VIX futures monthly expiration - What happens?

Jan 15, 2019VTS Community,

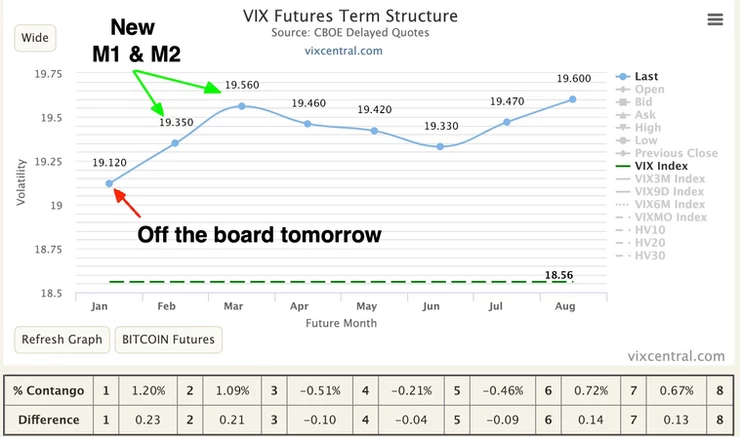

This is a follow up to the discussion yesterday regarding the very flat VIX futures term structure. Recall I showed how if we use the "wide" button it gives an accurate view of the true slope of the curve, and right now it's extremely flat reflecting that large institutional players are very undecided about this market as of now.

Today is VIX expiration day. That means the front month VIX future (M1) will be off the board tomorrow, and all the other VIX futures will shift downward.

- Today's 2nd month M2 will become tomorrow's 1st month M1 - Today's M3 will be tomorrows M2, etc

The result of this monthly shifting at expiration means that the levels of contango readings people are looking at will change, sometimes dramatically. This month it won't be that dramatic, but all things held constant from the moment I'm writing this, it will push the level of contango down a little closer to zero again.

If you use your finger to cover up the current M1, you can see that when the shift occurs tomorrow the VIX futures term structure will again look very flat (and more so if you push the wide button). The difference between the front month and all the others going out to the far end is very small.

Despite the reasonable performance of the S&P 500 lately, there is a lot of indecision out there.

Now it's important to know that this does not affect the actual performance of the volatility ETPs in any way. Those all function based on a dynamic rolling system of different weightings. So the allocation to that front month M1 that is moving off the board is already nearly 0% and the weighting to the back month M2 which is shifting down is nearly 100%. Sometimes I get that question:

So can't we just go long volatility on expiration day and capitalize on the contango levels dropping the next day?

No, there's no benefit to that because again, the volatility ETPs function based on rolling allocations. The removal of the front month has no impact on value because it's a constant 1 month rolling VIX future and it's already accounted for in the calculation.

But what it does mean is that contango / backwardation levels, the actual percentage value can be quite skewed near expiration dates and not reflecting the true levels. This month, it's similar, but sometimes the difference can be huge.

If you want a more detailed explanation of this very important component of the volatility complex, please check out this video below and feel free to ask me any follow up questions you have.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.