What's the Best Asset Class for Safety when Volatility is elevated?

Sep 30, 2021VTS Community,

As we continue the quest to make improvements to the VB Threshold strategy that crushed it for years but has recently been derailed by whipsaw, I think some of you will enjoy riding along with me in that process of data mining and trying to match up performance and improve future results. So today we'll check out all the potential assets and weigh their viability.

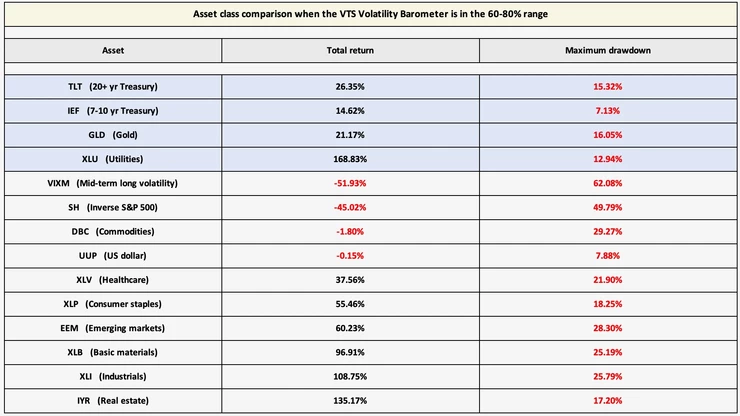

I'll share this for the other sections as well, but today we are looking for a new asset to replace TLT Bonds in the 60-80% range in the VTS Volatility Barometer.

There's two key things I'm looking for here and I would say I want them in this order:

1) Manageable drawdowns. This isn't an exact science because people have different risk tolerance, but our TLT positions as I showed yesterday are currently in about a 10% drawdown for that strategy which is still a fair way from the maximum drawdown of about 15%. So ask yourself, are you comfortable with how our TLT positions have done? Are you ok with things not working sometimes? How far past a 10% drawdown are you willing to go if the long term performance is good? To put it bluntly, even the best strategies will sometimes go through periods of garbage performance, so how far down are you willing to go?

2) Solid performance. The VB Threshold strategy already has long volatility as its high end signal so this is already a strategy where people have to be comfortable with higher drawdowns. I consider it a tail risk strategy with potential to do very well in bull markets as well, and higher drawdowns comes with the territory. So while we could just use Cash from 60-80% and be totally safe in that range, I'm actually looking for something with good performance here.

* I'm using the same 10,000 - 70,000 chart scale for consistency

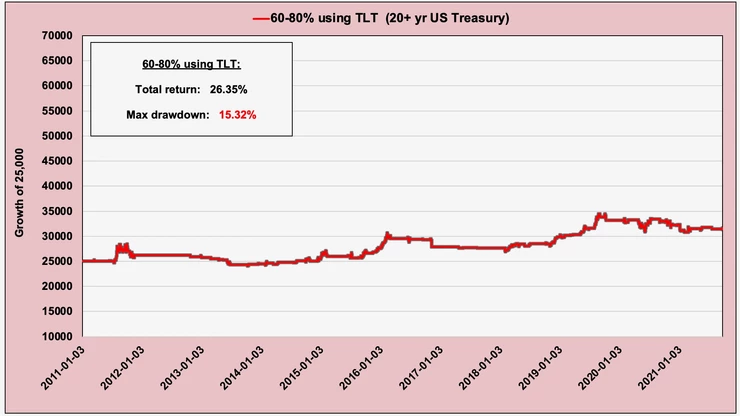

Our baseline and what we currently use: TLT Bonds

For safety when volatility is getting elevated, I'd say this is acceptable. Now in a world where it's much more likely that interest rates go up than down further, the argument for holding bonds isn't as strong as it used to be so can we do better? Can we keep the drawdowns in a similar range but improve performance?

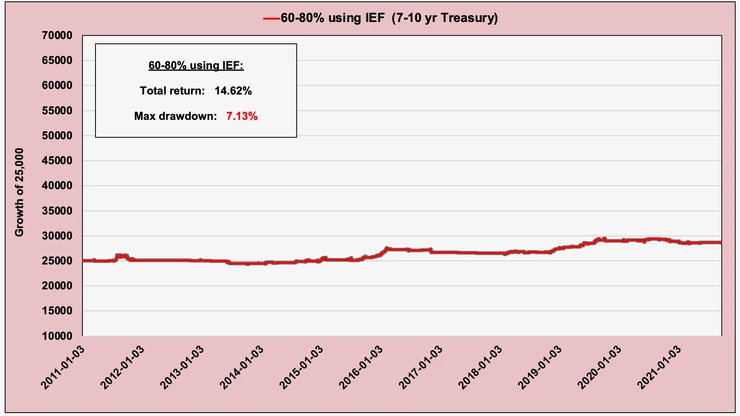

IEF (7-10 yr Treasury)

We already use IEF in the Tactical Balanced strategy so I wouldn't consider this anyway. However, it is decent as far as safety goes right? Positive growth with a low drawdown and I do feel IEF outperforms cash so it's solid.

