Investing Success Requires Decoupling from the S&P - Low Correlation Investing

Aug 13, 2021VTS Community,

Decoupling from the market is hard sometimes...

I've mentioned this in a few livestreams and people are always surprised to hear me say it, but the one performance statistic that I would say I am most proud of with my work over the last 10 years is the very low correlation to the S&P 500.

The Vanguard VBINX for example is 98% correlated to the stock market. Hedge Fund indexes are 95% correlated to the stock market. A high 90's percent of RIA's and financial advisors build portfolio's for their clients that will be 95% or higher correlation to the S&P 500.

They do this because the industry as a whole can sell their results in good times when stocks are going up because they participate in it and it's all high fives. Then when the market crashes they can easily say yes it sucks, but everyone else crashed as well so there's nowhere else to go to do any better. It's an easy sure fire way to make sure that investors are always trapped inside the hamster wheel.

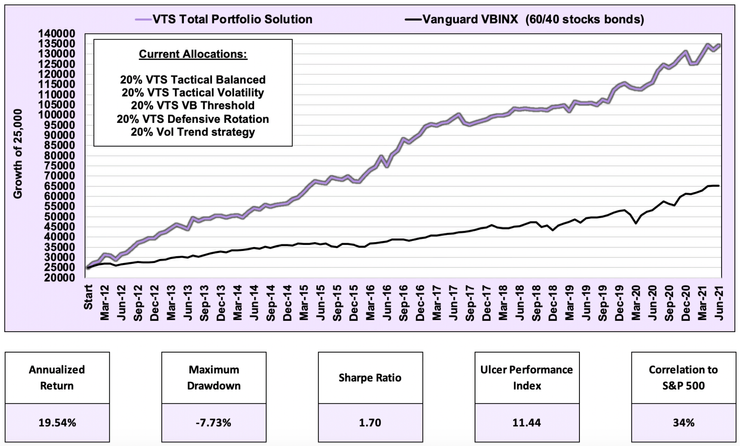

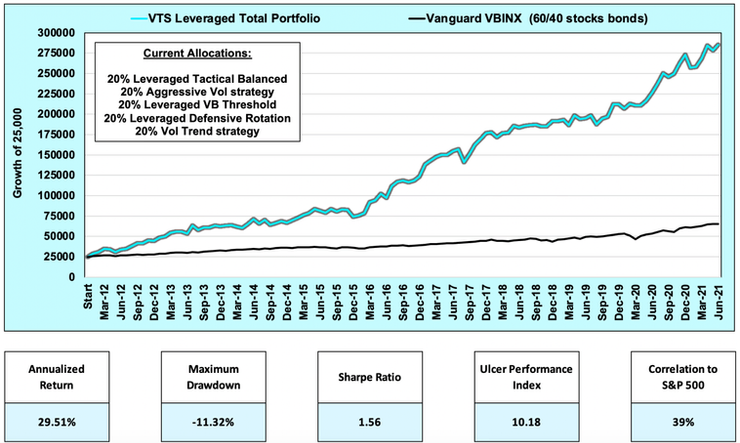

My portfolio correlation is as low as you will ever see, by design:

You might think my point of pride is the overall rate of return, or the Ulcer Index, or the low drawdown number. Sure those are good too, I won't shy away if you want to give me credit for something :)

But the truth is it's extremely difficult to create a portfolio that performs well during bull markets that isn't highly correlated to the S&P 500. It's actually the low correlation number that's the most difficult task to achieve and what I'm most proud of.

The problem of correlation to S&P:

The vast majority of the investment world is highly correlated to stocks and nearly everything crashes when the market does. That's the dreaded up down cycle everyone says they are trying to avoid. We've all seen the low long-term rate of return of the stock market and for many people it fails in two ways:

1) The drawdowns are way too deep and painful and they simply can't watch their retirement account drop more than 50% and still stay the course. They panic and pull the plug, they leave at the worst time, and it costs them years of their investing time horizon. Nearly nobody can actually follow a stock heavy portfolio for any extended period of time, it completely breaches their risk tolerance.

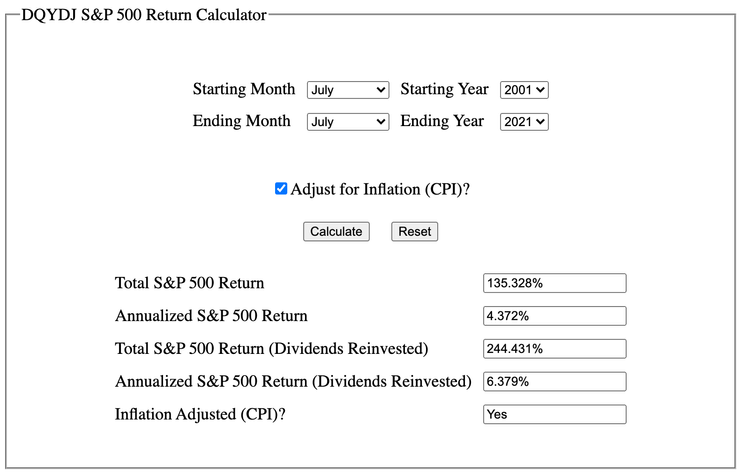

2) Even if they were able to close their eyes and follow it blindly, they still won't be that impressed with the final results. We're at all time highs now so the number is as good as it's ever looked, but even now the S&P 500 has only returned 4.37% a year over the last 20 years when adjusted for inflation. With re-invested dividends it may be as high as 6%, but again that number is only 6% because the market is currently at all time highs. I suspect in the future that number will be cut in half.

