Should we "Buy the Dip" sooner after a Market Crash?

May 02, 2025

Investing by Volatility Targeting isn't Perfect

Given the market has recovered about half of what it lost in all this tariff nonsense, and we are still in safety positions in our Tactical Rotation strategies, it seems like a good time to discuss the main drawback of this style of Volatility Targeting.

Click here if you want a refresher video on what Volatility Targeting is

I'm going to turn the spotlight onto my own Defensive Rotation Strategy and be honest about one aspect that can be very frustrating for investors following it.

There can be an uncomfortable delay getting back into the market...

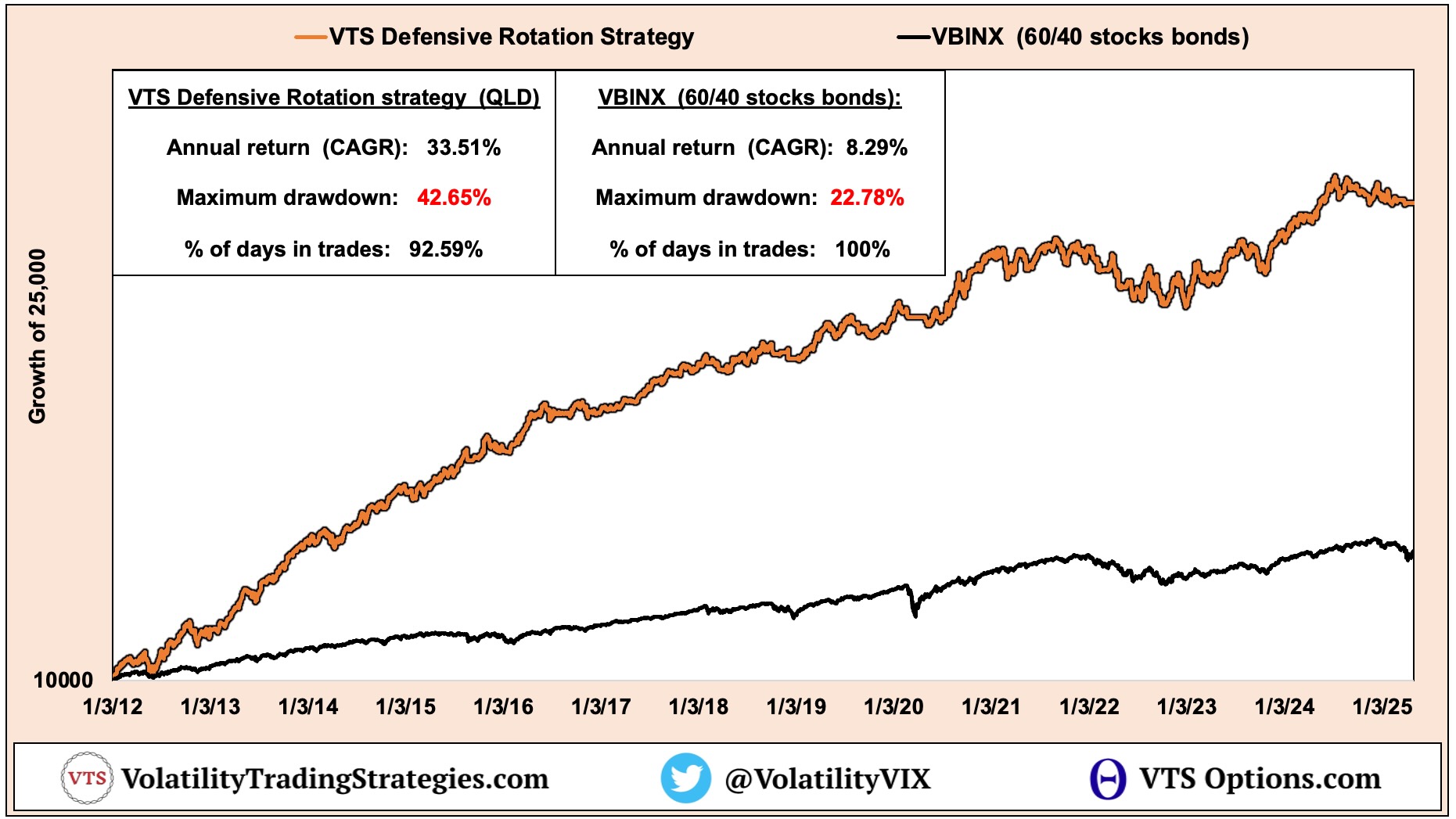

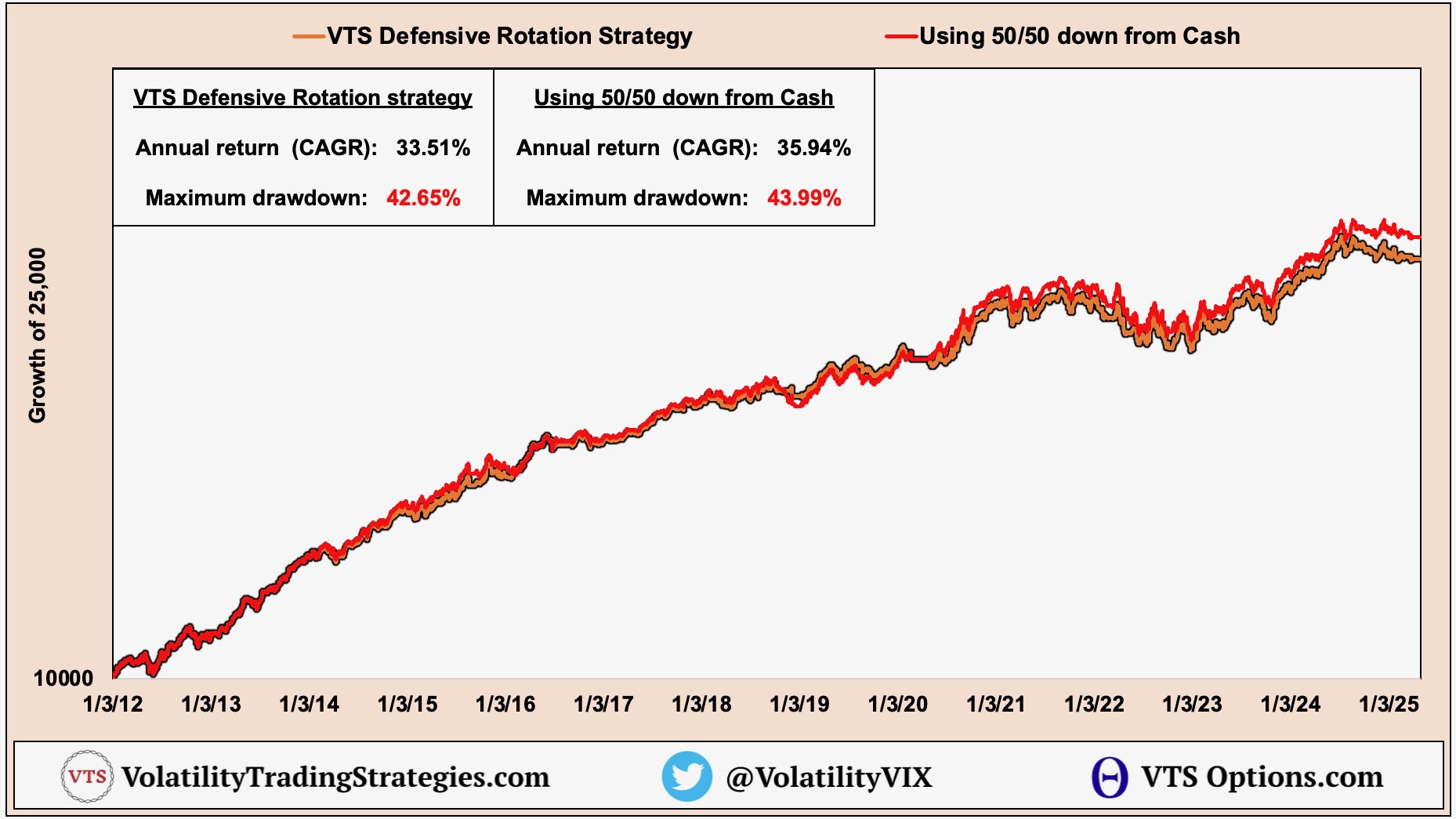

Defensive Rotation has CRUSHED the market!