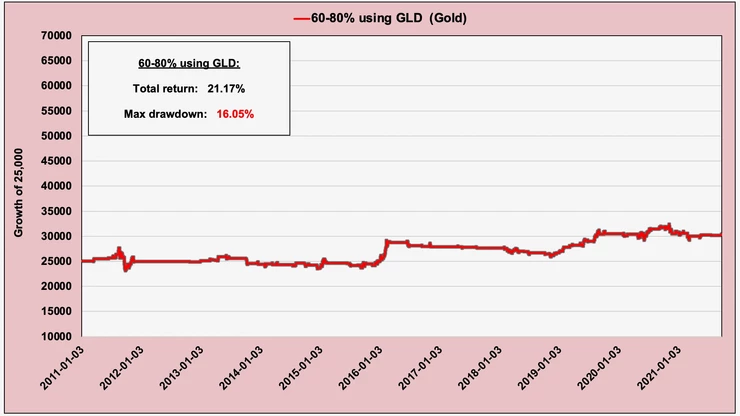

GLD (gold)

Again, Tactical Balanced already uses Gold as well in the high range so I'd like to reduce the overlap as much as possible. Gold is good, but it's out as well.

XLU (Utilities)

Our rockstar strategy this year, Defensive Rotation already uses XLU Utilities and it works out very well for that strategy. Utilities historically perform much better than equities in higher volatility environments, but we don't want to double up on positions so we won't use this twice.

IEF, GLD, XLU are being used already, so what's left?

Let's move on to the rest of the potentials. I will go from worst to best performance and let's see how far down the list we go before the asset class you had in mind makes an appearance. Before peeking at the bottom, pause and give it some thought. Which asset class do you think would work the best?

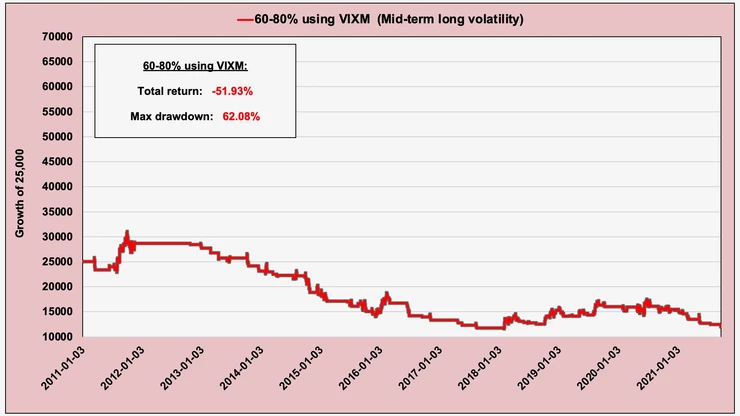

VIXM (Mid-term long volatility)

I personally love the VIXM as a long volatility ETP (and we will be putting it back into VTS strategies) but from the 60-80% range it's just too early and as a result, the performance is garbage. The 60-80% range is ambiguous, not full on market crash, so long volatility just gets chopped up.

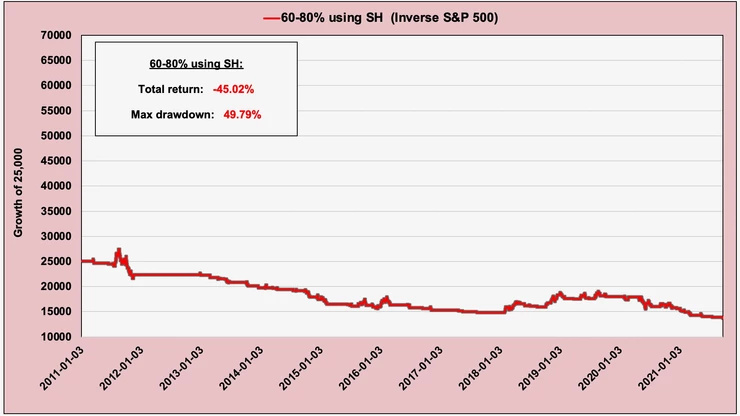

SH (Inverse S&P 500)

Directly shorting the stock market suffers the same fate as long volatility does. It's just too early in the volatility cycle to aggressively short anything.

