Real performance vs backtests

Apr 16, 2020VTS Community,

I've added several new questions to the website Q&A, but I'm also starting in on some of the more interesting ones, and I will expand on one of them today.

Question: Is the VTS Total Portfolio Solution real or a backtest?

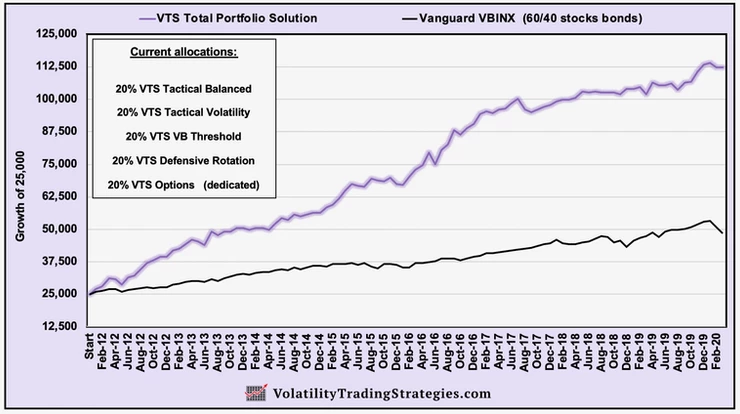

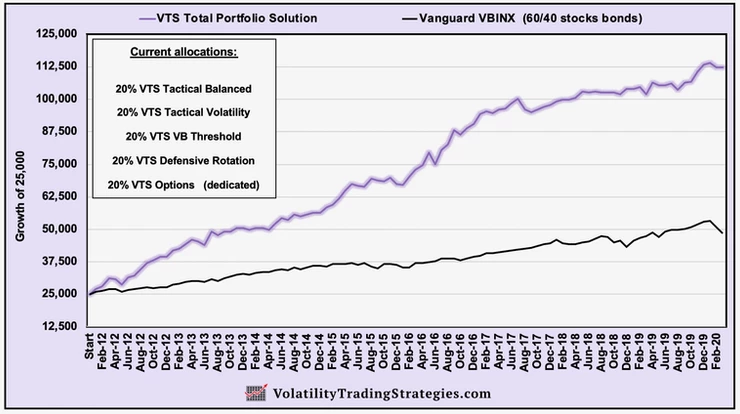

On the website, in all the daily emails, and in several of my articles and videos you will see a chart for the results of the VTS Total Portfolio Solution. It's a purple chart that looks like this:

It shows the VTS Total Portfolio Solution since January 2012 vs a benchmark, the Vanguard VBINX 60/40 balanced index fund.

That chart shows the real results for all the trade signals that were sent out in the daily emails to VTS community members since I started in January 2012.

- It's using end of day prices. Because everyone will be executing their trades at different times of the day depending on when it's convenient to log in to their trading software, I account for results using end of day prices. That way people can always look back on past trades and know what the price was for that specific trade and everyone has the same data.

- It shows the current allocations. The legend in the top left that you see is the current allocations of all the individual strategies in the portfolio. This does occasionally change depending on market conditions. When I launched VTS in 2012 for example, it was just three of those strategies (Tactical Balanced, Tactical Volatility, VTS Options)

The problem of changing "performance"

One of the dirty little tricks that is unfortunately used by many/most of the services out there is, whenever they make a change to their strategies, they update what it would look like on a chart and they post that as the so called "performance"

The problem with this is, it means it's no longer real results. It's just a backtest of something that was changed today and updated retroactively going backwards.

* It also means that if they wanted to (and they often do) is they could just keep making changes to strategies as they are failing and taking losses in live trading, continue updating the charts with new backtests, and it would always appear that the performance is good right?

Every time something doesn't work out, they say they are making a little change to the strategy, update the backtest and boom, great results again like magic!

And of course anybody looking at the website that wasn't a subscriber the whole time won't know any better. They will assume it's all real and amazing, when in actual fact it's been terrible and constantly changing to hide the poor results.

I do NOT do this!

The chart you see for the VTS Total Portfolio Solution is all the real results of the trades that were sent out to real people, in the allocations that the strategy had at the time. It's what a person would have experienced had they subscribed in January 2012 and just taken every single trade I've sent out in the proper allocations at the time.

Question: What "would" the current VTS Total Portfolio Solution look like going backwards?

I am very deliberate in not showing backtests and you'll almost never see me do it. I don't like to do it in articles or videos because people may mistake them for real results. If they just skim the article and don't pay attention, they may not realize it's just a backtest. I always want to make sure that when people see TPS charts anywhere in my work and especially on the website, that there is no confusion and they know it's the real TPS.

So I want to make this very clear, I'm going to show a backtest now.

