Replacing S&P 500 with Berkshire Hathaway

Apr 30, 2025

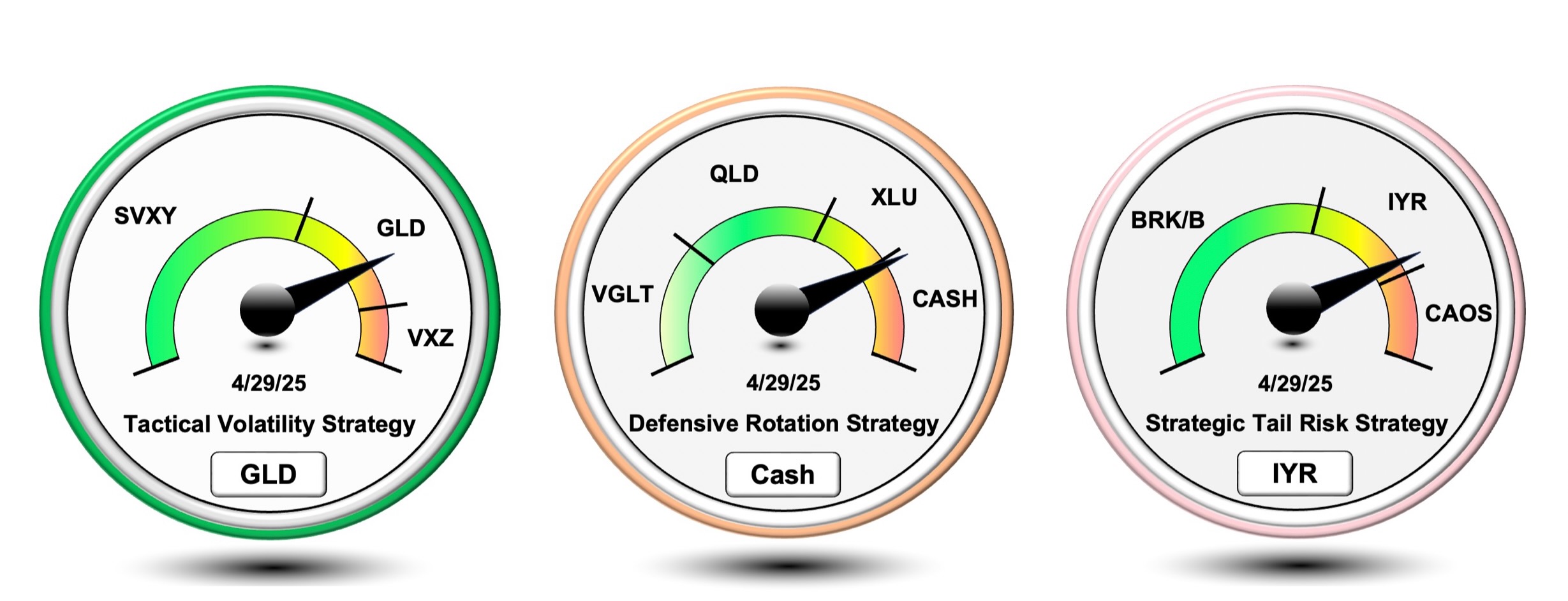

Today I want to introduce the last of the 3 small changes we're making to the VTS Strategic Tail Risk Strategy. So if you missed the articles on the previous two updates they are here:

- Using the CAOS ETF instead of Long Volatility VXZ

- Using KO Coke instead of IYR when Interest Rates are rising

Three strategies for maximum diversification

Our current Total Portfolio Solution has three tactical rotation strategies that apply what I call "3 point diversification" to make sure that our performance over time is as smooth as possible.

- Each strategy uses a different set of Volatility metrics for signals

- Each strategy uses different thresholds when rotating ETFs

- Each strategy uses a different set of asset classes and ETFs

This is why trading all three strategies together has much better risk adjusted performance than just trading any one of them on their own.

Strategic Tail Risk is more variable over time

Now with two of our strategies, Tactical Volatility and Defensive Rotation, the ETFs used are don't change over time. Now it's true that Tactical Volatility went from using XIV before 2018 to now SVXY, but basically the asset classes and ETFs in those two strategies are unchanged.

Our Strategic Tail Risk Strategy is the one that I allow myself to make changes based on an analysis of the current environment.

Replacing S&P 500 SPY with BRK/B Berkshire Hathaway

There's two main reasons why I believe Berkshire Hathaway is currently a better hold than the S&P 500. First, mathematically speaking it does show better backtested performance within the strategy. Second, I believe due to the large cash holding it is in a better position to potentially capitalize on what will likely be a difficult investing environment going forward.