So if an investor wants to outperform the S&P 500, they can just add leverage to the S&P right? If they just add some risk they can get a better rate of return right? Well sure, in good times that would work just fine.

But then by very design, every time the market crashes the portfolio would just crash even harder. Up periods when the market cooperates would feel great, and market crashes would be extra painful and cause some very bad decision making in the moment.

So what's the solution?

It's not an easy one and it really does require some out of the box thinking and a fair amount of patience.

The solution is to design a portfolio that has a low correlation to the stock market.

Now unfortunately, that's far easier said than done. There really aren't many (if any) asset classes that will perform well in bull markets that aren't highly correlated to stocks. A good risk manager will be the first to tell you that while sometimes on paper it appears something has a low correlation, in a crisis most of those correlations approach 1 and everything sells off at the same time.

People often think they have a diversified portfolio, but then the stock market drops 20-30% and they quickly realize they didn't. All their assets fall together and the damage is essentially the same as the overall market.

Tactical investing is the key, but there's a catch...

In my opinion the only way to perform well in bull markets and not crash during bear markets is to fully embrace tactical investing. Buy and hold in any form, even partially, won't be able to achieve that goal. At VTS our portfolio is made up entirely of independent tactical strategies that are specifically designed to have lower correlation to the stock market.

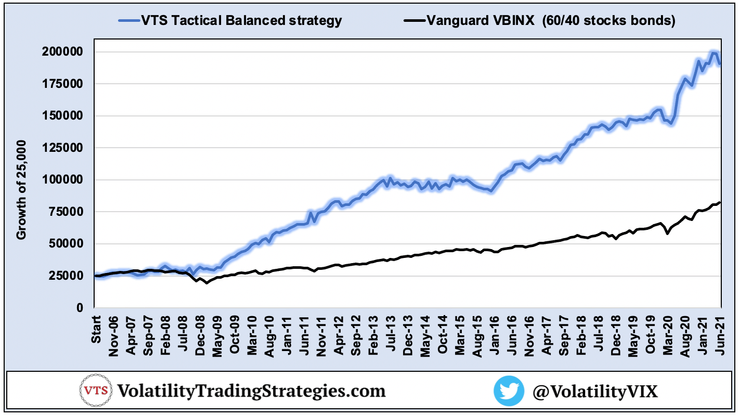

For example the Tactical Balanced strategy can rotate between positions in either stocks, bonds, or gold depending on market conditions. It means we don't have to ride the stock market off the cliff when it crashes, we can move to safety and limit the damage.

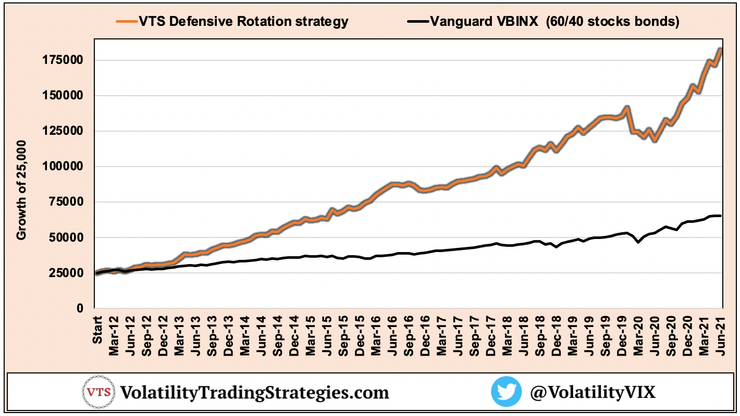

Our Defensive Rotation strategy can hold a position in the Nasdaq (QQQ) during good times and participate in uptrends, but then when market volatility is elevated and risk is building we can exit to Utilities or cash and weather the storm much better.

My Total Portfolio Solution and Leveraged Total Portfolio Solution are 5 independent tactical strategies each with a 20% allocation so the risk is spread out. Then on top of that diversification, each strategy also has it's own solution to exit the risky positions and move to safety.

Drawdowns are reduced, correlations are very low, and we have a portfolio that is not dependent on the stock market for it's long term success.

Sounds great, so what's the catch?

The catch is the investor must be willing to decouple from the S&P 500 performance. Sometimes that decoupling means we will perform better than the overall market and everyone will be happy. I've had several years where I far outperform the S&P. But sometimes that decoupling will mean we underperform the market, and unfortunately I've also had a few years where that is the case as well.

There's no way of getting around this. When you reduce your correlation to the stock market, it means the current performance of the S&P 500 is fairly irrelevant to our own performance.

-

Just because the stock market is near all time highs doesn't mean we will be doing well. It's frustrating to watch sometimes but it just comes with the territory of low correlation investing.

-

And just because the stock market is crashing, that doesn't mean we will be losing money. I've made a profit in almost every market crash in the last 10 years.

What the stock market is doing doesn't inform what my portfolio should be doing. That's why I've built my portfolio the way I have and view it as a multi-decade long holistic investing method that shows it's true value value over longer periods of time. It takes patience, it requires managing emotions, but I strongly believe the long-term benefit will be as clear as day.

Our VTS Total Portfolio Solution could loosely be considered a tail risk portfolio that can still make a nice profit in bull markets. It's not quite the holy grail of investing because everything goes through down periods, but it's the closest thing to it that I know which is why I fully embrace the process.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.