VTS Tactical Volatility strategy - Trade profit/duration data study

Jul 27, 2020Today is day 7 for our Long VXX Put position within the Tactical Volatility strategy. It was initiated on July 17th and we're still maintaining the same position today. For obvious reasons we hope this continues and we can continue with the trend, but the previous two trades within the Tactical Volatility strategy were held for just 1 day and then we moved right back to cash.

This sparked quite a few follow up questions on just how common 1 day trades are, so let's go over those numbers.

Why do these 1 day trades happen?

I realize it can be frustrating when this happens, getting into a new trade one day only to move out of it the very next day, but the truth is that is quite common.

Remember my strategies are all tactical in nature. Everyday I input all the volatility data points and then based on those most up to date numbers, all the strategies determine the best position to hold by market close the same day. Then the next day I do the same thing, input the data, trade signals are sent, and we hold those positions at same day market close.

Most of the time the next days position is the same as the previous day so we just maintain current positions. This is why the average monthly trade frequency for the strategies is still quite low. Most of the time we just maintain current positions.

However, there are times when we are very close to the threshold between two positions and the market can very easily bounce back and forth between them, causing shorter 1-2 day trades. Here's what the Tactical Volatility strategy trade dial looked like the day we entered this position on July 17th:

So the day we move into a new position, it's often times very close to a threshold and it wouldn't take much for it to move back across the next day. When we move into a new short volatility position after holding cash, if the market is down the next day, chances are good that will kick us back out of the trade just 1 day later.

How common are 1 day trades?

I've ran the numbers on every trade the Tactical Volatility strategy has taken since inception so we can go over these numbers today.

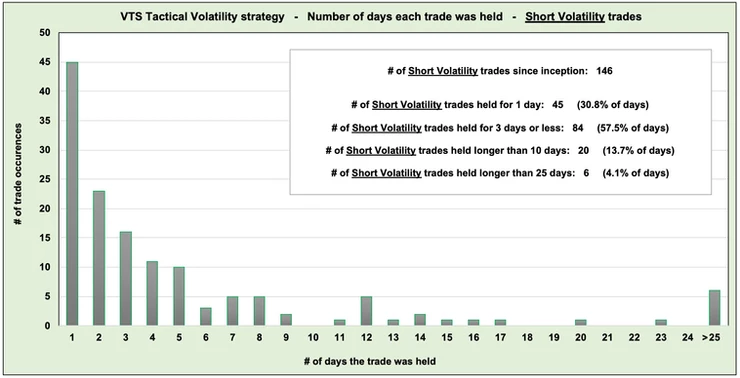

There's been 146 new short volatility trades since inception, so roughly 17 per year, and you can see the obvious pattern. 1 day trades are by far the most common, and then longer holding periods are progressively less frequent.

Roughly 31% of trades taken lasted just 1 day, and about 58% of all trades lasted 3 days or less.

Again when we think about why, it's pretty clear this is what we should expect. Those 1-3 day trades are happening because when the strategy moves from one threshold position to the next, the market may bounce around that level before establishing a longer term trend and it's not uncommon at all to move from short volatility to cash and back.

Average profit made based on trade duration:

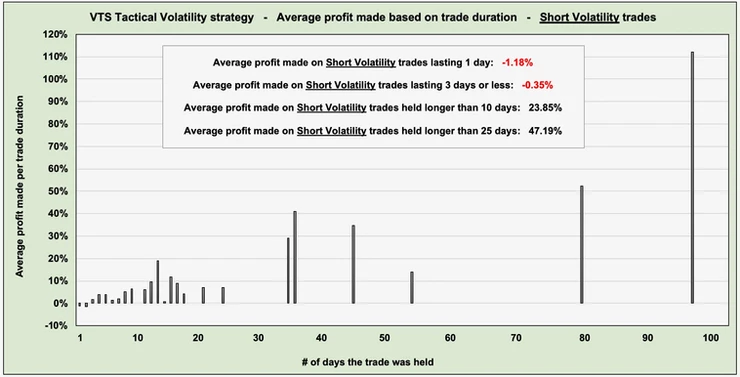

There's also a clear pattern of how much profit trades typically make based on how long they are held.