BRK/B vs SPY head to head

All three of our tactical rotation strategies are completely systematic and rules based, which means it's very easy for me to substitute any other ETF in to see how it would have performed. Now obviously that's just backward looking, we have to discuss the most realistic forward path as well later, but let's just look at the raw numbers.

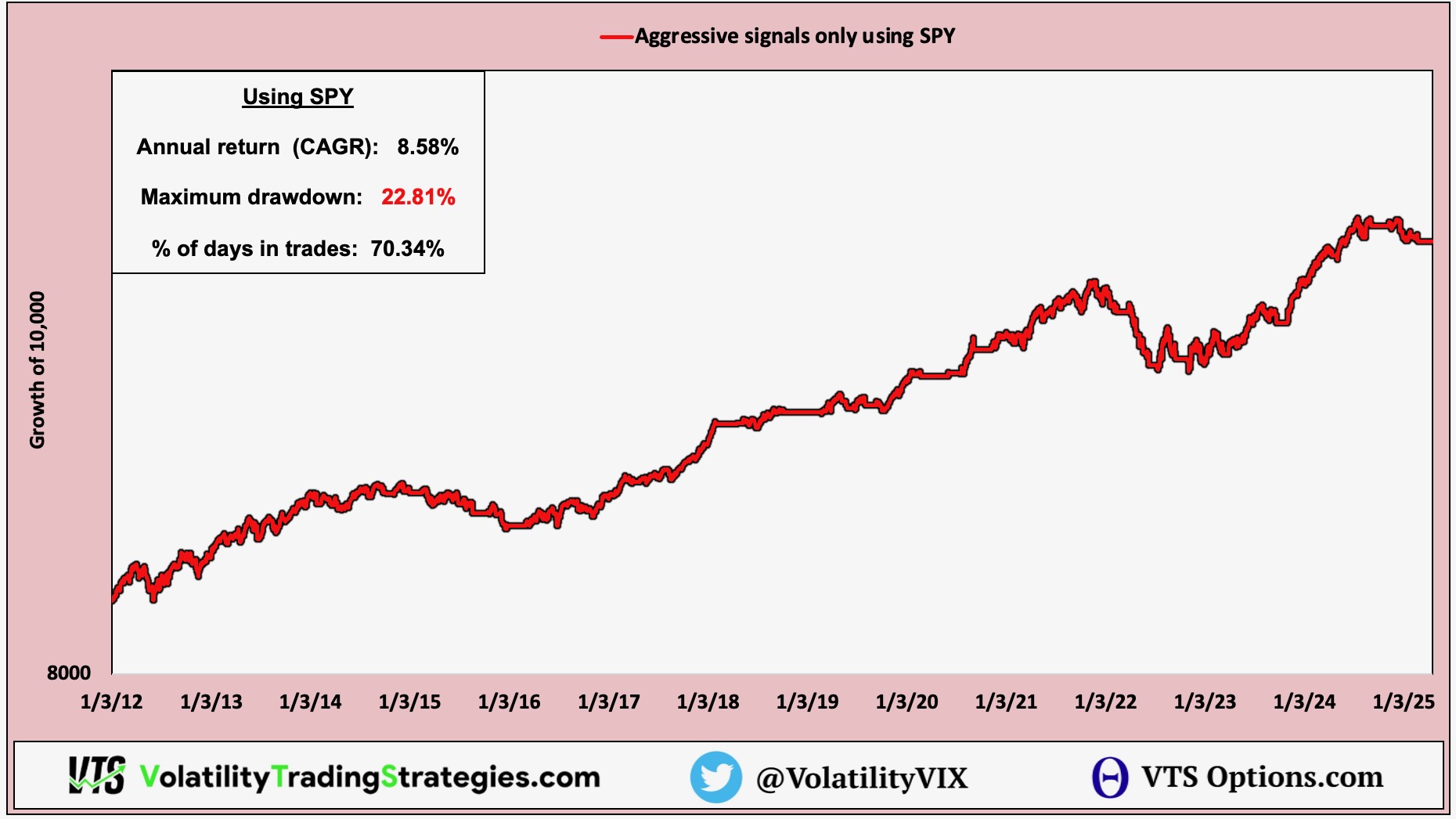

SPY positions only within the Strategic Tail Risk Strategy

* Remember, this is only part of the strategy, only when Volatility is in the mid to low range. The overall strategy is closer to 20% CAGR but this is only the low end SPY positions

So pretty decent numbers there. 8.58% CAGR on just 70% of trading days, with a manageable 23% drawdown. When we add in the IYR Real Estate and Tail Risk CAOS positions the overall strategy is far superior to the underlying S&P 500. I'll get to that in the next article.

