"Safety" asset classes and interest rate exposure

Apr 22, 2025

VTS Community,

Keeping the VTS Strategic Tail Risk Strategy in focus today, I want to move on to a discussion about our Safety positions and whether we can improve on them.

Now as a quick recap, the strategy harvests Volatility data and then divides the market up into three ranges to hold only the best performing asset classes for that range:

- Low Volatility "Aggressive" range where we currently hold the S&P 500 with the SPY ETF

- Mid-High Volatility "Safety" range where we currently hold the IYR Real Estate ETF

- Extreme Volatility "Tail Risk" range where we currently use Long Volatility VXZ. I also introduced another potential alternative called CAOS that you can read about here

What about not rotating to safety at all?

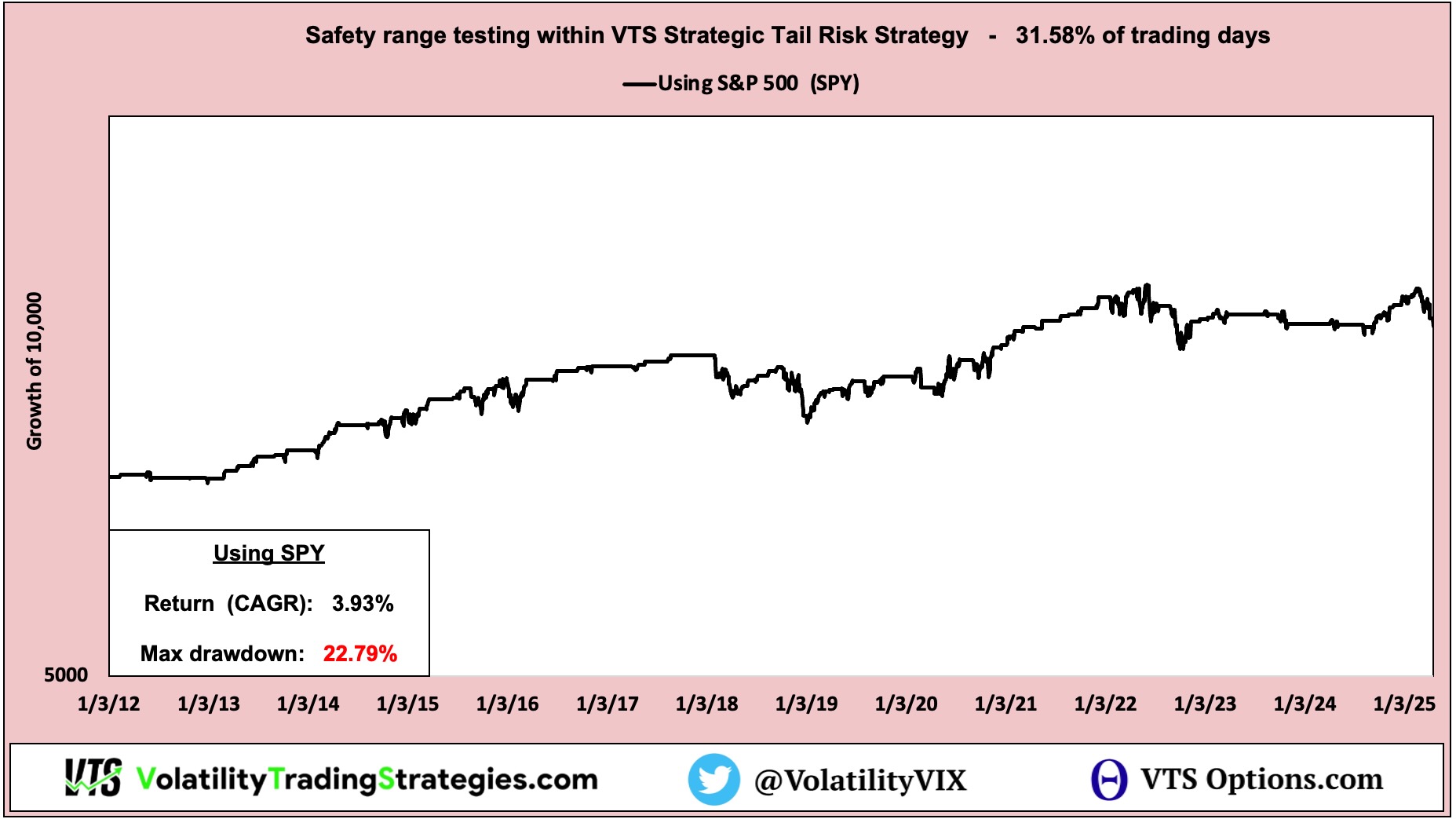

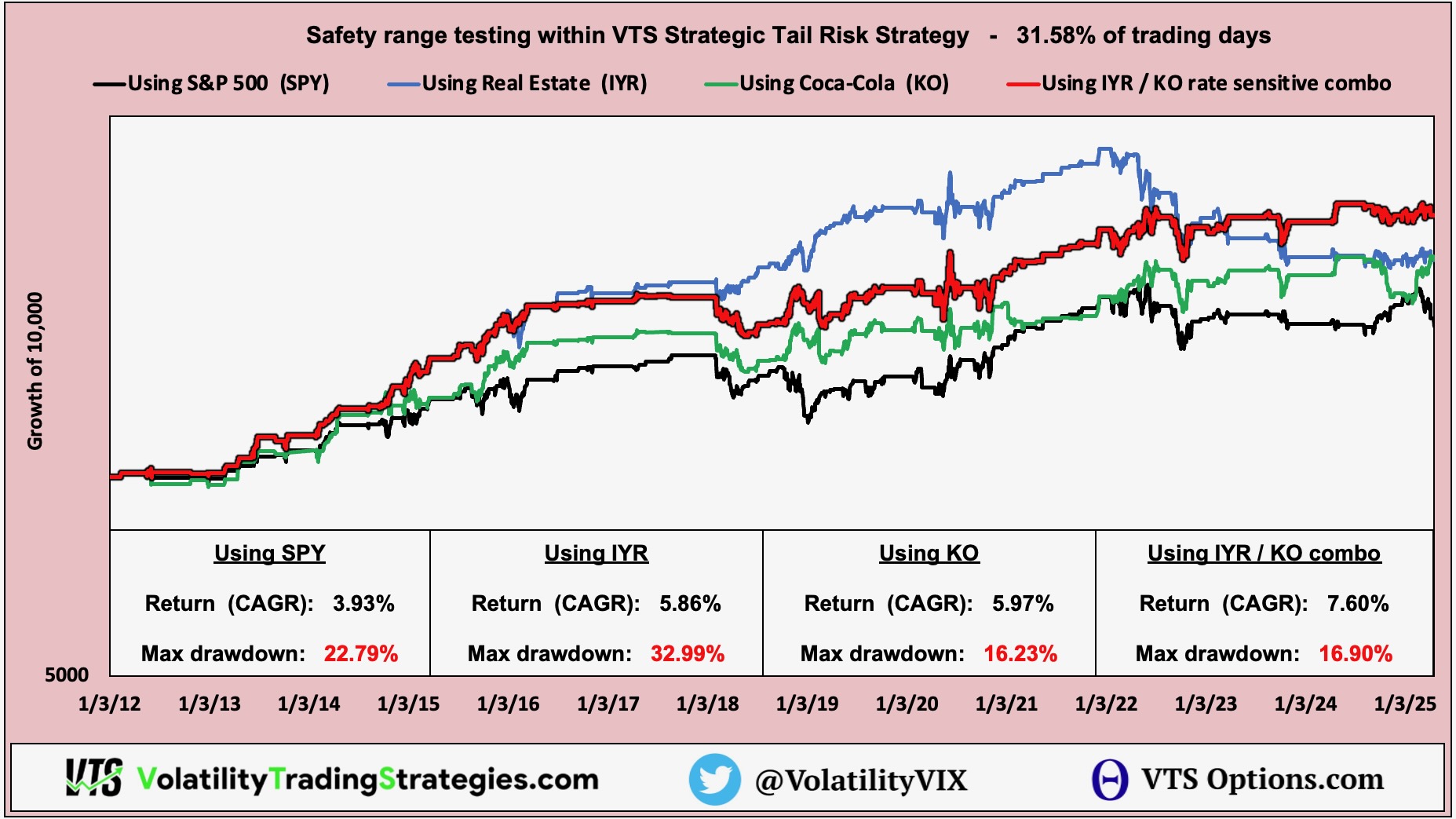

To set the benchmark, this is what those Safety positions would look like if we simply remained in the S&P 500 SPY ETF and didn't actually rotate into Safety at all:

The above chart is only showing our middle "Safety" range meaning it only shows the 31.58% of trading days in-between stable markets and crashing markets. In this middle ground range holding the SPY isn't a complete disaster. 3.93% return with a drawdown of 22.79% is manageable.

