Options Trading 101: Part 1 - What is an Iron Condor?

Feb 04, 2017I’ve always felt the name “Iron Condor” is the coolest sounding option spread there is. In fact one of my first websites I managed many years ago was called TheIronCondor .com. Beyond just sounding cool though, Iron Condors are also one of my personal favorite option trading strategies. So let me start this series off at the very beginning with: What is an Iron Condor?

An Iron Condor is a limited risk, non-directional option spread designed to have a high probability of earning a limited profit

If that sounds vague don’t worry, Iron Condors are actually quite basic when you get past all the lingo and they are an excellent option trading strategy for those new to option trading.

* It’s important to understand that option contracts can be either sold or bought and Iron Condors are the same. For our VTS Iron Condor Strategy though we only sell short Iron Condors as those match the diversification we are looking for within our portfolio. The vast majority of the time you hear Iron Condors being discussed either here or on other websites, it’s the sold short type.

Short Iron Condors:

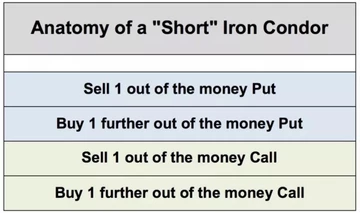

Here’s how the basic Short Iron Condor is constructed:

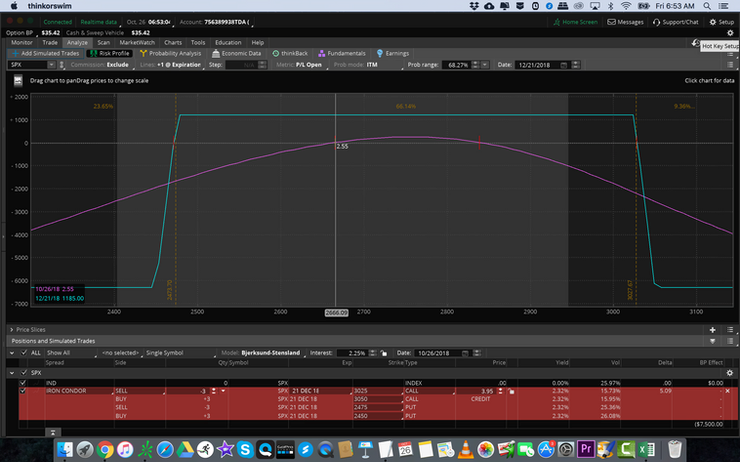

The Short Iron Condor is opened as a single spread so it’s not nearly as complicated as it looks, but essentially it’s comprised of 4 single leg options with the same expiry month. Or it can be viewed as a put spread combined with a call spread of the same expiry. Here’s what a basic Short Iron Condor looks like on the Russell 2000 (RUT):

-

Current price is the middle gray hash mark at 1377

-

The CALL strikes are at 1480 and 1500

-

The PUT strikes are at 1270 and 1250

-

Breakeven prices are 1482.04 and 1267.84

-

Maximum profit is 2.15 per contract, or 2150$

-

Probability of success is 89.25% (based on premium collected)

Now let’s revisit that definition I gave above:

An Iron Condor is a limited risk, non-directional option spread designed to have a high probability of earning a limited profit

-

It’s limited risk because we already know from the outset what our maximum loss is.

-

It’s non-directional because we have potential for profit equally in both directions.

-

It has a high probability because we’ve stretched the wings of the Iron Condor out very wide.

-

It has limited profit because we can only make profit equal to the premium sold

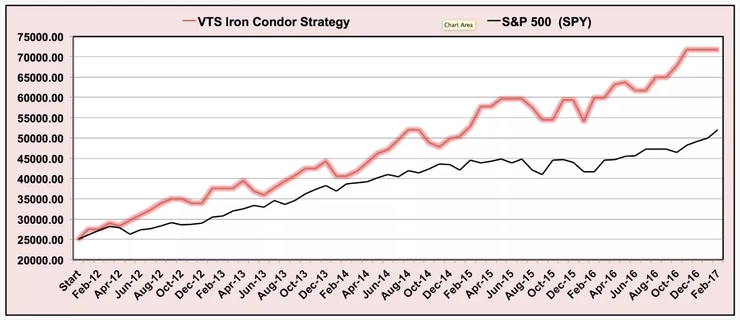

Short Iron Condors are well defined trades with excellent risk reward profiles because of how large the profit range is, and they are non directional (market neutral) so they don’t require us to make any market predictions of any kind. So whether markets move up, down, or trend sideways for extended periods of time the savvy Iron Condor option trader can still manage risk and turn in a nice profit.

In part 2 of this Iron Condor 101 series I’ll get into why we like to sell options rather than buy them. After that one you’ll know why we so rarely buy Long Iron Condors and almost always sell Short Iron Condors. Stay tuned…

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.