Why do we close Iron Condors early by using Stops?

May 14, 2025

VTS Community,

Question: Why close Iron Condors early?

I had a few people recently ask why we closed out that QQQ Iron Condor when it still had a lot of time left on it. It was also still a little bit inside the short strike, so the natural question would be, why not just wait and see if the market goes down a bit and turns that trade into a winner? There's a couple reasons I like to use the 50% stop-gain/loss and get out quicker

1) Reduce potential losses

Due to the fact that Iron Condors are market neutral trades with a wide center profit range, it does mean that the maximum loss will be significantly higher than the maximin gain, sometimes in the range about 3:1 on the risk side. That's just a function of how the trades are set up. So if you are letting trades expire, every losing trade will require about 3-4 subsequent winners to get back to break even.

We use a 50% stop-loss / 50% stop-gain on our Iron Condors to try to turn them into more 50/50 balanced risk reward and then at that point it's just a matter of getting more winners than losers.

Remember I include all trade fees and commissions in the official track record, so long-term I'm just trying to get about a 3:2 ratio of winners vs losers. Do that long-term, the law of large numbers takes over and the strategy makes a decent return.

2) More efficient use of capital

If we imagine a trade that's doing well and it hits the 50% stop-gain level, it will likely still have over a month to go on the contract. So a trader could wait another month to get that second half of the profit out, but in my opinion they are far better off just taking 50% of the profit and opening a fresh new position.

Higher trade frequency with wide wings is what we're trying to achieve with the strategy. Even though one of our rules is we initiate positions 45-75 days to expiration, they typically are only held open for a few weeks, or a month on the high end. By using a stop-gain it means we can churn more trades and capitalize on that slow Theta decay of the Options.

Rolling 1 year Iron Condor results

The last year has seen some crazy moves in the market with several of the largest Volatility spikes in history. From last August with the initial wave down, to December which was crazy, and now recently with all the Trump Tariff stuff, it's truly been a wild roller coaster ride.

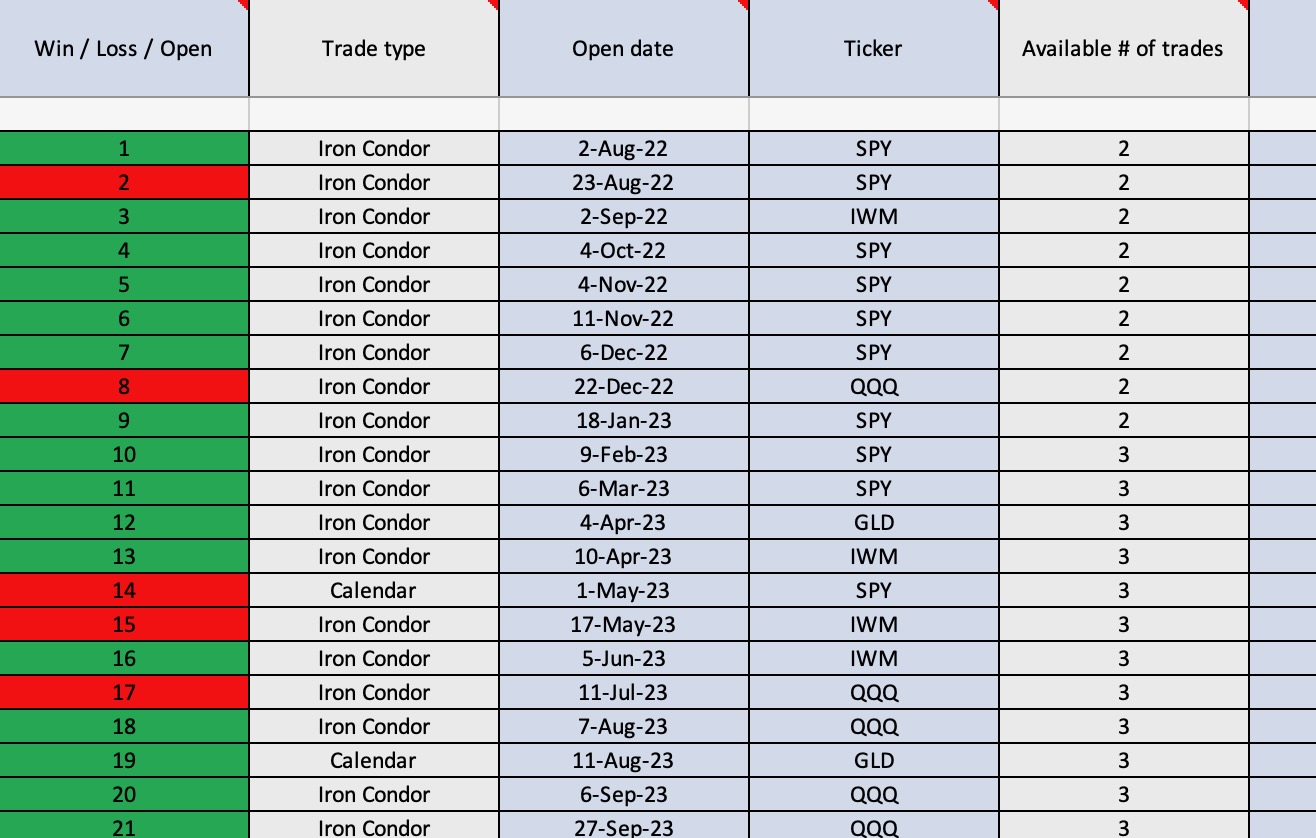

All things considered, Iron Condors are doing reasonably well given the big swings. Remember long-term we're trying for more winners than losers, at about a 3:2 ratio. We're not that far off in the last rolling 1 year. We can see the green for winners and red for losers on the left column.

What a target period may look like

Now ideally we would want something closer to what we saw in 2022/2023. That was a good ratio more reflecting the long-term strategy. Remember Iron Condors were one of the original launch strategies with VTS all the way back in January 2012. I also traded them for about 5 years before VTS was a thing, so I've been doing this now for roughly 18 years!

I've tested everything a million different ways and I definitely think using a 50% stop-gain / 50% stop-loss is the way to go

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.