GLD Gold is GARBAGE, but it's still our "Safety" position

Oct 03, 2023

VTS Community,

Last week I showed why we use the XLU Utilities ETF as our "safety" position in the Defensive Rotation Strategy. You can check that out here if you missed it.

Here's why GLD Gold is still our safety position in the Tactical Volatility Strategy

Given that GLD Gold had a bad last week, people are probably wanting to see the longer term results of those positions.

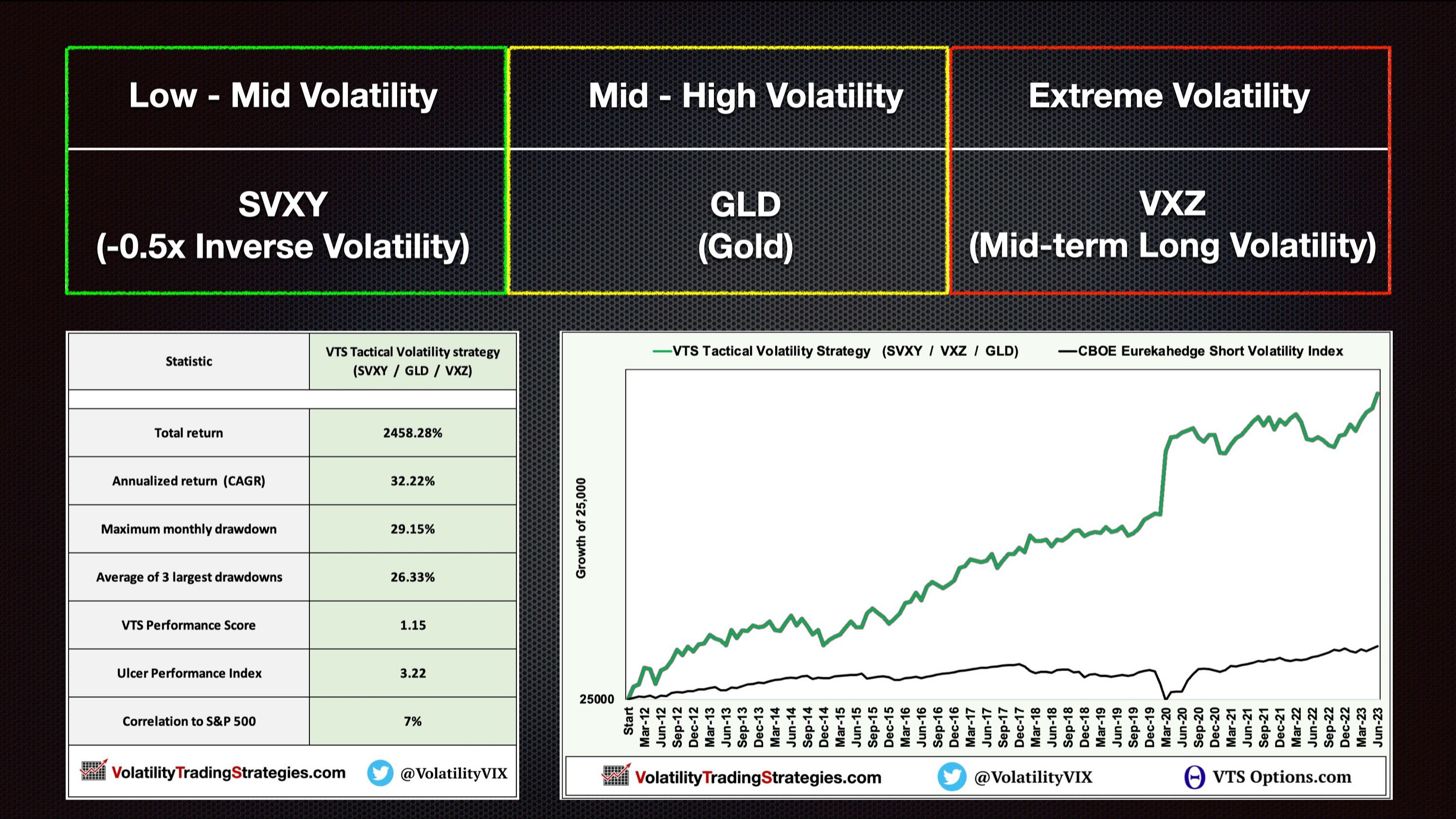

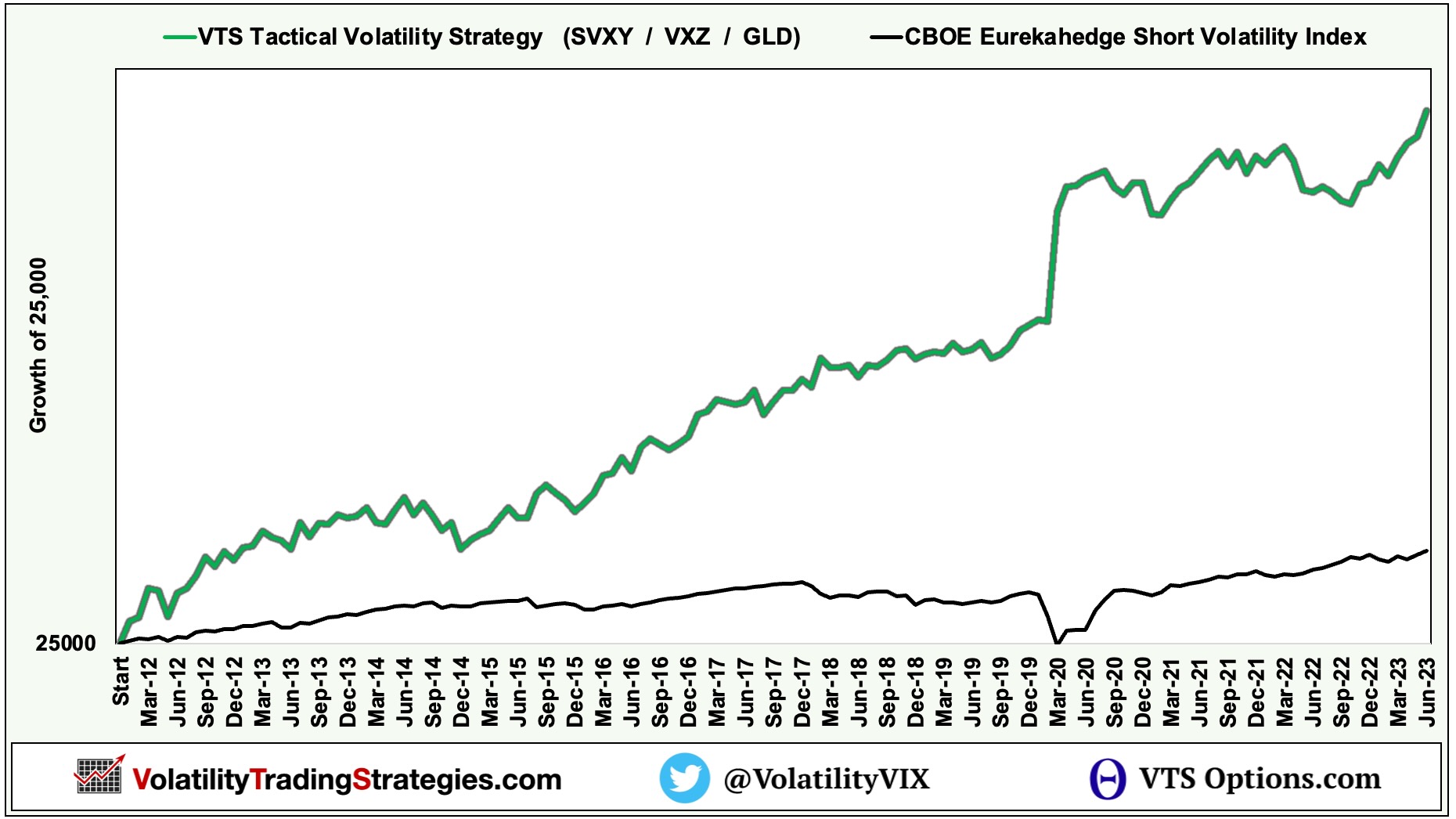

Remember, the Tactical Volatility Strategy rotates between three potential ETFs depending on current Volatility metrics:

Data mining Volatility metrics, we can allocate to the asset class with the highest probability of success given the current market environment.

Stable markets: -0.5x SVXY

Elevated risk: GLD Gold

Extreme Volatility: 1x mid Long Volatility

It's probably more intuitive to people why we hold SVXY and VXZ. On the two extremes, stable markets or extreme Volatility, clearly we want fully directional positions to capitalize on those conditions.

However, during elevated risk when the market hasn't fully collapsed, it's much more difficult to find positions that make a positive return in a reasonably stable fashion.

