Part 4 - Tactical Volatility strategy through the 2020 pandemic

Nov 15, 2021VTS Community,

How did VTS Strategies really do during the 2020 pandemic?

Part 2: Defensive Rotation strategy

Part 3: Tactical Balanced strategy

Part 4: Tactical Volatility & Aggressive Vol strategies

Part 5: VB Threshold strategy

Part 6: Total Portfolio Solution & Leveraged Total Portfolio

Continuing on with this 6 part series of how our VTS strategies would have performed had I just maintained positions throughout the pandemic in 2020 instead of moving the entire portfolio to cash, we come to one of the most important aspects of our portfolio, tail risk management.

Tail Risk is the financial risk of an asset or a portfolio of assets moving several standard deviations from its current price, above the risk of a normal distribution. Tail risk includes low probability events occurring at both ends of a normal distribution, but in general investors are more concerned with unexpected losses on the downside or left tail of the spectrum.

"Everybody has a plan until they get punched in the mouth" - Mike Tyson

The main reason why the long-term rate of return of the average investor is so poor isn't because they don't perform well during stable periods in the market, because they typically do. It's actually because they bleed too much of their capital during volatile periods, suffering painful drawdowns that may take years to recover from. This two steps forward and one giant step backwards cycle is what I've dedicated my career, and my VTS portfolio to solving.

That eloquent quote from Iron Mike Tyson sums up nicely why I've always put risk management at the forefront of my strategies, and why every one of our VTS strategies has mechanisms in place to tactically rotate out of risky positions and into safety positions when needed.

- Our core equity strategies, Tactical Balanced and Defensive Rotation are set up to move to safety during adverse periods for the purpose of preserving capital. Utilities, gold, short term Treasury, and cash are all utilized here to protect capital in a downturn.

- The focus of today's article, Tactical Volatility and Aggressive Vol are set up not only to preserve capital through cash positions, but to outright capitalize on adverse market conditions through strategic long volatility.

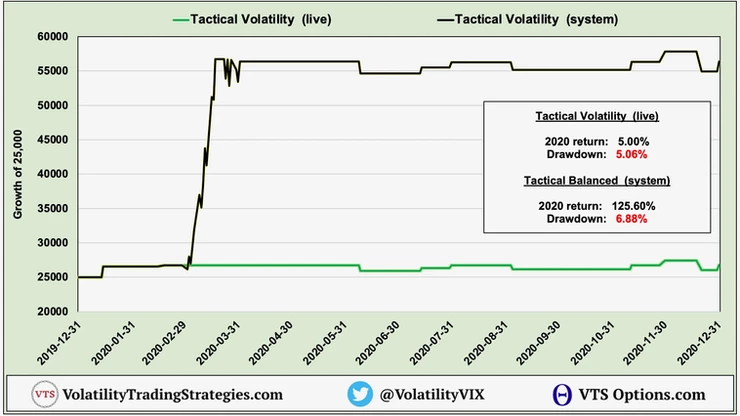

Tactical Volatility strategy live results vs system in 2020:

The Tactical Volatility strategy is on the conservative side and only takes the highest conviction trades. Since inception in January 2012 the allocations have been as follows:

- 44% of trading days allocated to short volatility

- 1% of trading days allocated to long volatility

- 55% of trading days allocated to cash

With volatility so elevated for the majority of 2020, the strategy remained mostly in cash and as a result had an uneventful year. For reasons I explained in part 1 of this series, I moved to 100% cash for 6 weeks of the pandemic. Now in a year with such a devastating market crash that's not a bad thing. There's nothing wrong with flat performance during the 2nd largest market crash of the last 20 years. However, it should have been substantially better. The systematic strategy itself would have caught 3 weeks of some advantageous long volatility signals and returned over 100%.