I repeat, I'm going to show a backtest now :)

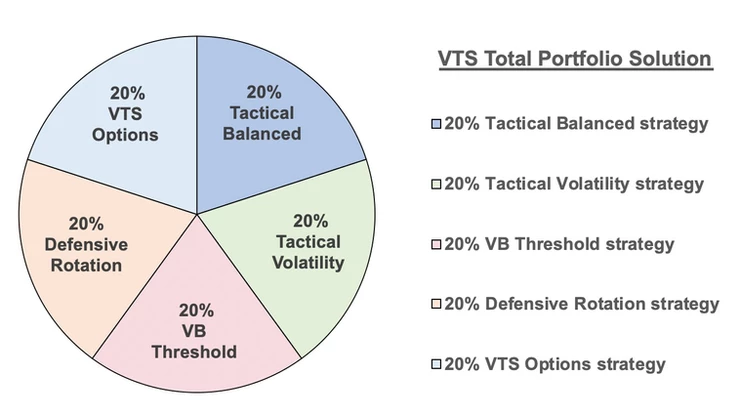

As of today the Total Portfolio Solution is the following:

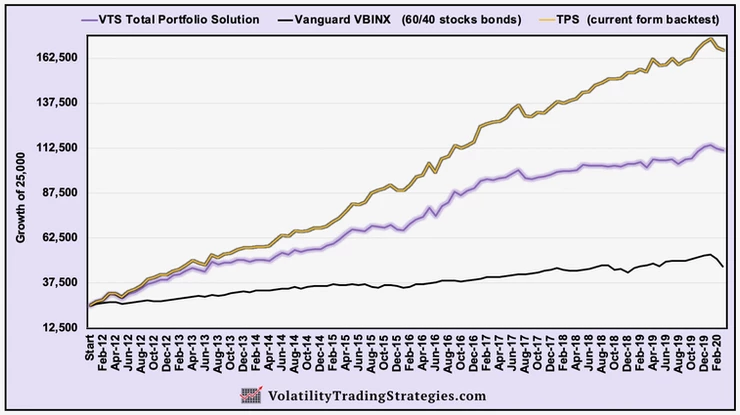

If you want to see how those allocations would have performed if we just drag them all back to January 2012, it's plotted in yellow:

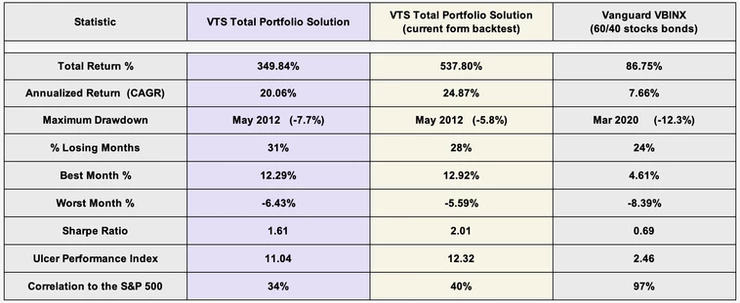

So it's not drastically different, the general shape of the curve is basically the same. The backtest of the current version of the TPS (yellow) is about 5% better per year than the actual Total Portfolio Solution (purple) was in real time. The current backtest is a little better than the real results.

Of course right? I'm always striving to make small improvements over time as both my knowledge base grows, and we add more data points through various different market environments. Volpocalypse, Q4 2018, and yes the Covid crash, valuable experience has been gained and I, and all of you, will be better in the future for it.

So the TPS is a little different today than it was in the past. Does that mean I should change the Total Portfolio Solution results on the website to show this current version dragged back to 2012?

NO!

In my opinion that would be totally unethical. It would be deceiving to show people a chart of the current version, because that's not the trade signals that were sent out to real subscribers.

The current allocations are the best version of my work and what I feel will perform best from today going forward. I have high confidence the current portfolio is better than the live trades of the past. But that would be a backtest, and I don't show backtests for the Total Portfolio Solution.

I show the trades that were sent out, this one:

This is my track record, and it's forever attached to me. Making changes to strategies today does not mean my performance in the past was suddenly better. Of course right, it seems totally stupid to even say that out loud, but it's amazing how many subscription services do this dirty little trick.

* And not only subscription services, but Hedge Funds, Mutual funds, RIAs. Backtests, survivorship bias, backfill bias, it's rampant throughout the financial industry.

Example: The newest addition to VTS is the Defensive Rotation strategy. You can check out the video for the strategy here. But this strategy went live in the portfolio just recently.

0% of the results of the VTS Total Portfolio Solution you see on the website reflect the new Defensive Rotation strategy.

Of course right, it's a new strategy. None of the results have added anything to the portfolio yet. Starting today going forward it will, but nothing is ever changed retroactively to reflect new allocations.

Golf analogy incoming...

I retired from professional golf in 2005, but just using my token golf analogy, would I ever have risen to the level I did in golf if I was always trying to hide my scorecard? No I wouldn't have. In golf, we post ALL results for the world to see.

If you shoot 75, all you want to do is rush to the parking lot without telling anyone what you shot. We used to call those crappy rounds "trunk slammers" because that's exactly what you did. You threw the clubs in the back of the car, slammed the trunk, and peeled out of there. Unfortunately, the scores are always posted, and that's a good thing!

It makes us own our mistakes. It builds character. It makes us better.

Another benefit of always being accountable for the actual scores (and trading results) is that it means we also get to celebrate our victories with pride. I'm proud of my track record. 8 years and 3 months later, VTS is still avoiding drawdowns and making steady progress, which is my mandate :)

So hopefully I've cleared this up. It's a question that comes up sometimes and I can totally understand why. People are so sick of getting deceived by shady businesses just flashing the latest and greatest backtest. It looks great, they sign up, and the real experience they have leaves a lot to be desired.

I don't hide my mistakes, and yes I do make them from time to time, but I embrace them and use them to make myself a better trader.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.