VXX Puts & Calls vs Short VXX - How has each done since Feb 18'?

Aug 03, 2020It's been a little while since I last addressed the "VXX Puts vs Short VXX" question so let's revisit this today. That is to say, which one of those two ways to represent a short volatility position is superior? Just shorting the volatility ETP called VXX outright, or simulating that position using options?

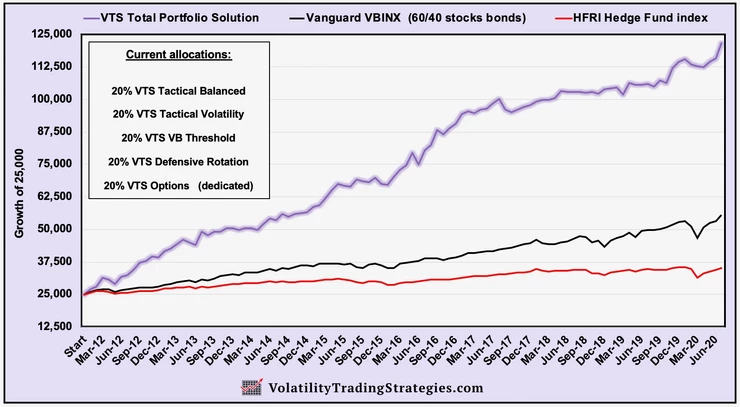

I'll be explaining the following chart:

History of the VTS Tactical Volatility strategy:

This is one of the 3 original strategies that I introduced when I launched Volatility Trading Strategies back in January 2012, nearly 9 years ago. The original Total Portfolio Solution was as follows:

So i've always been the type of investor to focus on a diversified balanced portfolio, I just do it in my own way. Instead of the standard buy and hold pie chart style where you hold various asset classes for the long term, I do everything from a tactical perspective moving in and out of the most advantageous positions based on all the metrics from the VTS Volatility Dashboard. It has served me well as the Total Portfolio Solution has more than doubled the benchmark with less than half the drawdowns.

While all our strategies play a vital role in the consistency of the portfolio, it's really the Tactical Volatility strategy that gets the most attention. It's only undergone one small change since inception, otherwise it has remained in the portfolio and materially similar for the last 9 years.

January 2012 - February 14th, 2018:

- Used the volatility ETP called XIV for short volatility positions

- Used the volatility ETP called VXX for long volatility positions

- Cash positions whenever signals are ambiguous (~50% of days)

February 15th, 2018 through July 2020:

- Using Long VXX Puts for short volatility positions

- Using Long VXX Calls for long volatility positions

- Cash positions whenever signals are ambiguous (~50% of days)

Why did we make the change?

On February 14th 2018 the old volatility ETP called XIV was terminated due to the volatility spike on February 5th which unfortunately destroyed over 90% of the value of the XIV in the after market rebalancing of the ETF. This forced us to find a new way to represent our short volatility positions

* Note, our signals picked up on the growing risk well ahead of time and we were safely in cash and safety positions in all our VTS strategies so we lost no money at all in the Volpocalypse event. In fact our portfolio was up 0.61% in Feb 18'.

It was also announced at that time that the other -1x inverse volatility ETP called SVXY was also going to be changing. It didn't terminate, but it did reduce its exposure to just -0.5x and it has been a watered down version of its former self ever since.

Why not direct short VXX positions?

I've done a full video breaking down all the advantages of using VXX Put and Call options so instead of extending this article too long, check out that thorough video and it will explain exactly why VXX options are superior to shorting VXX directly:

How have VXX options performed since Feb 2018?

The following chart is showing in green our live trading results for the VTS Tactical Volatility strategy. Since Feb 18' these are the VXX Put and Call options using my stock replacement method.

The black line is showing what the results would have been had we just shorted the VXX outright. Now it doesn't include borrow fees which can be significant, and it also assumes that there was always shares available to short which isn't a guarantee. But for the purposes of this comparison we'll just eliminate all the potential negatives of shorting ETFs directly.

As you can see, they are very close, actually within 5% of each other as of July 31st, 2020. In a nutshell the difference is:

- In good times our VXX Put and Call options may perform worse because we tend to use roughly 0.65 delta options, compared to the direct short VXX position which is the full -1x leverage. Less exposure will mean a lower return for winning trades.

- In bad times our VXX Put and Call options may perform better because our 0.65 delta options are also Vega positive, meaning there is an added buffer of protection that the options increase in value during market crashes. This means the damage in losing positions is mitigated more than the direct short VXX would be.

I prefer VXX Puts and Calls for the drawdown mitigation

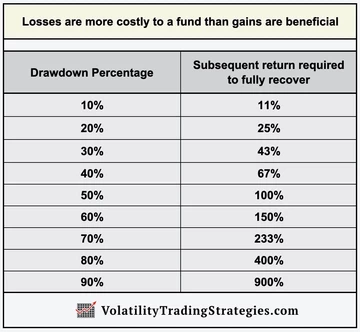

In the long run when viewed over many years, investors that do a better job mitigating damage will come out ahead. It's strictly a function of the math of drawdowns. The larger the drawdown gets, the higher the subsequent rate of return that's required to get back to break even.

Stock replacement through VXX Put and Call options is safer, and in my opinion will lead to a more consistent rate of return. It suits my investing philosophy very well. I know some people aren't familiar with options trading and they shy away from it, but once you get a few trades in you'll realize it's just as easy as any other trades you take.

If you want a refresher course on stock replacement you can check out the 3 part series here:

- Stock Replacement part 1 - Mechanics

- Stock Replacement part 2 - Trade example

- VTS Tactical Volatility strategy

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.