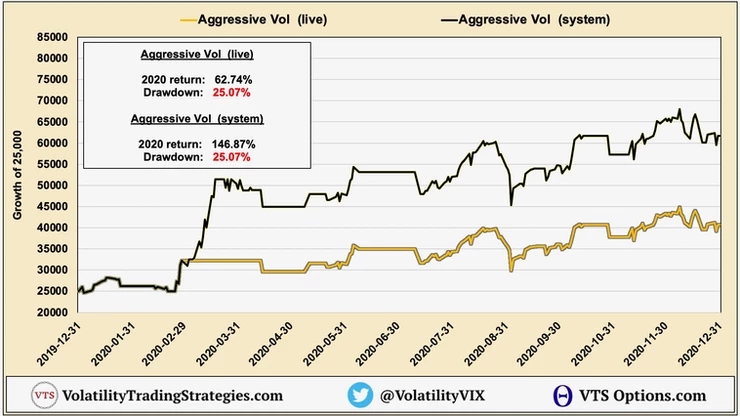

Aggressive Vol strategy live results vs system in 2020:

The Aggressive Vol strategy as the name suggests is set up to take a higher percentage of trades and be more active both on the short and long volatility side of the equation. Since inception in January 2012 the allocations have been as follows:

- 65% of trading days allocated to short volatility

- 2% of trading days allocated to long volatility

- 33% of trading days allocated to cash

The Aggressive Vol strategy was able to take a higher percentage of trades in 2020 and as a result it did have a very good year, returning 62.74%.

Again though, there would have been a three week stretch of opportunity for the long volatility trades to work their magic during the crisis. Hindsight is always 20/20 and I don't want to relitigate the reasons for moving to cash, but the systematic signals were set up to push those results to nearly 150%.

If you're getting value so far:

Subscribe to my YouTube channel

Performance during the 2008 Financial Crisis?

There's no doubt the 2020 pandemic was a very rough period for the stock market with the S&P 500 falling nearly 35% in a very short period of time. However, with so much financial engineering by the government and the Fed, it turned out to be quite short lived and within a few months it was on its way to recovery.

People can have their opinion on whether that was a good decision or not, but regardless, it does mean we are left with staggeringly high levels of public debt and a Fed balance sheet more than double the already insane levels it was at before. Roughly 1/3 of all the money ever printed occurred just in the last 2 years and it doesn't seem to be slowing down. What happens when there is another financial crisis? Will they have any tools left to rescue it, or will the last 20 years of questionable decision making catch up?

- The Aggressive Vol strategy is using a few volatility metrics for its trade signals that weren't available back in 2008 so unfortunately a backtest of that strategy is not possible.

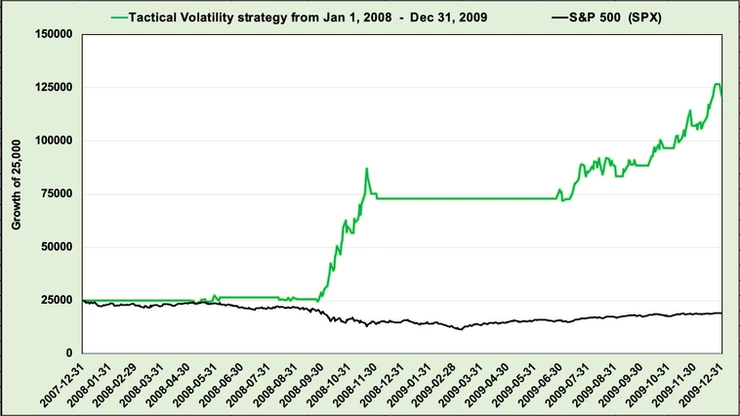

- The Tactical Volatility strategy on the other hand has had its set of metrics trading since 2004 so we can see roughly how it would have performed during the financial crisis. Obviously the next time around will have its own characteristics and no market crash truly repeats in the same way. However, I do expect a prolonged crisis at some point so it's a good idea to make sure we are ready for when it does.

Backtest of the Tactical Volatility strategy from 2008 - 2009

Although the Tactical Volatility strategy is only set up to take long volatility positions on roughly 1-2% of trading days long-term, that will be plenty to catch the worst of any future crisis. They are few and far between, but tail risk events happen fast. A well designed volatility strategy with strategic long volatility positions available can amplify return dramatically in a very short period of time.

I've said it many times but it's worth repeating here, I will not be moving the portfolio to cash in any future crisis. I had my reasons at the time and I just have to live with that decision, but that was a one-off that won't happen again. I've done the work, I've got the experience, and I've made sure the portfolio is robust in both good times and bad.

Our VTS strategies form a diversified tail risk portfolio that will be ready for any future crisis when it comes, because it will...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.