Matching ETFs to Tactical Strategies using Beta Factor

May 16, 2025

VTS Community,

How we match safety positions to strategy

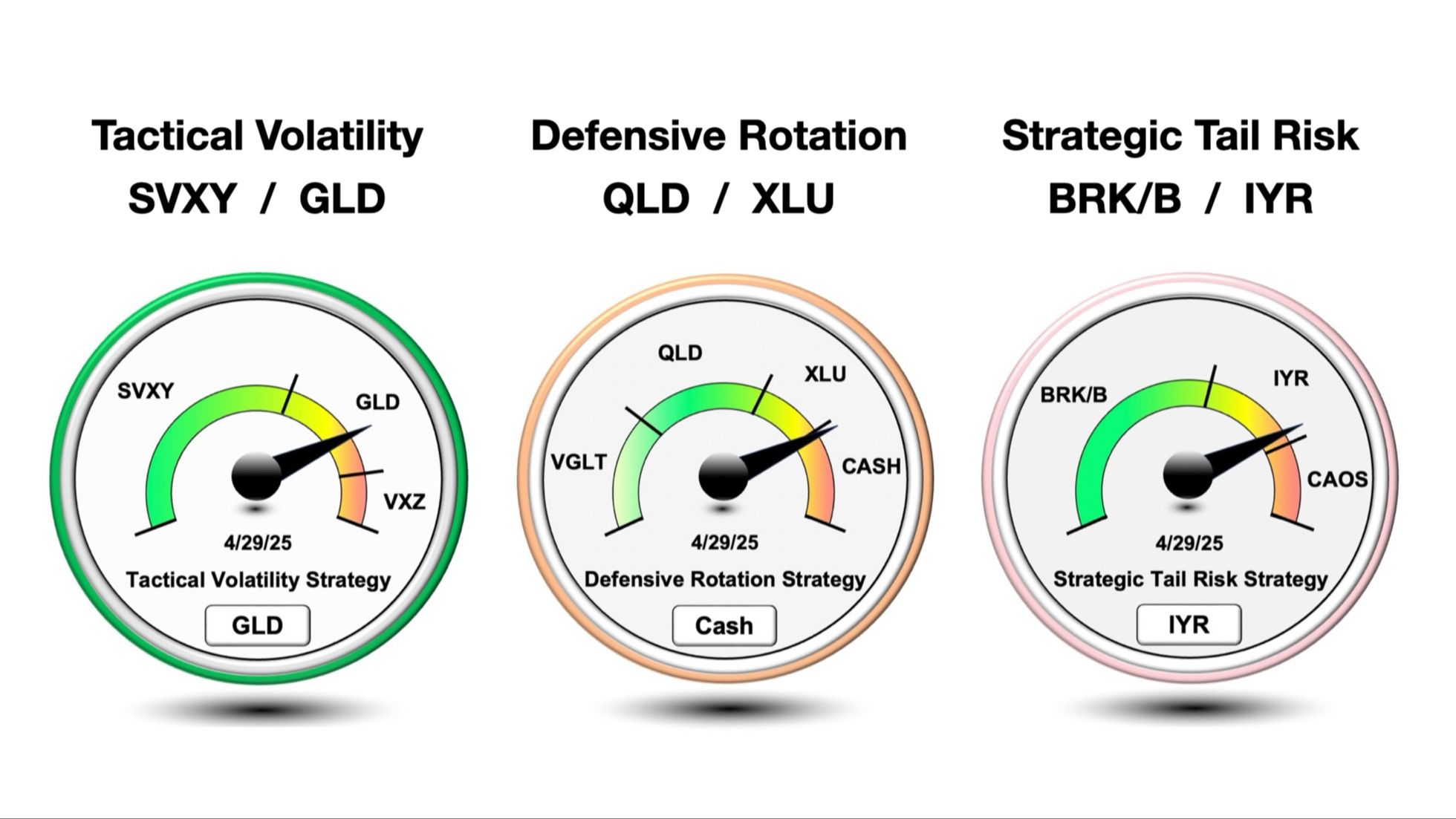

Within our three tactical rotation strategies, they all have a designated "safety" position that we move into when the market is too risky to be in the aggressive positions.

- Tactical Volatility Strategy uses GLD Gold

- Defensive Rotation Strategy uses XLU Utilities

- Strategic Tail Risk Strategy uses IYR Real Estate in flat or declining interest rate environments, and KO Cola-Cola in rising interest rate environments

Now the truth is, I could switch the strategies that those safety positions are assigned to. I could move GLD into Defensive Rotation, or XLU into Tactical Volatility, and IYR could also fit in to either of the other two. Now the results are more optimized the way it is now so this is the best set up, but it's not only performance that is the determining factor.

Beta matters

One thing I thought you may find interesting is that Beta factor plays an important role here as well. Just to define it:

Beta measures how much one security moves in relation to another security, and reflects both magnitude and direction

- Beta = 0 means there is no correlation

- Beta > 0 means there is a positive correlation

- Beta < 0 means there is a negative correlation

I like to match the lowest Beta safety positions to what I deem the most risky aggressive asset. You'll know what I mean when I list the Beta factors of our 3 safety positions:

GLD has a Beta to S&P 500 of 0.04

XLU has a Beta to S&P 500 of 0.61

IYR has a Beta to S&P 500 of 0.85

Which aggressive positions are the most risky?

Risk can be measured in many different ways and actually there's many factors that contribute. In general though if I were to just make blanket declarations:

- Tactical Volatility Strategy uses the Short Volatility SVXY as its aggressive position and I think that's the most risky

- Defensive Rotation Strategy uses 2x Nasdaq QLD as its aggressive position and I would say that's the 2nd most risky

- Strategic Tail Risk Strategy uses BerkShire Hathaway BRK/B as its aggressive position and I would say that's the least risky

The lowest correlation safety position should be paired with the highest risk aggressive position:

- GLD Gold is paired with SVXY in Tactical Volatility

The medium correlation safety position should be paired with the medium risk aggressive position:

- XLU Utilities paired with QLD in Defensive Rotation

The highest correlation safety position should be paired with the lowest risk aggressive position:

- IYR Real Estate paired with BRK/B in Strategic Tail Risk

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.