Currently, we use the GLD Gold. Again, I'll do a complete analysis comparing several asset classes soon.

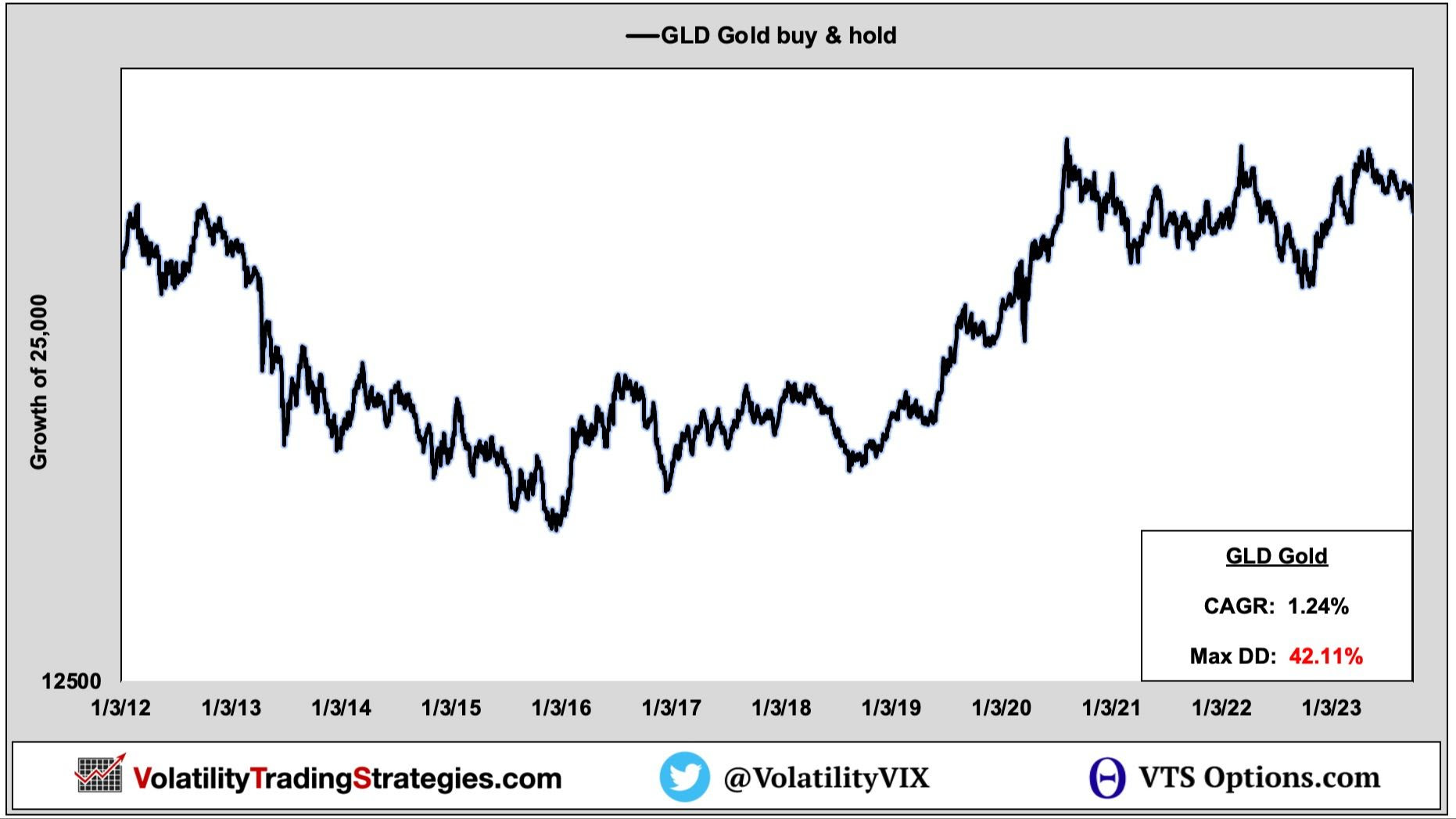

Buy & Hold Gold is terrible

I've ranted in videos and livestreams for years how much of a non starter gold is as far as performance goes. Sure it can have occasional periods of success, but overall it's just not viable as a buy & hold investment.

It's barely positive and has HUGE drawdowns...

