Volatility Metric: VVIX

Jul 23, 2019VTS Community,

With just a quick glance at my website it will be obvious that I am obsessed with volatility markets. You won't find any technical analysis or chart patterns in my work. You won't see me talking about fundamentals like discounted cash flow models or price to earnings ratios. Everything I do is from a volatility perspective. I believe proper analysis of volatility metrics is the most accurate and effective way to trade and my track record reflects that. Beyond that though, there happens to be another huge advantage here as well:

The volatility space is very complicated and few people understand the mechanics of how it all works.

Why is that important to me? Well, because it means there's huge opportunity for those of us that take the time to unpack it all right?

The harder something is and the fewer people that understand it, the more opportunity there is for those that do.

That's why I spend so much time educating the VTS community about these complex volatility markets. The more you understand them, the more efficient your trading will be. Now of course some people may choose to simply follow my strategy signals knowing they are based on a solid understanding of the volatility complex and not dive any deeper than that which is completely fine. But if you want to go further, I help people do that as well. Hang in there, keep learning, and the payoff will be a true edge over your competition!

VTS Volatility Dashboard metric #13 - VVIX

The VIX index is a broad measure of market volatility, calculated based off a strip of 30-day at and out of the money S&P 500 options. So the VIX index represents the markets expectation of forward volatility of the S&P 500. But "volatility" is essentially just variance or deviation, so the VIX index itself has volatility as well right?

Volatility of the VIX index is represented by the VVIX

It's calculated using the same methodology as the VIX, except it's on VIX options rather than SPX options. It is essentially the volatility of volatility (volatility of VIX --> VVIX)

-

The VIX is calculated from S&P 500 options

-

The VVIX is calculated from VIX options

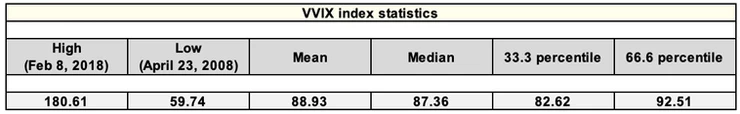

With a long term average of about 89, we can see that a VVIX reading below about 82.50 is in its lower 1/3 of long term values, and above 92.50 is in the top 1/3 of long-term values.

The relationship between all the various volatility instruments can definitely be confusing, and this is where we really start going down the volatility rabbit hole.

-

SPX options drive the VIX

-

The VIX drives VIX futures

-

VIX futures drive VIX options

-

VIX options drive VVIX

Derivatives of derivatives of derivatives etc. Then we add volatility ETPs as well which are also derivatives of the VIX futures market and it's no wonder most people give up trying to understand it all. Yet unfortunately, many don't give up actually trading the instruments anyway, even when they don't understand them. I hope I don't have to explain why that's ill-advised.

Practical applications of the VVIX:

There's several and I encourage everyone to try to find their own methods of implementing it in their trade decisions. For me, it's generally as an options trading tool.

Once a trader understands the basics of the options market and learns a few of the standard trade types, from there the biggest improvement in their long-term rate of return comes through increased efficiency. That includes things like reducing trade fees, having a trading plan, following trading rules, implementing proper position sizing, utilizing efficient stop-losses, and many more.

The VVIX itself can help us improve efficiency in two other categories as well:

1) Which underlying to trade.

While I do a healthy amount of trading on individual stocks and ETFs as well, I'd estimate at least 50% of my options trading takes place on either the S&P 500 or the VIX options market. The VVIX can be useful in deciding which one offers the better opportunity depending on what I'm trying to achieve.

-

If the percentile rank of the VVIX is greater than the percentile rank of the VIX, that may indicate that VIX options have the richer options premiums.

-

If the percentile rank of the VVIX is less than the percentile rank of the VIX, that may indicate that S&P 500 options have the richer options premiums.

The VIX has been around a lot longer than the VVIX, but in order to have an apples to apples comparison I have to calculate percentile rank starting on the same date. VVIX values go back to Jan 1, 2007 so I need to start everything on that date.

So as an example, since VVIX is relatively high right now compared to the VIX, options premiums may be richer on the VIX itself. So if I was looking for a net short trade I may be better off doing that with VIX options. If I wanted to be net long, SPX options may be cheaper.

* And to take it a step further, if I did want to be net long and use SPX options, recall from the VIX - VOLI residual metric that since VOLI is quite a bit lower than the VIX, I may be better off buying premium at the money on the SPX since that's where it's the lowest right now.

2) What volatility bias to take.

If I've already decided on trading VIX options, then VVIX can assist in deciding what volatility bias to take.

-

If VVIX is relatively high, all other things being equal that may indicate rich VIX options premiums, making it more advantageous to take net short vega trades.

-

If VVIX is relatively low, all other things being equal that may indicate cheap VIX options premiums, making it more advantageous to take net long vega trades.

Conclusion:

VVIX can also help guide some decisions with respect to volatility ETP trading, however I definitely want to focus on dedicated articles for those at a later date. Today was about introducing the VVIX as another cog in the overall volatility wheel.

I realize this stuff gets confusing, but after the VTS Volatility Dashboard is filled out, I can then circle back and start expanding the explanations of each of the metrics. Some are more important than others, but I wouldn't ever introduce a metric if I didn't feel it wasn't worth the effort to understand it.

I started volatility trading in 2005 and I'm still finding ways to improve on my strategies. It's a long process and I'm so happy to see so many of you engaging with it, asking questions, and coming up with your own uses for these volatility metrics.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.