Given interest rates are so low, is it even worth holding bonds anymore?

Oct 23, 2020VTS Community,

I'd like to address a topic that seems to be coming up a lot lately. Given the proximity to the US election and how uncertain the whole situation is, many asset classes are just spinning their wheels without making much progress, and that does include anything to do with bonds.

Q&A question #69: Given interest rates are near zero again, is it even worth it to hold IEF (7-10 yr treasury ETF) positions within the Tactical Balanced strategy anymore?

The VTS Q&A section can be viewed here.

So if you're not aware, the reason interest rates are being linked to our IEF Bond positions is that there's an inverse relationship between interest rates and bond fund performance.

- As interest rates go up, bond funds like IEF tend to underperform

- As interest rates go down, bond funds tend to outperform

So the question is essentially asking, if interest rates are already low and not likely to go much lower if at all, then why bother taking IEF Bond positions at all in the Tactical Balanced strategy?

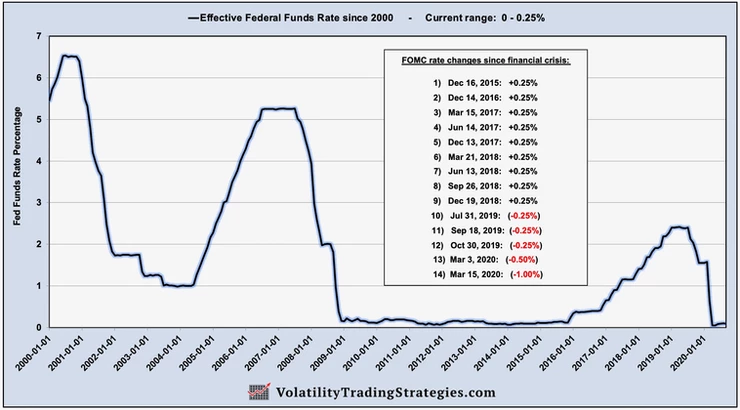

Effective Federal Funds rate (interest rates) since 2000:

Interest rates were basically zero from 2009 - 2015, and then from 2016 - 2018 they started to go up. So one might expect that a tactical rotation strategy which holds IEF Bond positions in certain market environments, that the performance of those IEF trades must have been quite poor. They'd be bad from 2009 - 2015 when rates were around zero, and then they would be even worse from 2016 - 2018 when rates were going up. 2009 - 2018 was arguably a very poor time to be holding any interest rate related bond funds.

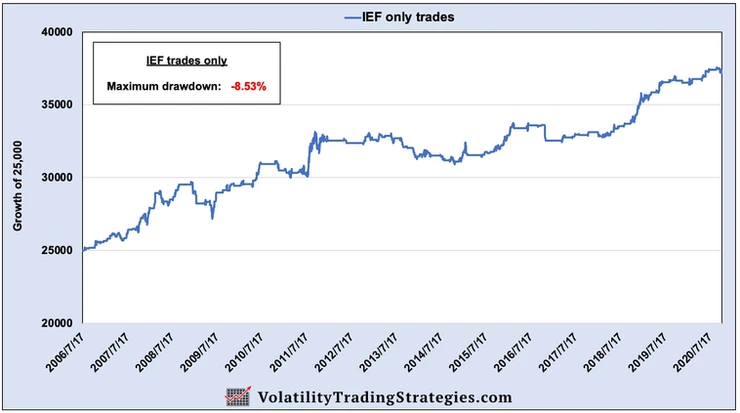

IEF trades only within the Tactical Balanced strategy (held on about 28% of trading days)

As you can see, that has not been the case. In fact the results from only the IEF trades have been very consistent over all different interest rate environments. Especially noteworthy was from 2016 - 2018 when rates were rising. Remember rising rates are the worst environment for holding bond funds, yet we still made some nice gains when we held IEF.

The basic reason for this is the Tactical Balanced strategy is not buy and hold. We only move into IEF bonds tactically when the overall risk in the market is elevated. During those more risky and ambiguous periods, it doesn't matter as much what interest rates are doing, we can still make money.

It's not ideal, but it's still worth doing.

Now in a perfect world I'd love to see rates at 3-4% and moving higher. I think that's healthier for the broad economy and business, for the average investor, and for the global markets in general. However, we can't trade the market as we'd like it to be, we just have to trade what is, and higher rates just don't seem to be in our future, at least not for several years. It only took the Fed a few months this year to unwind all the progress they made towards rate normalization. I can't imagine they will turn around and start raising rates again any time soon.

Conclusion:

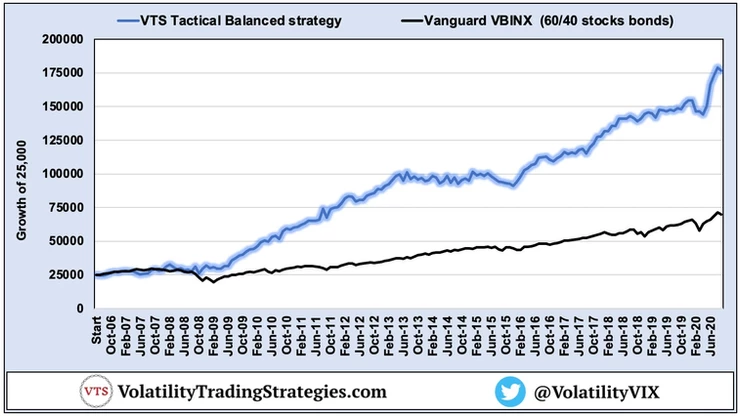

With respect to the Tactical Balanced strategy, I still have confidence that the IEF Bond positions will do their part and protect capital during riskier market periods. That's what they are designed for. To give us the highest probability of successfully preserving capital and avoiding the excessive drawdowns the stock market sees from time to time.

In my opinion nothing fundamental has changed in the last few years and I definitely think that our IEF trades are still very important in achieving that goal.

It's impossible to get every tactical trade correct, and sometimes they just don't work in the short run. Remember on a day to day basis the markets are essentially a random walk. But in the medium to long term is where the true edge lies. The Tactical Balanced strategy has done its job as a "core" portfolio allocation brilliantly and I do expect that to continue for years to come as we move forward into much more uncertain (and potentially rocky) times. I for one will focus on consistency and just stay the course.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.