However, we don't target just acceptable. We want the best long-term results we can get which is where the IYR Real Estate ETF comes in.

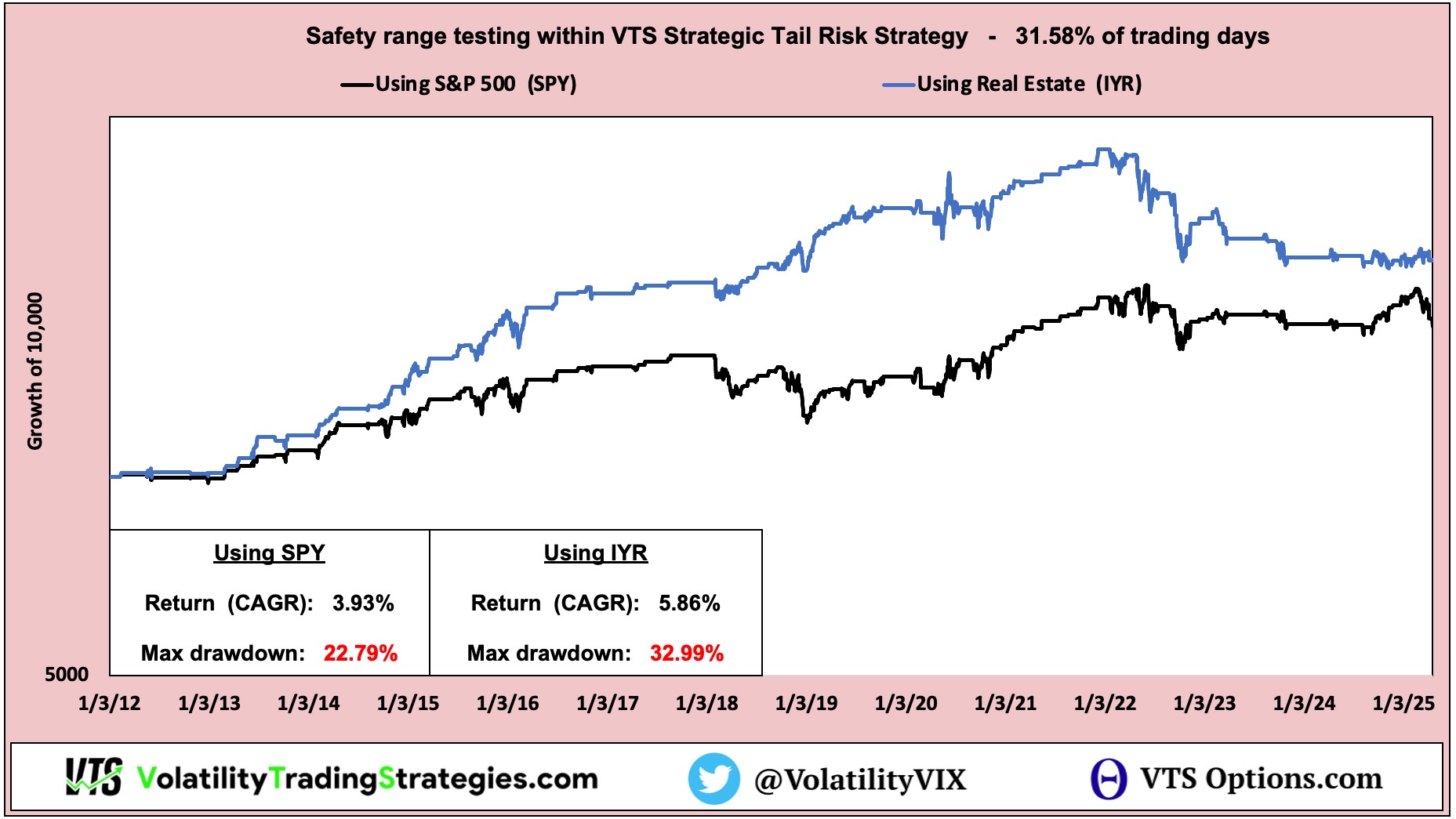

SPY vs IYR as a Safety position:

Now clearly the rate of return is significantly better, and for a time before 2022 it was way ahead. Real Estate is far superior to SPY most of the time. There in lies the problem though, it can also underperform under certain market conditions.

