Introducing the CAOS ETF - Can it be used during a Market Crash?

Apr 21, 2025

VTS Community,

I mentioned last week that I will be introducing a few changes to the VTS Strategic Tail Risk Strategy. Now there will be a video or two coming discussing these further, but just to set the table for one of the changes, I would like introduce an ETF you may not be familiar with.

CAOS - Alpha Architect Tail Risk ETF

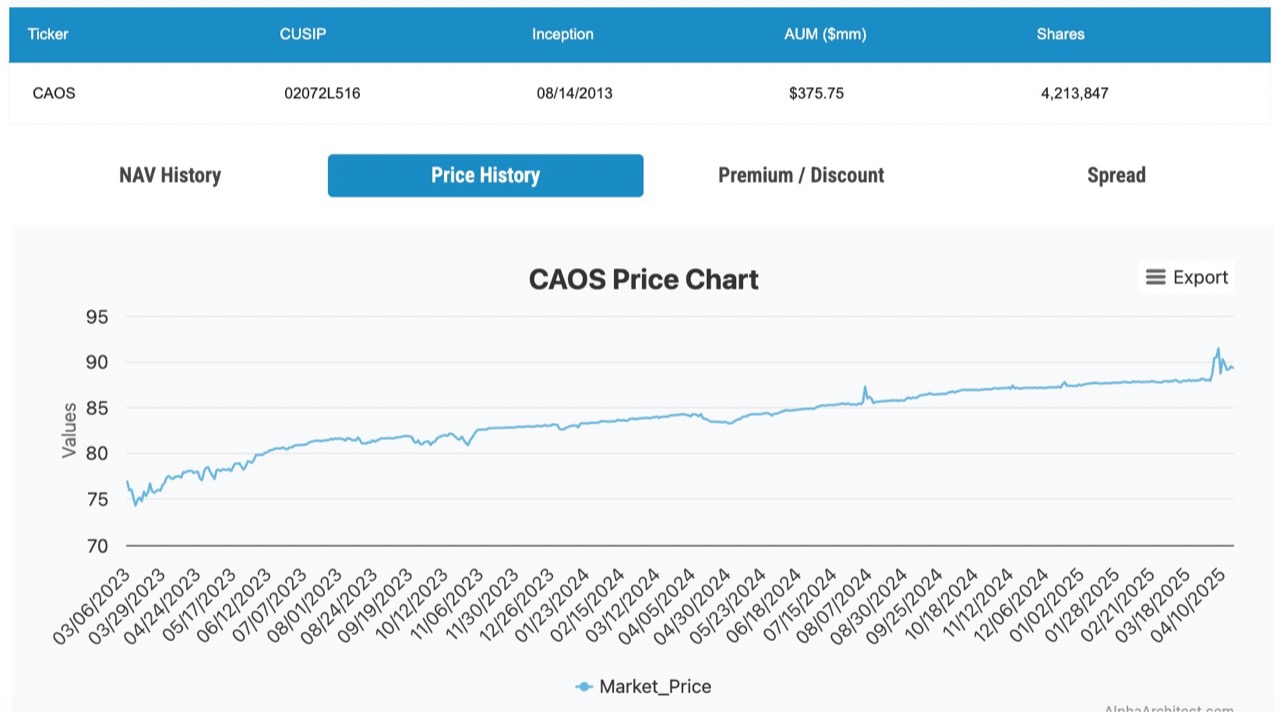

With net assets of about 350 million, it's not a huge ETF yet but it was only officially packaged as an ETF a couple years ago. It did exist as a Mutual Fund all the way back to 2013 so it's not actually that new, but the ETF version is all we are interested in for trading. I can't say for sure whether it will grow in popularity or not, but given that I like it, hopefully people see the same potential. Neither here nor there, it's plenty big enough for our purposes so let's unpack what it is.