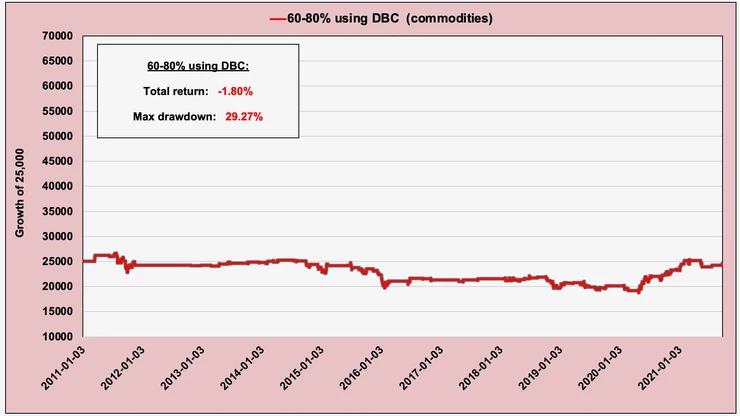

DBC (Commodities)

No. Just... no

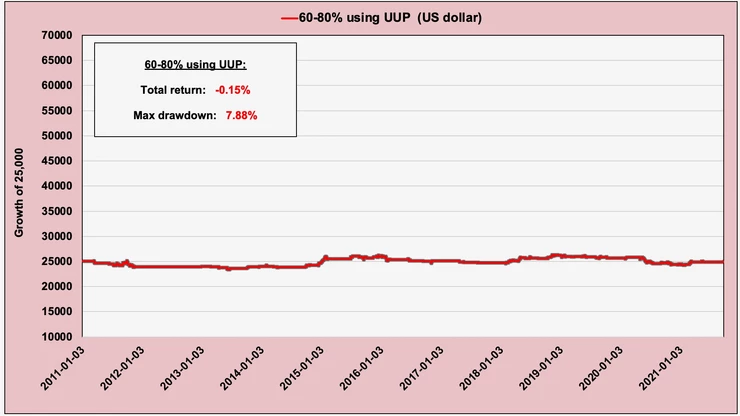

UUP (US dollar)

Again, not even worth considering when Cash is easier if a person is looking for no drawdown.

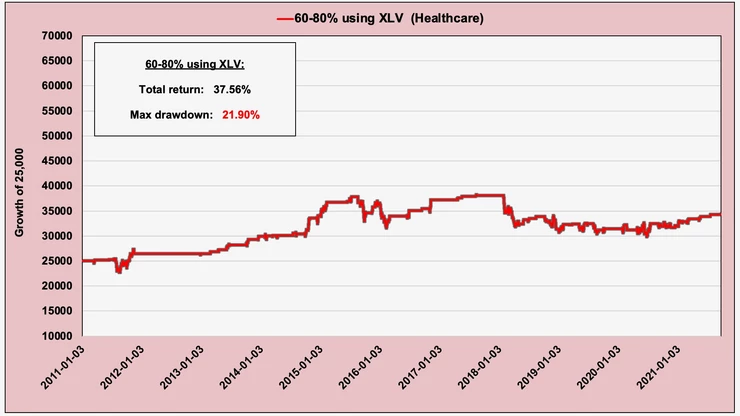

XLV (Healthcare)

We're now in the positive total return range of the potential assets, but that's a pretty large drawdown compared to the total return.

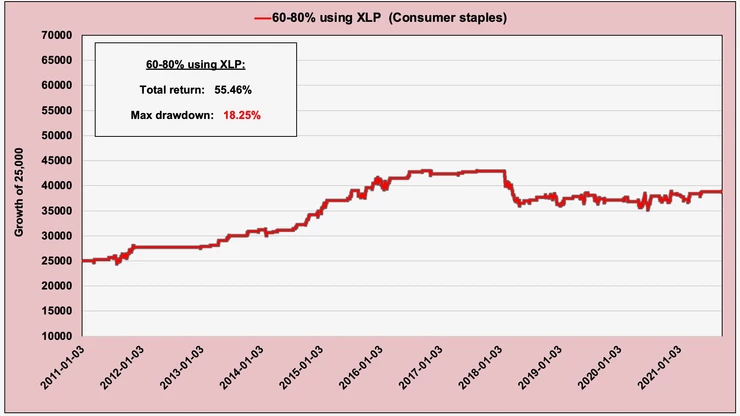

XLP (Consumer staples)

The Consumer Staples ETF has some potential and I would say it's probably the first one so far that is actually starting to look better than TLT. Flat for the last 3 years though so let's see what else there is.

