VTS Performance with and without Iron Condor Options

Jul 15, 2025

VTS Community,

GREAT question from a long-term (6 years) VTS member:

Is it possible to show the Total Portfolio Solution return if you remove all the Option strategies since inception?

You all know I love questions that have several layers inside them to unpack, and this one is also very timely because at some point in the next few months this subject is going to come up again. I'm not ready to re-launch the VTS Options Academy (our old community that was Options only) but I'm getting relatively close to something we could start with. It'll be a longer term work in progress with many strategies added as we go, but I'm getting closer to an initial launch of a couple strategies to get people going.

It may make the most sense to entirely split the communities between VTS and VTS Options again so this great question is just the start of a longer conversation to be continued soon.

Not all Options Trading is created equal

Options Trading itself is a term as diverse as the term "sports" for example. While it's true that Mixed Martial Arts and Bowling are both sports, I think we can all agree they are quite different. Options Trading is the same thing.

Buying Long Call Options on individual stocks is Options Trading, and so is selling market neutral Iron Condors on equity indexes. They are both technically Options Trading, but vastly different in their structure, goals, and outcomes. Same broad category of Options, but entirely different animals.

I personally trade Options in two different categories:

1) Speculation. I have a few strategies that are designed for absolute return, with my VIX Options Strategy having the largest allocation in my Options portfolio. It's a strategy that's made about 24% a year since 2013, and I trade it independent of everything I do which means it's meant to make higher return with manageable risk.

2) Diversification. I also have a suite of Option strategies that while I do also want them to make an adequate rate of return, they are primarily designed to add negative correlation to the main VTS tactical strategies.

* Our Iron Condor Strategy is a diversification strategy. It's there mainly to insulate the overall VTS portfolio against excessive drawdowns by adding a different market exposure to the portfolio.

** Our Volatility Trend Strategy that was in the Portfolio in previous years (VXX and UVXY Broken Wing Butterflies) was also a diversification strategy. It was there to add negative correlation to equities.

What would removing Options do to our Total Portfolio?