CAOS since inception as an ETF in March 2023:

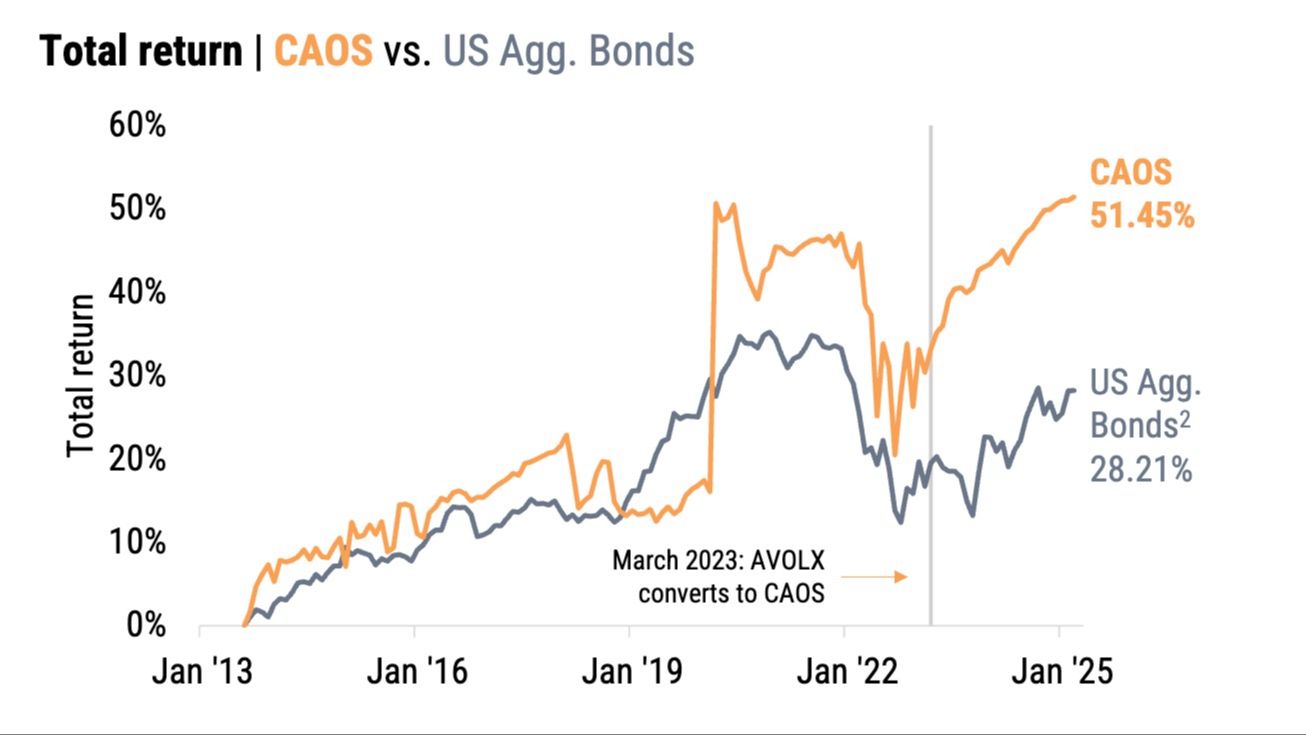

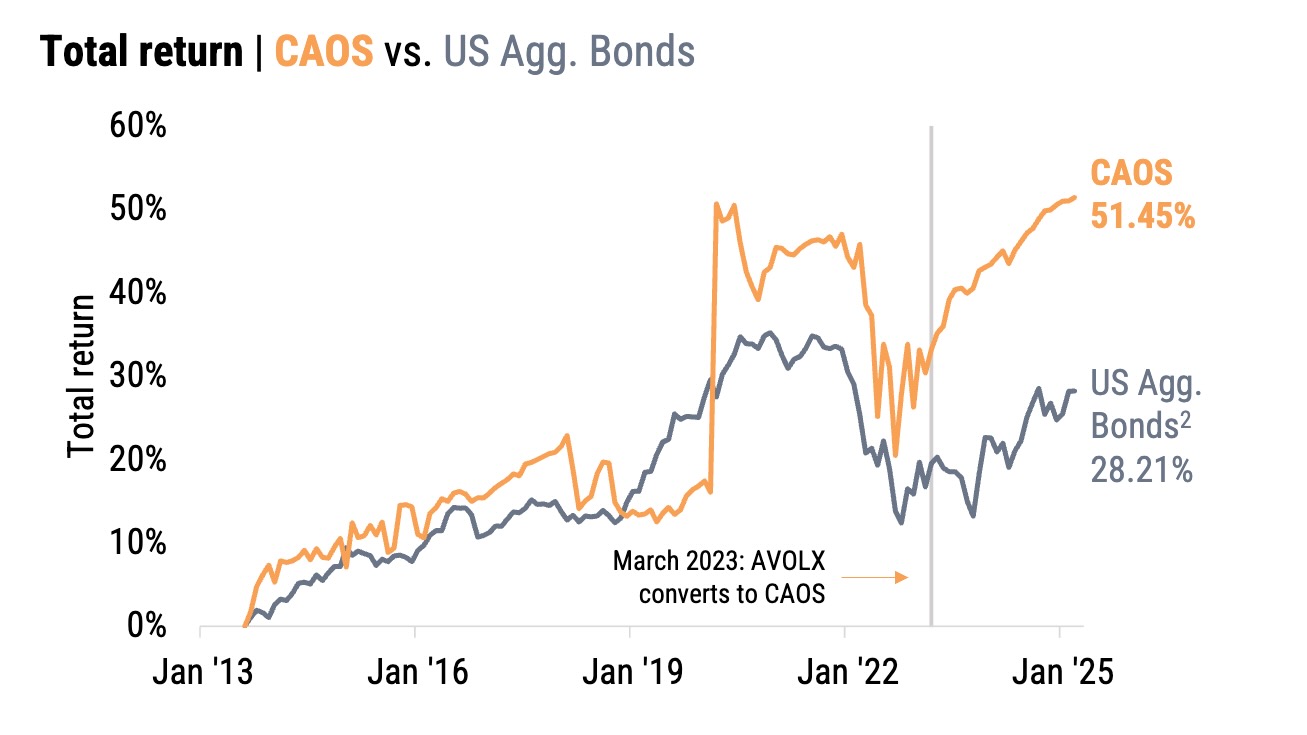

Now on first glance it doesn't appear to be that impressive. In fact, through many market environments it doesn't behave a whole lot different than Bonds as we can see in the comparison below:

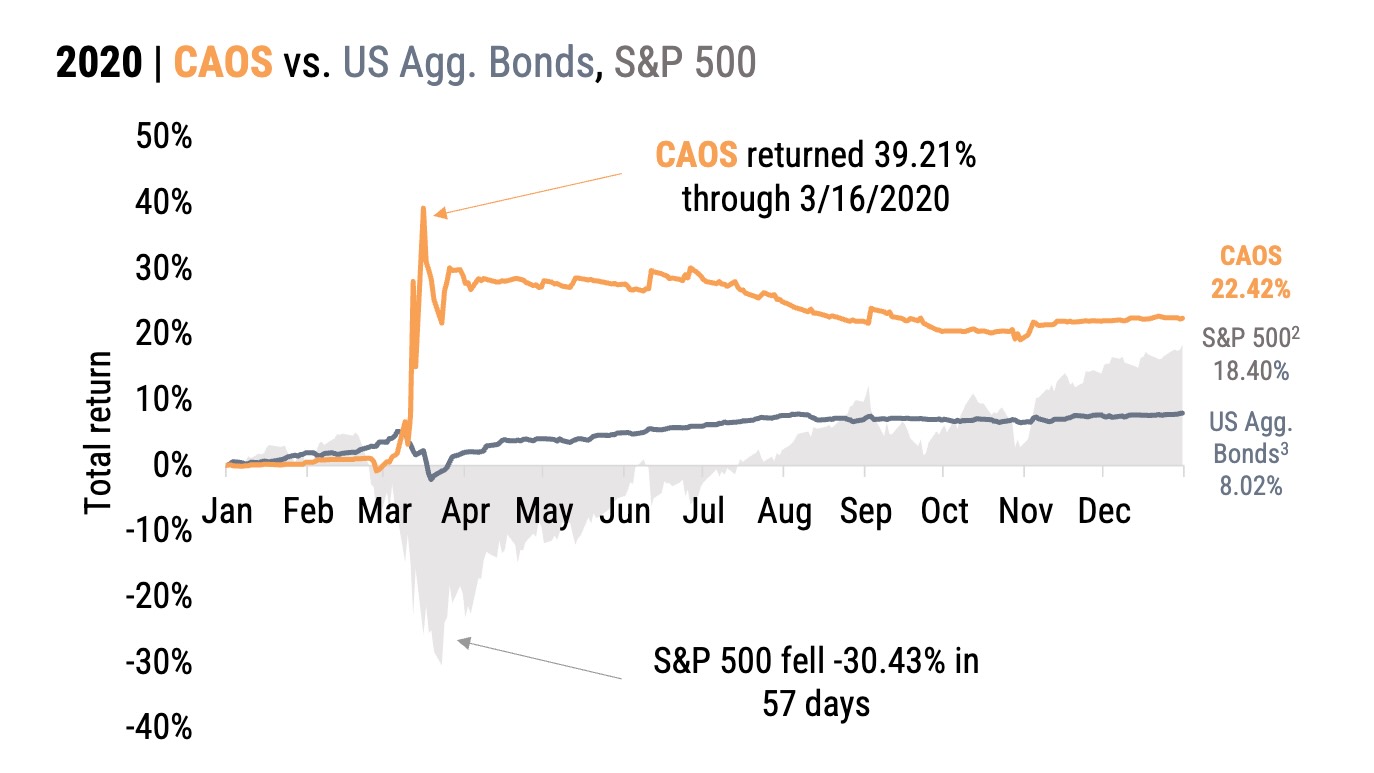

Now hopefully your eyes are drawn to that one acceleration period in 2020 when it significantly outperformed Bonds. That's really the key aspect of the Fund that makes it so appealing for an active trader like myself. The reason that CAOS so dramatically outperformed Bonds during that pandemic crisis has to do with how the CAOS ETF is constructed.

I won't get into the specifics of how those three aspects work, it gets a little technical and is not required reading, but it has components that essentially behave quite similar to fixed income, but then also has an S&P 500 Put Option aspect to it. Those Put Options are what gives it the name "Tail Risk" because during times of elevated Volatility we can expect CAOS to significantly outperform Bonds.

Zooming in to just the 2020 Pandemic we can see the decoupling:

As you all know, the VTS Strategic Tail Risk Strategy harvests Volatility data and then divides the market up into three ranges.

Low Volatility: Our "Aggressive" range where we currently hold S&P 500 (SPY). Given that these positions are held on roughly 65% of trading days, the bulk of the strategies performance is coming from just trend following during stable market periods.

Elevated Volatility: Our "Safety" range where we currently hold Real Estate (IYR). These mid to high Volatility ranges are the most ambiguous in the market and requires a partial exit to safety. Too risky to hold stocks, but not risky enough to move to anything negatively correlated to equites just yet. The Real Estate ETF serves this purpose well.

Extreme Volatility: Our "Tail Risk" range where we currently hold Long Volatility (VXZ). Only reserved for the highest risk ranges, this is when we need a position that is clearly negatively correlated to equities so we can try to capitalize on an all out market crash.

