M1:M2 VIX futures contango crossover STILL not working...

May 13, 2019VTS Community,

The S&P 500 is down big today on more China/US trade war nonsense, which has once again pushed the M1:M2 VIX futures into backwardation. That means I have to endure the pain of seeing a hundred tweets talking about how that's somehow a brilliant market signal to move to safety. It never fails, when VIX futures move to backwardation, so many people start talking about how that means it's time to be safe.

Really? What is that advice based on? Shouldn't timing signals have roots in actual data rather than just opinion?

Everyone has their pet peeves and for me, few things annoy me more than when people give investment advice that's not based on any factual data what so ever. Because this is such a widely talked about and wildly inaccurate piece of advice floating around out there, let's examine the myth of the 0% contango/backwardation crossover signal yet again...

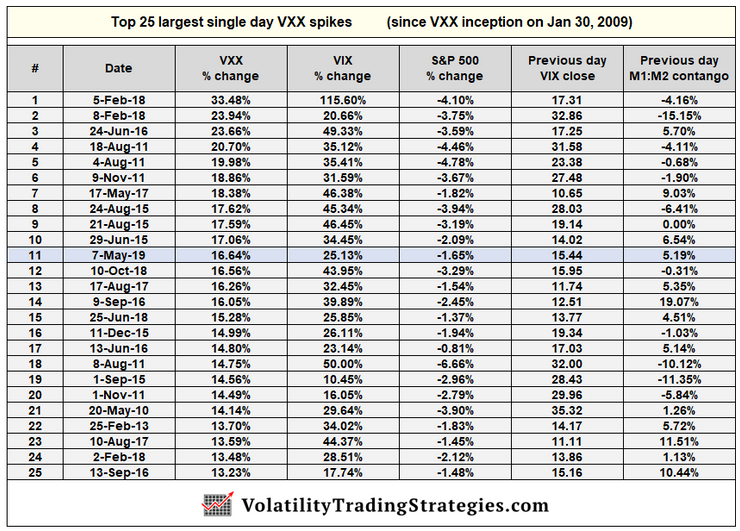

As the chart above shows, 13 of the top 25 largest VXX spikes in the history of the product happened during M1:M2 VIX futures contango. That means the 0% threshold is less than 50/50 in predicting volatility spikes. It's a coin flip at best.

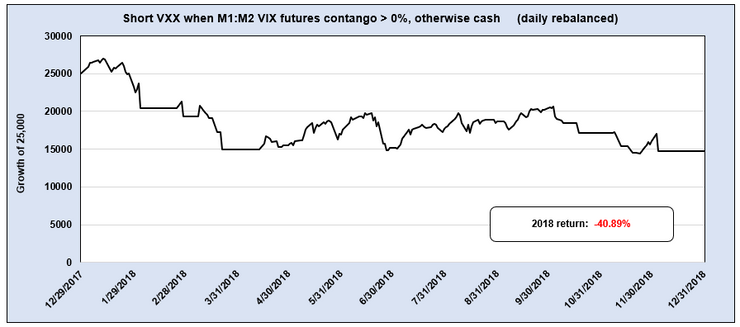

It didn't work at all in 2018:

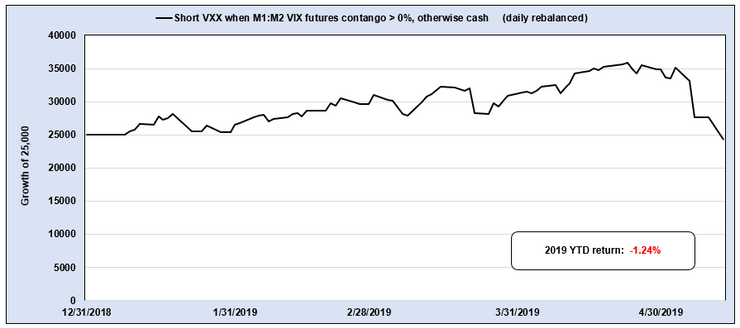

It's not working so far in 2019:

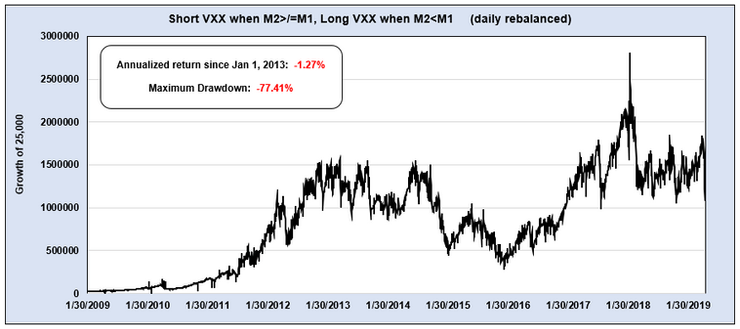

But it gets even worse than that. Using contango/backwardation as a threshold signal to go short or long VXX hasn't led to any gains in the last 6 years.

From Jan 1, 2013 to May 13, 2019 that 0% threshold strategy led to a -1.27% annualized return with a gut wrenching -77.41% drawdown. No reasonable investor could have ever followed that strategy, and even if they did hang on for dear life during the worst of it, it still didn't produce any results at all.

I've written several articles breaking down the failures of this 0% signal, here's one to check out later. VXX and why following VIX futures contango may fail

Should we be surprised? Why would such a simplistic signal be expected to work? Sometimes I think people forget how difficult successful investing is. It's just not realistic to expect to log in to vixcentral.com every morning, check the level of M1:M2 VIX futures contango and expect that to produce any alpha. It takes real work and a detailed understanding of the volatility complex to be successful.

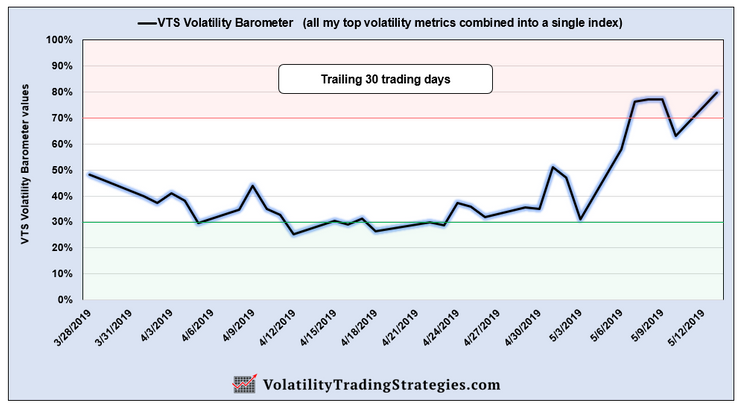

The VTS Volatility Barometer and Volatility Dashboard in the daily subscriber emails are meant to help people find signals that actually work. Signals that actually do keep investors out of as many of the bad days as possible. No signals are perfect and they all get it wrong sometimes, but there are ways to mathematically quantify which ones work better than others.

Why are my volatility strategies safely in cash today and the Tactical Balanced strategy making a little profit parked in gold? Because all the indicators I track said that despite M1:M2 VIX futures moving back to contango last Friday and the mad stampede of investors piling back into aggressive trades because of that, my signals were saying we were not out of the woods yet. We were barely out of the red zone after last Friday's recovery.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.