low correlation to the S&P 500 is the one I'm most proud of. It's very easy to have a low correlation to the stock market in a bull market, but it's VERY difficult to do it while also outperforming the S&P.

Since our correlation to the broad market is so low, our drawdowns can happen at times when you wouldn't expect it (like now for example). We can still suffer drawdowns due to whipsaw even when the S&P 500 doesn't fully crash. If you want to beat the market, you have to do something different than the market.

The flip side of that coin is, we can dramatically reduce drawdowns and through strategic long volatility even profit from market crashes when the vast majority of the investment world will be bleeding capital.

VTS is tactical tail risk while performing well in bull markets, and these VIXM positions within the VB Threshold strategy are one of the reasons we can achieve that balance.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.