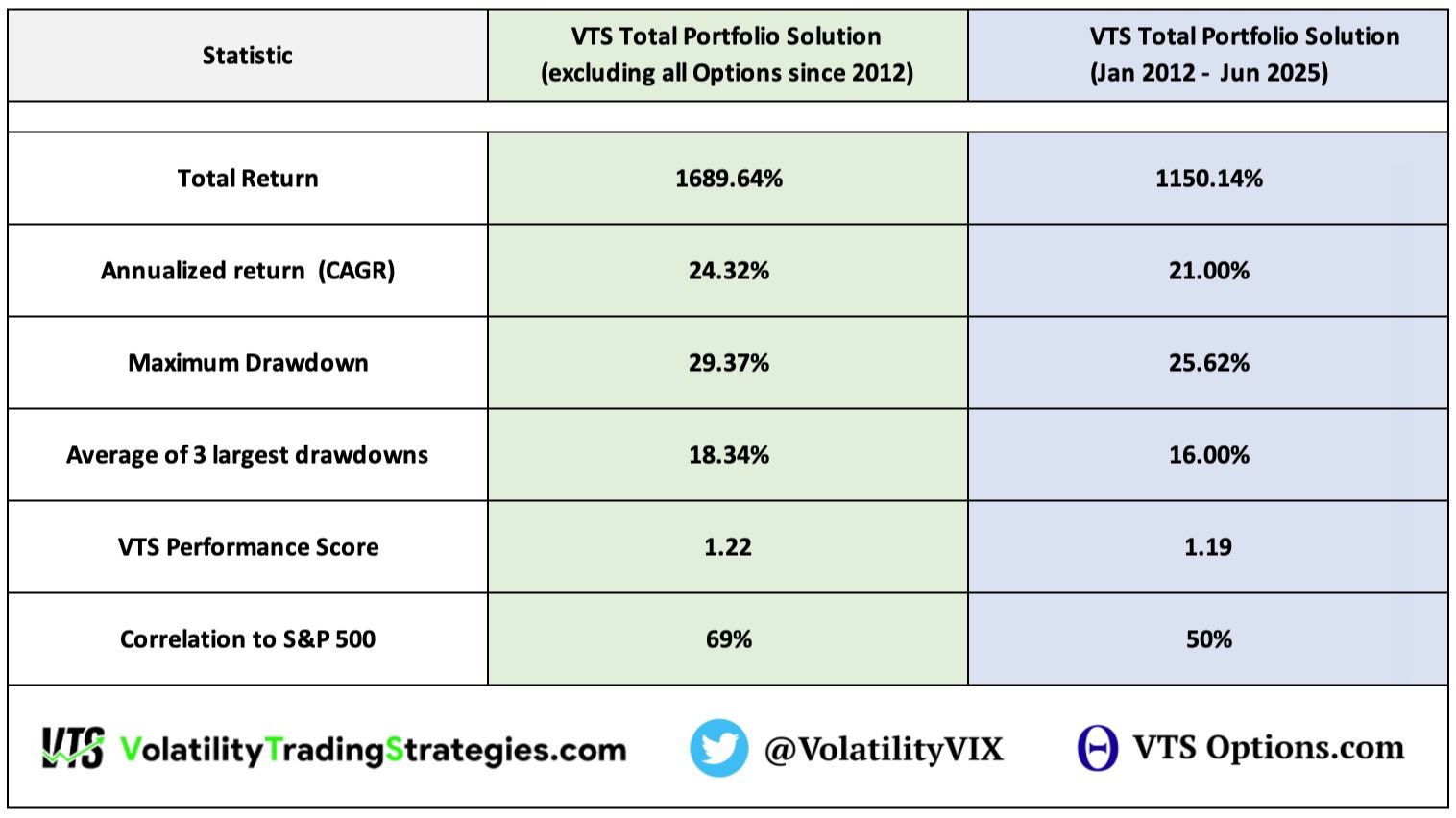

By showing the actual performance statistics of both portfolio's side by side, you'll see what I mean by Options Trading designed to add diversification rather than absolute return.

- In BLUE, the live performance of the entire VTS Total Portfolio Solution including all strategies since inception in January 2012

- In GREEN, the live performance removing Option strategies and just showing the tactical rotation strategies (Tactical Volatility, Defensive Rotation, Strategic Tail Risk) since inception

Annual Return

While I don't think this is the most important metric, it is the headline number so to speak and we can see that removing the Options strategies would actually have us at a little higher rate of return.

- Technical victory: Portfolio without Options

Now it's close enough and recency bias has something to do with this. Our two Options strategies (Iron Condors and Volatility Trend) are both flat for the last 2 years, so some of this performance difference is just that the recent whipsaw market environment isn't ideal for them. Including Options the last 2 years has not been beneficial.

Technically speaking though, removing all our Options strategies since January 2012 would bump up the return from 21% a year to 24% a year.

Maximum and average of Drawdowns

Among all the various ways people can gauge performance metrics, I do believe that reducing drawdowns is probably the most important one.

The reality is, most investors over-estimate their own risk tolerance. They think as long as the long-term rate of return is sufficient, they can sustain the odd crash. Then they find out in real time when it actually happens to them, that watching their capital get depleted really is an emotional problem and they pull the plug at the worst possible time.

Drawdown reduction is paramount in long-term investing

- Technical victory: Portfolio with Options

Our Total Portfolio Solution with and without Options is fairly close here, but that extra few percent of drawdown reduction could make a difference for some investors.

I can tell you first hand as someone who has managed a live trading community for almost 14 years now (and not for nothing) with a fantastic track record, we did lose about 20% of our community during our only significant drawdown which happened in 2022. Now many of them did come back, and many new people have joined, but my point is that even a drawdown that never even touched 30% was enough to send people running for the hills.

Over-estimate your own risk tolerance at your peril! Drawdown reduction is extremely important long-term.