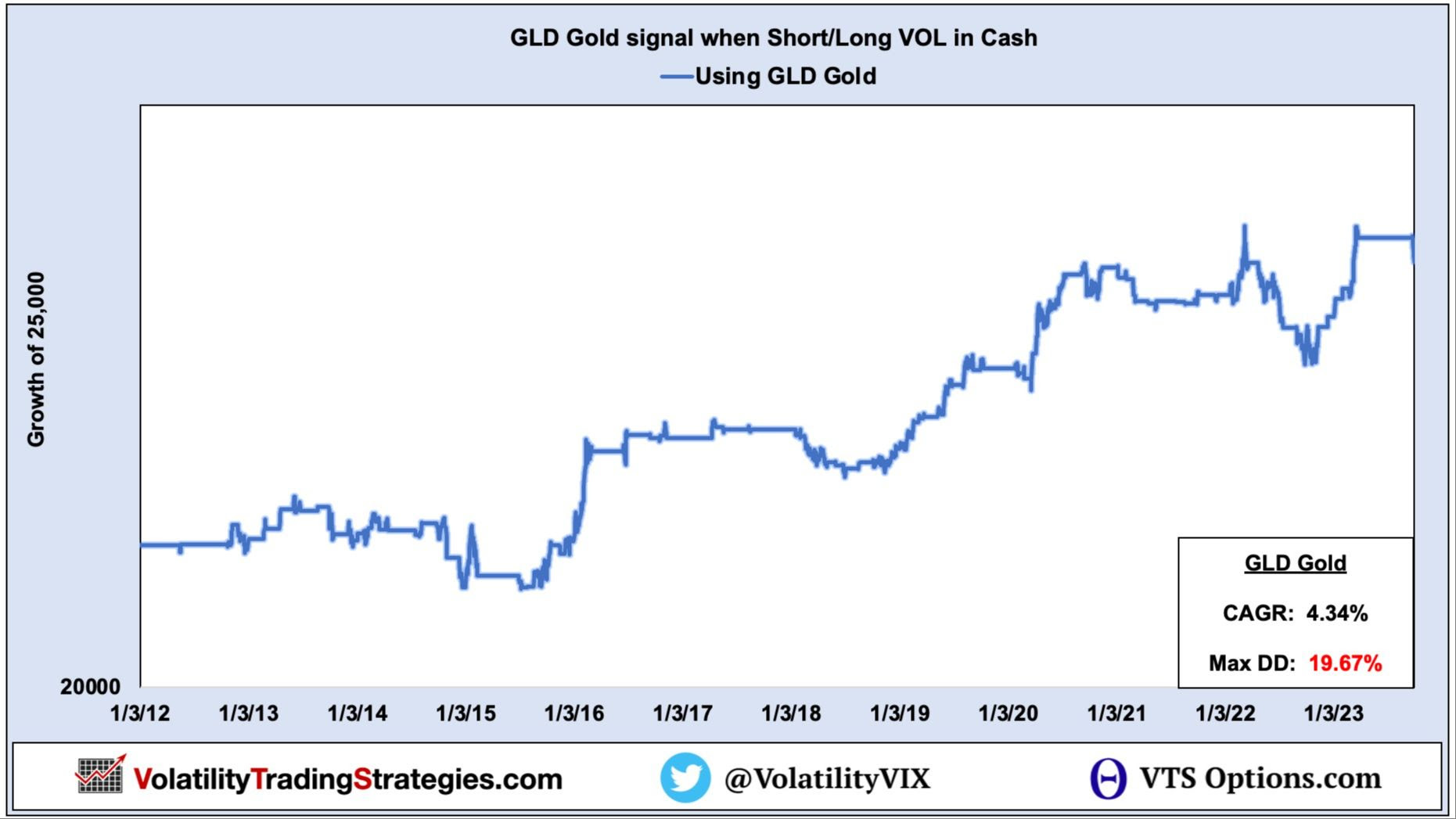

But we're NOT buy & hold, we're tactical

For our purposes though, we're just parking capital in the GLD Gold for short periods of time when it's too risky to be holding short volatility SVXY positions. This is what the performance looks like when we are holding our GLD Gold positions within the Tactical Volatility Strategy:

4 times the performance with less than half the risk. As far as a "safety" position goes within a tactical strategy, this does the job nicely for us. Gold still remains one of the most frustrating asset classes and a non starter for buy & hold. I feel sorry for the "gold bugs" who have kept the faith over the years and just never get rewarded no matter how high inflation goes.

For us, it's purely a short-term parking spot for capital in between our two directional long or short Volatility positions.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.