VTS Defensive Rotation Strategy changes for 2023

Jun 07, 2023

VTS Community,

Portfolio Changes: VTS Defensive Rotation Strategy

If you've been a longer term subscriber you're aware that I typically hold myself to a once annual audit of results, usually in January, and then I allow a window to make any necessary minor strategy changes for the next year. Now it's rarely necessary, typically we just hold things as is, but this general policy is to avoid overfitting.

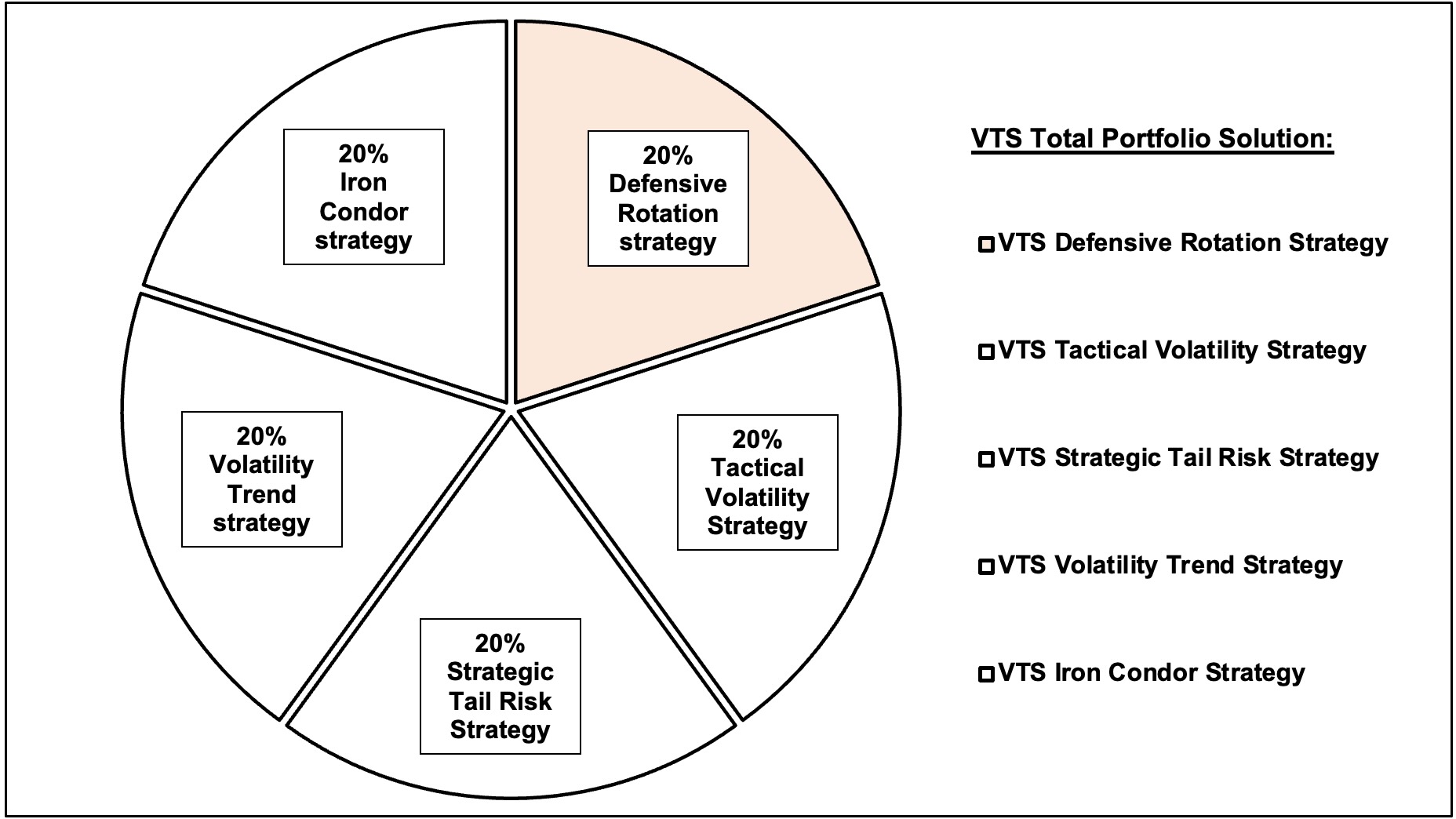

I didn't make any changes this past January so it's been about 18 months since the last tweak. It's time to go through the entire portfolio of 5 strategies and put forward what I feel will perform the best over the next few years.