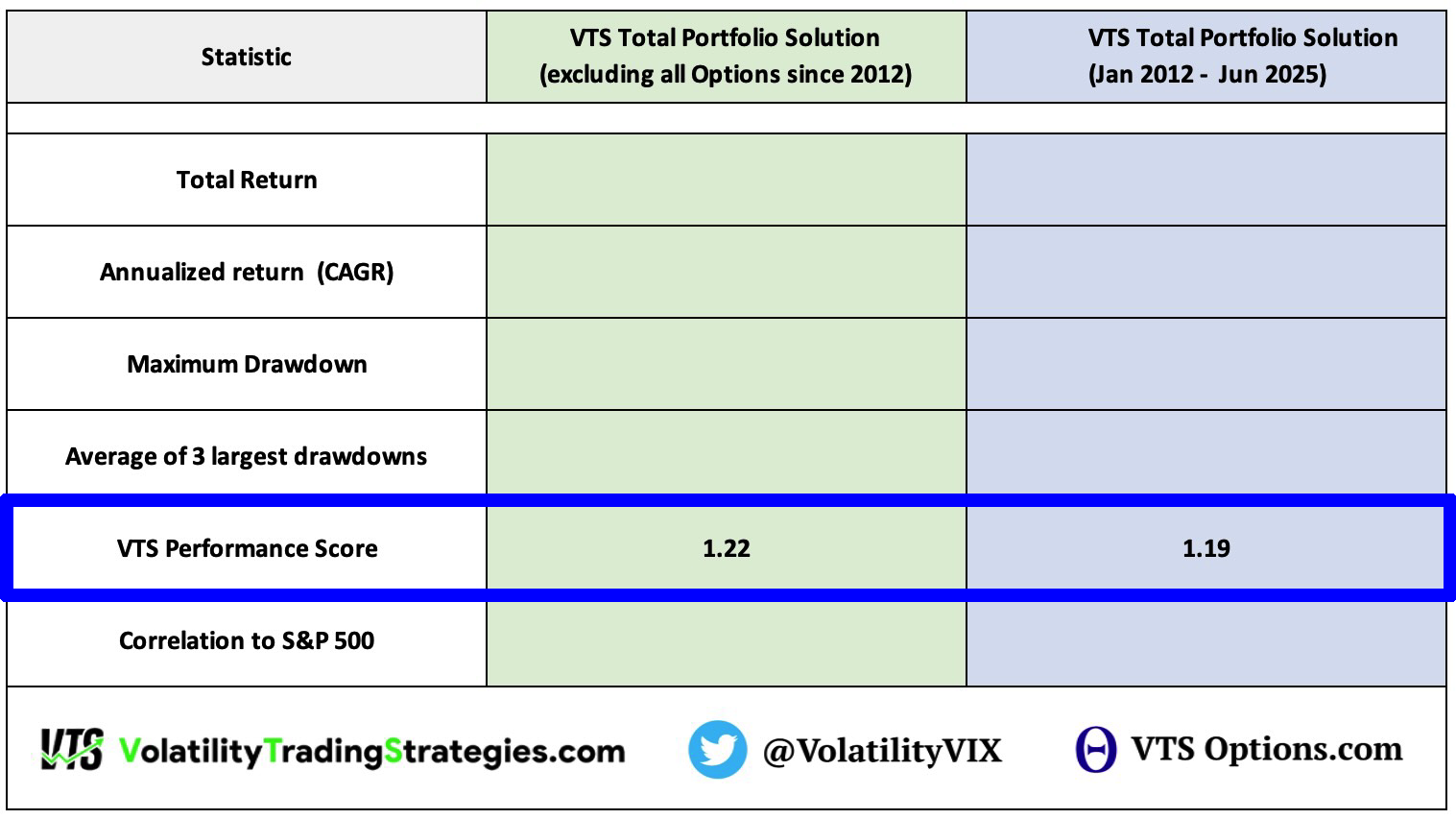

Risk Adjusted Return (VTS Performance Score)

The VTS Performance Score is my own creation of an overall risk adjusted return metric that can gauge the effectiveness of a strategy or portfolio in a single value.

Click here for Video explanation of the VTS Performance Score

* The higher the number the better

- Technical victory: Portfolio without Options

In the grand scheme of things there is effectively no difference between 1.22 and 1.19. Those are both very high values which shows that both portfolios definitely achieve a rate of return that adequately justifies the level of drawdown. To add some context, here are the Performance Scores for other benchmarks over the same time period

- S&P 500: 0.63

- 60/40 VBINX: 0.36

- CBOE Short Volatility index: 0.24

- HFRI Hedge Fund index: 0.38

- All Weather Portfolio (Ray Dalio) 0.25

Our VTS Total Portfolio Solution being well over 1 in both versions (with and without Options) speaks to the exceptional ratio of performance to drawdown reduction.

