US Credit Downgraded to Trash?

May 19, 2025

Surprises overnight and weekends have so far been the norm in the Trump Presidency and I suspect that will continue. The latest one if you've been watching the news is that ratings agency Moody's has downgraded US Credit rating from Aaa to Aa1.

Now it's not really a big deal to be honest, it's not like people don't already know the reality, but the market is down a little on the news. We'll see where things go, impossible to tell these days, but I thought maybe we could just take a peek at what all the fuss is about.

Debt is the problem

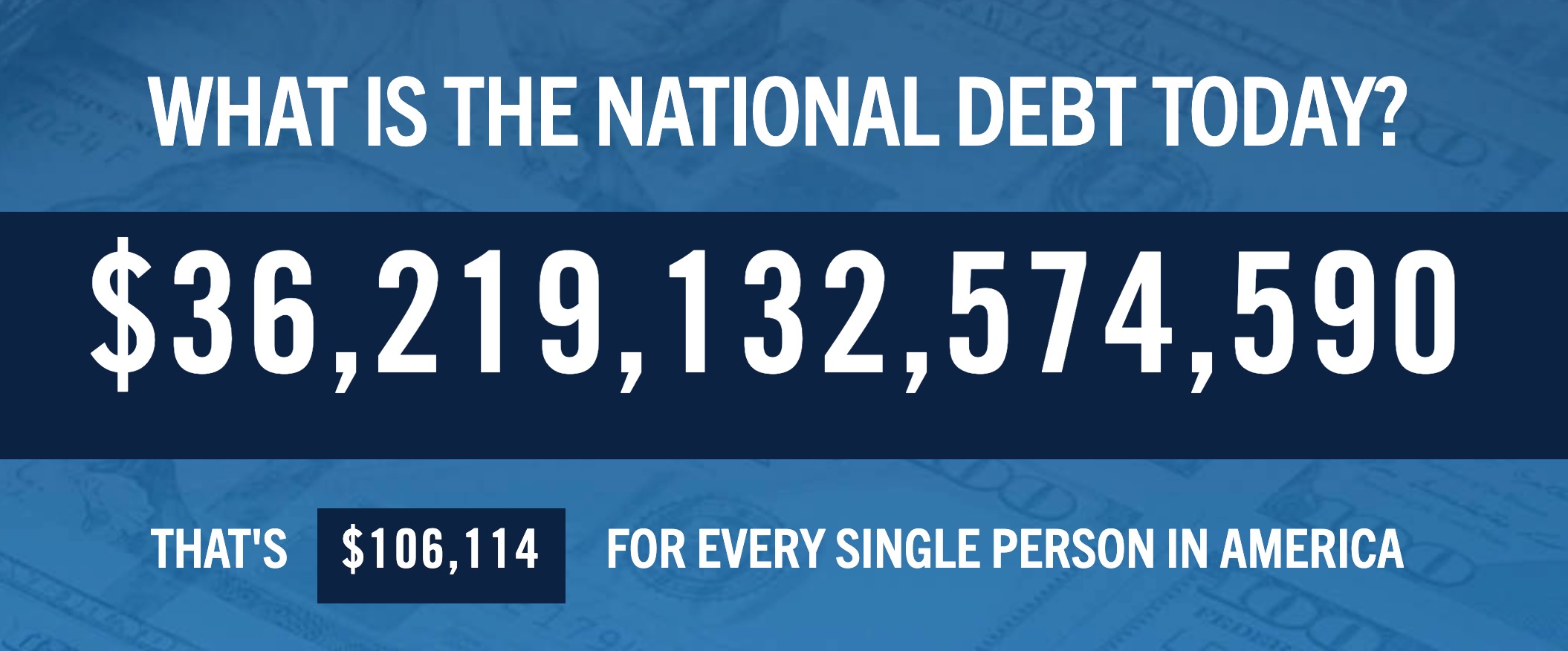

There's several ways to measure debt and how serious it is. The raw nominal value for US debt is probably the one you hear most and it's currently sitting at:

Now that nominal value gets a lot of headlines, of course it sounds like a really big number, but it really doesn't mean much without further context to GDP or how much a country makes.

If I told you a person has 1 million dollars of debt, is that a lot?

