Options Trade #11 - SPX Bear Call Spread

Jun 09, 2018VTS Community,

New VTS Discretionary trade today. Non participants of this strategy, have a great weekend!

On April 9th, 2018 I introduced one of the more common option spreads called a Bull Put Spread. Since then we’ve opened three of them and been quite successful so far. Remember Bull Put Spreads are a bullish trade that I like to put on whenever the market is testing a low point and support level. This year that support line has been the 200 day moving average. Just to jog your memory if you’ve forgotten, here are the three spots we opened Bull Put Spreads this year as the S&P was dancing on that 200-day (green line)

We set them up just as the markets are testing the low and hopefully the support line isn’t breached. However Bull Put Spreads are only half of the equation. We can also throw on similar trades called Bear Call Spreads when markets are testing a recent high and resistance level, and we’re at one right now.

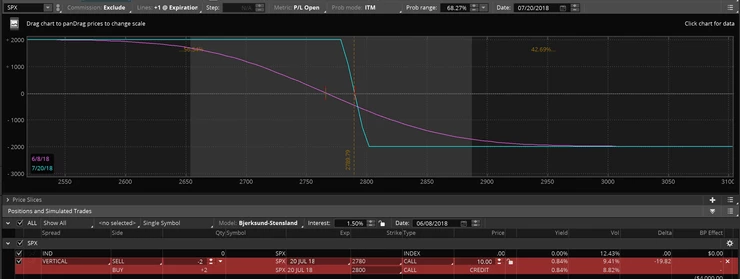

So Bear Call Spread it is. Note* ThinkorSwim calls it a "vertical" but it's the same thing, just semantics. Here’s what that looks like:

The Trade: SELL to OPEN 2 x 20 July 18' SPX 2780 CALL BUY to OPEN 2 x 20 July 18' SPX 2800 CALL Credit: ~ 10.00 * prices may change throughout the day so get the highest you can

Margin requirement: - 1 option contract = 100 shares - Max loss per contract is 10.00 (20.00 strike gap - 10.00 credit) - 100 * 10.00 = 1,000 margin per contract - VTS Model Portfolio is opening 2 contracts for a 2,000 margin - This is roughly 8% of the VTS Discretionary portfolio

* scale according to your allocation size and risk tolerance

** If you're new to options consider starting with a paper account

Stop-loss: - I don't use hard stop-losses on these types of trades. - Our stop-loss is a close above the resistance line of 2780

Allowing some room, a close above 2790 is our Stop-loss

In this case we’re hoping that since the S&P 500 has had a nice run up of late it’s about to take a small break. We don’t need a crash, we’re just fishing to see if 2780 will prove to be a resistance line. If it is the trade will make money. If it’s not and we see a close above 2790 we'll get out and move on to something else.

My investing style has always been focused on diversification and risk management so I trade each of our strategies independently of one another. That means I never take trades in one just because we have something open in another. However having said that, since we are long MDY and both Volatility strategies are also in the market, this Bear Call Spread is quite timely to just balance things out a little bit. If it succeeds it’ll offset some of the losses from the other trades. If it fails, it means the other trades are probably going to do well. Again this isn’t the plan but it’s a nice bonus…

Lastly, based on the answers from the last VTS Questionnaire here, I know about half of you prefer written articles and the other half prefer videos. My office here in Vancouver is very nearly ready so I will definitely get back into making videos for some of these important articles as well. I use Bear Call Spreads and Bull Put Spreads regularly so stay tuned for those in the coming weeks…

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.