Tactical Balanced strategy - Where is the performance coming from?

Sep 10, 2019VTS Community,

When I showed the breakdown of each of the individual 20% sections in my Strategic Tail Risk strategy it was well received, so I thought I would do the same thing today for the Tactical Balanced strategy and show a little more clearly where the performance is coming from.

Click here for the full Tactical Balanced strategy explanation.

One of my strongest held beliefs when it comes to successful long term investing is that it's absolutely mandatory for investors to have a reliable, profitable, and safe core portfolio holding. With that in place it then becomes possible to dedicate smaller portions of the portfolio to potentially higher growth strategies like options and volatility trading for example.

The trading world is absolutely packed with people trying to show strategies that take small amounts of capital and grow it more aggressively. That's what sells, big profits. The problem is, even if a person did earn 20-30% a year on a smaller portion of their portfolio, it still won't have that much impact on their overall net worth if they don't also have a majority of their portfolio that's also consistent and doing well. A stable core portfolio that navigates down markets well is required in order to even be able to allocate any capital into something with a higher rate of return.

I personally trade options and volatility ETFs with confidence (even through the occasional drawdown) because I have a very solid core portfolio holding that has performed well in every single drawdown the S&P 500 has had.

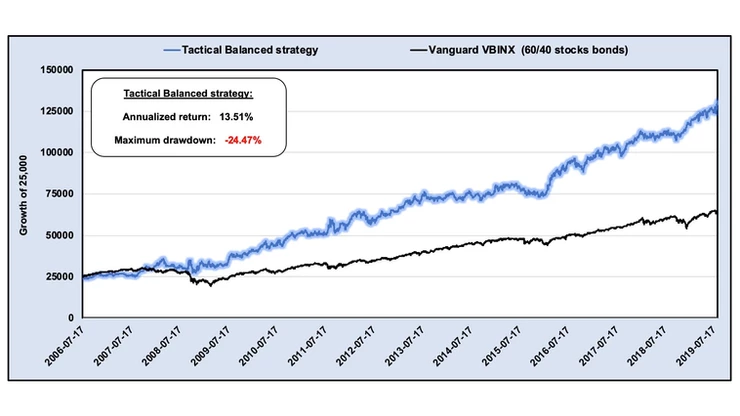

Tactical Balanced strategy - This strategy rotates between positions in either stocks bonds or gold depending on current market conditions. By analyzing volatility metrics I can determine when it's safer to be in stocks and when the market is too dangerous and it's time to move to safety bonds and gold.

* Since there's occasionally some confusion, the Tactical Balanced strategy does not use the VTS Volatility Barometer. I didn't start using the Volatility Barometer until January 2015, but the Tactical Balanced strategy has been around a lot longer than that and it uses its own set of volatility metrics to navigate the market. The VB Threshold strategy directly uses the Volatility Barometer, but the Tactical Balanced strategy does not. They are different, and that's one reason why they only have a very low 21% correlation between them. They both have performed very well, with very little correlation between them, making them a nice compliment.

Of the many strategies that I trade within my portfolio, the Tactical Balanced is in my opinion the most important. It's actually the lowest performance as far as annual return of any of the strategies I have, but it's still the most important because it is the foundation of everything else that I'm able to do. It's been so consistent and reliable through every single market environment that it frees me up to do what I want with the rest of my portfolio.

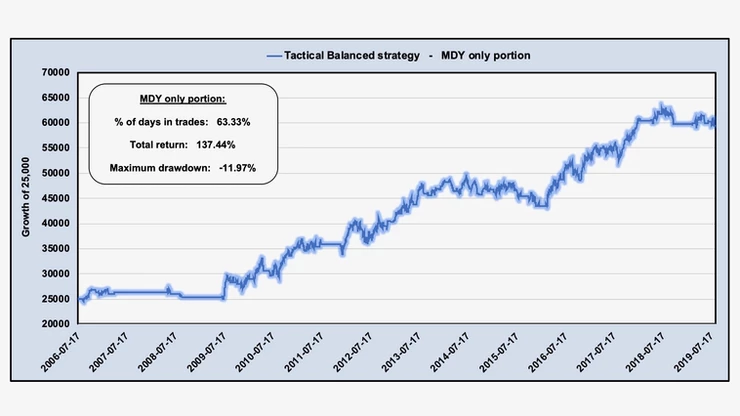

MDY stocks only - I hold stocks when all the volatility metrics I track are stable and calm. Since markets do trend up over time, I do think it's important that the bulk of the performance is coming from stocks. So I skew my volatility metrics to allow for roughly 50% of trading days to be allocated to stocks. Now it's been an abnormally long 10+ year bull market so I've held stocks even more than the targeted 50%, up at 63.3%, but in the long run it should balance out to about half of the time in stocks.