Before I talk about the weakness I do want to establish a baseline here that there is absolutely nothing "wrong" with the strategy

I think you'd be hard pressed to find anything that's outperformed the market so handily over the years with such consistent risk management. Obviously 2022 sucked, as I've talked about at length the asset classes that are traditionally safe were also down just as much as stocks so there was nowhere to hide, but overall I am thrilled with the strategy. Feel free to send me a link if you know of anything better, I'd be very interested to see what my competition is.

So it's a very biased opinion but I think every investor in the world should have some exposure to the Defensive Rotation Strategy.

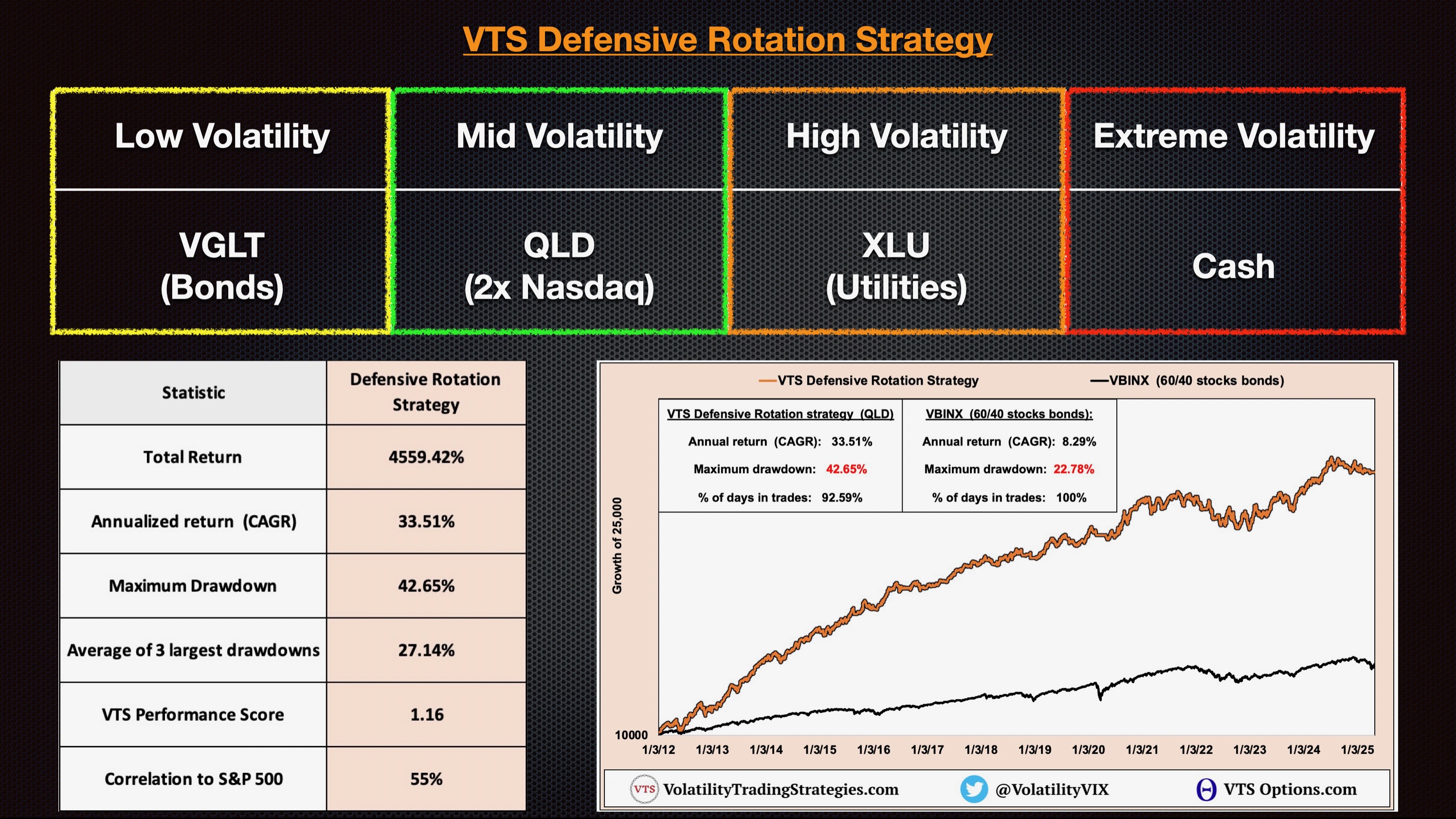

Tactical Rotation through Volatility Targeting

The strategy functions by mining Volatility Metrics and then we only hold the asset class that performs best during that level of market Volatility.