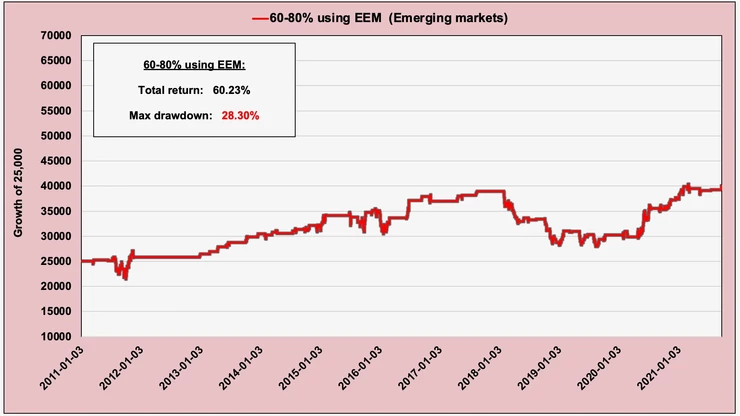

EEM (Emerging markets)

The Emerging market ETF is always interesting because there is some performance there. However, the drawdowns are larger and the correlations to US equities is a little harder to predict. Long-term I suspect it would perform better than TLT, but when things dislocate I think it would be very frustrating.

XLB (Basic materials)

Despite the large drawdown, the overall performance is significantly higher here which means that if a person had the risk tolerance, XLB may add some absolute performance in the long run.

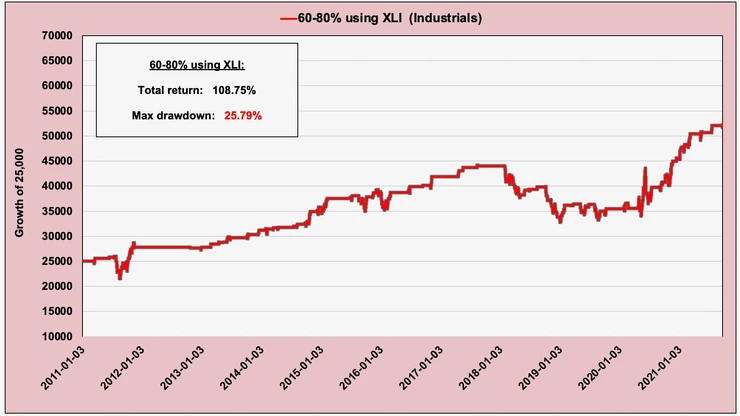

XLI (Industrials)

Same situation here, the past performance is high enough to justify the larger drawdown so despite the fact that it would have taken some conviction to continue to use it in 2018/19, long term it seems well worth it to me for what is a "safety" position.

So what's left? Which one is the winner?

Have I shown the asset that you were thinking? Have you seen anything yet that would be better than either TLT Bonds, or just holding Cash? If not, let me take one more shot at this.

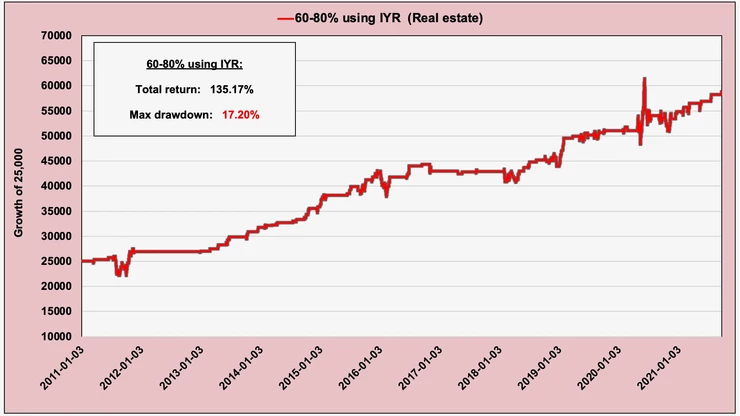

IYR (Real estate)

Quantifiably speaking, and keeping in mind the standard disclaimer that past performance is not indicative of future results, I would say the IYR real estate ETF in this test nails both of the requirements we are looking for. Performance and drawdown wise it's actually in line with the XLU Utilities within the Defensive Rotation strategy. Of all of the assets I've shown those two are the clear winners.

Summary of all potential replacements:

So there's something to chew on there. Replace TLT Bonds with straight up cash as a safety position that would by definition not suffer any drawdowns in that 60-80% range? Or, increase the drawdowns of the strategy and try to add some positive alpha with the IYR real estate ETF?

I've decided, but what would you do?

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.