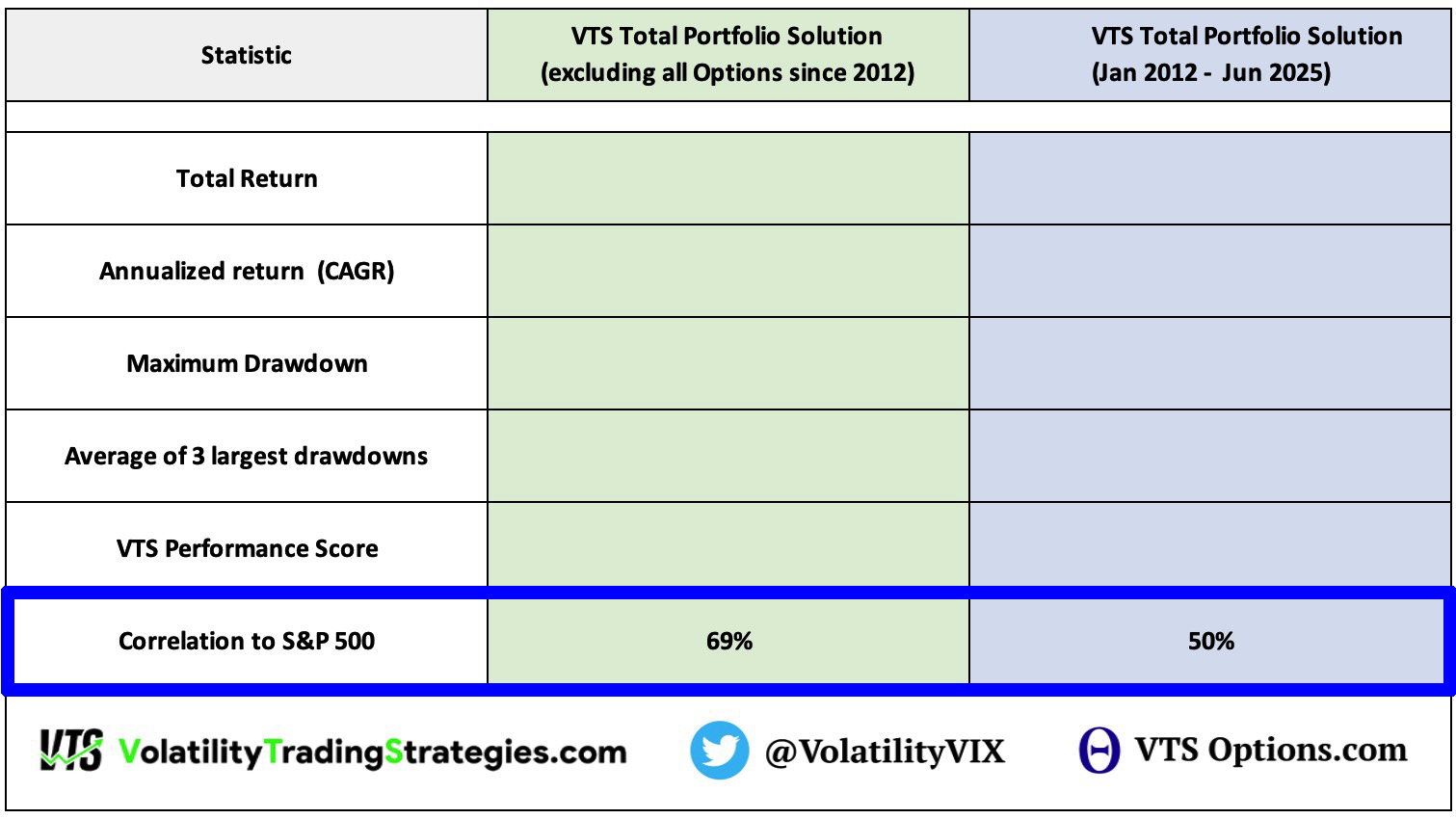

Correlation to the S&P 500

This is another performance metric that is highly overlooked, and that's especially true during this rather long bull market since the Great Financial Crisis in 2009. Now it's true we have seen some >20% S&P 500 declines so I'll leave it up to you as to whether it still counts as the same bull market. However, the recoveries afterwards have been so unusually fast that I think you could easily make a great case that we've been in a bull market for 15 years.

I do believe though, at some point, having a portfolio with lower correlation to the stock market is going to pay for itself in gold.

Strategies that make money when stocks go up are a dime a dozen. Strategies that make money when stocks are no longer going up are very rare, and extremely valuable. This is what my work at VTS is based on. Producing market crushing performance while keeping correlations low

For context, the vast majority of investor portfolio's are well over 90% correlated to the S&P 500, in some cases 95 - 98% correlated. This is a problem if you believe stocks won't go up forever...

- Technical victory: Portfolio with Options

This is perhaps the area where adding Options Trading strategies like market neutral Iron Condors will see the most benefit. In strong bull markets I suppose you could make a case that it simply drags down results. In the long-run though I think the value added of correlation reduction more than makes up for any performance drag.

I haven't made any hard decisions yet, but that may be something I'll consider when deciding what to do with Iron Condors when VTS Options does re-launch in a few months. Again, a total separation may make more sense logistically, but I will NEVER stop trading Iron Condors!

Conclusion

I would say the overall performance picture is roughly the same so as always, VTS members can assess their own risk tolerance and make the call. This can basically be summed up in a simple sentence

Our absolute return is a little higher without Options, and the risk adjusted performance is a little better with Options

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.