Tactical Volatility on hold, Aggressive Vol will take the lead

Jan 07, 2022VTS Community,

As we've talked about throughout this week, there are very few functional changes to the portfolio to start 2022. Most of what I've done are just visual changes to simplify the daily email. We talked about the change in allocations, so today let's finish off the discussion with the only other structural change worth mentioning:

The Tactical Volatility strategy will be put on hold until we see overall market volatility return to lower levels.

As I've talked about in the past, I'm not an overly creative person, I'm more analytical and math based. So when it came to naming the three volatility strategies back in 2012 here's what I went with:

* Note, these are the original allocations from many years ago. They have changed since then as I will explain, but again, this is just a picture from a very old video to illustrate the point below.

Tactical Volatility - Intended to be the main strategy and for the first 6 years it was using the old XIV. We switched to using VXX Put options when the XIV was terminated in the February 2018 Volpocalyse event. Just a note since people will email me when I mention that, we were in fact 100% in cash and took no losses in Feb 2018. It just meant we had to switch our method a little bit and now we use long dated long VXX Put Options.

Conservative Vol - Used the old ZIV / VXZ combo because M4-M7 VIX futures move slower than the old XIV, which is what made the strategy more conservative. I told you, I'm not very creative :) With the ZIV now delisted by Credit Suisse I'm not sure this strategy will ever return. It's a shame, I really liked the old ZIV.

Aggressive Vol - Uses the SVXY to represent short volatility, which again for the first 6 years was a -1.0x inverse volatility product structurally identical to the XIV. It was deleveraged in February 2018 to -0.5x and we now use the deleveraged SVXY. If and when new products get launched we'll certainly give them some consideration but SVXY works well.

That does beg the question though, if the old XIV and SVXY were structurally identical, what makes the Aggressive Vol strategy "aggressive?"

Well it's not the position it holds. Currently our VXX Put options in Tactical Volatility are roughly the same Delta factor as the 0.5x SVXY, so they are again very similarly leveraged positions.

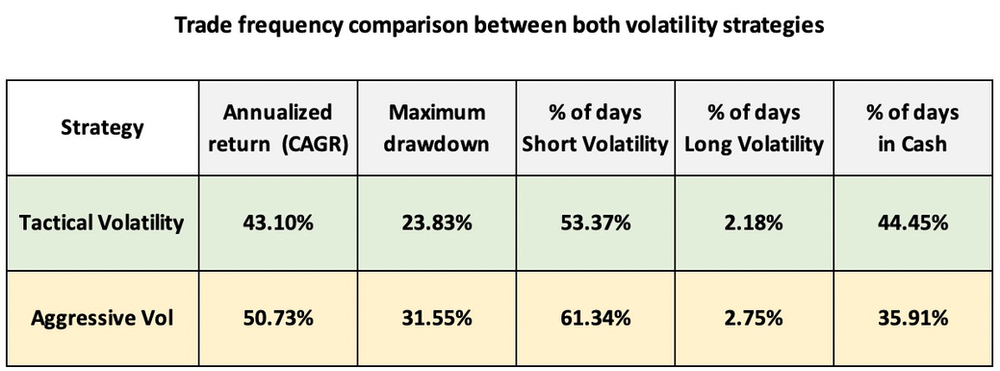

It's actually the increased trade frequency which makes me consider that strategy to be more aggressive. As you can see in the table below, there's about a 10% difference in how often each strategy takes trades:

- Tactical Volatility is designed to ride the short volatility trends, but exit to cash quicker when volatility is elevated to potentially reduce drawdowns. On the long volatility side it also enters those trades a little slower.

- Aggressive Vol is designed to stay in trades a little longer and also get into new trades a little sooner. As a result, the absolute long-term performance (CAGR) has been higher, but that does come with increased drawdowns as with the maximum being about 8% higher. There's that risk/reward trade off again right. Tough equation to beat...

* I should mention here as well with respect to those CAGR numbers, remember I did make the discretionary decision to remain in cash during the early stages of the pandemic. We don't relitigate the past, but if you're interested in seeing what the true tail risk portion of the strategies are supposed to look like, you can check out this article here (Tactical Volatility through the pandemic)

Why is Tactical Volatility on hold then?

Simply put, the changes that I would make to the Tactical Volatility strategy to start 2022 would be to increase the trade frequency about 10%. Essentially that lands it squarely in the range of the already existing Aggressive Vol strategy. At least for the short-term future, one of them is now redundant.

"Short Vol" strategies rely on longer term trends for their outperformance. The truth is it's impossible to avoid single day volatility spikes that come out of nowhere, there are no signals that see those ahead of time. One day the market is totally normal, and then after a gap down in the overnight session the next day can be a rough one. It's unavoidable.

