Growth vs Value Correlation is alarmingly low

Sep 01, 2021VTS Community,

Growth vs Value correlation is at extreme lows:

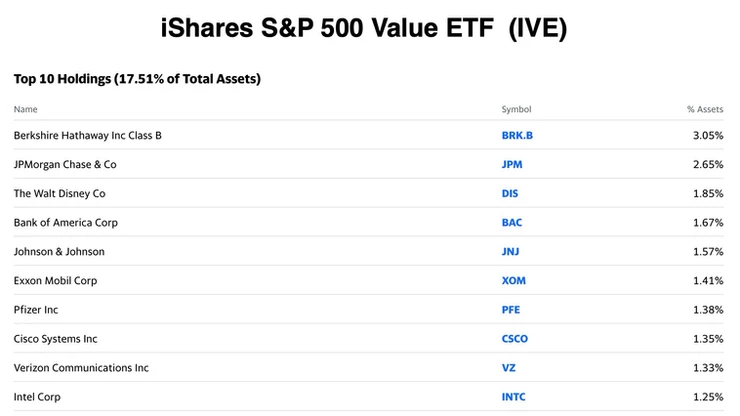

When trying to gauge the pulse of market participants and potential risk appetite, one thing I like to keep an eye on is the relative performance and correlation between S&P 500 growth and value. Long-term the performance is similar, but how they get there is a little different. Growth will typically outperform when investors are chasing yield, and Value performs well when investors are seeking more safety. For a better idea of why that is, we can look at the top 10 holdings of each ETF:

The Growth ETF (IVW) is clearly quite tech heavy with large holdings in all the usual suspects of high flying momentum names. Apple, Google, Tesla, etc

The Value ETF (IVE) on the other hand not only has a much more even distribution of allocation size, but the holdings themselves are considered lower beta stocks. Berkshire Hathaway, Johnson and Johnson, not overly exciting names but ones that have stood the test of time.

Since those iShares ETFs launched in 2000 and not quite long enough to get a glimpse of before the dot.com bust, I also track the data for the Wilshire Large-Cap Growth and Value indexes.

Wilshire Growth vs Value since 1999:

Like I said they both perform about the same long-term, but the times they do better is more what we're looking at. As I always say, losses are more costly to a fund than gains are beneficial and we can see that in the chart. The larger drawdowns of the Growth ETF have hurt it's long-term performance a lot.

In the run up to the dot.com bust we can see that Growth significantly outperformed Value, and then collapsed pretty hard in the 2000 crash and throughout the recession.

Notice Growth is once again accelerating? Is that a red flag?

Correlation breakdown?

Another rather alarming way of looking at this Growth vs Value relationship is with a rolling 1-year correlation. Remember correlation is a comparison of how two assets move in relation to each other. Not in magnitude, but in direction.

- A high correlation approaching 100% would mean when one of them goes up, the other one goes up as well, or vice versa, both going down together. A lower correlation would mean the relationship is weak and they often diverge in direction to each other.

For the past 31 years the correlation between Growth and Value has been 89%. So where are we now?

Not since the dot.com bust days have we seen a disconnect like this. Clearly investors have a high risk appetite and that Growth ETF has seriously dislocated from the Value names.

There are no absolutes in the investing world so the best we can do is look for mathematical probabilities, tendencies, red flags etc. This stark disconnect in the last one year between Growth and Value is absolutely something to pay attention to. When investors get too excited and too focused on chasing high yield, that would be a time to make sure you have a plan in place ahead of time for when this all unravels. It may not happen today, or even this year or next, but what goes up must come down. The next financial crisis may be quite spectacular.

Our tactical VTS strategies can stay fully invested as long as the good times roll on, but they're always ready to move to safety when necessary. Nothing wrong with taking a page out of Jason Bourne's playbook and keep our backs to the wall with full awareness of where the exits are. Never know when we have to make a quick break for the door!

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.