- Well if their annual income is 100,000 then yes that debt seems totally unsustainable. Even if they saved as much as they could they are likely 20 years away from paying it off.

- However, if I were to say that same person makes over a million dollars a year, well now they are a couple years of responsibility away from paying it all back and it wouldn't be too much to worry about.

Debt to GDP ratio

A better way to view how serious a country's debt actually is would be to measure it in terms of their GDP. By dividing the debt by GDP we can see if the country is the equivalent of that person with a million dollars of debt making 100,000 a year, or a million a year.

Not all debt is created equal (China)

Now a quick note before we get to the numbers, even the Debt to GDP ratio doesn't tell the full story because it doesn't say WHY the country is going into debt and where their money is being spent.

In this latest Tariff debacle I made the point several times that while we can definitely say that China also has a growing debt, it's not accurate to view China's debt the same way we view the US debt.

- The US debt is largely accumulating by simply servicing the existing system and keeping the lights on. There isn't a whole lot of investment in the future going on in Western countries. Honestly, when was the last time you got excited about a big project they were taking on?

- China on the other hand is accumulating debt in large part because they are spending huge amounts of money on building their global dominance in manufacturing, and rolling out countless infrastructure and energy mega projects that will pay huge dividends in the future. Dams, bridges, electrical grids, hydropower, airports, hospitals, high speed rail, national roadways, shipping ports, and countless other expenditures

The US and China are two very different animals, just saying...

It's not a perfect measure

Debt to GDP matters more as an internal comparison of a country over time. If for example a country went from 50% Debt to GDP to over 100% in say a decade, that would be something to pay close attention to.

Debt to GDP is less useful in comparing two different countries with two different societies and spending habits.

* This is one of the reasons why so many experts have been wrong about Japan for decades. I'm not saying they don't have issues, they certainly do face challenges. However, their seemingly staggering debt doesn't mean quite the same thing when you look under the surface.