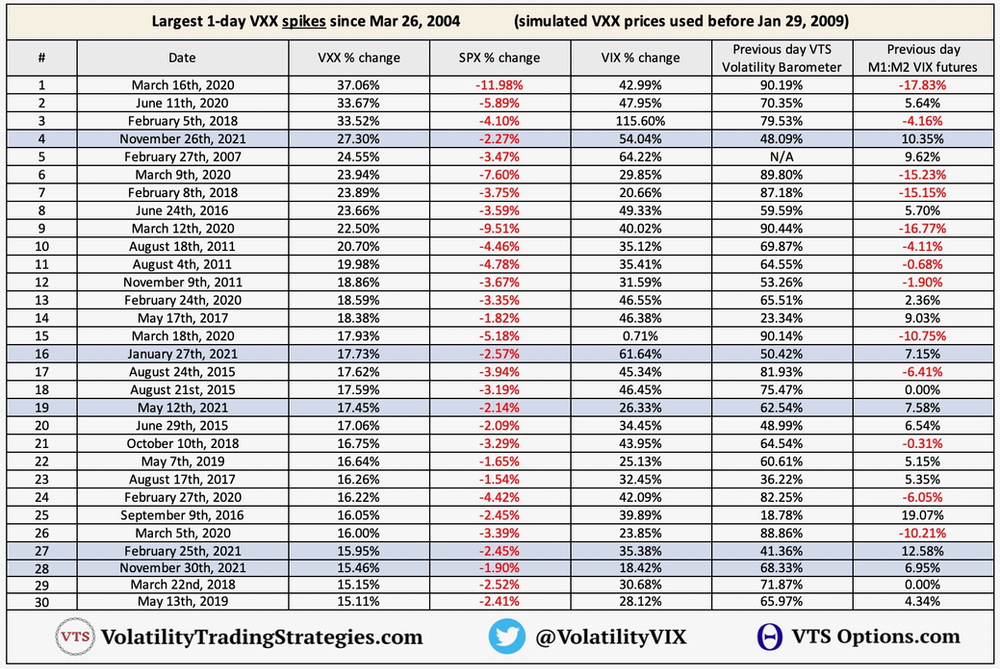

2021 had 5 of the largest VXX spikes in history, and all 5 of them came when the previous days volatility metrics were stable. It was just one of those years with a lot of surprise spikes:

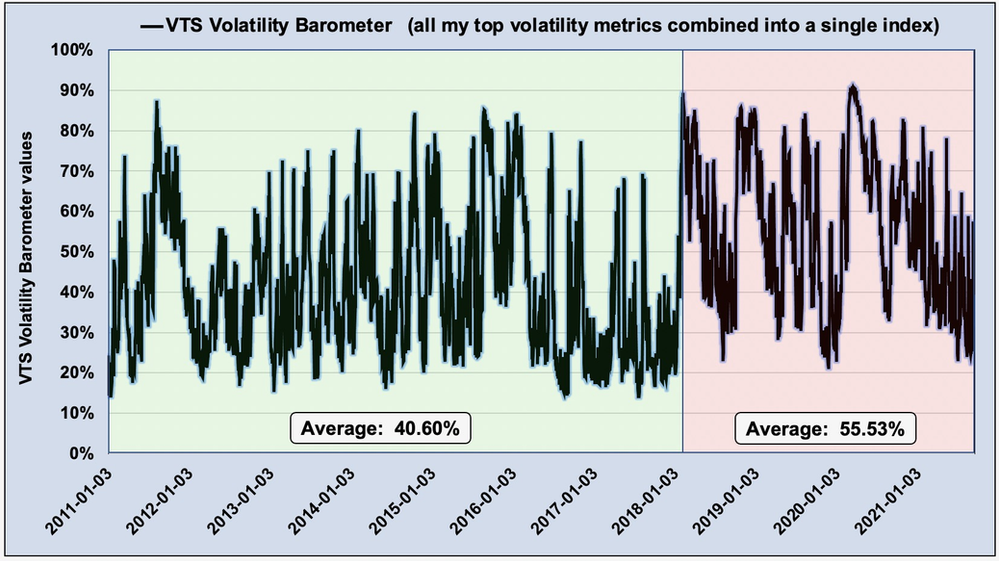

So if some volatility spikes are unavoidable, that means short volatility strategies rely on the good performance of longer term trends to balance that risk reward equation. But that's the problem isn't it? In recent years those stable trends have been much less frequent, and much shorter lived in duration. There's just as many (if not more) volatility spikes, but there's far fewer stable trends.

We are clearly in a higher volatility regime since February 2018:

So there's two considerations to potentially improve performance:

1) Reduce the trade frequency even further, to try to cut out even more of those unexpected volatility spikes we've been seeing in the last few years. The big problem here is, in this higher volatility regime with far fewer the lower volatility trends to ride out, what would end up happening is you're just further reducing your profit periods. It's probably true just based on statistical probability that the trader would avoid a few more of the unexpected volatility spikes. However, I personally believe the reduction in good periods would be even more costly and reduce overall performance.

2) Increase the trade frequency, to allow for some longer profit periods when volatility is declining from those higher levels. For lack of a better term, we are in a "buy the dip" environment where there is relatively high conviction that the market will recover shortly after trouble arises. So while there aren't many low volatility trends to speak of these days, there are some opportunities there in the higher volatility bands.

If low volatility trends were more prevalent like they were from 2011 - 2017 then there's no question I would select the first option from above. I would reduce the trade frequency to eliminate more of the unexpected spikes, but we'd still have plenty of good periods to take outsized profit.

Given that we're no longer in the golden years pre-2018, the best course of action to try to increase performance would be to increase trade frequency. Now I'm always on the conservative side of things and I would never increase frequency to the point where the strategy is expected to be riding drawdowns deep into the negative. We will still be getting out of trades as volatility is rising.

* The Aggressive Vol strategy still holds cash 36% of the time

However, my solution to the recent problem of lack of low volatility trends would be to increase the trade frequency of the Tactical Volatility strategy by about 10%. Again, that means it's redundant now because it would be virtually the same as the Aggressive Vol.

Instead of changing Tactical Volatility and removing Aggressive Vol, it's just more efficient to leave Tactical Volatility as it is and just put it on hold. Aggressive Vol strategy will still give you the choice to use the SVXY, or the long dated VXX Put options, whichever you prefer.

I have no doubt Tactical Volatility will make a triumphant return in the future, but I will have to wait until I see evidence that some lower volatility trends are possible. Right now there seems to be a pretty strong floor in volatility. Until that breaks, we'll just proceed forward with a single volatility strategy that has a 10% allocation in the VTS Total Portfolio.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.