We'll circle back to those conditions in a minute but let me introduce another comparison and one of only a handful of individual stocks that I would ever consider using within a strategy. I much prefer ETFs, but there's a handful of individual stocks that are large enough and have attractive performance.

The best defensive stock in the world

Coca-Cola is in my opinion the very best "safety" stock to hold during elevated Volatility. Trust me I've ran the numbers on all of them and the winner always comes out to be Coke

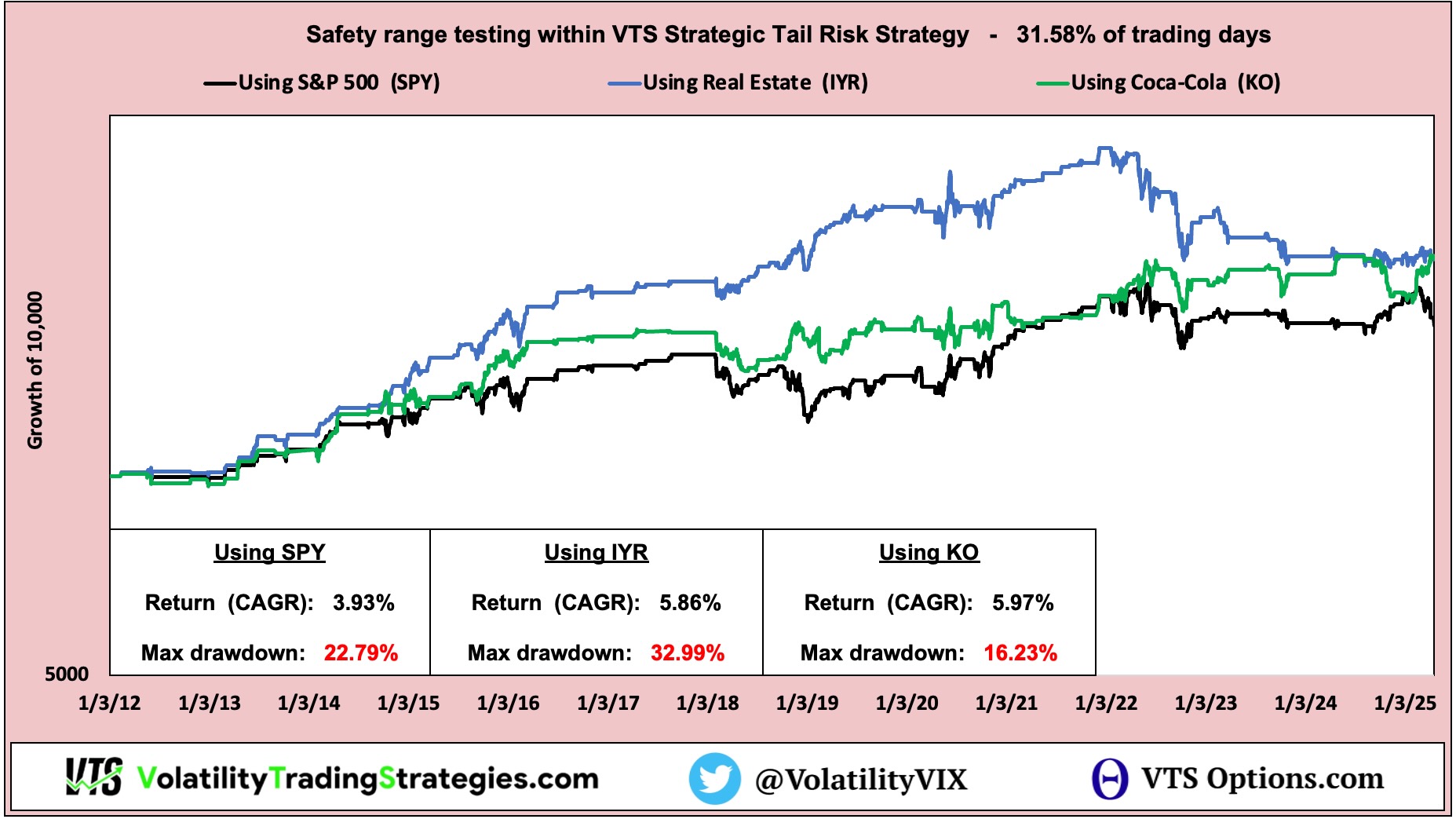

SPY vs IYR vs Coca-Cola (KO) as a Safety position:

The combination of performance and consistency with KO is unmatched and we can see that in the numbers. 5.97% return with only a 16.23% drawdown, it's a steadily rising uptrend throughout.

