There is a HUGE difference between 5%, 10%, and 15% CAGR

Jun 03, 2025

VTS Community,

Fake "Trading Guru's" are killing your retirement

In this brave new world of mass social media, there's millions of people vying for attention by posting trading results, talking about their strategies, and trying to spin it as best they can (most of the time by flat out lying) in hopes of monetizing a following. Now you might be thinking, pot calling the kettle black right? Yes I also want to get my work out there but give me some leeway here to make a point :)

The problem is social media moves very quickly and things get normalized with each passing year. The claims of outlandish performance have to get crazier and crazier just to get any eyeballs.

It gets to the point where the average investor who is just trying to grow their capital and reach a comfortable retirement doesn't even know what a realistic rate of return is anymore. They're going to get brainwashed into thinking they also need to make 40% a year just to avoid poverty.

You do know they're lying right?

Now hopefully I've done enough education over the years to convince people that when you hear those crazy claims of insane performance, they are lying. There's never any performance shown, it's just tweets and videos making claims.

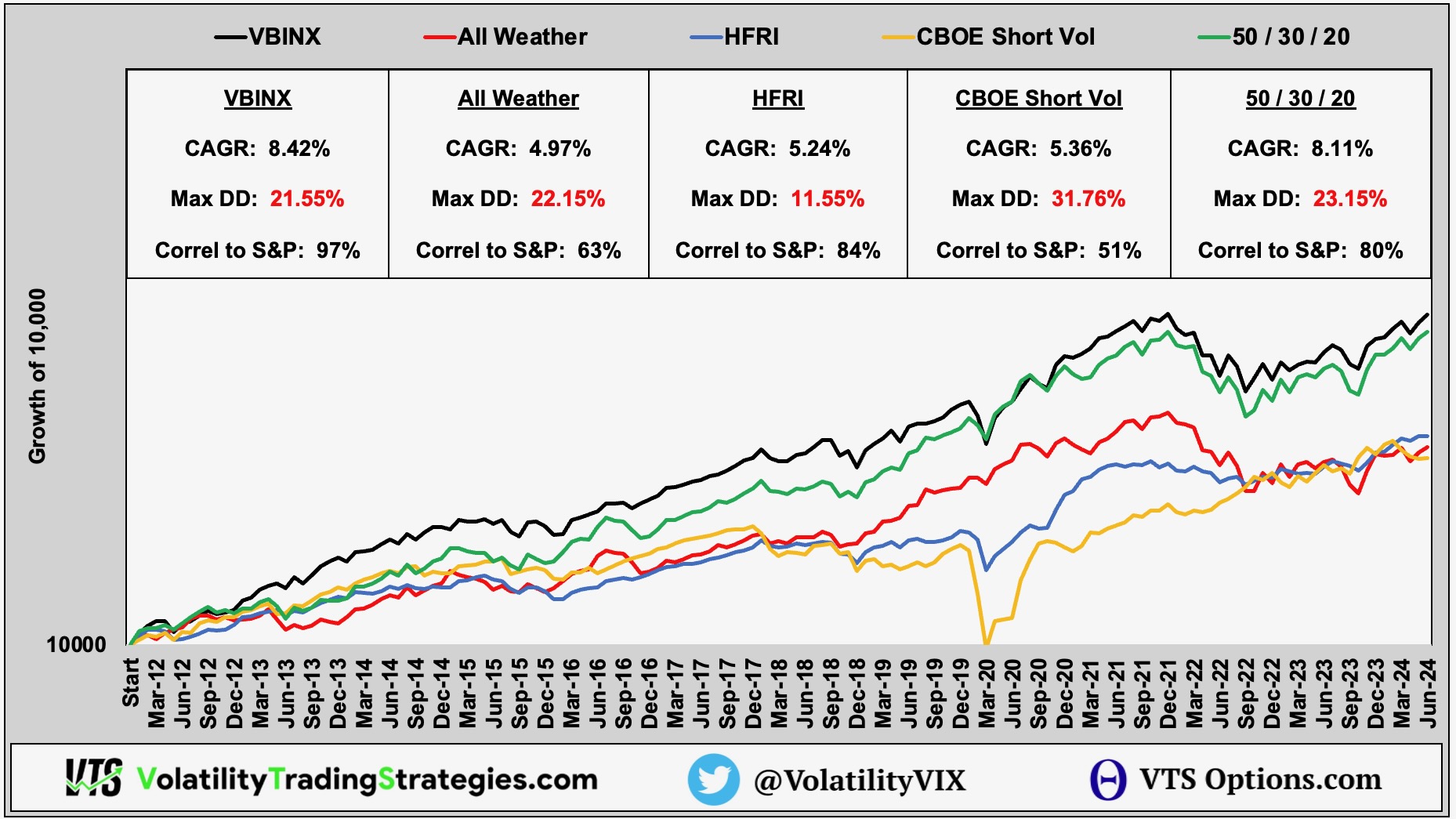

It's no coincidence that for the relatively small percentage of asset managers that are either regulated to show performance, or there are easy ways to track performance, that the average is mid single digits at best. Remember, even for the Hedge Fund managers who are some of the best and brightest on Wall Street have a hard time even getting 7%.

