Tactical Investing WHIPSAW! - What is it, how to reduce it?

Oct 06, 2021VTS Community,

All methods of investing have advantages and disadvantages so determining what style a person will adopt is just a matter of trying to maximize the good and minimize the bad and then let time and the law of large numbers do its thing. I have planted my flag firmly in the systematic rules based strategy world and my VTS portfolios are set up in such a way that we can do something that very few other investors out there can:

We can profit from markets that go in either direction. During a bull market or bear market we can make a great return.

Now that might sound like I'm making a claim that I've found the Holy Grail of investing and I'm saying I can't lose money. Like "Up, down, whatever, we can make money" but actually there is a market environment which does pose problems for quant based investing and will lead to losing periods for that style:

WHIPSAW!

Whipsaw is essentially when a trading system signals for a change of position because a set of indicators has moved into a different threshold, only to see the market reverse shortly afterwards back to the original levels. The rules based system moves from one position to the other and back, most likely taking a trading loss in the switch. Tactically changing positions quite often leads to losses the next day because we are working with defined thresholds and flip points.

One could argue the T+1 win/loss ratio is pretty close to 50%. In the very short-term the market is just a random walk and under no obligation to establish a trend within 1 day of switching positions. It freely moves around and quite often bounces back and forth a few times near thresholds before finding consistency. So whipsaw within an individual trading strategy is very common and generally not a major issue, it's just how the process works.

But whipsaw portfolio wide, multiple times, that's a problem. 2021 has been a record year for whipsaw.

In order to have a diversified portfolio I've set up all the individual VTS strategies to use a different sets of volatility metrics, with different asset classes, and different threshold levels of position changes so that long term it's a much smoother experience and hopefully we only get one or two strategies at a time being whipsawed.

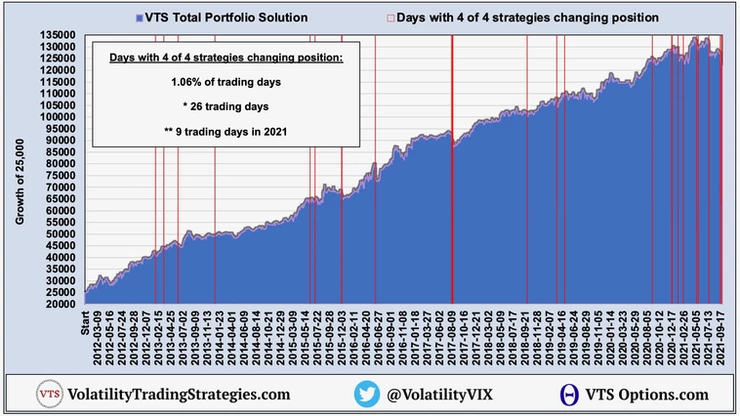

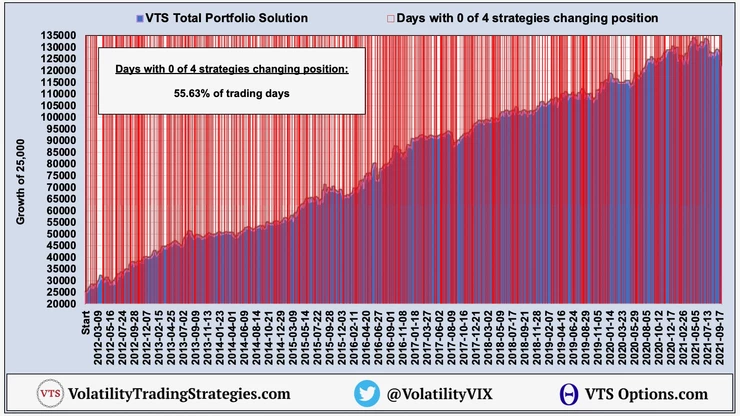

In 2021 though, the entire portfolio and all 4 strategies have been whipsawed 9 times, which is far more than ever before. The chart below is showing how often all 4 Tactical strategies changed positions on the same day:

All 4 strategies means:

Tactical Balanced

Tactical Volatility

VB Threshold

Defensive Rotation

* VTS Options is not included in this

The VTS Total Portfolio Solution is a few months away from its 10th anniversary of live trading and we've only had 26 days in 10 years where the entire portfolio changed positions at the same time so it averages about 2.5 times per year or about 1% of trading days.

All 4 tactical strategies changing positions at the same time:

- 2012: 0

- 2013: 3

- 2014: 1

- 2015: 3

- 2016: 1

- 2017: 3

- 2018: 1

- 2019: 2

- 2020: 3

- 2021: 9

So 9 times in 2021 so far, that's by far the record. Late 2020 had a few more so essentially its happened 12 times in the last 1 year of trading.

That's the major weakness of quant based investing and I would argue the only weakness of our VTS portfolio. Like I said as long as there's a reasonable trend, up or down we don't really care, we can tactically rotate into positions to take advantage of it. The major weakness is too many instances of whipsaw which definitely will cause problems. One or two strategies is fine and just part of the process, but too many portfolio wide and it starts to add up.