Let's start with what is not undergoing any changes. 20% of our portfolio is dedicated to the Defensive Rotation Strategy and it will remain as is with no changes at all going forward.

If it ain't broke, don't fix it

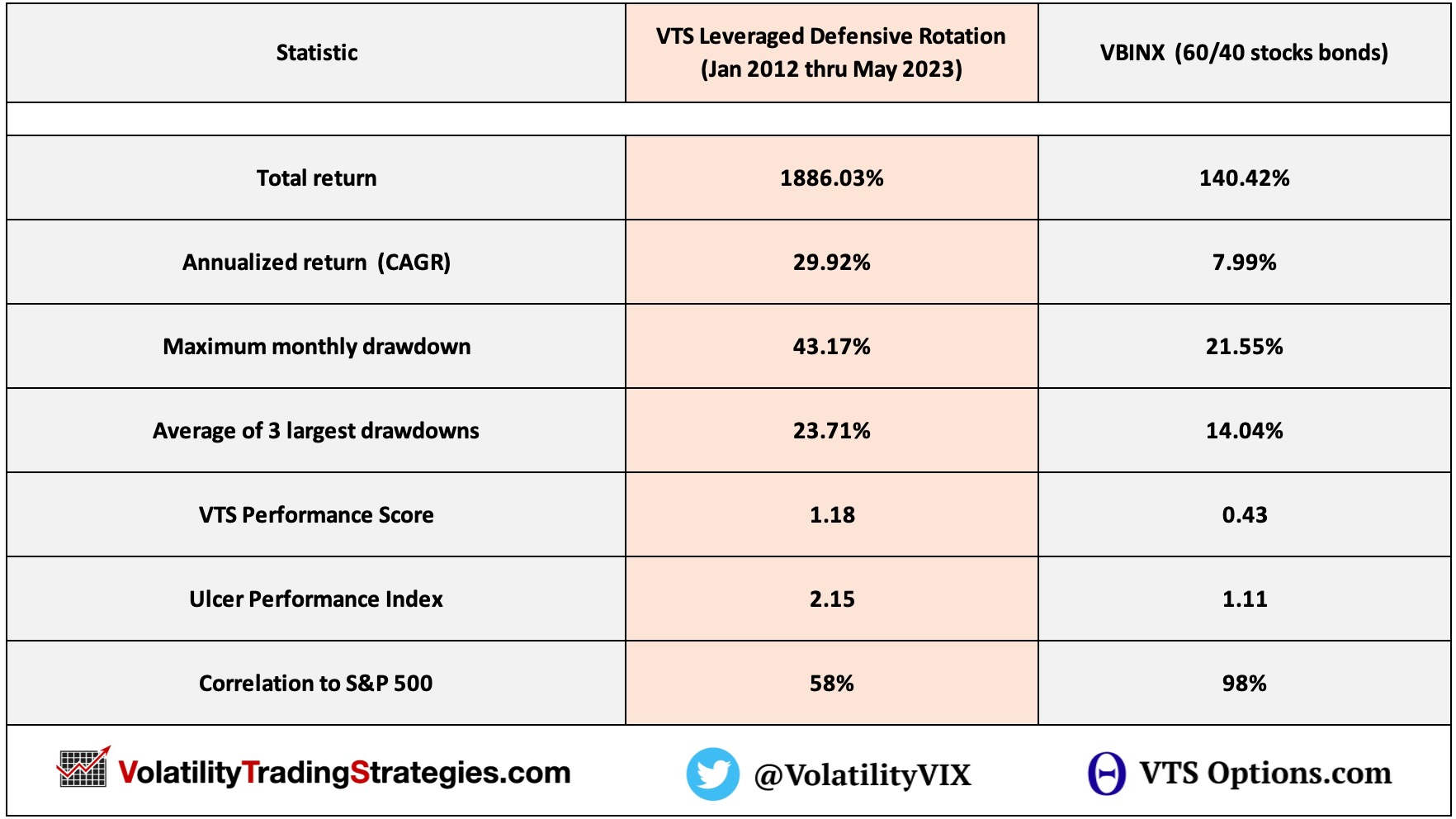

Performance wise the Defensive Rotation Strategy has been a great performer in our portfolio for several years. Now it's definitely subject to larger drawdowns as well, that comes with the territory of a high return strategy. Remember, the Nasdaq index itself is very volatile and has significantly large drawdowns as is.

Our Defensive Rotation Strategy uses 2x the Nasdaq through the QLD ETF as one of our potential holdings. While I do focus a lot of effort of minimizing drawdowns by rotating to Utilities, bonds, and Cash when necessary, it's just not possible to make it through all market environments unscathed.

The first half of 2022 was an example of that. We did spend some time in safety, but unfortunately Utilities, Bonds, and pretty much every other asset class was down significantly as well in 2022. There were very few places to hide and just stating it plainly, that was my worst performance period since VTS launched all the way back in January 2012.

On a relative basis it wasn't "that" bad...

Whenever we're talking about performance and drawdowns, sometimes the language used can sound dangerously close to making excuses which is something I do not do. I don't brag during good periods and I don't make excuses during bad periods. I just report what happened so we can get a better understanding of the past and potential future trajectory.

Although the Defensive Rotation Strategy did have a 43% drawdown at the low, that was significantly less than the underlying QLD which is the primary position we use.

2x Nasdaq QLD:

The 2x Nasdaq QLD suffered a maximum drawdown of 65%, is still down almost 40% from its high, and it still has to recover 65% to get back to break even.

The Defensive Rotation Strategy only had a 43% drawdown, the strategy is up 43% so far in 2023, and as a result of this risk management we are within 15% of the all time high in the strategy.

