Is our leveraged Portfolio 2x the performance of the non-leveraged Portfolio?

Jun 08, 2021Question from a VTS Community member:

"I thought the Leveraged Total Portfolio was supposed to be double the performance of the standard unleveraged Total Portfolio Solution but it doesn't seem to track at 2x, why is that?"

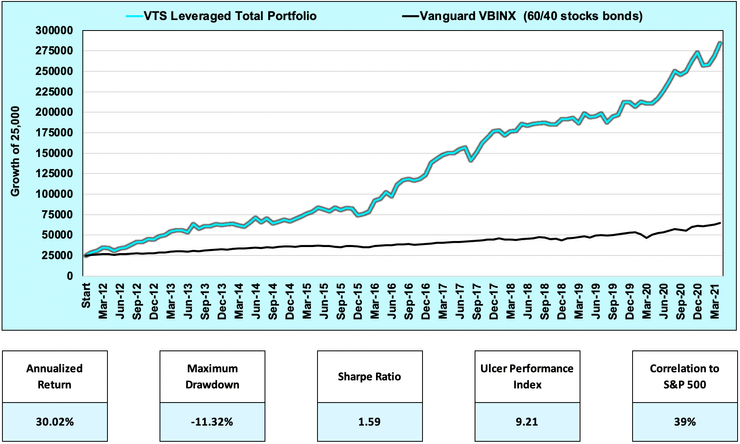

Great question from Max, thanks. He's right, our two portfolios don't track with 2x leverage to one another, it's actually closer to 1.5x long term. Now it may not always be that way, it will be subject to what positions we hold and when, but as a rough long term estimate it will probably be closer to 1.5x.

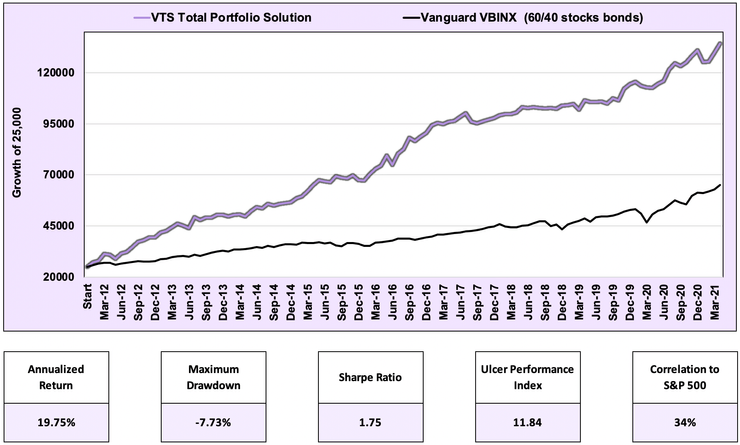

Total Portfolio Solution (non-leveraged)

Leveraged Total Portfolio (leveraged)

The short answer is it's not supposed to track at 2x the unleveraged because not all the positions in our strategies are using leverage. We only use leverage on the positions that are advantageous, which typically will mean only the equities positions and sometimes if the market conditions are right, perhaps the short volatility positions as well. But the safety positions aren't meant to be aggressive so those are still using non leveraged ETFs.

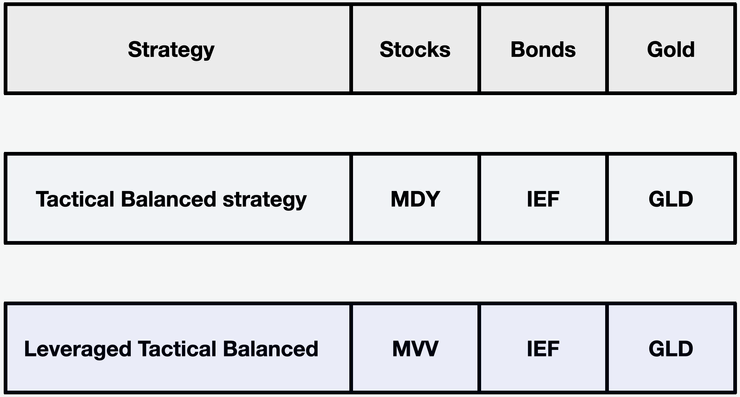

Let's use the Tactical Balanced strategy as the example. This strategy tactically rotates between three possible positions (stocks, bonds, or gold) depending on market conditions and the levels of our volatility metrics:

We can see that the Leveraged Tactical Balanced is only adding leverage to one of the three positions and that is MDY stocks. For that position I have deemed it ok for certain people with a higher risk tolerance to double up on the position and use the 2x version which is MVV.

