Here's why I use GLD Gold instead of short S&P for my bearish positions

May 09, 2019VTS Community,

I've got two great questions here from VTS members that have come up a lot here in the last few days with all this market turmoil:

1) "For the VTS Tactical Balanced Strategy, I don't understand why you don't use an inverse S&P 500 ETF instead of gold. Wouldn't it be better in a market crash?"

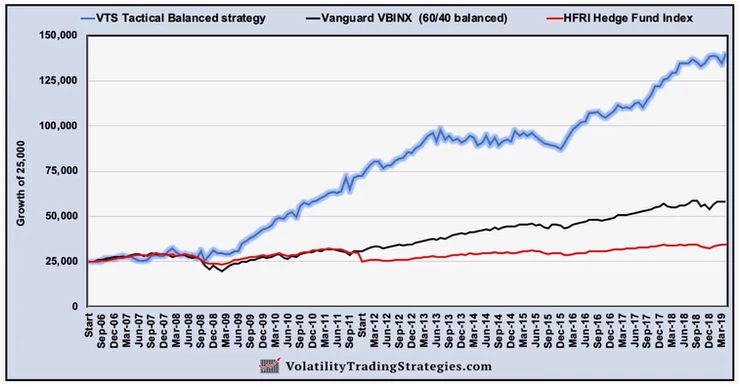

Remember my Tactical Balanced Strategy rotates between stocks in stable low volatility periods and either bonds or gold in times of elevated volatility. Now those gold positions don't flash very often, roughly 15% of the time depending on the type of market environment, but they are vital in stabilizing things during down periods in the market. The only way to produce the kind of performance I have is to focus very heavily on risk management, and how to timely exit stocks and into safer assets.

The strategy has done very well, but I can certainly understand why using short S&P would seem to make more sense. After all, when stocks are crashing it would seem the most direct way to profit from that would be a simple inverse S&P 500 product, maybe something like SH (Proshares Short S&P 500 ETF)

And granted in a recession the odds of inverse S&P 500 outperforming gold is quite high, but the problem is, what happens when the markets don't completely crash? What happens if it's just a series of shorter corrections within the context of a bull market like we've seen for the past 10 years since 2009?

As we've seen time and again in the 121 months and counting since the last bottom in 2009, markets do "bounce" quite strongly from pull backs and corrections, and an inverse S&P 500 product will feel 100% of that loss.

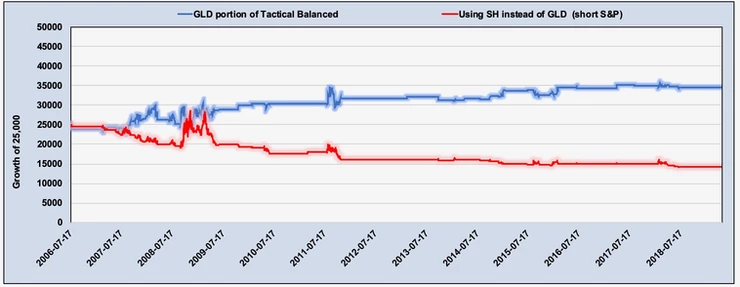

Gold on the other hand isn't that highly correlated to stocks, so when markets bounce and the inverse S&P 500 product gets crushed, gold doesn't necessarily, and sometimes gold even experiences gains as well. This means gold is actually a much better choice for the low end of the strategy. Here's showing just that low end of positions, either GLD or SH for inverse S&P.

* Remember this is only the bottom 15% or so portion of trading days, the rest are just showing cash for when the strategy was in IEF Bonds or MDY Stocks.

That's substantially worse, but why is this happening? In the context of a 10 year bull market, there will be pull backs and corrections along the way, but few and far between and for the most part they will be shallow.

If you short stocks every time there's weakness, you'll end up getting into inverse stock positions just as the markets are ready to bounce and recover.

That's a recipe for disaster, and a constant 10 year run of bleeding capital. Sure in a big recession it makes a huge profit and it's high fives all around. But what about the other 10 years? Investors in general usually underestimate how difficult it is to outperform in good times AND bad. On one side or the other it's easy.

- If markets are raging higher you just ignore risk management and buy stocks with both hands, you're a hero.

- In bear markets, clearly you just short stocks and laugh all the way to the bank.

But in the real world, long term profitable traders need strategies that can work on both sides at once, without requiring market predictions and a crystal ball to succeed because of course none of us know what's coming tomorrow. it's much harder than it sounds, which is why the majority of investors (and the majority of fund managers) won't beat index funds in the long run.

2) "How far do you think markets will crash if there is no trade deal?"

From my blog yesterday, I'm my opinion, opinions don't matter, we have to separate what I think will happen from what I'm going to do. So first, as always I am just going to trust the volatility metrics will inform me of the right trades within a reasonable amount of time. But I don't mind offering my opinion when asked.

The issue here is, it's hard to even have an opinion because we have the classic double unknown that I talk about a lot. It happens during binary events like these trade talks. It happens when governments have deadlines like debt ceilings or bills passing. And it also happens during every single earnings report out there.

The double unknown

- The first unknown is the outcome of the event itself. Nobody can know whether these trades talks are going to be successful or not. I wish I did, but honestly, there is so much misdirection and false reports floating out there that I don't think anybody could reasonably represent that they actually know with any confidence.

- The second unknown is that once the outcome is announced, we still don't know how the markets will take the news. It would be easy if we said, if it fails markets will crash and if it succeeds the markets will recover, but is that true? There's plenty of times when the opposite happens. Seemingly good news gets sold, and bad news gets bought. Just like with earnings season. Sometimes bad reports result in the stock shooting up. Sometimes great reports are sold off hard. There's often times no rhyme or reason to it.

In a perfect world we'd have accurate reliable information to base our estimates of success and failure on for these events, and we'd subsequently buy good news and sell bad news. Sadly, we're far from that ideal world. In our reality, we have no idea what's really going on behind the scenes, and even if we did it wouldn't matter because we have no idea how the big players are going to respond to it when it's known.

These China trade talks and this deadline is the classic double unknown situation. So in my mind the only strategy that makes sense is to keep my head down, and the only information I'm going to act on is what the actual data and signals tell me. This time around, they had me positions very conservatively since Monday and nothing has changed since. They're still saying caution is warranted here.

If the talks go well and there is some resolution, and the markets take it well and push higher, then I would imagine the volatility metrics will have me out of my more bearish GLD and VXZ positions very quickly. No harm no foul. They are just there to protect against and potentially profit from the larger 10%+ crashes. And of course at some point in the future, perhaps a 40%+ recession. But the data makes the decisions...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.