That is a high rate of return for such a small drawdown. Anybody who says you can't time the market is just wrong. Obviously day to day it's impossible, that's just noise. And I'd even say over several days or a few weeks it's not possible to do it consistently. But in the long run over several years, absolutely! A person who understands volatility metrics and how the markets tend to move within each of the different volatility regimes absolutely can time the market.

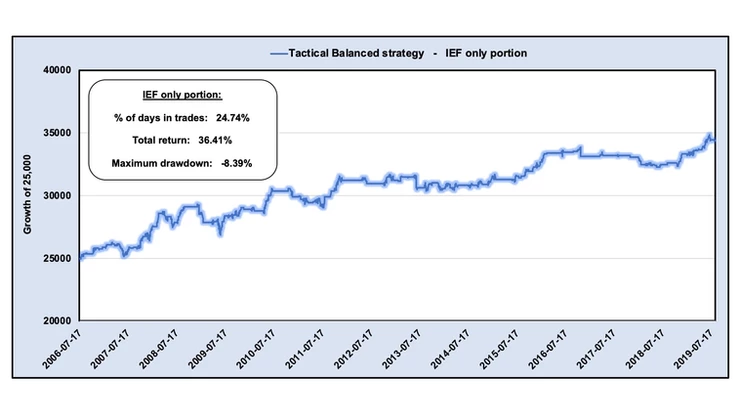

IEF Bonds only - My bond allocations are the "middle ground" positions when the markets aren't quite stable enough to hold stocks, but also aren't completely falling apart either. It's just designed to get a modest rate of return during those times when markets are too ambiguous and I can't go long or short with any conviction. Holding IEF Bonds until the markets demonstrate a more solidified trend has been quite successful for me over the years.

This middle ground allocation to IEF Bonds isn't the growth engine of the strategy. This is the portion that actually helps me best avoid stock market drawdowns, and in a way could be viewed as the "cash" portion of the strategy. Now clearly the performance is much better than cash which is why I take them, but the main point here is to have something safe to exit to when stocks are risky.

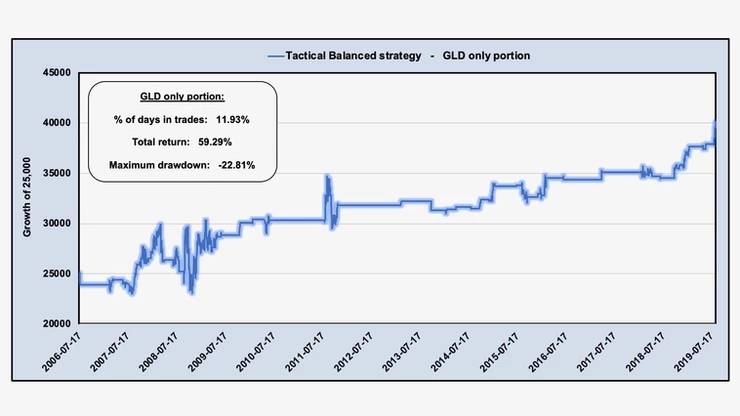

GLD Gold only - In my opinion, every trading strategy that hopes to be successful long term must have bear market signals built in. Nobody likes to talk about it because most of the investing world is long only hoping stocks go up forever, but unfortunately recessions do happen. Markets do occasionally go through extended declines. Any strategy that doesn't have a plan for that eventuality is just trading on borrowed time. The S&P 500 for example. We already know what's going to happen right? Of course we don't know when, but we do know that at some point these bull market gains will be offset by a pretty substantial bear market loss. Hopefully not all of it, but it's pretty normal to retrace 30-50%.

The Tactical Balanced strategy has the ability to rotate into GLD Gold positions in times of extreme volatility. It doesn't happen as often, only 11.93% of trading days since inception, but when it does its these positions that help save the strategy from those ugly extended bear market declines.

There are no guarantees in the investing world. However, there's one thing that I am willing to bet my money on. Being long the stock market during low volatility, and being long bonds and gold during high volatility, there's a high probability that plan continues to be the best way to navigate. The consistent performance of the Tactical Balanced strategy isn't luck. The volatility metrics divide the market into low, medium, and high volatility regimes and then from there we know what position has the best chance of positive returns.

I don't ever ask any personal questions to VTS Community members. I don't know if they are investing small or large portions of their net worth in this Tactical Balanced strategy. However, it's worth mentioning that I always assume it's large portions of a persons net worth, and therefore needs to be stable and consistent. This isn't play money or side money. I take it seriously as if it's major portions of a persons net worth, that's how it's designed and what it's meant for.

With my stable core portfolio taken care of, it frees me up to take a little extra risk with other portions of my portfolio.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.