Notice the profit on short duration trades on the left is very low, and then the profit predictably rises as we hold the positions longer out to the right?

Short volatility positions in VXX are based on our understanding of the VIX futures term structure, and the natural tendency of VXX to decay a small amount per day under stable market conditions.

* One of our specialty volatility metrics VTS Crush Level approximates the expected 1 day decay of VXX. For reference, today it's at 0.46% VXX decay per day.

It's not a quick process, it may only be 0.5% or so a day on average, but in stable markets when the VIX futures term structure is in contango and we have positive roll yield, this profit can be captured with relative consistency.

So it makes sense that the longer a position is held, this increases the probability of a higher profit. That roll yield has a longer period of time to take effect and positively effect our bottom line.

The goal of the Tactical Volatility strategy is to position into short volatility when it is most statistically advantageous, and then just let time and that VIX futures roll yield take effect.

- Average profit on trades lasting 1 day: -1.18%

- Average profit on trades 3 days or less: -0.35%

- Average profit on trades 10 days or longer: 23.85%

- Average profit on trades 25 days or longer: 47.19%

Profit on all 1 day trades since inception:

Why are 1 day trades frustrating? Well if they were often times profitable then we wouldn't care would we? Jump in, take a quick profit, get out the next day, what's wrong with that?

Well, unfortunately it doesn't work that way...

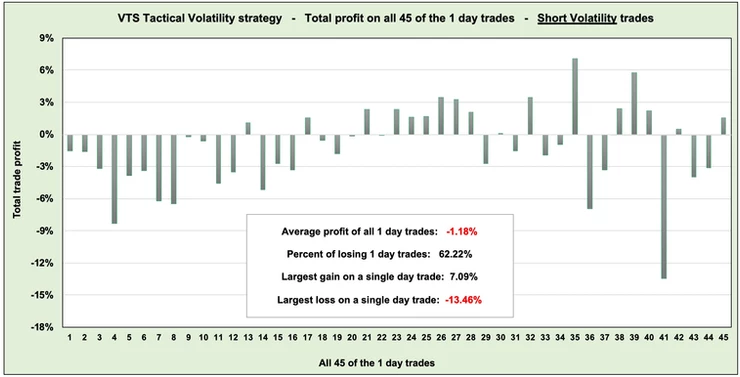

Again, when the strategy is close to a threshold between cash and short volatility, the market can go back down the very next day and kick us right back out of that position and into cash again. When this happens, it's because volatility metrics rose. More of than not, that means a loss for the 1 day trade.

Here's the returns for all 1 day trades since inception:

62% of the time these 1 day trades are losers, and on average they lose -1.18% for that 1 day period.

Now of course markets are unpredictable on one day time frames and it's certainly possible to make a nice gain even if the trade only lasts 1 day. The highest 1 day trade profit was +7.09%, that one felt pretty good and nobody minds getting in and out with a big win. The biggest loser though at -13.46%, that wasn't a fun day. That was just one of those rare times where we entered a trade and the markets crashed the very next day. Ouch.

The Tactical Volatility strategy is trend following:

This is obvious when you say it, but important none the less to think of in this way. While 1 day trades may be frustrating, they are in fact necessary.

After all, you can't have a 2 day trade if you didn't already hold it for 1 day :) You can't have a 5 day long trade if you weren't willing to hold it for the previous 4 days, etc...

When the Tactical Volatility strategy indicator moves from cash into the Short Volatility range, we're looking for longer term trends. We want to have the opportunity to hold that position for long enough that the VIX futures roll yield naturally provides that decay and leads to profit. The longer the position is held, the higher the probability of success.

We don't always get it, and the market is free to do what it wants in the short term, but it is those longer term holding periods we're targeting. The vast majority of the strategy's return over the years has come from being patient and riding longer term trends.

There has been a volatility regime change since January 2018 so those longer term trends are fewer and further between these days, but trust me that won't always be the case. Markets go through cycles, and patient traders who manage risk well will be rewarded when those trends continue in the future.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.