Updated Quilt Chart through Q3 2025

Oct 04, 2025

VTS Community,

Not to jinx it, but 2025 is going very well so far. If the next 3 months are uneventful then maybe we'll cap off the year in style, but we'll be ready for anything.

Between you and I, secretly I wouldn't mind a 20%+ bear market decline like we had in Q4 2018. There's nothing wrong with a little panic reset in the market to bump up Volatility for the year following, but we'll see.

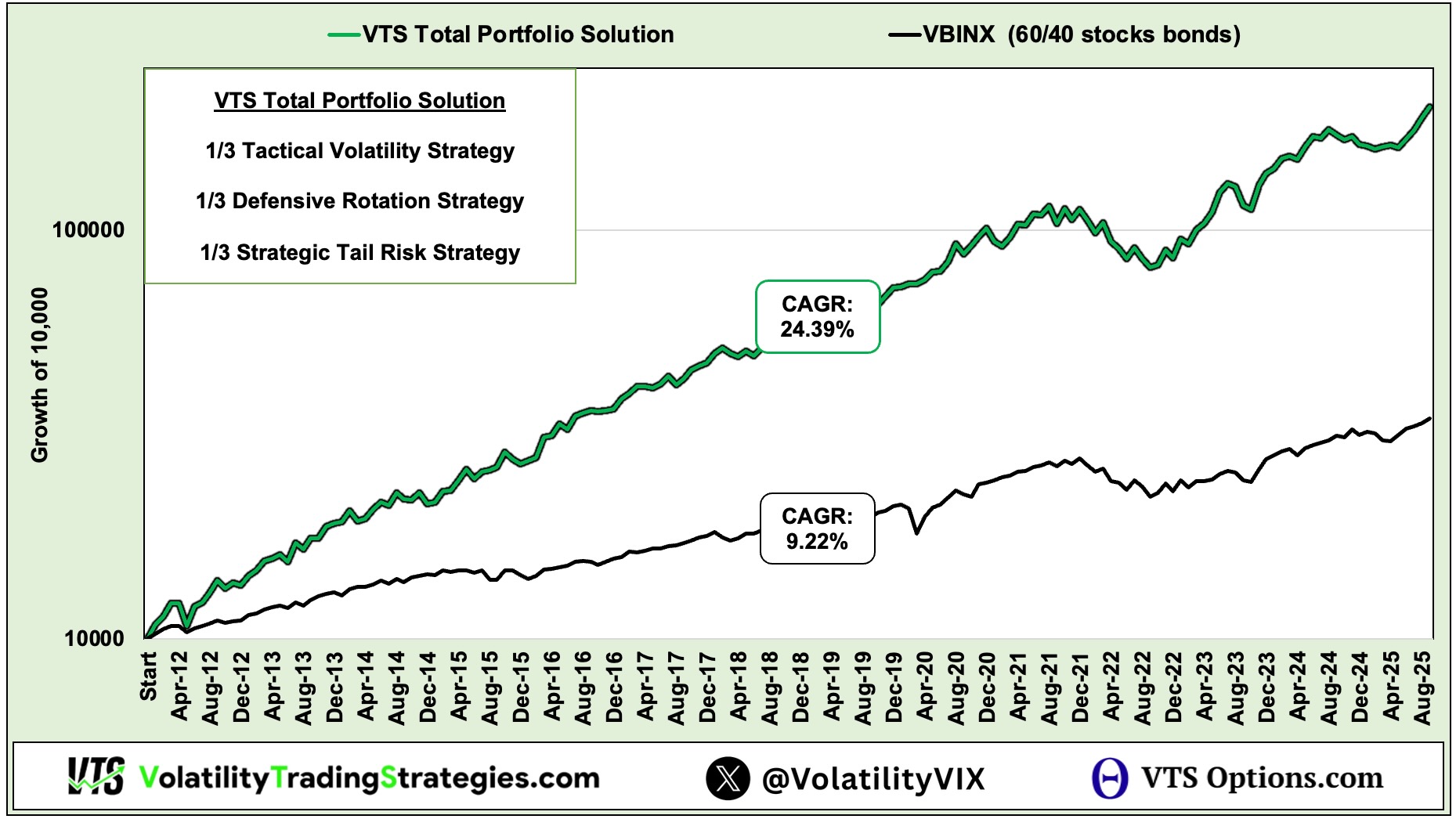

Our 3 active tactical strategies are doing what they are designed to do. Minimize drawdowns when the market isn't doing well, stay in safety if the market is too risky, and then of course outperform the market when it's on a good trend. We've had a little of both this year. We had to utilize safety positions the first few months to keep drawdowns low, and the last 4 months has been full steam ahead in this uptrend.