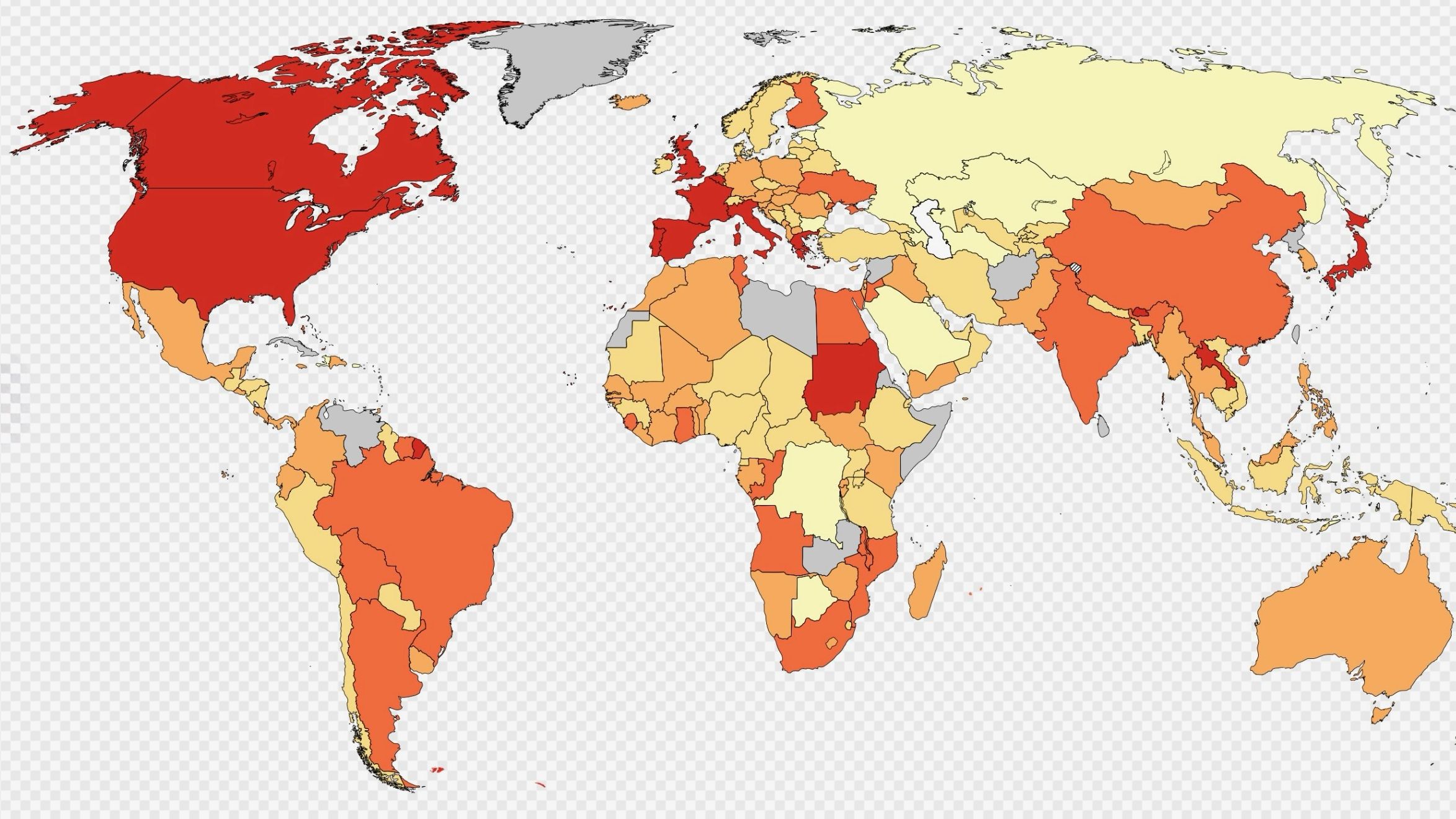

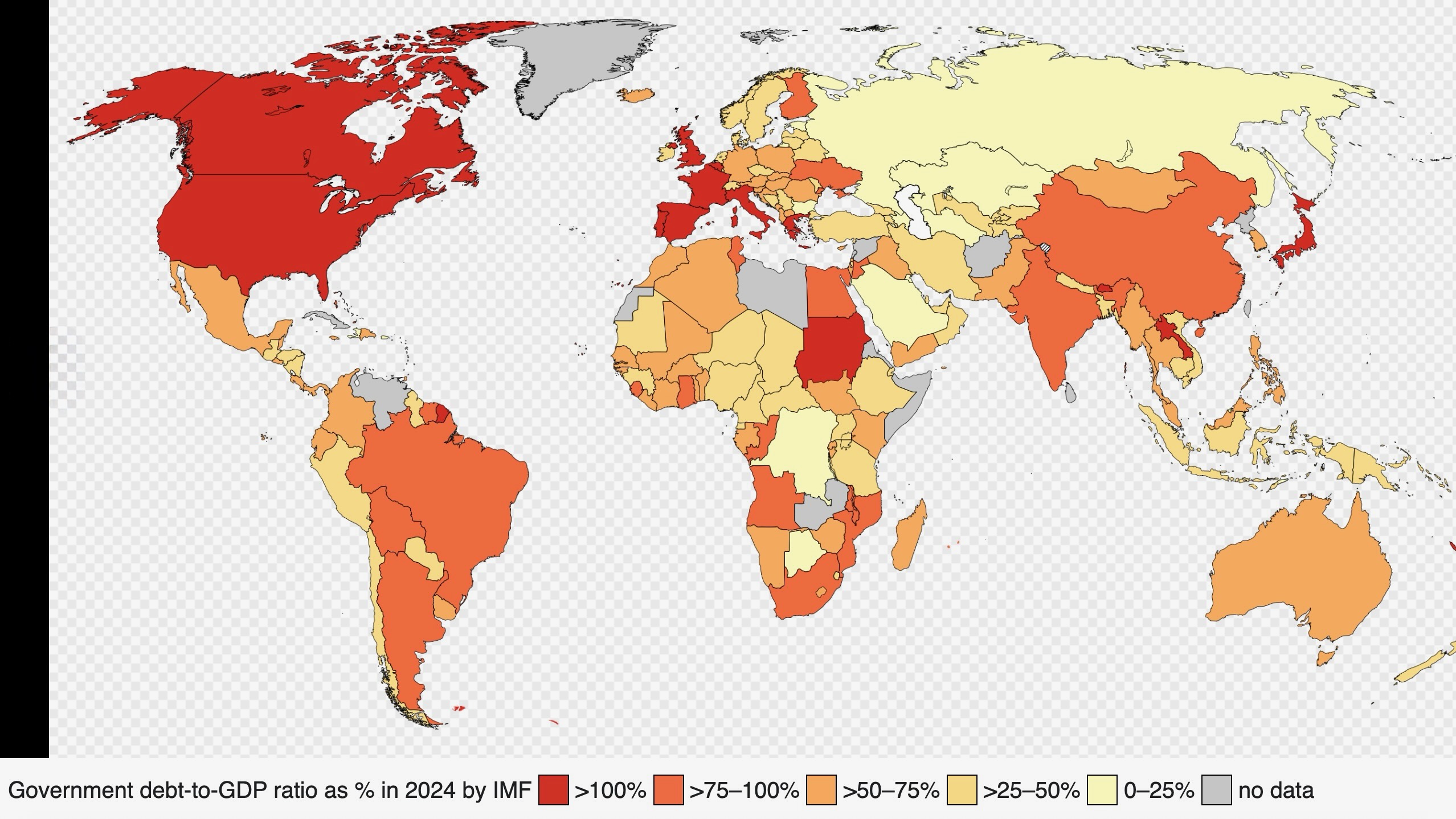

Debt to GDP around the world

Let's look at some numbers though. Here's a general heat map of the world with light yellow being very low Debt to GDP and bright red being the danger zones for very high Debt to GDP.

Notice any pattern? 🤔

A few noteworthy comparisons (as of 2022)

United States: 121%

China: 88%

Germany: 64%

Japan: 251%

United Kingdom: 102%

Canada (my home country): 105%

United Arab Emirates (my tax residency): 30%

Taiwan (my 2nd residency): 23%

Panama (my 3rd residency): 54%

Italy (my next residency): 137%

Hong Kong: 9%

Singapore: 175%

Switzerland: 37%

Brazil: 86%

Australia: 49%

Norway: 38%

Sweden: 36%

Spain: 107%

Saudi Arabia: 28%

Russia: 21%

South Korea: 56%

Ireland: 41%

India: 83%

Good debt vs bad debt

Again I think people need to have a much more nuanced conversation when it comes to debt and what exactly it means.