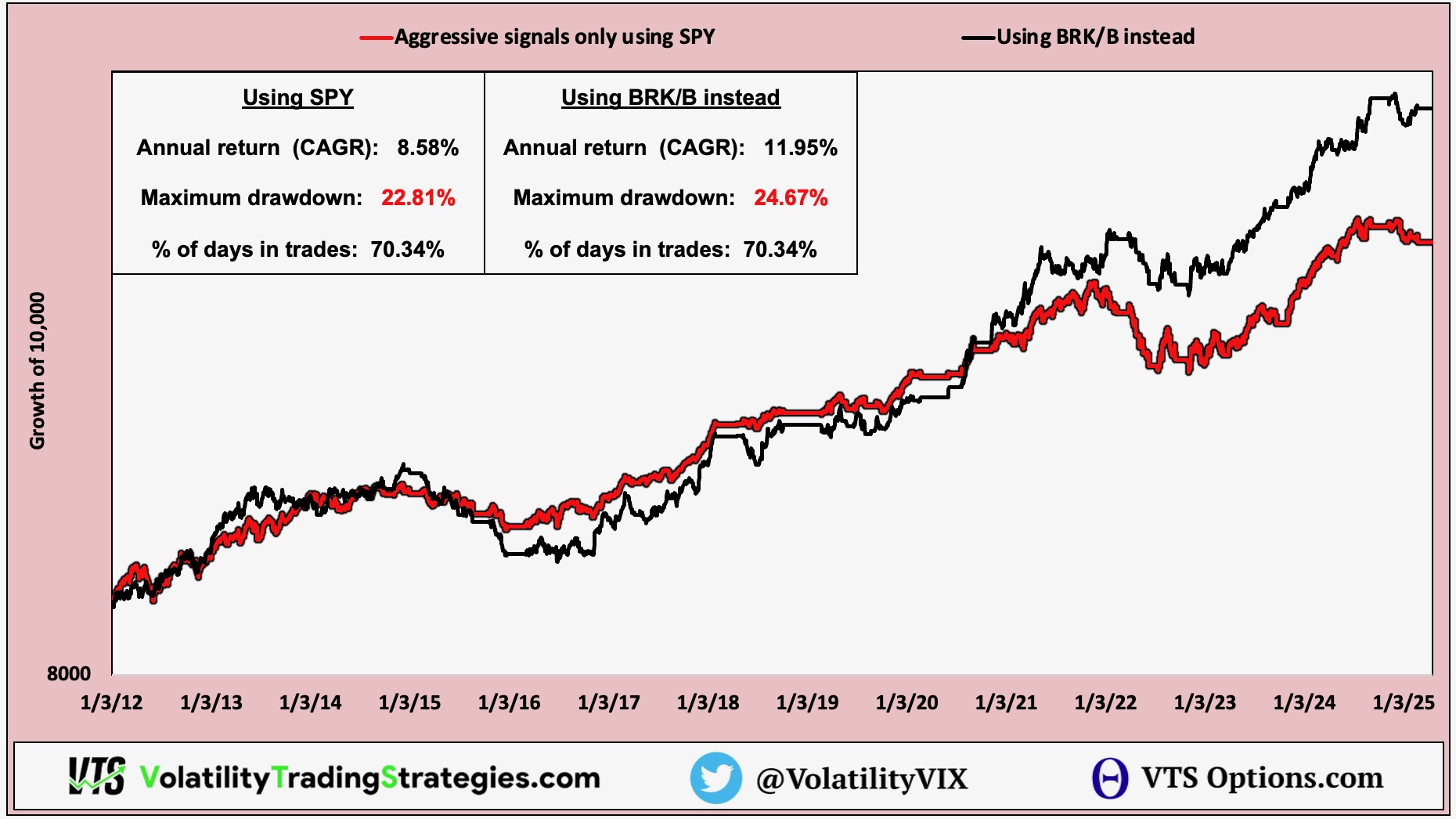

Now let's check out how Berkshire Hathaway does:

* I'm using BRK/B given the price is low and investable for people even on smaller account sizes. BRK/A is over 800,000 per share, obviously that's a non-starter but BRK/B is about the same price as SPY.

Head to head, Berkshire Hathaway is actually over 3% higher return and it doesn't really add much of anything to the risk.

Now up until 2022 the performance was about the same give or take. Since then however, Warren Buffett and the team over there have done a better job at reducing drawdowns and as a result the performance has significantly decoupled from the S&P 500.

Why will BRK/B outperform SPY going forward?