Just to give you a visual representation of this, look how well KO has handled the Trump Tariff war nonsense in the last month. The drawdown was pretty small, and it's already very near all time highs again making it a formidable safety stock.

Interest rates weigh heavy on "Safety"

The one market environment that IYR Real Estate does not perform well in is when interest rates are rising. It's similar to Bonds in that respect as there is an inverse relationship there. If rates are going down, Real Estate (and Bonds) will perform well. If rates are going up though, Real Estate struggles.

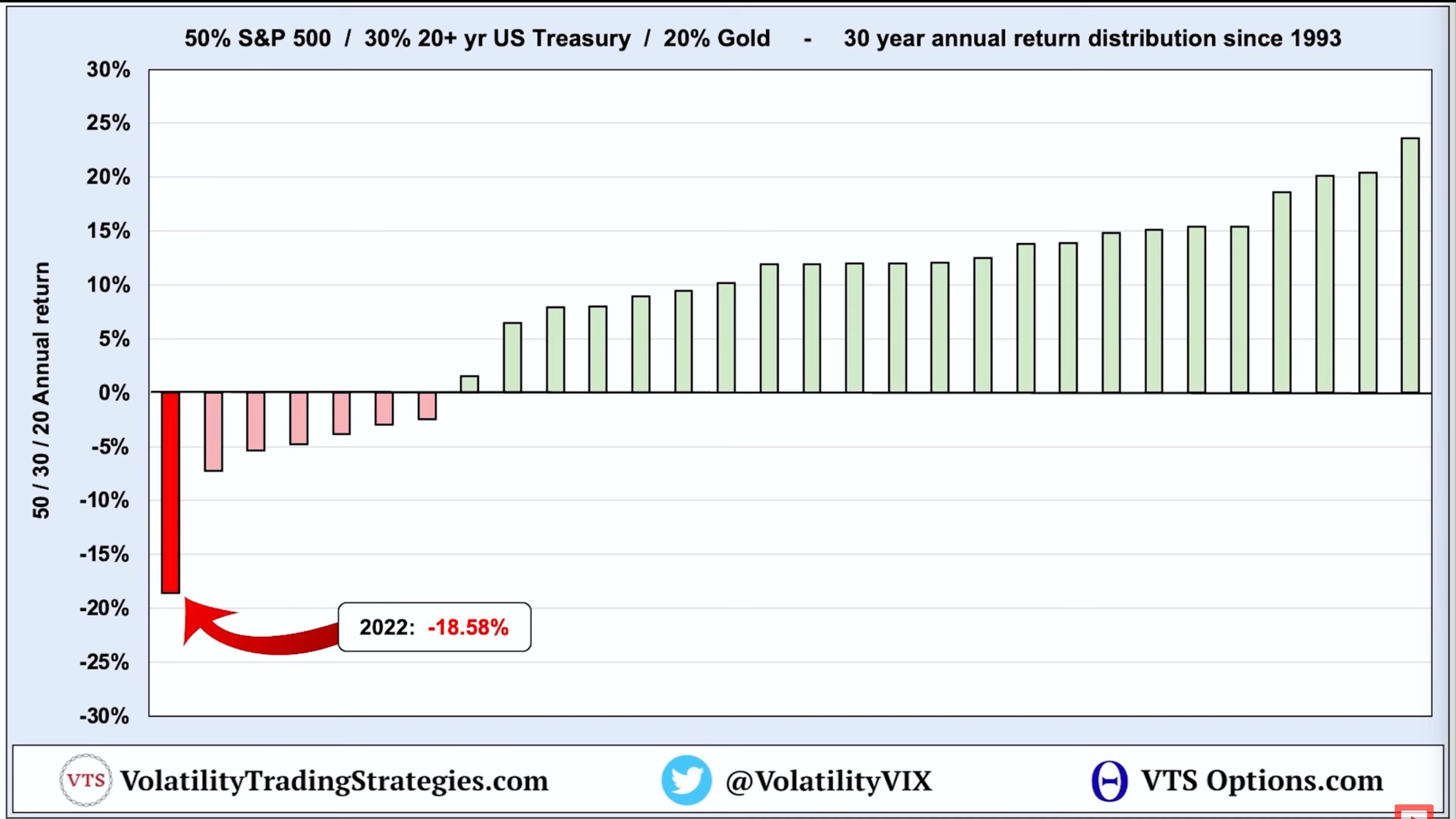

This is the primary reason why IYR Real Estate fell just as much as the stock market in 2022, and Bond ETFs actually fell way more than stocks. It was a perfect storm year for the underperformance of traditional safety assets, in a year where stocks got crushed as well!