For IEF Bonds, while it's still mathematically advantageous to use leverage when measured on an absolute level, given where interest rates are right now I don't see any advantage to adding leverage and in fact it could be detrimental at this point.

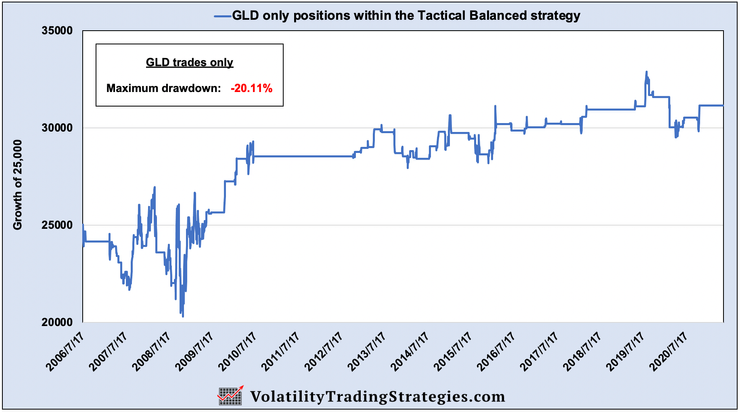

For GLD Gold, same thing it's still mathematically advantageous to use leverage, but the issue is it will significantly increase the drawdowns and I just don't think it's worth the added emotional stress.

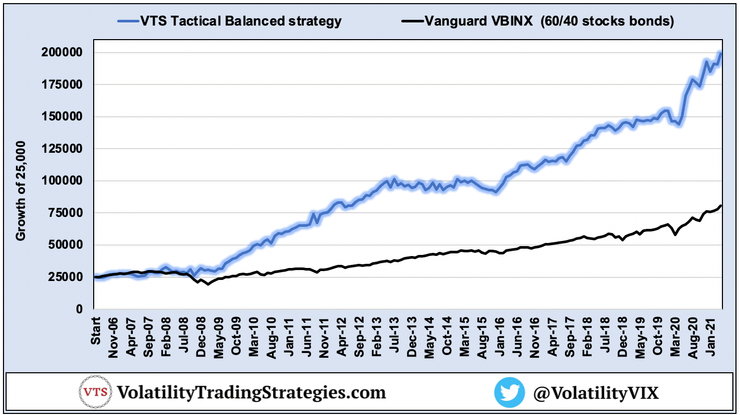

Tactical Balanced strategy:

The Tactical Balanced strategy continues to do its job in the portfolio very well, but it has suffered a few drawdowns along the way, that's normal for any strategy. Now you might be tempted to think they happen when we're holding equities and the market crashes, but that's not actually true.

Because we rotate out of aggressive positions and into safety quite quickly when volatility metrics are elevated, our MDY Stocks positions are actually surprisingly consistent. It's the GLD positions that are responsible for the larger drawdowns. Again still worth holding, but gold during a market crash can still be unstable. We can see this when we break down each position's contribution to the strategy long term.

MDY only positions within Tactical Balanced:

IEF only positions within Tactical Balanced:

GLD only positions within Tactical Balanced:

Now obviously outside of a full on financial crisis I would expect our GLD positions to continue to be quite stable as they have been for the last 10 years, but the big question is, what will gold do if there is another crisis? I don't personally know, and I don't think anybody else does either. Since our gold positions are just meant to be for safety, I don't think it's a good idea to try to leverage those.

Within the Tactical Balanced strategy, only the MDY stocks positions are using leverage. IEF bonds and GLD gold are still just the standard 1x ETFs in both of our portfolios.

* This is true for all our other strategies as well:

Leveraged VB Threshold uses SSO instead of SPY, same for the rest.

Leveraged Defensive Rotation uses QLD instead of QQQ, same for the rest.

Aggressive Vol uses Vol ETPs instead of low delta VXX Put options, same for the rest.

That's why the Leveraged Total Portfolio doesn't track 2x the performance of the standard non-leveraged Total Portfolio Solution. It won't be 2x because not all the positions are being doubled. Only the ones that I feel are consistent and predictable enough to add performance without risking the drawdowns getting too large. Long-term, it'll likely be closer to 1.5x the performance give or take.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.