VIX futures term structure explained

Dec 15, 2012I don’t think a day has gone by since early 2011 that I didn’t check the VIX futures term structure and add those values to my various spreadsheets. It is arguably the most important aspect of any trading system designed to profit from trading volatility products such as XIV and VXX. I think it’s very important that members of our VTS community here have a basic conceptual understanding of what the VIX futures term structure is and why it’s important.

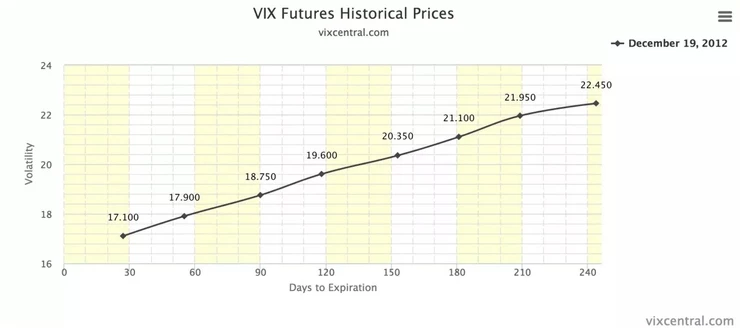

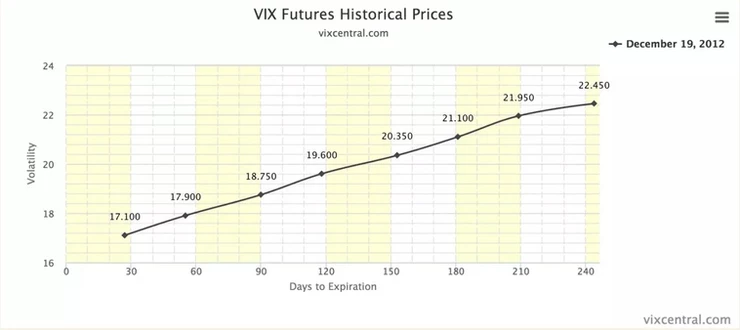

A picture tells most of the story so I’m going to start with that. Thanks to the good work by Eli over at vixcentral.com we have a great resource to get the latest values.

The VIX futures term structure is just a basic plot of all the monthly values of implied volatility of S&P 500 options. You can see in that picture, the front month as we call it is at 17.10 and the plot goes all the way out to 8 months later with a value of 22.45. Term structures aren’t limited to the VIX. You can actually plot a term structure for anything with futures values. The oil and gas market for example, or an interest rate curve. These futures term structures are quite common, but for volatility traders it’s the future VIX values we are interested in.

Why is this important?

Well as I’ve mentioned in the VTS Tactical Volatility strategy video, the products we trade (XIV and VXX) derive their price based on a calculation of the first and second month VIX futures term structure. So depending on the term structure and more specifically the first and second month of it, we can get a good read on whether the XIV or VXX has a mathematical headwind or a tailwind going forward. It doesn’t tell the whole story of course, there are many other variables at play as well which I will cover in depth, but it’s a very good starting point and one that forms the basis of virtually all volatility trading out there.

Contango vs Backwardation

You may come across these terms at various points in my blog articles and videos as well as quarterly reports so I’ll explain what is meant by them.

VIX futures term structure in contango:

That same picture from above is an upward sloping VIX futures term structure which means it’s in contango. See how the futures values start at a low point and progressively increase as you go further out in time? This is considered the norm because the VIX futures term structure spends most of it’s time in contango. Plenty of other factors come into play, but in general this upward sloping contango futures term structure means the XIV has a small mathematical tail wind.

VIX futures term structure in backwardation:

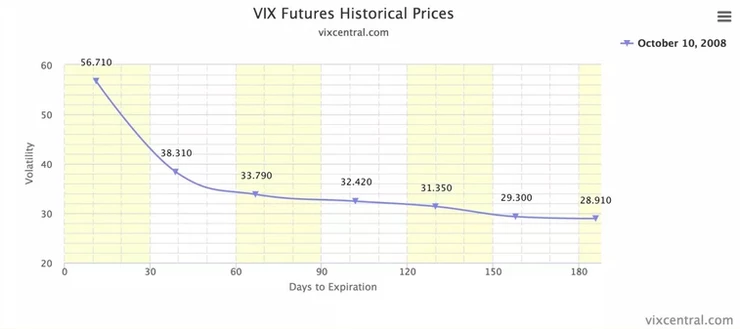

Backwardation is the opposite of contango. It’s a downward sloping futures term structure, meaning the front month starts high and get progressively lower as you move further out in time. This implies that market participants are expecting volatility to be lower in the future. Backwardation doesn’t happen nearly as often and it’s usually pretty short lived, but during extended market declines it can linger for several months. Again there are many other factors to consider, but a backwards VIX futures term structure means there is a small mathematical tailwind for the VXX.

The shape and magnitude of the VIX futures term structure is a very important component to any volatility trading strategy, but it would be a mistake to base a trading system around it entirely. There are also many other factors that come into play. Stay tuned for a lot more content in the coming months and years.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.