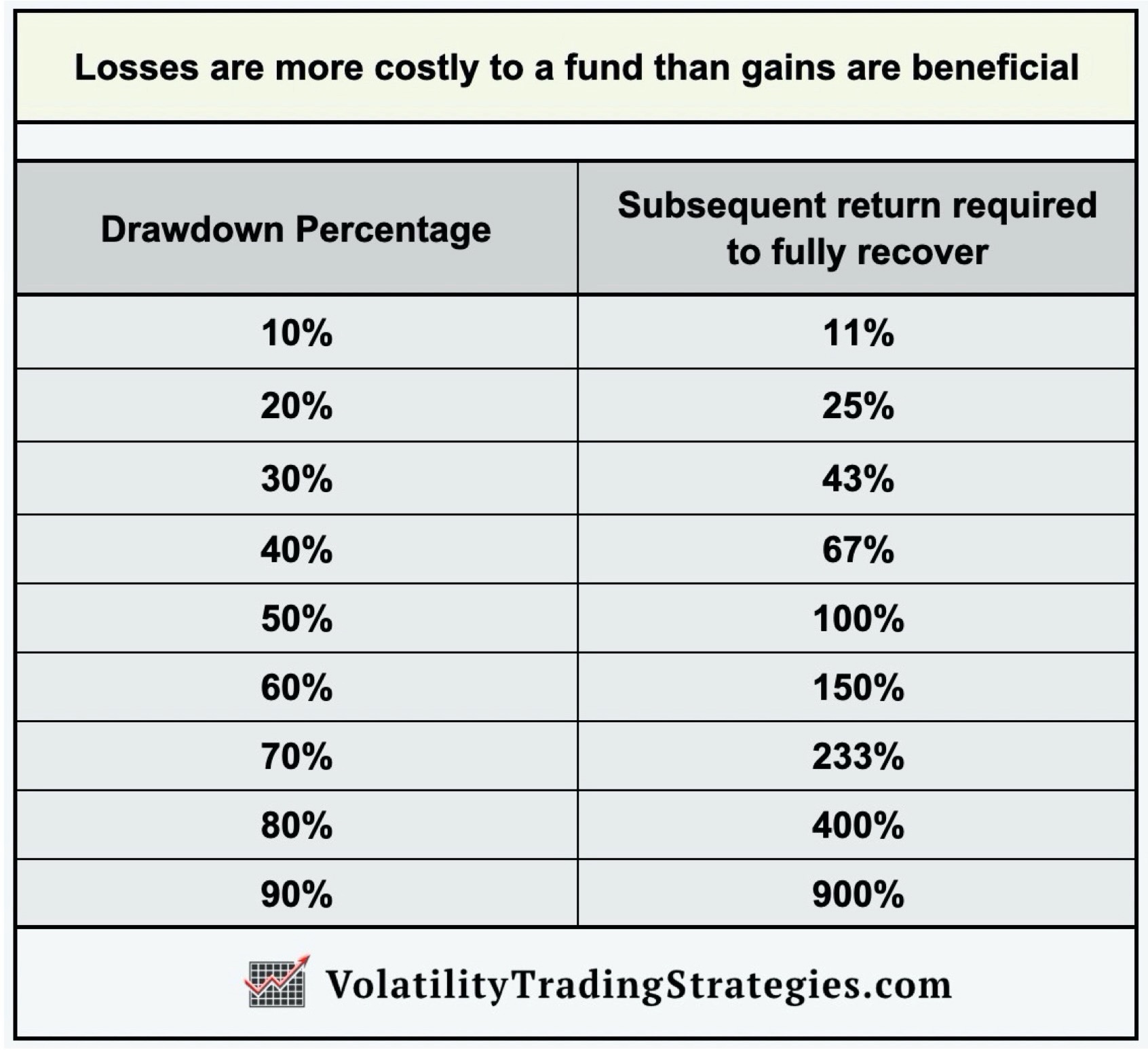

Drawdown recovery is exponential, not linear

The difference between a 65% drawdown and a 43% drawdown may not sound like that much, but remember drawdowns scale on an exponential basis. If we calculate what rate of return is required to get back to breakeven after those drawdowns I think you'll see why it's a big deal to mitigate damage as much as possible. Even 20% less can make a monumental difference long-term.

- 65% drawdown requires 186% return to breakeven

- 43% drawdown requires 75% return to breakeven

Do you see the difference that makes? That's because mathematically losses hurt a portfolio far more than gains benefit. If we can reduce the drawdowns as much as possible, it means we will always be in a much better position to recover from them later on.

I'm quite pleased with the results all things considered

The market has not nearly recovered from 2022 yet, and with several economic headwinds and what seems to be the most highly predicted and expected recession in history looming over us, it's impossible to say when that full recover will finally take place.

All any of us can do is put our best strategies forward and then navigate whatever comes with discipline and patience.

