Why move from Stocks to Bonds in Low Volatility? - Defensive Rotation VGLT vs QQQ

Jul 13, 2021VTS Community,

Today I'd like to preemptively answer an important question that I suspect might start coming up soon in my email inbox. Now that will depend on whether the markets continue to cooperate, but the question I'm anticipating having to answer soon is:

Question: Why does the VTS Defensive Rotation strategy move to VGLT Bonds when volatility is low?

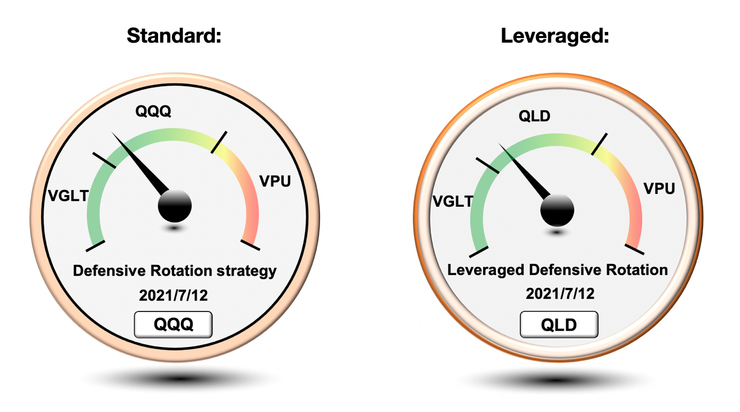

Great question my hypothetical friend :) So remember, the Defensive Rotation and the Leveraged Defensive Rotation both will move to VGLT Bonds in low volatility environments. We don't leverage our safety positions so both of the strategies will move to the same VGLT position when that happens.

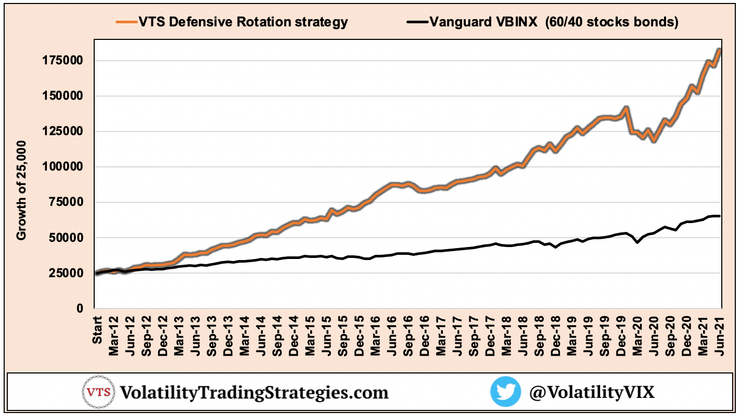

VTS Defensive Rotation strategy:

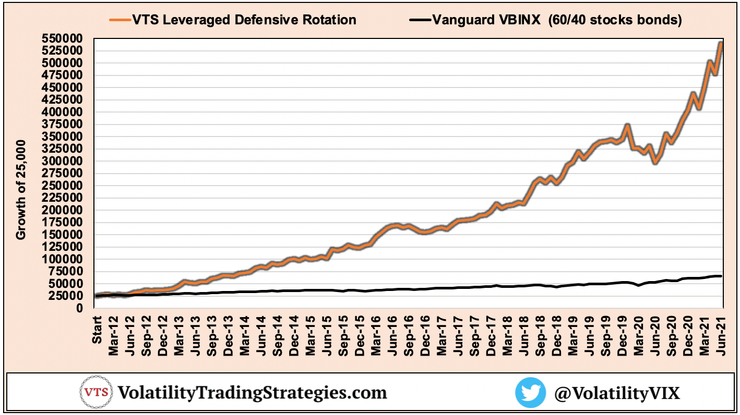

VTS Leveraged Defensive Rotation:

Trade dials showing ETP positions based on volatility levels:

There's two main reasons why this strategy moves to VGLT Bonds during lower volatility environments:

Reason 1) Diversification. When volatility is low, we will already have the Tactical Balanced strategy allocated to MDY Stocks, and we will also have at least one but as many as all three of the volatility strategies allocated to short volatility. The Aggressive Vol strategy definitely will be, and VB Threshold and Tactical Volatility don't move out of short volatility until more extreme low volatility levels so they will likely be short volatility as well. Essentially we will already have enough equities and short volatility exposure within the portfolio.

* Defensive Rotation will rotate into VGLT bonds to add diversification to the overall Total Portfolio Solution.

