Does the Volatility ETF "SVOL" have any purpose?

Jun 16, 2025

Does SVOL have any useful purpose?

The relatively new Volatility ETF called SVOL actually gets a lot of attention and I certainly get a bunch of email questions about it. It has nearly a billion in assets so it's significantly larger in AUM than even the much longer standing SVXY, VXX, UVXY, etc. You could make a case that SVOL is the most successful Volatility ETF on the market right now, which is odd to me because I consider it a non-starter as far as using it for any purpose at all as I will explain.

1) SVOL isn't useful for Tactical investors

Given that it's roughly 0.25x leverage factor to the VIX futures it tracks, it's too watered down for our purposes as tactical investors and it is significantly worse than the SVXY we use within our Tactical Volatility Strategy.

I've shown many times that the -1x SVIX is a little too leveraged and leads to unsustainable drawdowns for most investors risk tolerance. However, SVOL at just -0.25x just doesn't go up enough during long stable trends in the market. SVXY at -0.5x balances this risk reward ratio the best which is why it's our top choice.

2) SVOL also usn't useful for buy & hold investors

This is where things get a little dicey and people are certainly going to push back against this. "Dividend investors" are a strange bunch to me and they certainly don't like when you poke holes in their investing thesis of chasing yield over performance.

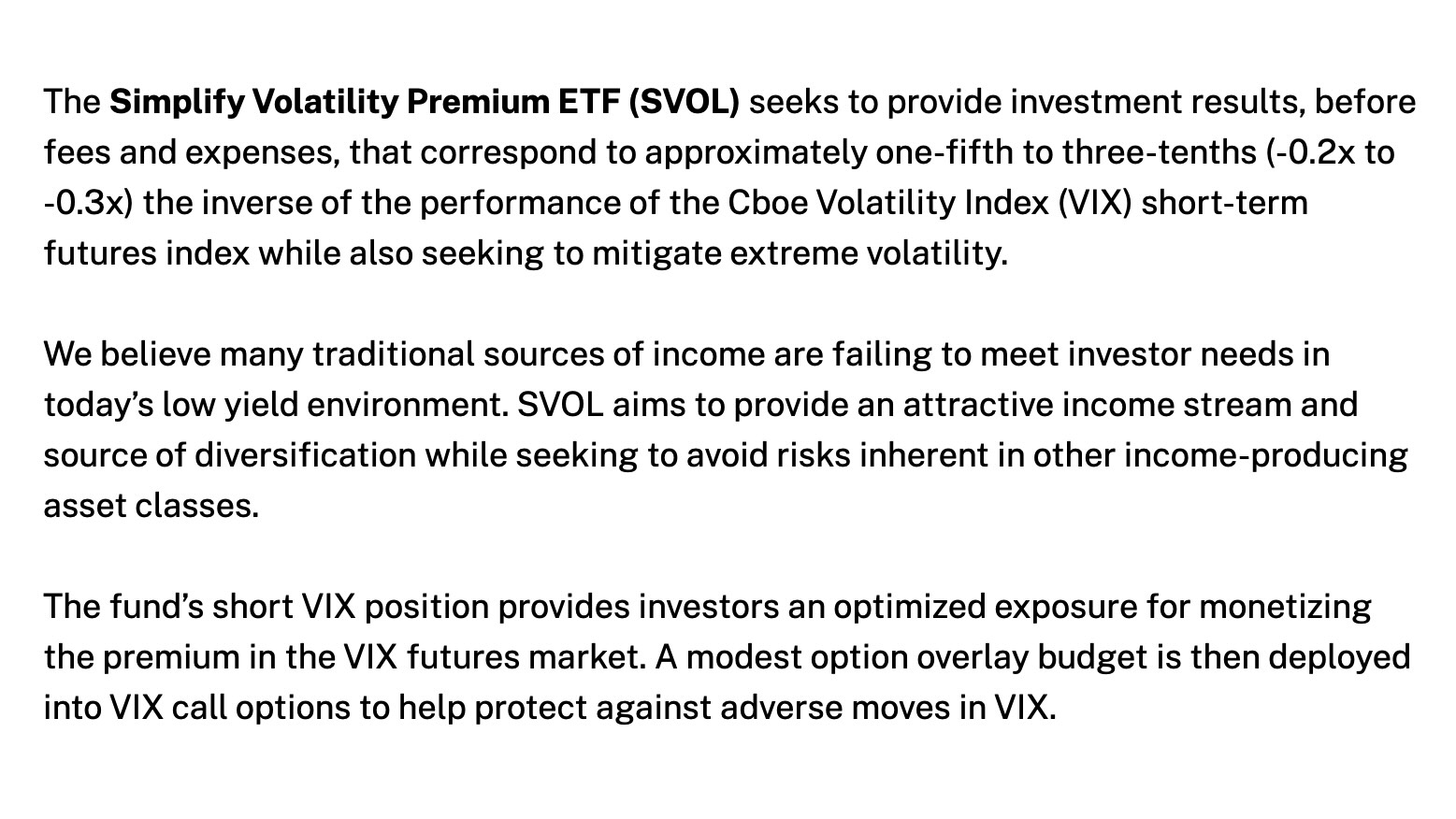

The folks managing SVOL are actually pretty smart and the marketing material on SVOL really hits the nail on the head for what many investors are looking for:

- A Short Volatility Fund designed to perform well during stable markets

- A very high ~20% dividend to attract a certain type of investor who doesn't really understand where dividends come from. Spoiler alert, directly out of your own asset base

- A hedging component which is the main reason why so many investors are hesitant to short Volatility in the first place.

SVOL seems to be the perfect fund right?

Those 3 points, Short Volatility returns, a massive dividend, and a hedging component to keep people safe, it's no wonder it has amassed over 900 million in AUM.

Dividends come directly out of the stock price

One of the most disappointing realizations that dividend investors make in their journey is the day they realize that dividends come directly out of the stock price, and you aren't actually making anything when you get "paid" a dividend.

All that happens is the dividend gets paid out and you have more cash in your account, and the stock price gets reduced by the dividend amount and you have that much less equity value in the stock.

If you have 100,000 in equity value and you get paid a 5,000 dividend, your cash value goes up by 5,000 and your equity value drops to 95,000. You still have the same 100,000 the day after the dividend is paid. It's truly staggering how many investors don't know this, but it is true none the less

It's a net zero transaction and no money is made

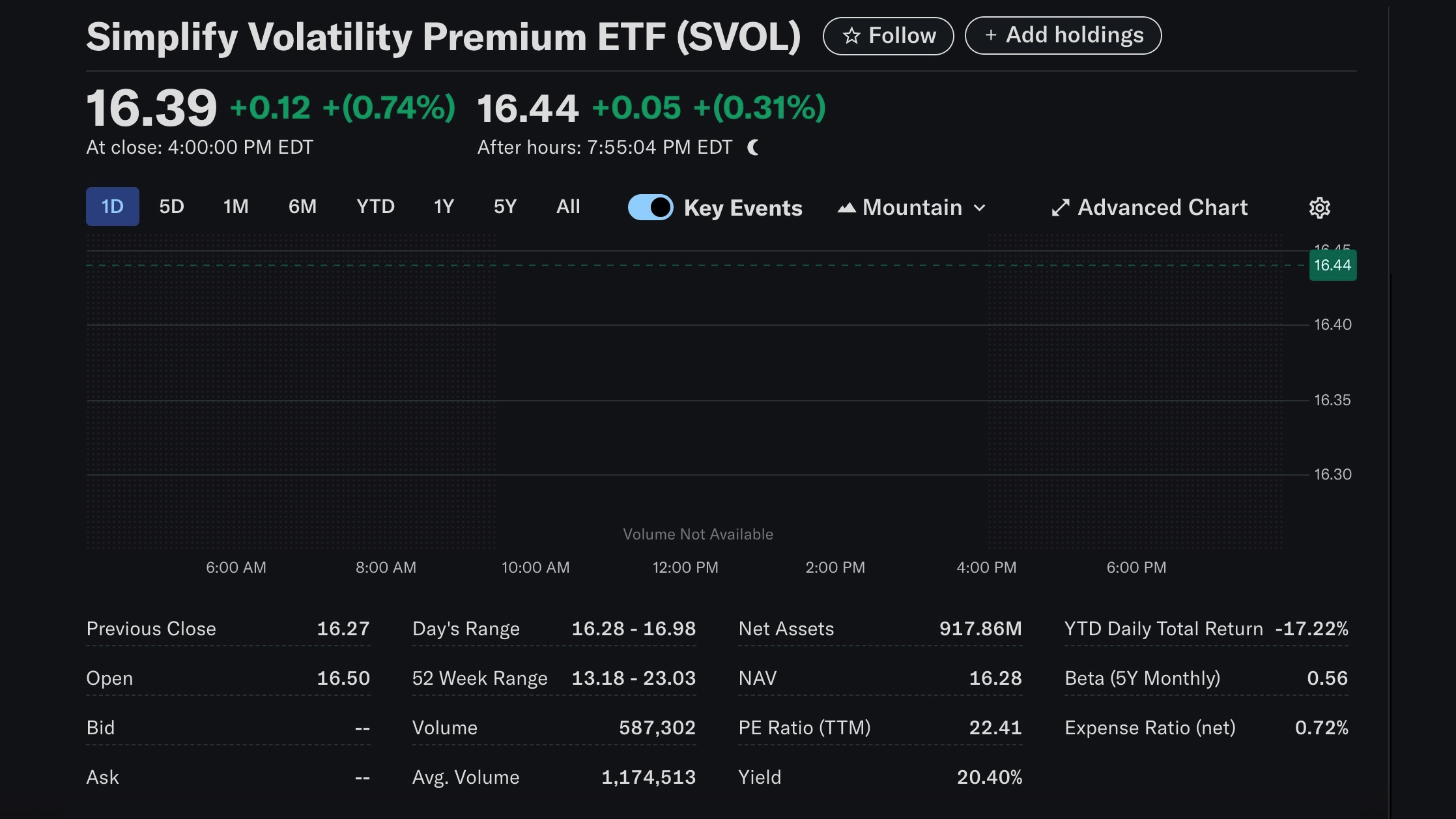

This is why when you look at something like SVOL that pays a hefty dividend on a long-term chart, it appears to be going down substantially.

SVOL since inception:

Actual performance is all that matters

Given that dividends are a net zero transaction with no actual money being made, it really just comes down to the long-term performance when including those dividends right?

So all we have to do is plot SVOL including dividends vs S&P 500 including dividends, to see if it's suitable for buy & hold investors

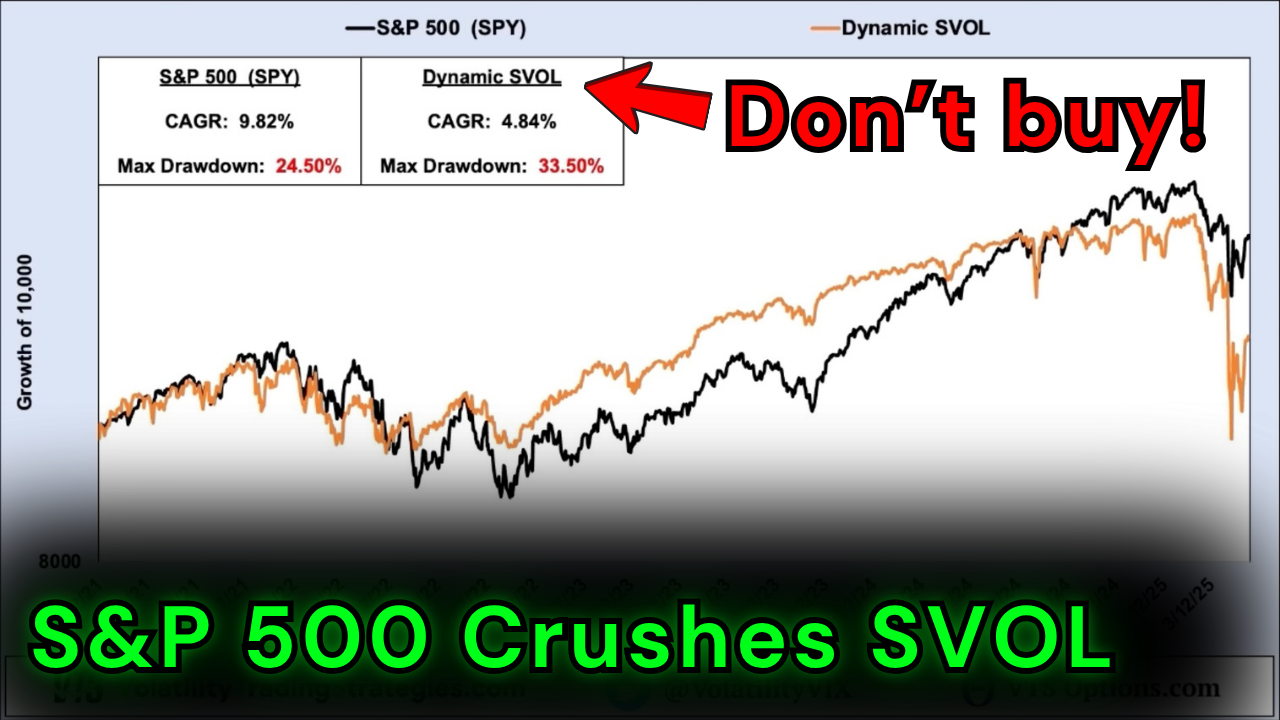

I hate to burst the bubble of the (900 million AUM) people who hold SVOL, but it's quite obviously worse on both absolute performance, and risk adjusted performance.

- The rate of return CAGR is about half the S&P 500

- The drawdown is significantly higher as well

I'm all ears. Can anyone make a legitimate case for why anyone would hold SVOL over a simple buy & hold S&P 500?

Video: SVOL is overrated: S&P 500 crushes it

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.