VTS Discretionary Options strategy - Closing summary

Jul 06, 2019VTS Community,

I've gone over this in several blogs already so I'm sure most of you are fully aware, but in case there's a few that aren't, the VTS Discretionary Options strategy has now officially been removed from Volatility Trading Strategies. The only options content that remains is within the Tactical Volatility strategy and the use of VXX puts and calls to represent those positions. That will continue as it is in my opinion the best way to execute short and long volatility positions.

My new dedicated service through T3live.com called Options 360 has launched.

This will allow me to be far more active than I was able to be before as well as teach a wider variety of trade types. I believe it's going to be a much better service and everybody will learn a lot more about the wonderful world of options trading. I hope you all join me there!

I'd like to do a final wrap up of the VTS Discretionary Options strategy and highlight some of the obvious strengths of options trading for those of you on the fence as to whether to pursue this skill or not.

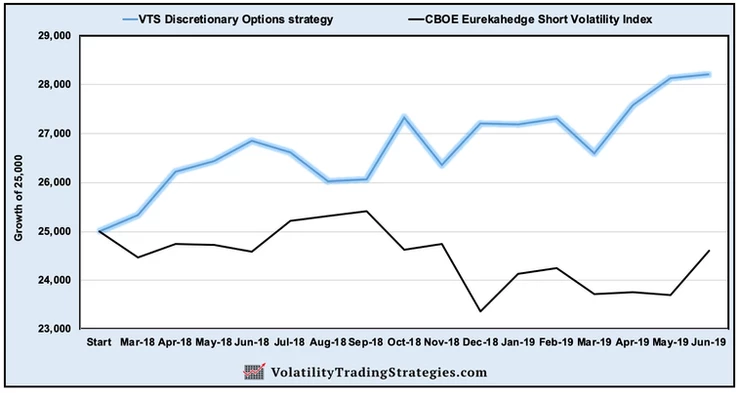

For the 16 months that the Discretionary Options strategy was active, it was one of the most volatile periods for the stock market since the financial crisis in 2008. There was the big -20.2% crash in the 4th quarter of 2018 to contend with as well as the -7.6% correction just a month ago, along with a couple periods of strong recovery as well. Extreme volatility on both sides, but not much actual progress made on the S&P level.

While it certainly wasn't the best environment for maximum profit, I'm actually thankful for this period because it highlighted several major advantages to options trading:

1) The potential to profit in non trending markets

Without options trading, market participants are stuck in the binary world of up vs down. If markets are without trend and go nowhere they make nothing. Options trading introduces the potential to profit from sideways action by structuring Delta neutral Theta positive positions. Iron condors, calendars, straddles, strangles, diagonals, butterflies, there's many ways to structure an options trade to make a profit even if the underlying market goes no where. This can be a nice added boost to a portfolio that is otherwise not making any forward progress.

2) Reduced correlation to the S&P 500

As the old saying goes, "everybody is a genius in a bull market." Since most asset classes in the world are strongly correlated to the S&P 500, the truth is when stocks are rising it gives a lot of people the false impression that they are effective investors when in fact it's simply due to the overall rise in asset values.

But when that changes and stocks start to go down, the vast majority of fund managers find out the hard way they weren't actually providing any alpha. They were just the lucky beneficiary's of a rising stock market, and when that ends they have no effective way to maintain the portfolio.

But with options trading, we don't actually require the markets to perpetually go up to make profit. In the past I was purely a derivatives trader, and 2007/08 were some of my best years. I'm not afraid of a repeat of 2008. In fact, aside from the fact that I know most investors will be greatly harmed by another financial crisis which will be very painful to watch happen, as an options trader I'm not personally worried about my own portfolio. There's plenty of ways to maintain stability despite markets crashing.

3) Multiple potential profit factors.

As I mentioned, with the standard investing that most people take part in it's a very binary situation. Up or down, long or short, that's pretty much the extent of it. But with options trading we not only have that, but we add two other elements to the equation as well. Time and volatility.

While it does make it more complicated and adds a larger barrier to entry, the experienced options trader has three dimensions to potentially profit from rather than just the singular dimension of price which is a huge advantage.

- Sometimes the only thing we are certain of is the time frame. If there's a major event on the horizon for example, sometimes we don't know what direction stocks will move or why, but we do know that something will happen on a specific date. Being able to structure trades to take advantage of this time factor can be a game changer.

- Likewise, sometimes price and future value are ambiguous, but volatility levels are more clear. Without the tools to target volatility specifically the opportunity just passes by. Options trading allows us to remove price from the equation and strictly target volatility.

Due to the fact that I didn't want to overload VTS with options content, I kept the allocations very light. I typically am only in the 10-20% range of cash holdings with my options portfolio mostly allocated to trades. But for the 16 months of the VTS Discretionary strategy, my cash holdings averaged 61%. This is very high, more than double my usual amount.

So technically the return could have been at least double what it was if not more if higher allocations were made. The new Options 360 service that has launched will be more active.

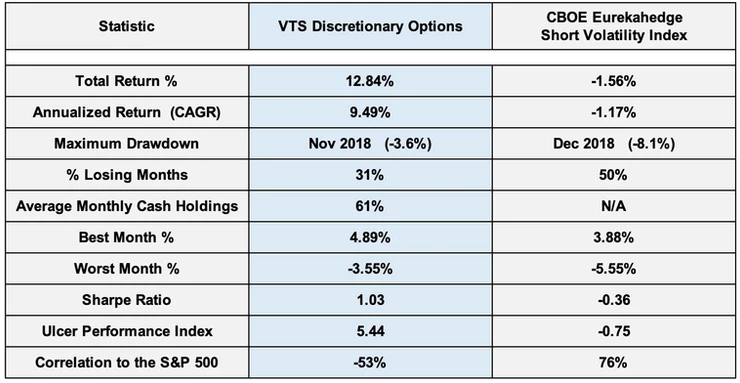

Aside from the much lower trade allocations though, otherwise I have no complaints. The rate of return was decent, would have been great with higher allocations, the drawdowns were very small considering how volatile the overall market was, and correlation to the S&P 500 was strongly negative which is a hugely under-appreciated statistic.

In the investing world it's very difficult to find profitable asset classes and strategies that are negatively correlated to stocks, but options trading allows that. The goal is to be able to profit regardless of what the overall market is going. Up down or sideways, there are ways to structure profitable trades.

The VTS Discretionary Options strategy returned much more than the S&P 500 over that same period, with only 1/6th the drawdown.

You all know that's my investing philosophy. Consistency and long term profitability through different market environments. If you've watched my 5 part series on risk adjusted return you'll appreciate those statistics in the above table. From a risk adjusted perspective they are all very strong. The strategy did its job nicely.

- Part 1) The Sharpe ratio 1.03

- Part 2) The Ulcer Index 5.44

- Part 3) Maximum drawdown -3.6%

- Part 4) Correlation to the S&P 500 -53%

- Part 5, putting them all together

So hopefully everyone is ready for the next level. Options 360 will ramp everything up a few notches, I hope you're on board.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.