Why is the "Short Vol" trade not working lately?

Jan 26, 2021I've had a lot of questions recently asking what's up with volatility and why it is remaining so high. Considering 20% of our portfolio is volatility ETP related, I understand it can be very frustrating to watch the stock market slowly drift upwards and yet not have the short volatility trade participate. In fact, the short vol trade is actually negative in the last two months. There's two questions we need to answer:

First, why is the short vol trade down lately?

Second, what is causing it?

1) Why is the short vol trade down lately?

This is an easier question to answer because it has to do simply with the methodology of the volatility ETPs. They aren't stocks and aren't based on supply and demand. Based on that methodology we can easily explain why they are moving the way they are.

VIX index for the past 1 year:

After the VIX index reached such high levels during the Covid crash, it's only natural that it will come back down to more normal levels. It got back to 20 pretty fast all things considered, but in the last two months the VIX is actually up.

While that is interesting, remember Volatility ETPs don't track the VIX index, they track VIX futures. We can see the same behavior in the VIX futures market. In fact it's even more pronounced.

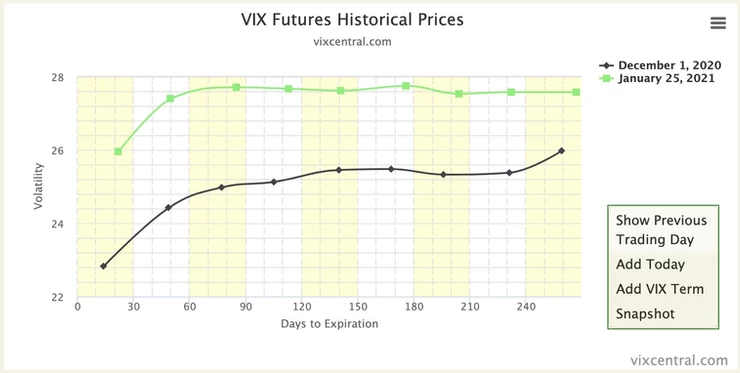

Comparing the VIX futures term structure in the last 2 months:

December 1st, 2020 in black

January 25th, 2021 in green

What does all this add up to? Well, it means stagnant volatility ETPs doesn't it?

If the VIX futures term structure is higher now than it was 2 months ago, that means the VX30 constant maturity VIX future that those ETPs hold is higher as well. If the VIX index is higher, then convergence to the spot VIX at expiration is higher as well. (click here for a full video explaining the VX30:VIX relationship)

Since Volatility ETPs are a direct relationship between VIX futures and the spot VIX at expiration, by very mathematical definition they would also be struggling in this environment.

1 year SVXY (no higher now than it was 2 months ago)

1 year VXX (no lower now than it was 2 months ago)

So the why is easy. Volatility ETP prices are directly based on the changing value of the front two month VIX futures contracts they hold, and how those contracts converge to the spot VIX at expiration. If those futures are drifting higher, the short vol trade through the various volatility ETPs like SVXY and VXX can't perform.

2) What is causing traders to bid up VIX futures?

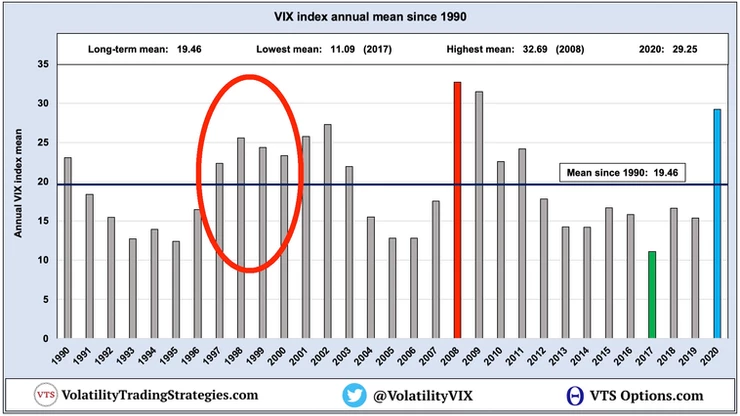

That my friends is a much tougher question to answer, but this type of environment is not unprecedented. We've definitely seen extended periods in the past where volatility can lose its traditional inverse correlation with the stock market and remain very sticky in the higher ranges, even as stocks keep marching higher.

1997 - 2000 is one such period where the stock market was climbing 20-30% a year, yet the VIX index was consistently averaging in the low to mid 20's.

We could just be in an environment where institutions and asset managers feel they want to participate in the stock market, but have their doubts as to sustainability and want to remain hedged.

Net long stock portfolio and hedge it with VIX futures?

Maybe... Like I said, nailing down what's causing it is a much harder question because the VIX futures are a free and open market. Market participants are clearly keeping a bid under them, but the reasons may vary.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.