Can we replace the S&P 500 based indexes with Nasdaq (QQQ) ?

Oct 27, 2020VTS Q&A question #66: Can I use QQQ instead of the other stock market ETFs you choose?

Check out the VTS Q&A section here.

We currently have 3 tactical rotation strategies that all use a specific broad stock market ETF:

- Tactical Balanced uses the S&P 400 MidCap ETF called MDY

- VB Threshold uses the S&P 500 ETF called SPY

- Defensive Rotation uses the Vanguard Total stock market ETF called VIG

The main reason I use three different ETFs for three different strategies is because it makes it much easier to trade the entire portfolio in the same trading account. If they all used the S&P 500 (SPY) for example, since all three strategies have different market timing it would get confusing to keep track of which shares are part of which strategy. So having each strategy with its own designated ETF just makes things very easy. When you see MDY shares in your account, you know it's for Tactical Balanced, etc...

The most important thing in all of these strategies is staying within the broad asset class of stocks. Beyond that though, you can view all broad stock market ETFs as interchangeable with any of these positions. MDY, SPY, VIG, QQQ, DIA, etc. Even S&P sector ETFs like consumer staples XLP could serve a purpose.

If you felt like the outperformance of technology in the last few years will continue, then yes feel free to replace QQQ with any of those other three stock indexes (MDY, SPY, VIG)

There's two reasons why I don't use QQQ in those three rotation strategies:

1) The strategies were designed and launched many years ago, and the outperformance of tech over the others is a recent occurrence only in the last few years. When the strategies were designed, I chose S&P 500 based stock indexes for a reason, they were better.

* Now the Defensive Rotation strategy is newer, but for that one I tried to stay consistent with using Vanguard branded ETFs for all three positions, which is why it's VGLT, VIG, VPU. No other reason than that, Vanguard ETFs are popular for good reason.

2) We have another strategy that isn't currently in the Total Portfolio Solution called the VTS Breakpoint strategy. That one does use the QQQ for its stock holding.

* I may bring back the Breakpoint strategy in some capacity in 2021, perhaps as a small part of TPS or maybe just as a free strategy for the public, we'll see. I do a once annual audit of all results and strategies and allow myself to make small changes here and there. It's a way to stay updated with the current market, but also guard against overfitting by changing too often. So when I do my annual diagnostic at the end of the year, I'll see if the Breakpoint fits in anywhere.

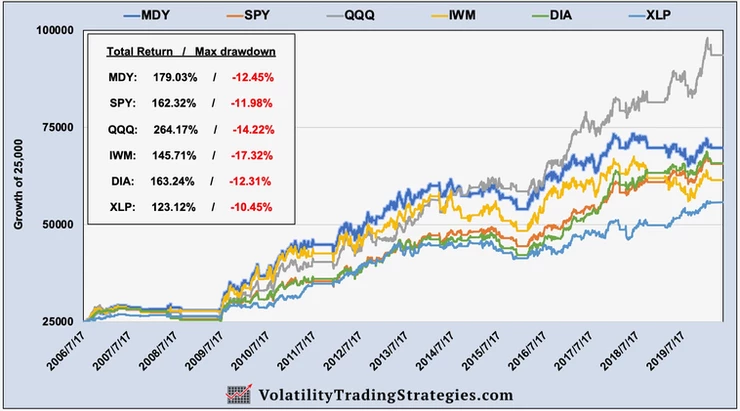

But if you're curious as to why the MDY was chosen over the QQQ specifically for the Tactical Balanced strategy, here are the results of just the MDY portion of the strategy along with some other major stock ETFs as a replacement.

VTS Tactical Balanced strategy launched live in January 2012. As you can see in the chart, back then the MDY was the top performer so it made the most sense to use that one.

Now its performance has been weak in the last couple years compared to a few of the others, but over the entire 9 years the strategy has been live, MDY is still in the #2 performance position which is good to see. Tech (QQQ) has really accelerated in the last couple years, which is why I get this question so often about replacements.

The simple answer is, yes you can use QQQ in place of any of the broad stock market ETFs we use.

Just remember, there is a very common psychological bias called recency bias where we allow recent events to weigh more heavily in our minds than perhaps they should.

Investing is a long term process. It's easy to see QQQ at the peak there, it is the top performer as of now. Just remember, if you want to use it as a replacement, you're doing so because you think it's FORWARD performance starting today going forward will also continue. Don't allow recency bias to sway your decision.

If you think starting today the QQQ's will continue to outperform, then yes you can find a spot for it in the Total Portfolio Solution. Just pick one of the three stock market ETFs we use and switch it for QQQ.

I'll keep you updated on the VTS Breakpoint strategy and where it may fit in for 2021...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.