All 4 strategies are positioned aggressively, finally!

Jul 21, 2020VTS Community,

As of yesterday we have all 4 of our strategies in what are considered aggressive positions, finally! This alignment of all 4 strategies at once hasn't happened since February 14th of this year, which was one week before the Covid crisis started. As of now:

- Tactical Balanced strategy is long MDY stocks

- Tactical Volatility strategy is short volatility with VXX Puts

- VB Threshold strategy is long SPY stocks

- Defensive Rotation strategy is long VIG stocks

Now of course it would be nice if we could continue with a green light market for a few weeks and just ride the wave. That is after all when the best gains happen, when we get a decent trend.

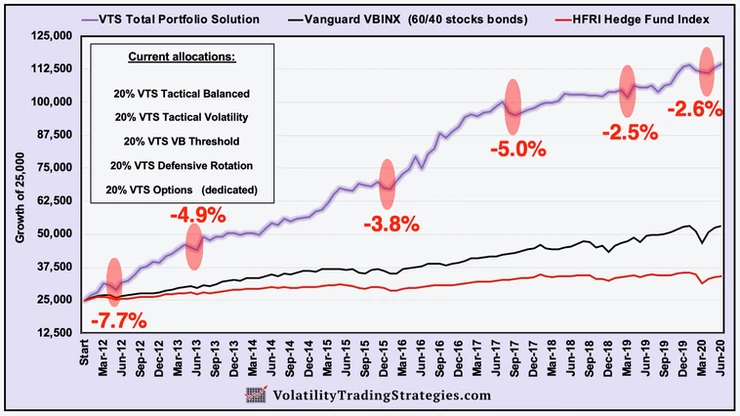

All our safety positions are there to reduce portfolio drawdowns when the market is in turmoil, and we've seen plenty of that in the last 3 years. In fact through all this mess, the Volpocalypse event in Feb 18', the Q4 2018 crash, and the Covid crash, we've kept our portfolio drawdowns below -3%. That's quite a feat given the turmoil in the market.

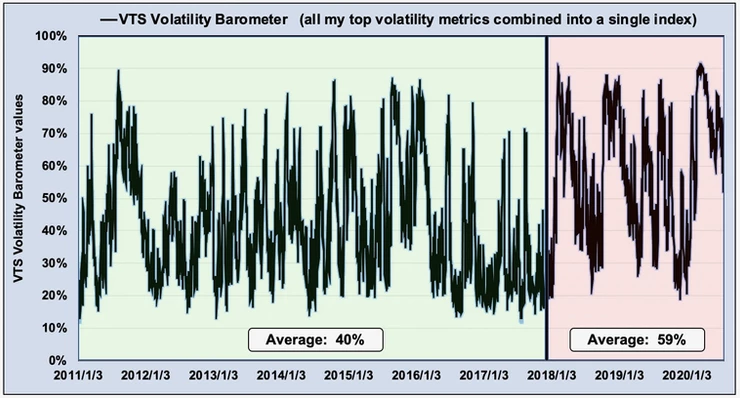

But there's no doubt the best gains happen when we can ride longer term trends. The best period where the largest gains happen for us are when the VTS Volatility Barometer is between about 20% - 60%.

That's our sweet spot! Around 40% on average.

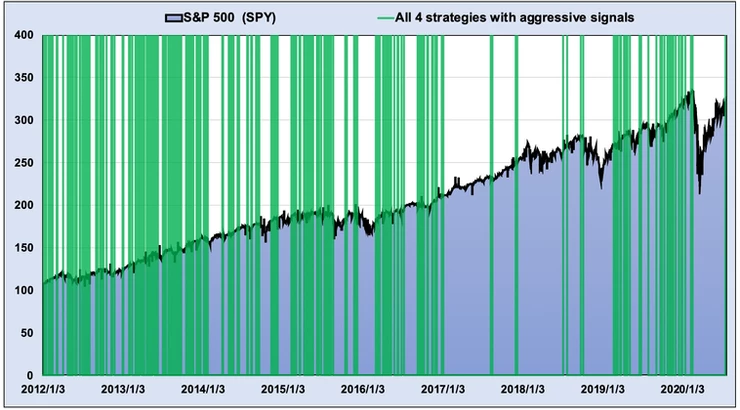

Here's an illustration of all the times since the Total Portfolio Solution officially launched in January 2012 where all the strategies had the alignment of aggressive positions at the same time.

As you can see, in the last 3 years we haven't had nearly as many opportunities to get all the strategies working at the same time. We've had shorter windows of opportunity interrupted by major market crashes. But that's to be expected right? Markets don't always have a trend, so we do spend some of our time just treading water and avoiding drawdowns.

In a nutshell that's what my Total Portfolio Solution is.

- During stable market periods when volatility is lower, we target returns higher than the broad market.

- In tumultuous times when volatility is elevated and uncertainty is high, drawdown reduction is the highest priority.

Obviously none of us have any control over the market and what it's going to give us to work with in any given year. If I had my choice I would go with either stable lower volatility markets or a prolonged financial crisis. Both of those periods should be quite profitable for us. Unfortunately we can't choose so we do the best we can with what we're given.

Regime change:

It's pretty clear when viewed on a volatility chart that the period from 2012 - 2017 was more advantageous than 2018 - 2020.

That is a significant regime change since January 2018. We went from the VTS Volatility Barometer averaging 40% (our sweet spot) to now almost 60% (safety zone)

It is what it is and we're ready for anything. The point of a diversified portfolio of tactical strategies is that we always have something working for us no matter what the market is doing.

But obviously it's best when all are working at the same time. Let's see if we get some of that as we move into the 2nd half of 2020 :)

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.