* So holding only 1 position at a time, that's important for later

Extreme Low Volatility ---> Hold VGLT Bonds

Mid - Low Volatility ---> Hold 2x Nasdaq QLD

High Volatility ---> Hold XLU Utilities

Extreme High Volatility ---> Hold Cash

Volatility metrics can remain "sticky" for a while

This style of Volatility Targeting works incredibly well most of the time as the strategy results show. However, it's not perfect and there is a weakness. After major market crashes, those Volatility metrics can remain in very high ranges for several days, and sometimes a week or two after the market has already started to recover.

Essentially it means that the very same Volatility metrics that pushed us into safety in the first place, are the same Volatility metrics that can hold us in safety a little too long afterwards.

After a major crash like we saw recently with Trumps tariff war, it can feel like we're remaining in safety positions too long and missing out on some of the recovery.

Differentiating Volatility going up vs coming back down

One of the keys to my success with our VTS strategies is my ability to exit to safety quickly, before any major damage is done in the market. Drawdown reduction is the single most important aspect of any investing strategy and I have no interest in changing how the strategy operates when Volatility is spiking upwards.

What we're really talking about is whether there's a way to get back into the market sooner when Volatility is on it's way down.

VTS Strategies are Quant based

It's very important that any mechanism added to the strategy remains 100% systematic and rules based. I have no interest in layering on my own personal gut predictions of where I feel the market is going. I have plenty of VTS Options strategies that are largely discretionary and personal decisions come into play. The VTS side of my portfolio must remain as systematic as possible.

Back into QLD sooner when Volatility is declining?

After the market has crashed and the Defensive Rotation Strategy has spent at least 1 day in Cash, what would it look like if instead of moving back into the XLU Utilities positions we skipped that and went straight back into the QLD. This is definitely a quantifiable method of getting into stocks sooner.

Remember, ONLY on the way down. On the way up, XLU as usual. On the way down, QLD instead:

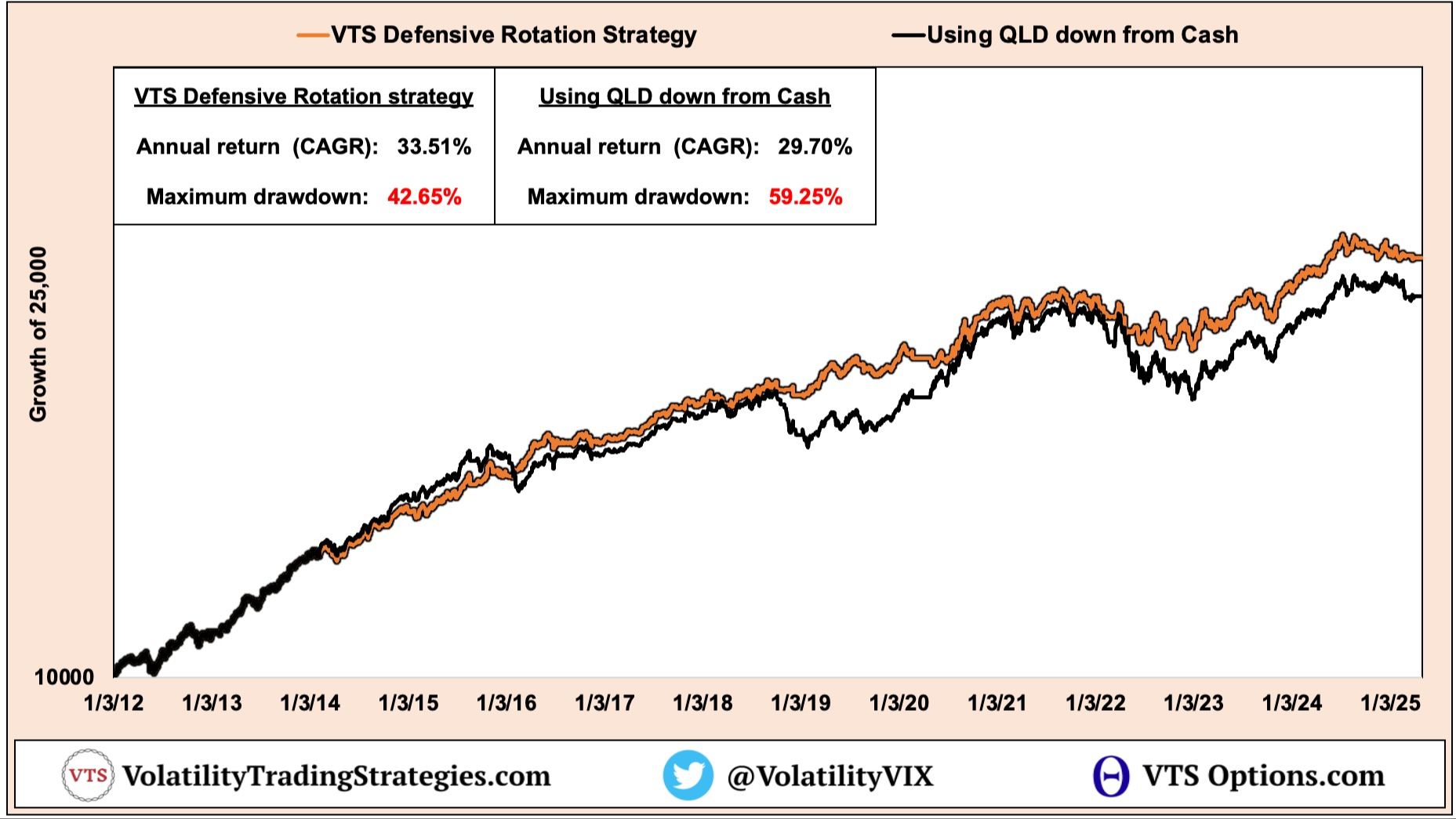

The rate of return itself isn't a huge difference, only down about 3% CAGR, but the real problem is it would definitely introduce larger drawdowns.

Sure there are times when the market just V bottoms and goes straight back up like after the 2020 Pandemic for example. After the bottom it was way better to just get right back into the QLD and we can see that in the chart.

But there's also plenty of times the market itself chops around for a while after the market crash, and perhaps even has a secondary crash like we saw in the 2015 / 2016 China Hard Landing fiasco.

Getting back into QLD quickly walked straight into the 2nd leg down

What about a 50/50 position?