- The "All Weather Portfolio" made famous by Ray Dalio, an investor apparently so good he's a mega billionaire, has a hard time cracking 5% a year.

- The HFRI Hedge Fund Index, again some of the smartest investors with degrees from all the best schools making just over 5% a year.

- The CBOE EurekaHedge Short Volatility Index, managers playing near my wheel house underperforming a basic 60/40.

You get the point. There aren't that many in the investment world who do show performance, and for the small percentage that do, it sure as hell isn't 40% a year is it?

On Twitter and YouTube, everyone is a genius investor because they can say anything they want, knowing they never have to actually show results. The only way you'll know they are lying (which they are) is if you pay them money and realize first hand they are lying.

Unfortunately, by then they've already got your money

Investing is all about balancing Risk / Reward

Once you understand there is a risk reward ratio that you can bend but never break, you will realize that the higher rate of return you chase the less likely it is that you'll hit it. Trying to make 40% a year will almost certainly lead to you actually losing money long-term when the market humbles that risk taking attitude.

5% vs 10% vs 15%

Hopefully when you see the actual numbers you'll realize that retiring a multi-millionaire is within your grasp, if you're patient and control your risk.

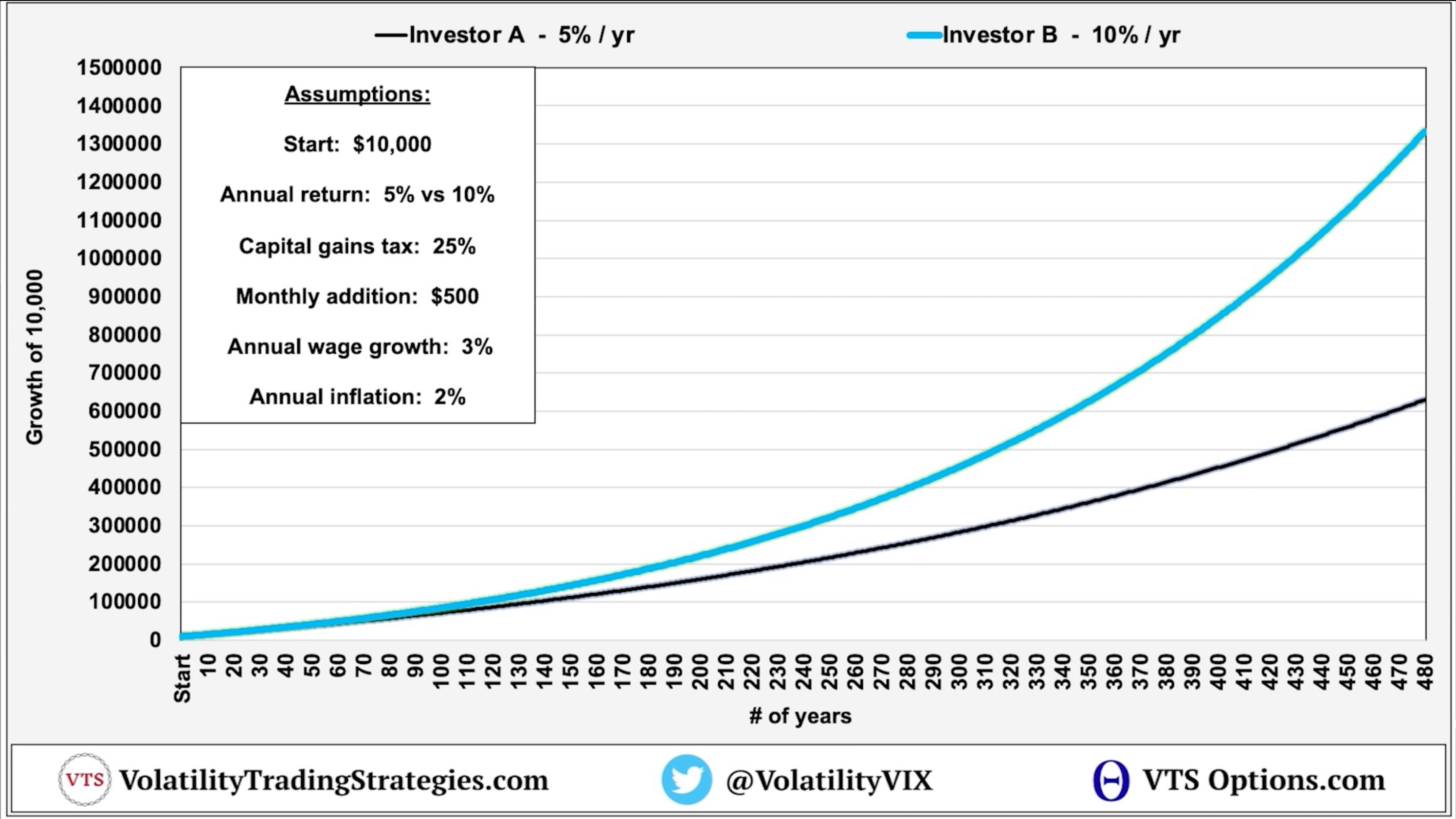

- Let's start with two investors with $10,000, each adding $500 a month, and the only difference being one of them makes a 5% annual return and the other makes a 10% annual return

Investor A with the 5% rate of return will have over $500,000 in retirement. It might surprise you to hear that the average American has roughly $250,000 in retirement so this long-term investor making 5% a year is already well ahead of the curve. It sounds unbelievable but statistics show the "average investor" only makes about 2-3% a year long-term.

