Defensive Rotation Strategy up 50% in 3 months

Sep 23, 2025

VTS Community,

Defensive Rotation Strategy is on fire!

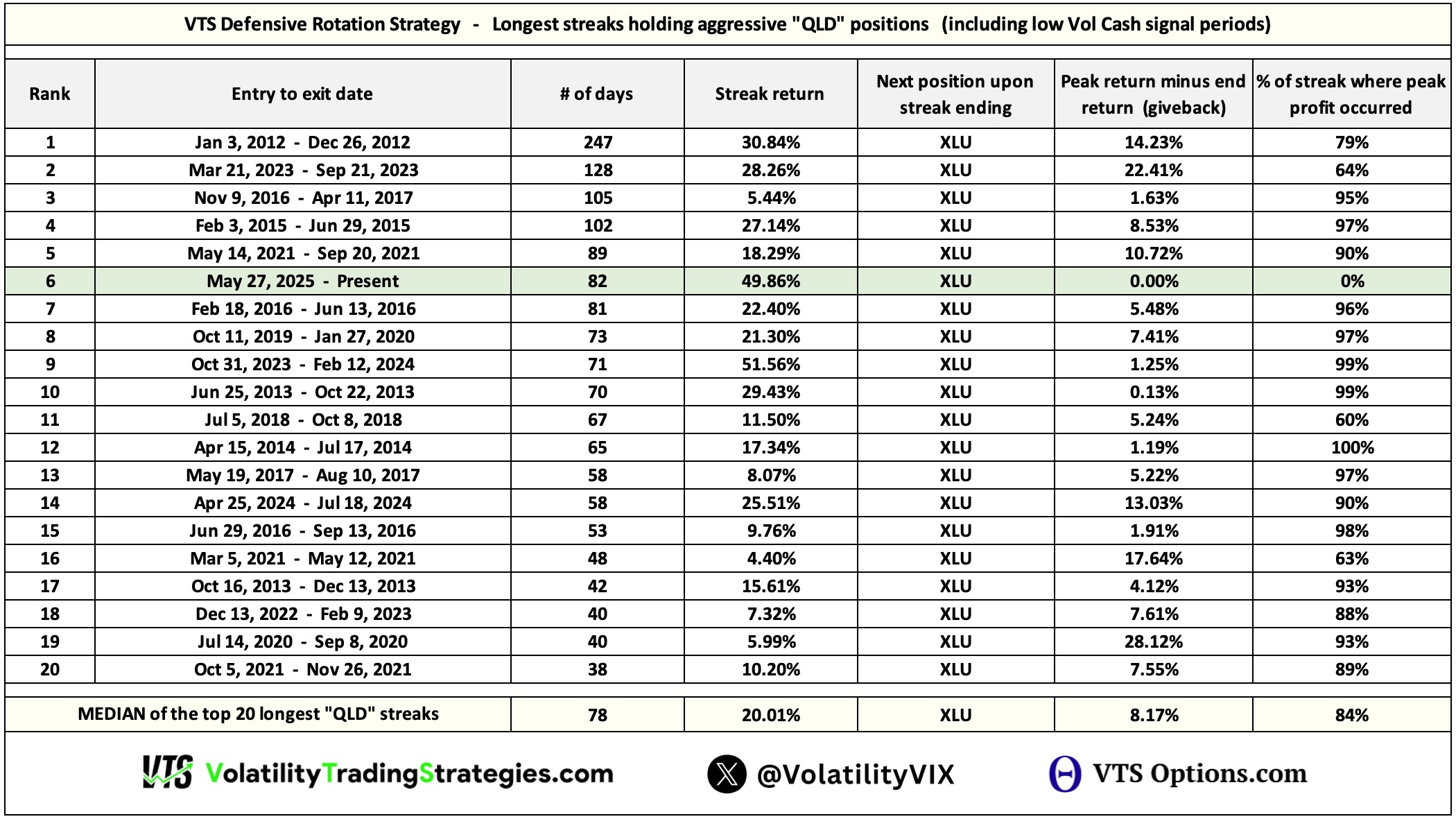

It's been quite a run since our original 2x Nasdaq entry on May 27th, 2025. To get an idea for how fun this run has been historically, here are the top 20 longest streaks with our aggressive QLD positions.

* This also includes our recent "Hysteresis" system of exiting during Volatility Barometer readings below 20%, which actually worked out brilliantly this past 3 months and made us a nice bonus profit, so I've just counted those low Vol ranges as a continuation of the streak. If you need a refresher course on this:

Click here for Hysteresis part 1

Click here for Hysteresis part 2

It's now the 6th longest aggressive streak at 82 days and counting, with a return so far as of yesterday of 49.86%, pretty sweet!

Tactical Rotation "giveback"

If you look to the right at the 2nd to last column in the chart above you'll see the one that says peak return minus end return. With Tactical Rotation through Volatility Targeting style investing, we only exit our QLD position and move to safety when the Volatility Barometer rises over 66%.