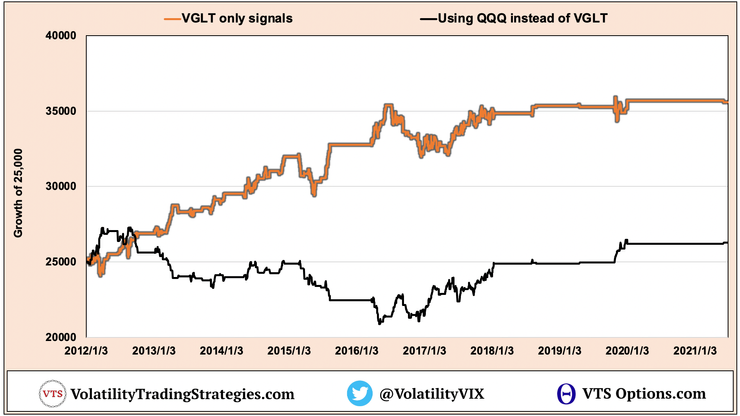

Reason 2) Better performance. This may come as a surprise to many of you, but the performance of VGLT Bonds is actually better than QQQ Stocks in the lower volatility environments. If we isolate the performance of just the VGLT signals within the Defensive strategy, I can easily compare that to how QQQ would have performed if it was the ETP holding of choice instead.

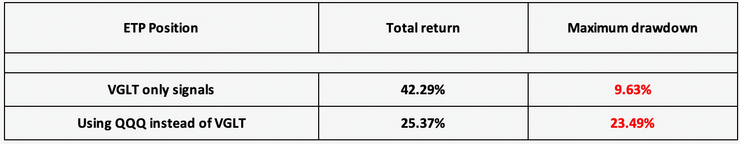

Actual VGLT only signals vs holding QQQ instead of VGLT:

- The orange line shows the VGLT only signals within the Defensive Rotation and Leveraged Defensive Rotation strategies. Even though these signals don't flag that often, we can see that when they do the performance has been quite consistent. With a drawdown of less than 10%, this is what a good safety position should look like. It's a nice bonus that we've had a solid performance boost as well from these when we hold them, but it's really that low drawdown number I'm more interested in.

- The black line shows what it would look like had the strategy used QQQ for those signals instead. Now it's not terrible and mathematically it would still have been beneficial to hold QQQ during those lower volatility ranges, but it's quite clearly more volatile. The maximum drawdown would have been quite a bit higher at 23.49% which does deviate a little too far from what I consider "safety"

* Defensive Rotation will rotate into VGLT bonds to increase performance by reducing the drawdowns in lower volatility regimes.

Why does QQQ stop working as well in low volatility?

The easiest explanation is just market exhaustion. Like I said these signals don't flag that often and it actually takes a pretty long period of stability before we see volatility drop that low. We can see this lower frequency when we look at the VTS Volatility Barometer.

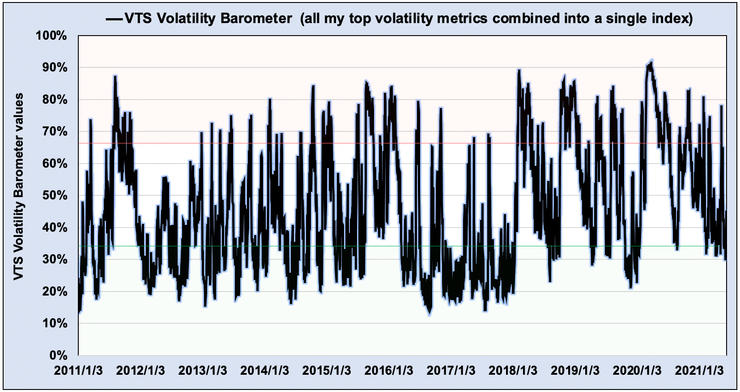

VTS Volatility Barometer since inception in Jan 2011:

From 2011 to 2017 it was more common of course as that period was a lower volatility regime, but even then the trips below 30% on the Volatility Barometer didn't last very long. Since the regime change in February 2018 trips below 30% have been very few and far between.

Since nothing goes up or down forever it is just basic trader psychology that when stocks rise consistently for such a long period and volatility enters those extreme lows, more and more market participants start to doubt the sustainability of the run.

It's not always the case, but quite often these periods of extreme low volatility coincide with intermediate market tops.

That doesn't mean the market will crash of course because low volatility begets lower volatility and things could just remain fairly stable for a while. As the old saying goes, markets can remain irrational longer than you can remain solvent. I'm not at all suggesting these low volatility periods are the time to start betting on a market crash because that's not typically how it works.

However, it may mean that actual gains in the broad stock market indexes like QQQ will be harder to come by. As we can see from the comparison above, exiting stocks and moving to bonds during these low volatility ranges has acted as a solid safety position by improving both absolute performance and reducing drawdowns.

In summary there is both a portfolio construction reason and a quantifiable performance reason for moving to VGLT Bonds in lower volatility environments:

1) Improves diversification within our family of tactical rotation strategies in the Total Portfolio Solution.

2) Improves performance of the Defensive Rotation strategy itself by increasing absolute return and reducing drawdowns.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.