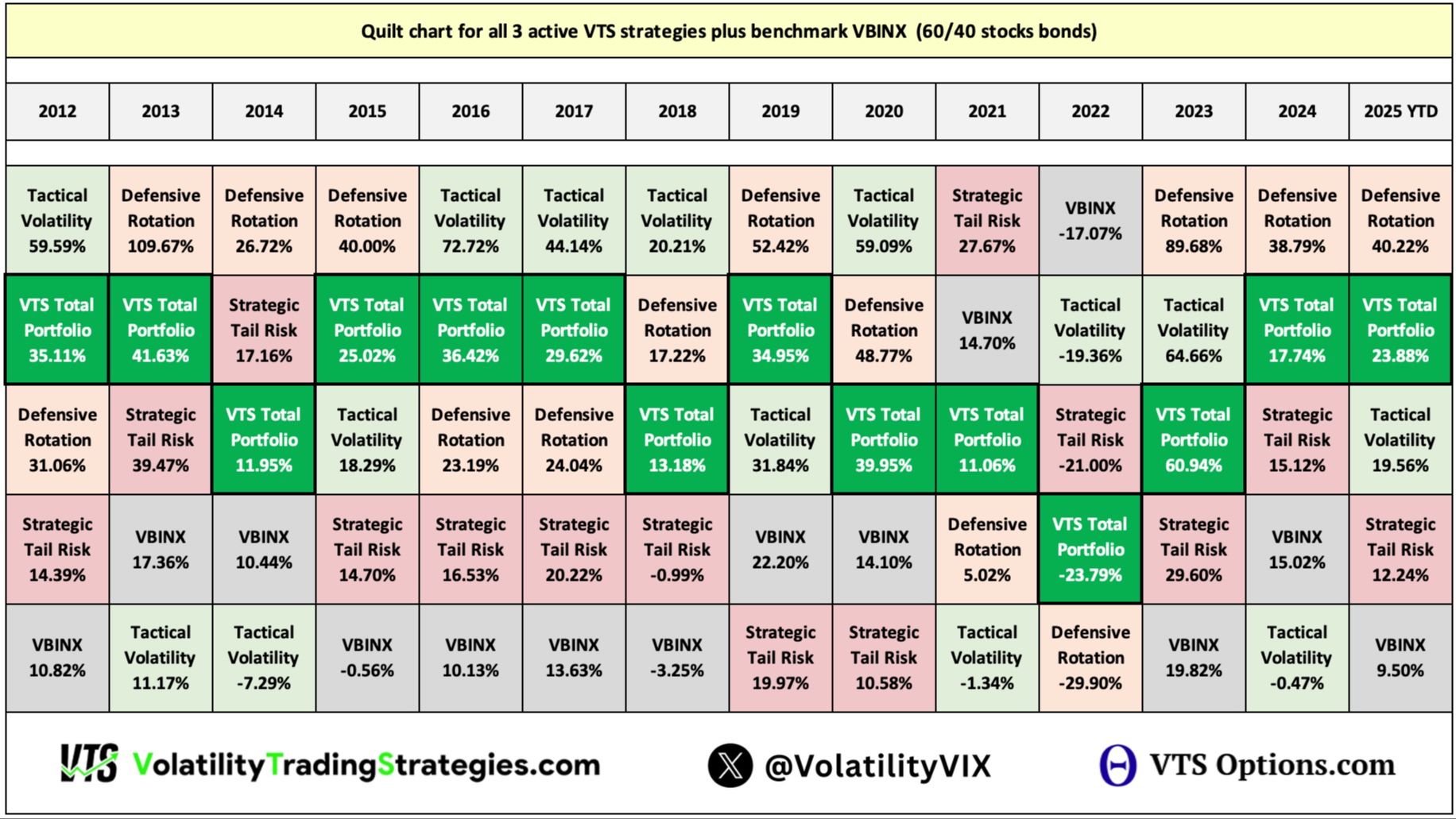

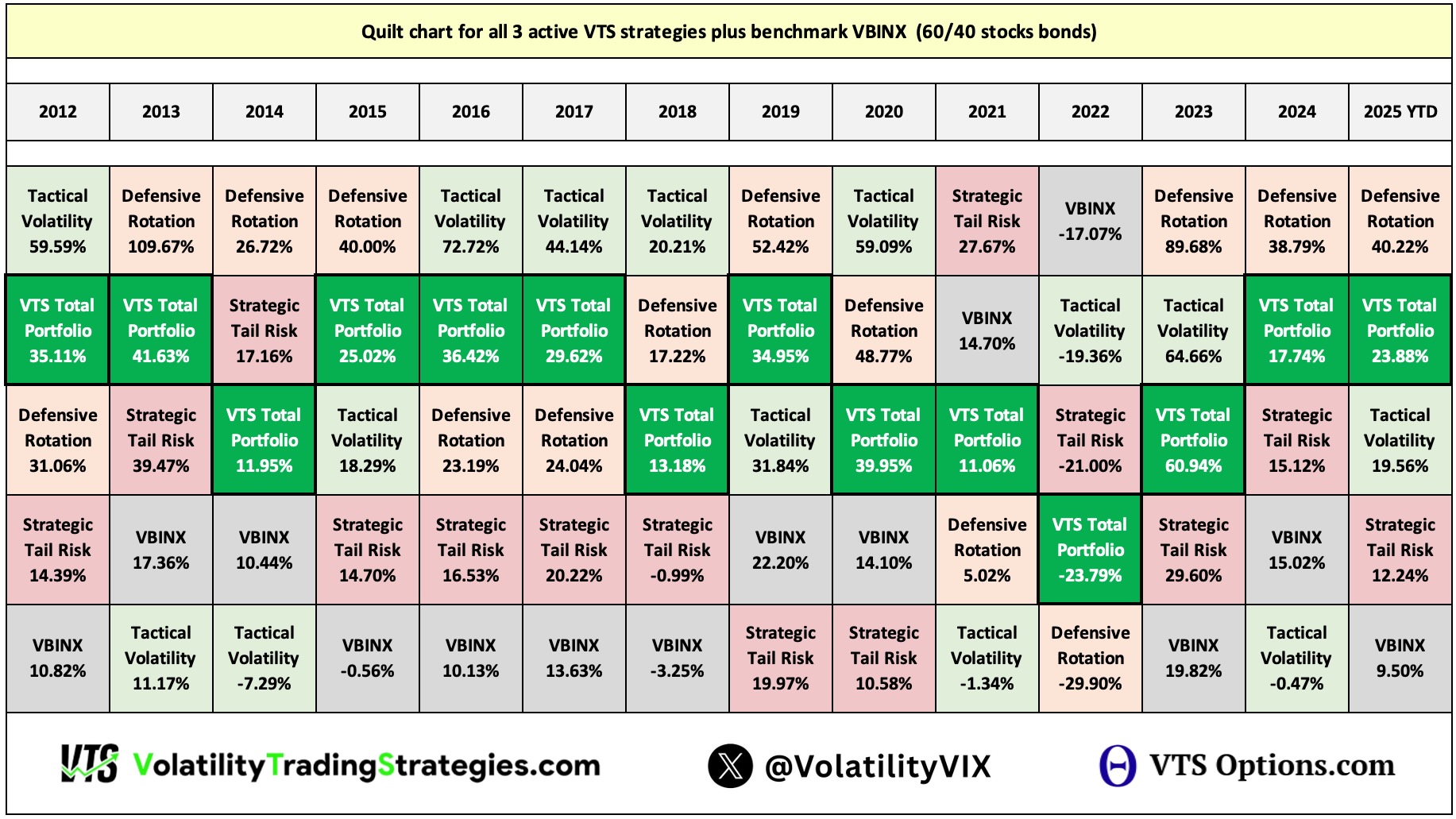

Let's take a look at the updated "quilt chart" of all 3 of our active strategies. A quilt chart is a great way to see a snapshot of performance all presented together so a few trends and comparisons can be readily made.

* I haven't added the optional Bitcoin Breakpoint Strategy. I could definitely do that, but the issue there is first of all it only has data going back to 2020, and beyond that, I only started trading it live the last few years so it's not a very long record of live trades, I don't think it means that much. But if there's demand (email me) then I can certainly add it in for next update. I know that more and more people are trading Bitcoin, and I get a lot of questions on that strategy, so if you do want me to add it even though it's only about 2 1/2 years of live trading, I will.

Quilt chart updated through September 2025:

Stocks at all time highs can cloud judgement

Most investors overestimate their risk tolerance. In good years it may be tempting to say, why even bother with a diversified portfolio? Why not just go all in on our top performer? Why not just put everything in Defensive? Clearly it's done the best recently right?

Well, you could, I'm not here to tell anybody what to do with their money if they choose to go against the recommended portfolio. For me though, I very much value consistency and lower drawdowns as I fully understand investing is a multi decade process. Chasing big gains does run the risk of a punishing drawdown in a bad year, which if the investor pulls the plug they will not be around to enjoy the good times afterwards.

Unfortunately, we did have some VTS subscribers leave in 2022 during that drawdown, and they weren't around when we V bottomed shortly after and rocketed past all time highs again.

Nothing kills forward progress more than selling out at a bottom, which is why my top priority is always to give people a portfolio they can invest in for the long run that won't cause them to make an emotionally charged mistake and pull the plug.

I'm providing a portfolio that IF people follow it for decades, minus a few rough patches along the way, they will look back and appreciate how much value it added and how large their retirement account actually grew to. But that does require diversification, and patience...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.