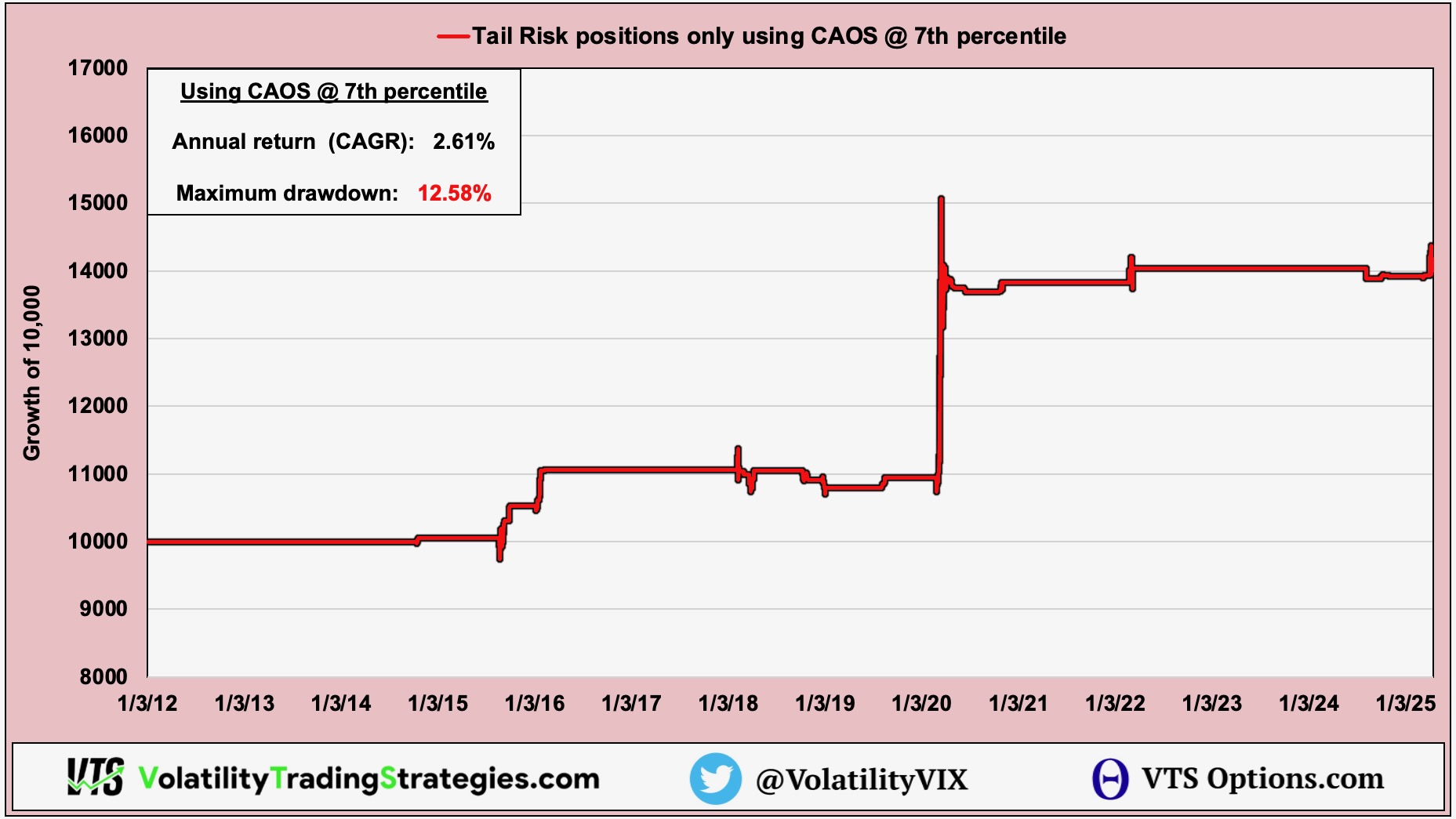

It's in that last range for extreme market Volatility where the CAOS ETF can be used with some nice results. Now I will leave the exact performance details for a future article but just as a teaser, here's what it would look like if we used the CAOS ETF only in the bottom 7th percentile of Volatility data that I collect for the strategy signals.

Remember, that is the most dangerous period for the market and very likely the S&P 500 is collapsing during those extreme Volatility ranges.

To not only avoid the damage, but to actually make a nice return on a small sliver of trading days adds an intriguing alternative for us to our current Long Volatility positions in the VXZ.

There are VERY few ETFs that offer any protection during market crashes. In fact I would say that Bonds don't even qualify for that job anymore given the current landscape.

Long Volatility VXZ is obviously one of them though which is why it has been our top choice for so many years. However, the CAOS ETF adds another viable alternative to the list that deserves further consideration.

To be continued...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.