In fact, a 50% stocks 30% bonds 20% gold portfolio had by far its worst performance in history in 2022, far worse than even the 2008 Financial Crisis:

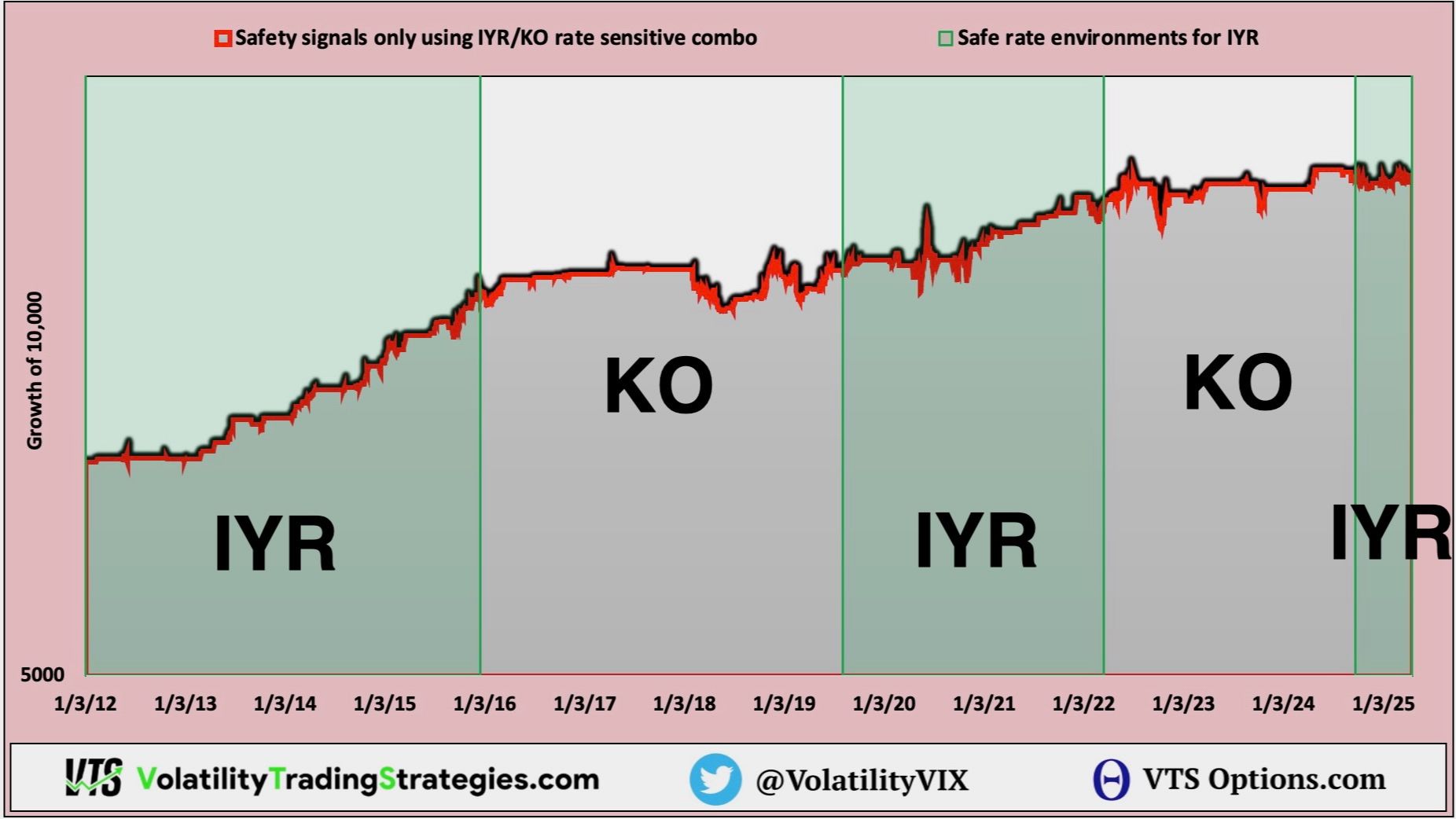

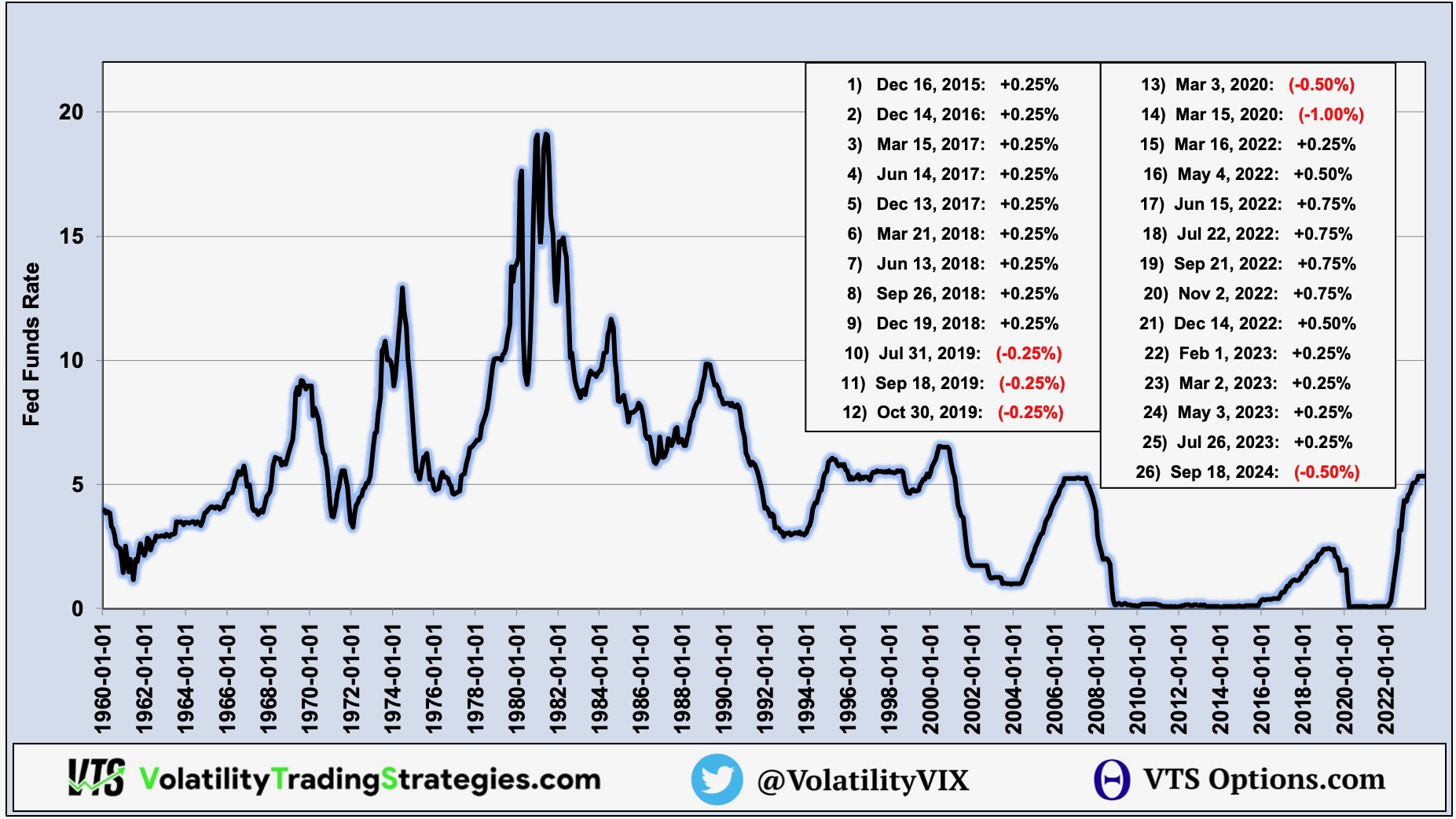

Overlaying interest rate policy of rate hikes and rate cuts, we can isolate those dangerous periods and try to avoid holding the wrong safety asset at the wrong time.

Just using official interest rate changes as a mechanism to switch out the Safety position seems like a great filter, and it's quantifiable so we can easily test it within the systematic rules of the Strategic Tail Risk Strategy.