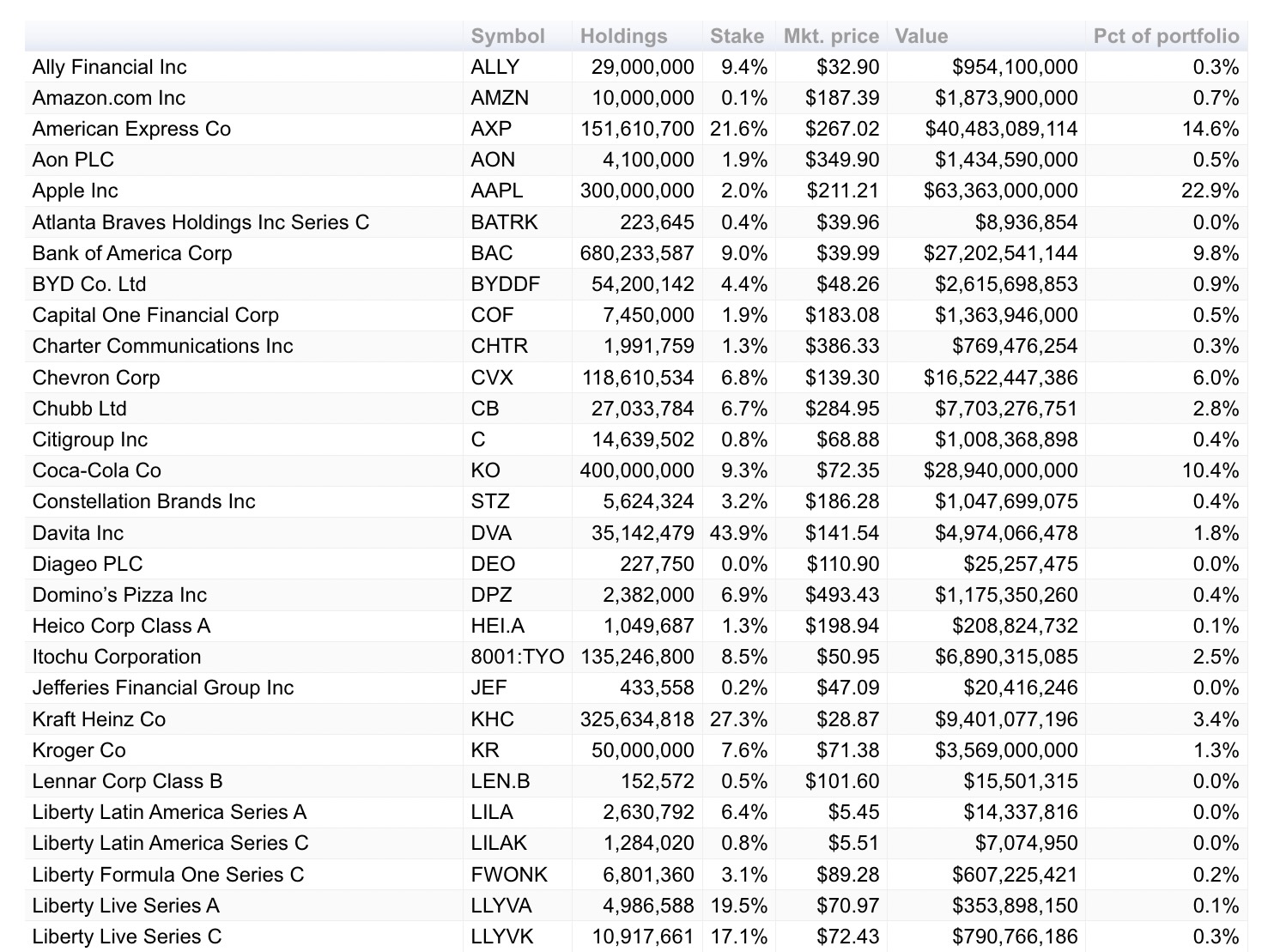

It's not actually the underlying holdings of Berkshire itself that is attractive to me. Now I will say I do like some of the companies they have chosen to overweight which is important. I wouldn't buy it if I didn't think they were good stock pickers. Here's the full list if you want it.

Berkshire is cash rich!

In my mind the real reason BRK/B is attractive right now compared to the S&P 500 is that they have managed that outperformance over the last 5 years while building a staggeringly large 335 Billion cash pile.

If I am correct in my analysis that this tariff shake up is almost certainly going to push the US into recession, and perhaps the rest of the world with it, it's actually a huge advantage to be sitting on such a large stockpile of cash. Not only is their risk exposure naturally lower but they will also be in an excellent position to capitalize on any good bargains, or just adding to their strong positions over time.

VTS Strategic Tail Risk Strategy

I have made the change to the trade dial so for the time being our official position will be BRK/B instead of our old position of SPY.

* I will of course be making a new strategy video because we've made a few small changes recently and I want the explanation video to reflect those, expect that soon.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.