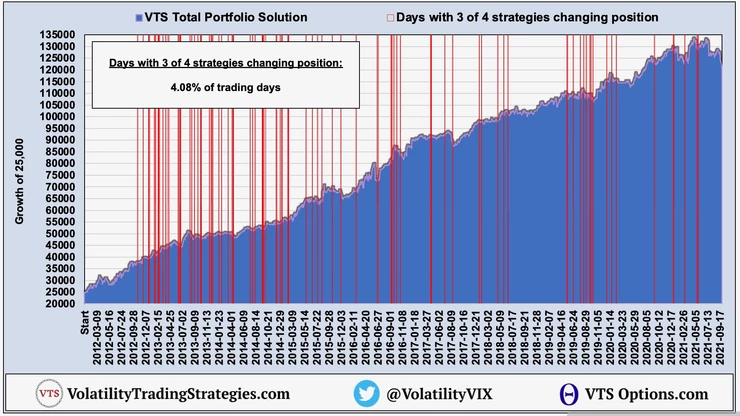

3 of 4 strategies changed position on 4.08% of trading days

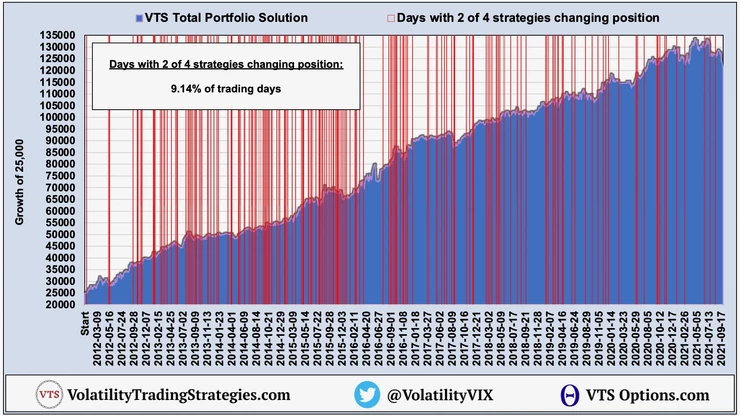

2 of 4 strategies changed position on 9.14% of trading days

1 of 4 strategies changed position on 30.10% of trading days

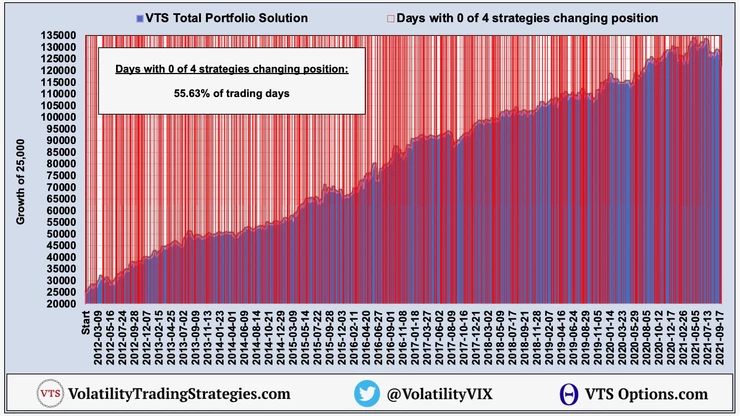

0 of 4 strategies changed position on 55.63% of trading days

If you're getting value so far:

Subscribe to my YouTube channel here

Follow me on Twitter here

Two ends of the spectrum:

Buy and hold:

By far the most widely adopted investing style is the good ol' buy and hold method of just setting up a portfolio of different asset classes and then letting it do what it's going to do. Occasional rebalancing typically takes place but essentially it's a hands off portfolio subject to the whims of the market. I've talked at length about the myriad of downsides to buy and hold investing so we'll skip the rant today.

- The upside is there's no whipsaw in buy and hold because there's no threshold changes of position.

- The downside of course is they can't play both sides of the market and typically get crushed in market crashes, bringing the long-term rate of return down to mid single digits.

Tactical investing:

In order to beat the market you have to do something different than the market. Low correlation tactical investing like VTS does require some courage and willingness to stand out from the crowd. Fortunately, most of the time we stand out with outperformance but there are times when we stand out for underperformance too (I haven't found the Holy Grail just yet)

- The obvious upside to tactical investing is that we can significantly outperform the market long-term by reducing drawdowns and having the ability to take advantage of market declines.

- The downside is the dreaded whipsaw where in certain market environments we can bleed capital with position changes. If they are too frequent, that is going to lead to underperformance.

Without a doubt the area I spend the most time on when fine tuning my portfolio is reducing the impact of whipsaw. Trying to optimize the diversification of strategies, signals, and assets used to keep it to a minimum.

Unfortunately, whipsaw can't be eliminated because no matter how we set things up, we are working with tactical rotation and thresholds, and trading decisions do have to be made. All we can do is have the courage to take the positions our signals give, and after that it's out of our hands.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.