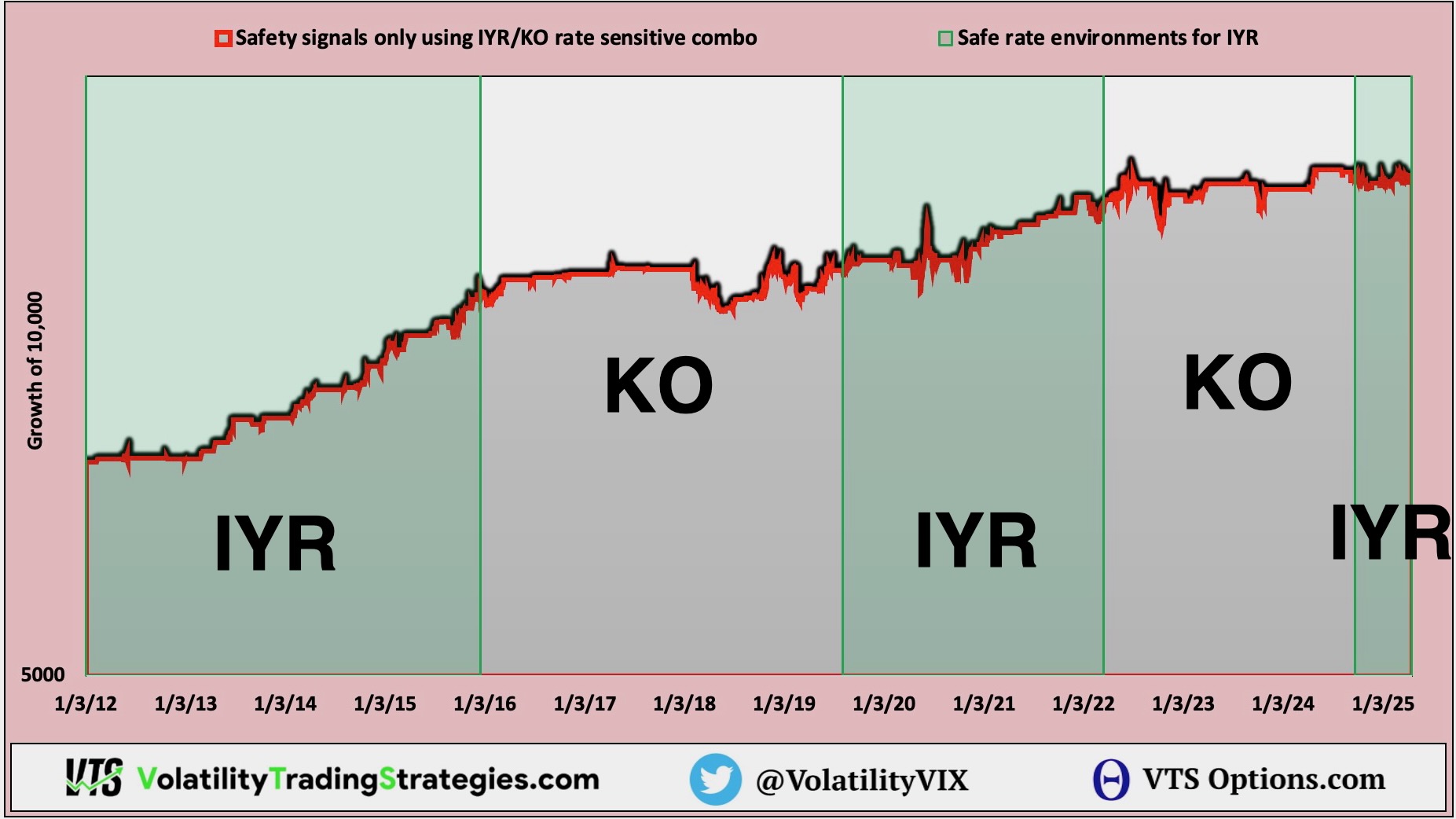

- Hold IYR Real Estate in flat or declining rate periods

- Hold Coca-Cola KO in rising rate periods

Switching out the Safety position the day after an official FED policy change reveals an improved method of protecting capital.

SPY vs IYR vs KO vs IYR/KO rate sensitive combo

* RED line is the IYR/KO combo

Using the rate sensitive combo system leads to improved results across the board. Now a 7.60% return on just 31.58% of trading days, and a maximum drawdown of just 16.90% which is very reasonable.

An elegant solution to improve Safety positions

Fortunately this doesn't add any additional complication to what is already a complex Tactical Rotation strategy involving detailed Volatility analysis.

On the contrary, it's actually very easy to implement given that that rule takes place the day after an official interest rate change. No guesswork or front running required.

Just sub in KO Coke instead of IYR Real Estate when rates are rising

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.