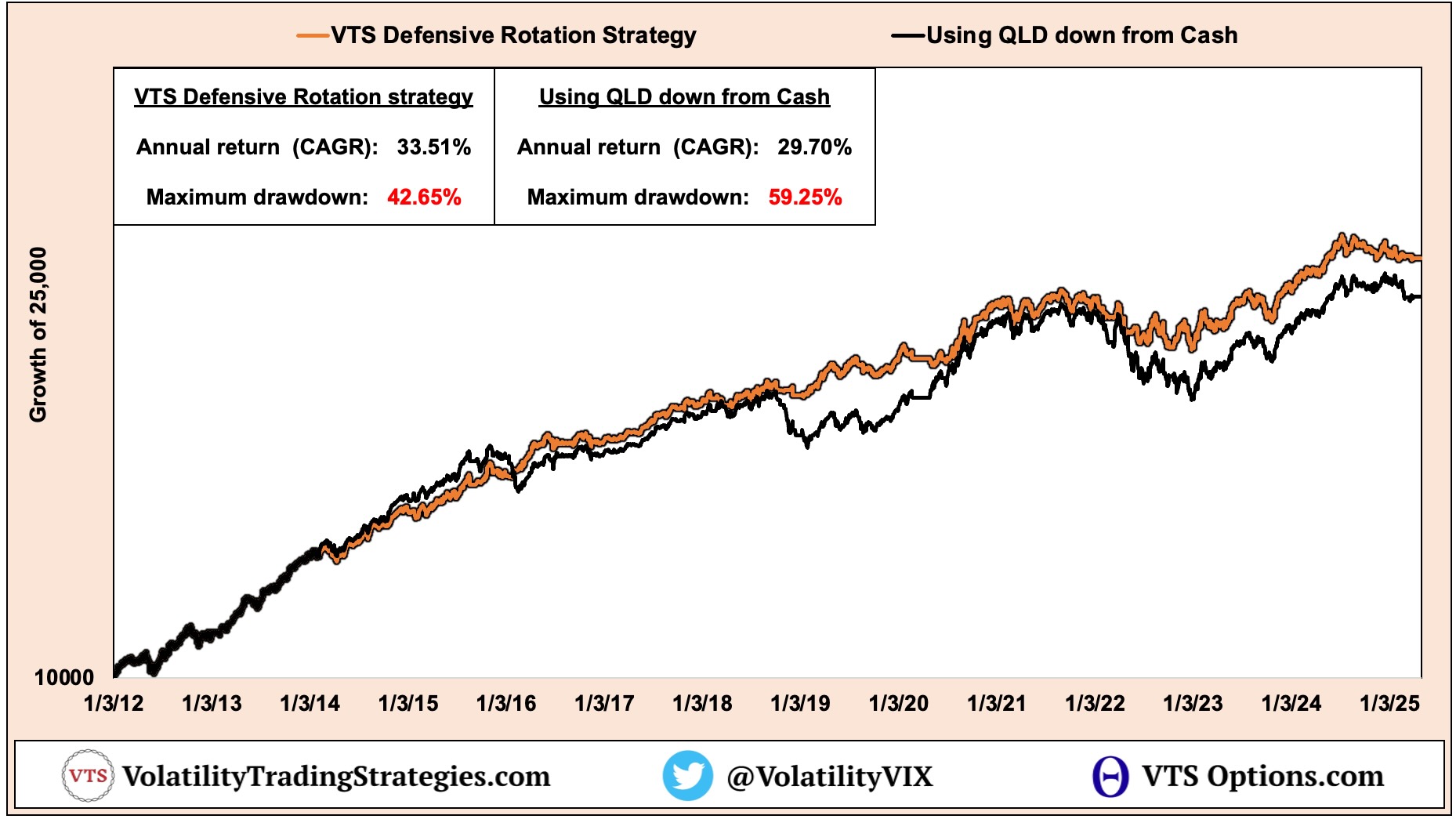

Here's where things do actually get interesting. Instead of going all in QLD after the strategy moves back out of Safety when Volatility is declining, what about a 50% XLU and 50% QLD position?

This might be a good balance where we still get the safety aspect of XLU in case the market has another leg down coming, but we also get exposure to the market in case it is a strong V bottom.

We're not talking about a huge difference here, only 2% CAGR with slightly higher drawdown, but technically speaking there is a little added Alpha there with the 50/50 method.

Recency Bias may be a factor here

If we look closely in that chart we can see there really wasn't any meaningful difference from 2012 all the way to the Pandemic in 2020. Using 100% XLU vs a 50/50 XLU/QLD position when Volatility is declining to get back into the market faster was basically the same thing.

Since 2020 it's pretty clear there has been more of a "Buy the Dip" mentality in the market and it would have been beneficial to find quantifiable ways to get back into the market sooner.

Tariffs are a different animal

The real question we have to try to answer is, are we still in a quick buy the dip market, or has the market dynamics actually changed?

As bad as the Pandemic was, they did throw a vaccine and trillions of dollars of market stimulus at it and it did resolve itself pretty quickly.

Changing the structure of global trade through tariffs on the other hand could actually be a long lasting shift in the economy. Of course anything is possible, but I'm just not sure investors are going to be so quick to pile back into the market this time around.

Sure, the last couple weeks have seen some buying (on historically low volume I might add) but do market participants really have that much conviction that everything is fine?

Any official change to the Defensive Rotation Strategy?

As far as an actionable decision to make that small change to the strategy, to be perfectly honest I'm just not sure yet so we'll hold off. As I said, technically speaking it is slightly better, but that advantage only remains if we also remain in a buy the dip environment.

Does this feel like a buy the dip environment to you?

I'll spend some time over the weekend crunching some more numbers, maybe consulting with a Ouija board, and I'll circle back to this topic soon.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.