Investor B though with a 10% rate of return has almost 1.4 million dollars. That is a shockingly large difference for what seems like such a small improvement in rate of return right?.

An extra 5% a year can get them almost a million more? Yes!

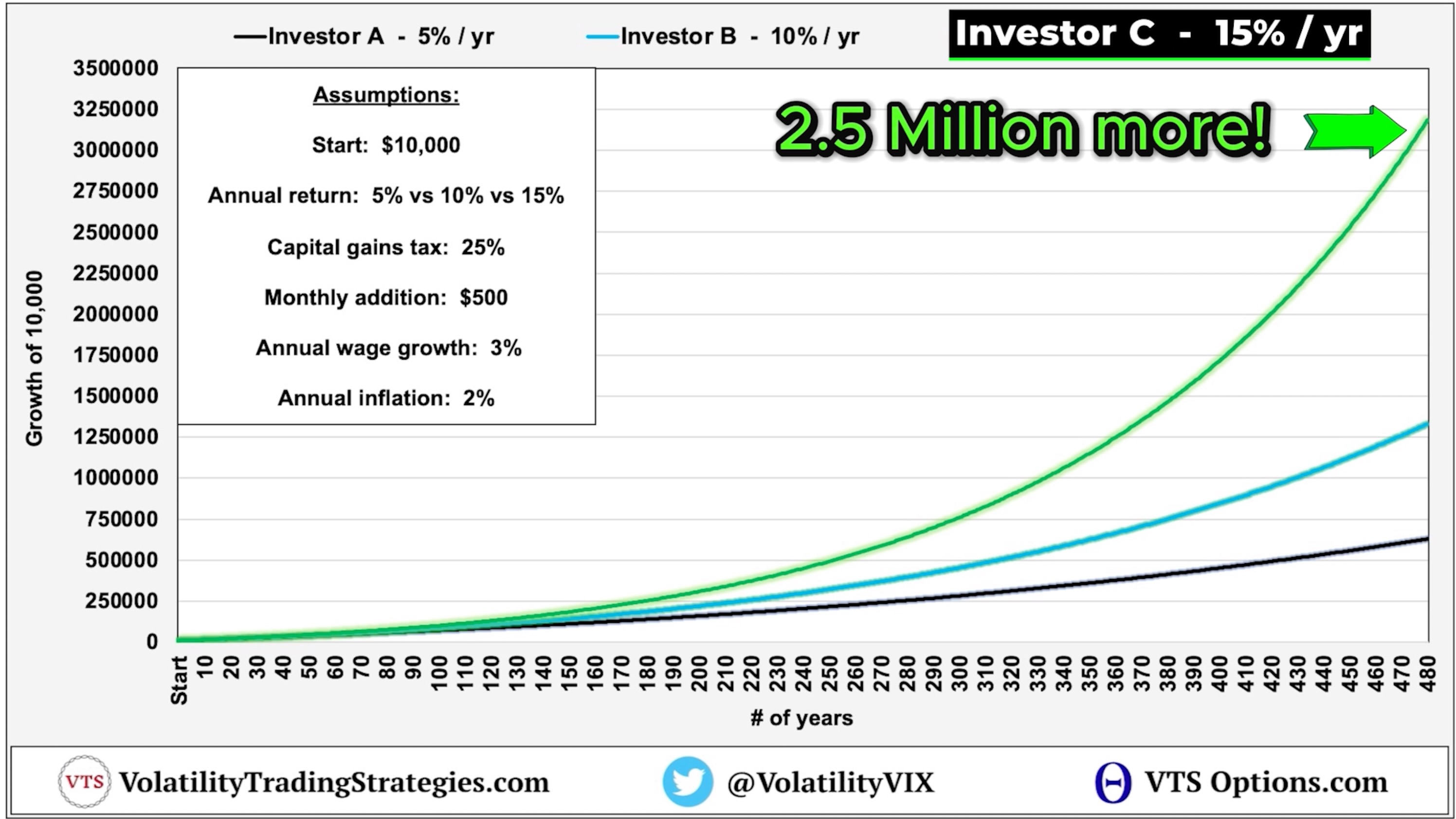

- What about investor C, same $10,000, same $500 a month, but now they make a 15% a year rate of return

Investor C making 15% a year and adding a measly $500 a month can retire a multi-millionaire with over 3 million dollars.

15% a year forever is all you need

One of the best things you can do for yourself as an investor is to maintain realistic expectations and make sure you're investing style matches what you can actually achieve. Don't get derailed by shiny objects on Twitter.

Some years you can make 20% or more. Other years you'll break even. Some years you will even have negative results. Long term though, if you keep those realistic expectations, you will retire wealthy!

15% a year as a long-term average is fantastic!

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.