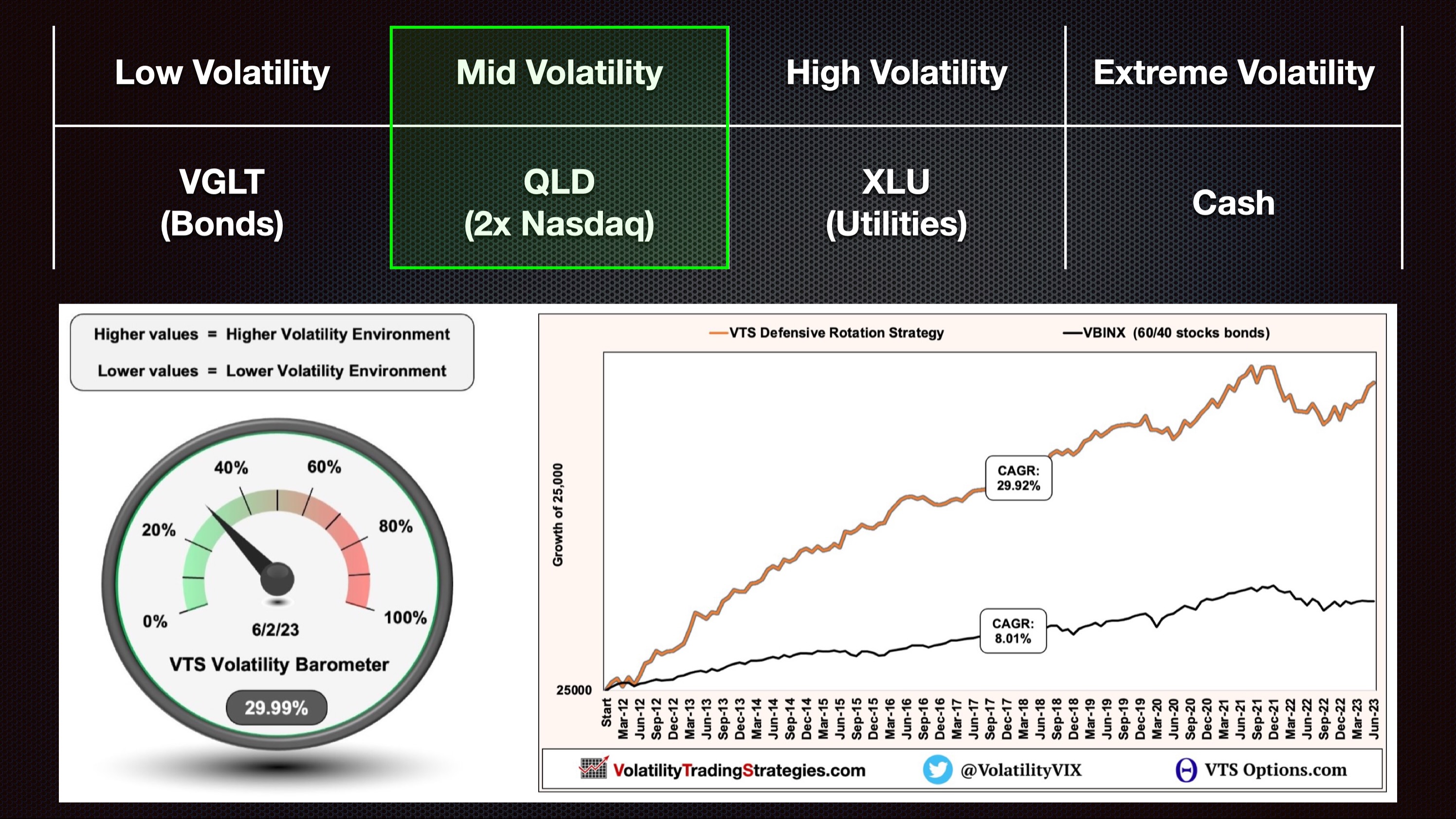

The tactical nature of the Defensive Rotation Strategy means we can target the asset classes that have the highest probability of success given the current volatility environment.

2x Nasdaq QLD: This is the primary driver of performance and we hold the QLD roughly 60% of trading days when volatility is in the stable range.

XLU Utilities: As the first level of safety in the strategy, we rotate into the Utilities ETF as volatility rises. Historically speaking Utilities perform much better than equities during more volatile periods. Now of course that wasn't the case in 2022 which is what caused us some trouble, but over the last 15+ years it's been a consistent theme.

Cash: During the most volatile periods in the upper 90th percentile, at that point even Utilities start to underperform which is why we will rotate into full Cash on about 10% of trading days.

VGLT Bonds: This is not something we've seen very often in the last 5 years given the higher Volatility regime we've been in since Volpocalypse, but when Volatility gets to very low levels, the market is running on fumes at that point and moving into Bonds is the safer position.

No changes to Defensive Rotation Strategy

As they say there is no reward without risk, it's unavoidable. The only thing we can do is structure our strategies to have the best chance of success given the current environment. Defensive Rotation is structured such that we can participate in any further market rallies, but we will also rotate into safety Utilities or Cash if the market does turn South.

The real question is, how will Utilities perform if there is another leg down in the market? I'll continue that thought at another time...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.