It's currently in the QLD range, and we need it to move to XLU to exit:

This does mean that quite often, the market has to go down a little bit in order for us to get that elevated Volatility exit signal to XLU Utilities. I call this the giveback

It's just part of trading, nobody can ever consistently call the tops and bottoms of anything, so the next best solution is relying on Volatility metrics to give us that signal.

Now fortunately, there are times when we actually can top tick it, when Volatility rises without a stock market decline. There is some evidence that we're seeing some of that now, so at least based on early indications it doesn't appear to be a very long trip to an XLU Utilities exit signal. It could actually be pretty smooth when it happens, we'll see.

Sometimes we can get those signals to exit to safety without giving back much of anything

There's also several more in the 4-6% range of giveback, with a long-term average of 8.17%. Given that we're up about 50% right now, it's a pretty comfortable margin but unfortunately there is no way to avoid potential giveback.

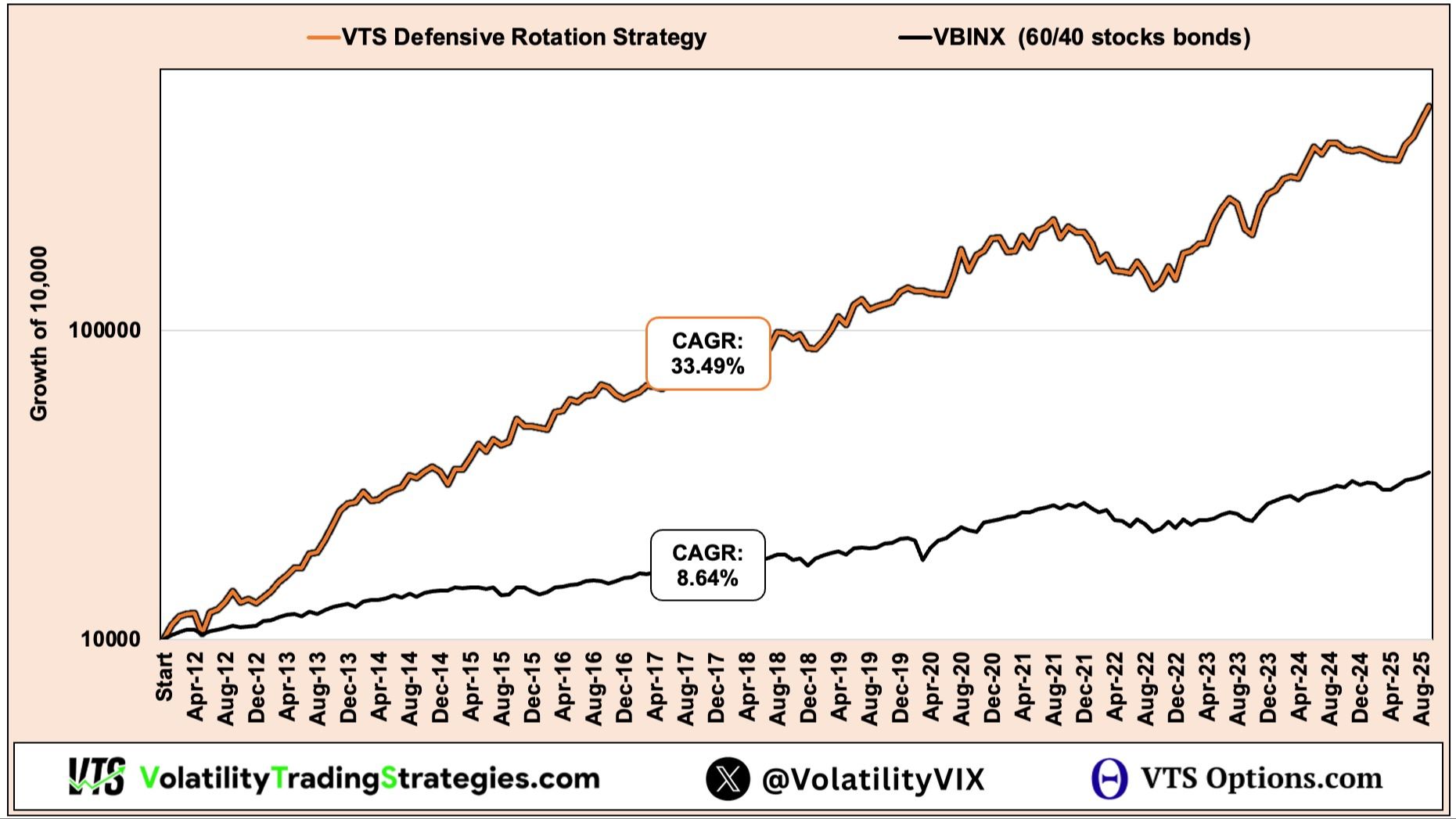

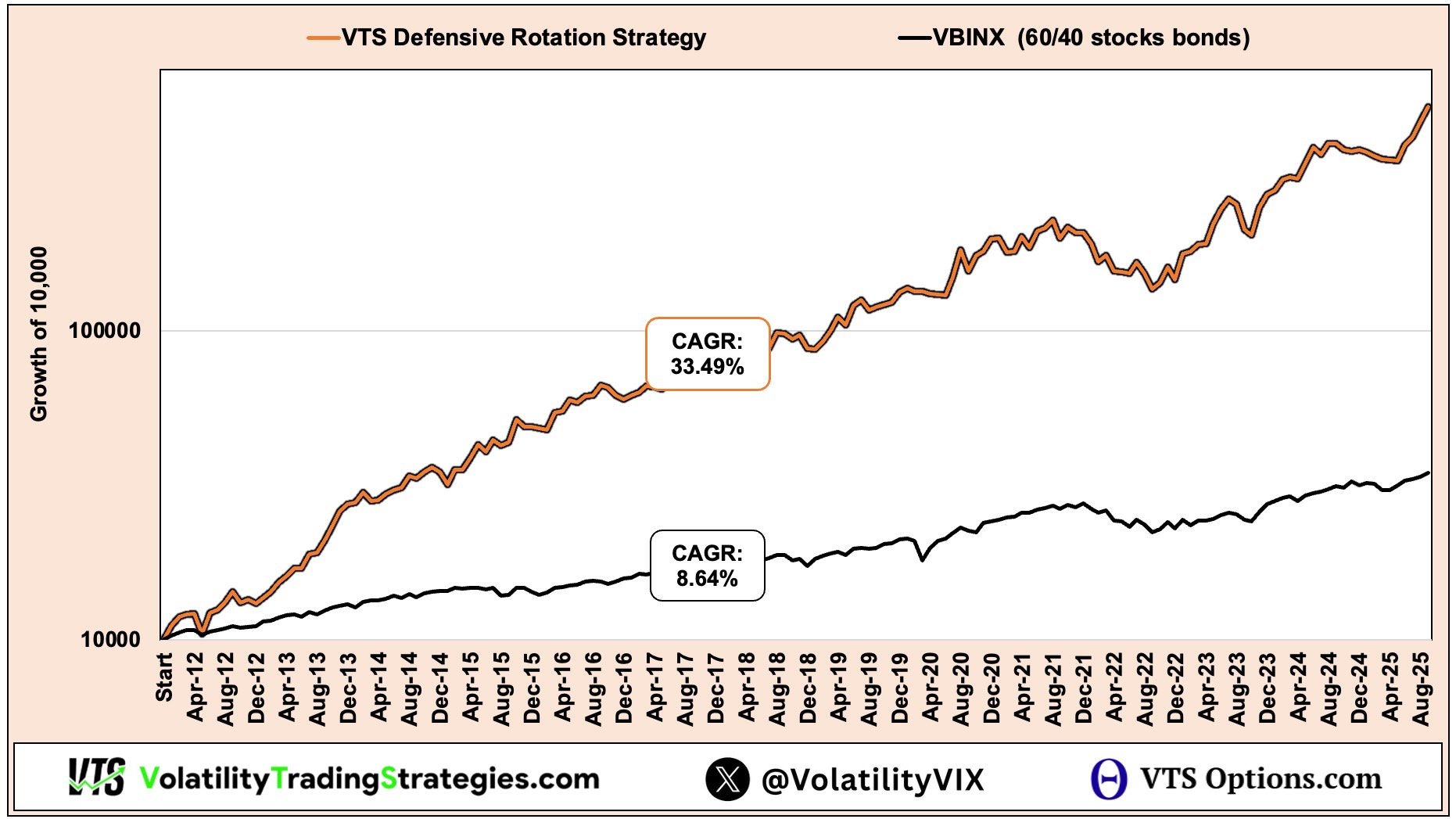

Imagine being a buy & hold investor

This giveback I'm talking about may sound a little unfortunate when you see it, that we are actually expecting to lose a little of our final return when the market turns. You have to remember though, that is infinitely better than giving it all back when the market inevitably crashes in the future.

20-year chart of QLD

Our original buy price on May 27th, 2025 was 105.42. I've marked that price on the chart for clarity with that green line. That TINY little profit run to the right, is our 50% return :)

Now the question is, do people really believe that 105.42, marked by that green line, is going to be the lowest price going forward? It's never going to dip back below that? I don't know about you, but I find that very, VERY hard to believe.

Buy & hold investors just continually ride trends up, then crash back down, ride it back up, crash back down, and long-term they make very slow progress that isn't much better than the inflation rate.

Tactical Rotation can double and triple dip

If you're willing to exit to safety when the market is risky, and you can side step some of those inevitable corrections, it means we can make profit twice, or sometimes even three times through the same price range.

It could easily happen that the market takes a dip, we exit to safety, lock in a massive profit, and then we'll have another opportunity to get back into QLD at around the same price we originally bought it at back in May.

All three of our tactical strategies have experienced this double and triple dipping numerous times in their history. That's not the only reason for the killer return, but that's definitely a big one.

Make money on trends when they are available, and get the heck out of the market when it's crashing. Rinse repeat

Parabolic! But we have to be ready to move to safety...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.