Although China is having some issues the last decade, certainly the real estate market is concerning, but overall I would say I'm optimistic that their debt spending is going to pay off.

For the United States, Canada, and the more "Westernized" European countries, I'm not so sure. We all had our hayday many decades ago and now we're just basking in our glory and spending what previous generations sacrificed to give us.

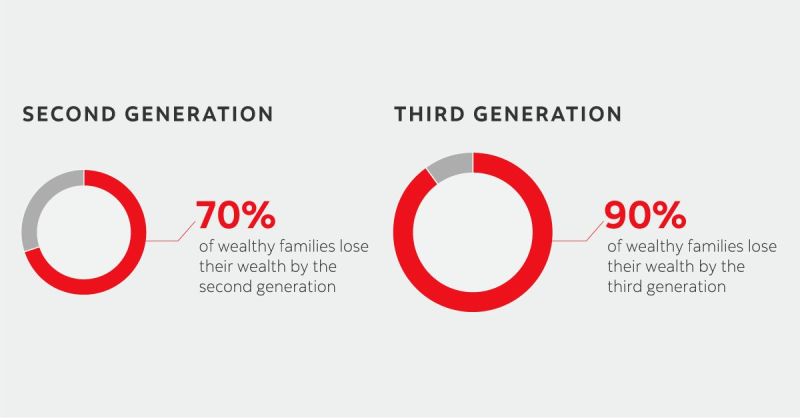

Wealth doesn't necessarily last

Moody's giving the US a downgrade is just putting it in the headlines for a few hours. The debt issue is something we've all known about for many years. Political gridlock is at the heart of the issue.

These days, the sitting administration spends most of their time trying to roll back the decisions of the previous administration. Then the next one tries to roll back theirs, and so on, and so on...

We in the West would be wise to remember that the gifts previous generations gave us are pretty easy to squander.

90% of inherited wealth is gone by the 3rd generation

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.