Options Trade #23 - SPX Broken Wing Iron Condor

Oct 29, 2018VTS Community,

Hopefully everybody had a great weekend. I suspect for a lot of traders out there outside our community, it was a nail-biter because of how we ended last Friday. An ugly down day, VIX futures term structure strongly in backwardation, and some headline news risk as well. I certainly wasn't predicting a "Black Monday" type crash, but the conditions for one were present so it wouldn't have been very much fun riding sensitive positions over the weekend. I slept like a baby being in our safety positions, but let's see if we can get into a few new trades this week. Options trades are easier because there's always a trade for any market environment, but for our ETF strategies, we may have to hold off until volatility settles down.

Broken wing Iron Condor Conditions are ideal right now for an Iron Condor. High volatility and a market that has been fairly rangebound with moves in both directions, it's the right trade right now. However, today I'd like to do a little variation on the standard trade by introducing what's called a broken wing. It's a very good middle ground between an entirely neutral trade, and an entirely directional one. The volatility metrics I track indicate the selling pressure in the broad markets may be subsiding. But at the same time, with such a violent crash recently, I don't want to be completely directional either selling something like a bull put spread.

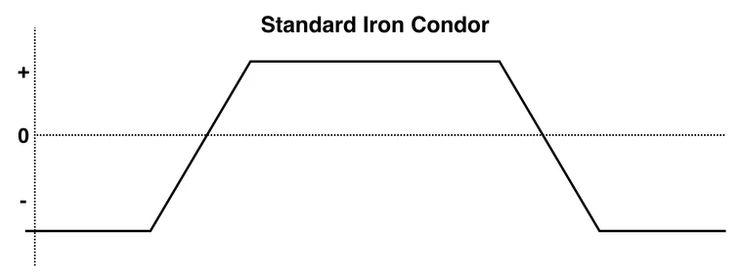

The typical Iron Condor has long strikes an equal distance away from the short strikes making it symmetric, equal on both sides. It's the classic market neutral trade and looks like this:

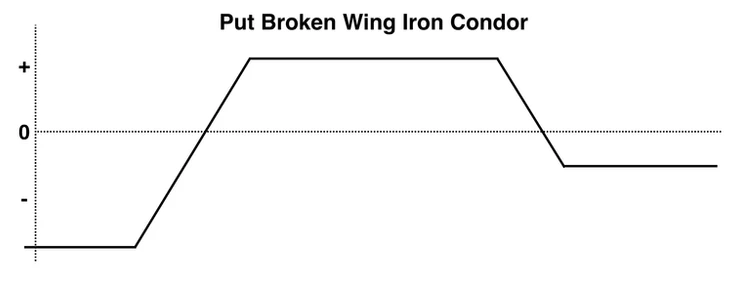

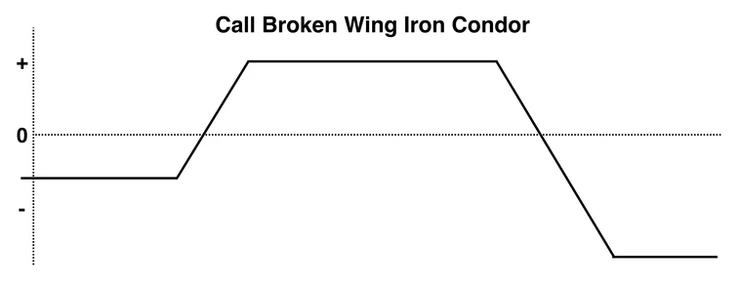

The broken wing Iron Condor is very similar, except we extend one of the long strikes an additional strike away, making the trade non-symmetrical. Now we can do this on either side depending on our bias.

You can see the first chart, the Put broken wing Iron Condor has a positive bias, meaning that trade is ideal when we fear the risk is to the upside. It transfers some of the upside risk and shifts it to the downside. Right now, my volatility metrics indicate a higher probability the S&P goes back up, so that's the side we want to protect against.

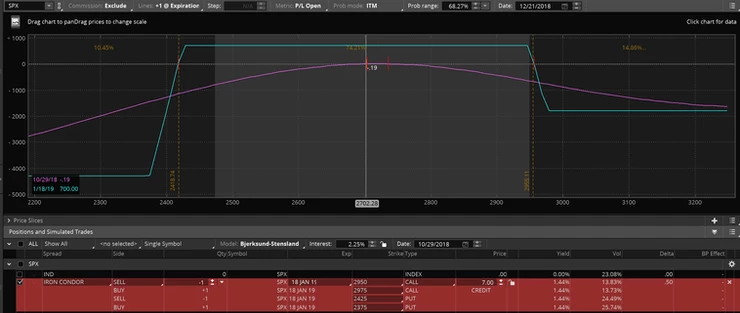

The Trade: Put Broken Wing Iron Condor on SPX

- Buy to Open 1 x 18 Jan 19' SPX 2375 Put

- Sell to Open 1 x 18 Jan 19' SPX 2425 Put

- Sell to Open 1 x 18 Jan 19' SPX 2950 Call

- Buy to Open 1 x 18 Jan 19' SPX 2975 Call

- Credit: ~ 6.90 Days to expiry: 80

* prices move around, so just get the highest premium you can. I've seen it as high as 7.15 this morning so higher the better.

Margin Requirement: 1 option contract = 100 shares The margin requirement is the strike gap minus the premium For broken wing condors we use the wider side (50.00 - 6.90) * 100 = 4,310 per contract. For directional trades, I like to keep the allocation smaller.

The VTS Discretionary Options model portfolio is at 26,061.38 4,310 margin is 16.54% of the portfolio

* You can scale your trade to roughly 15-20% of your VTS Discretionary Options funds

Stop-loss: I don't use hard stop-losses for Iron Condors. Instead, I have developed a proprietary method of measuring the risk-reward profile day to day and determining if it's still advantageous to remain in the trade or close it.

However as a rough estimate, we typically stop-loss out of trades at 1.3 - 1.6 x the premium collected.

So if the 6.90 premium we collect for the trade rises to about 10.35, that would be a ballpark range we will consider closing it for a loss.

Today's SPX Iron Condor

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.